Closing Bell: Money’s too tight to mention, but NRA mentions it anyway as ASX dips

"All good, the cleaners will sort this. Pub?" (Pic via Getty Images)

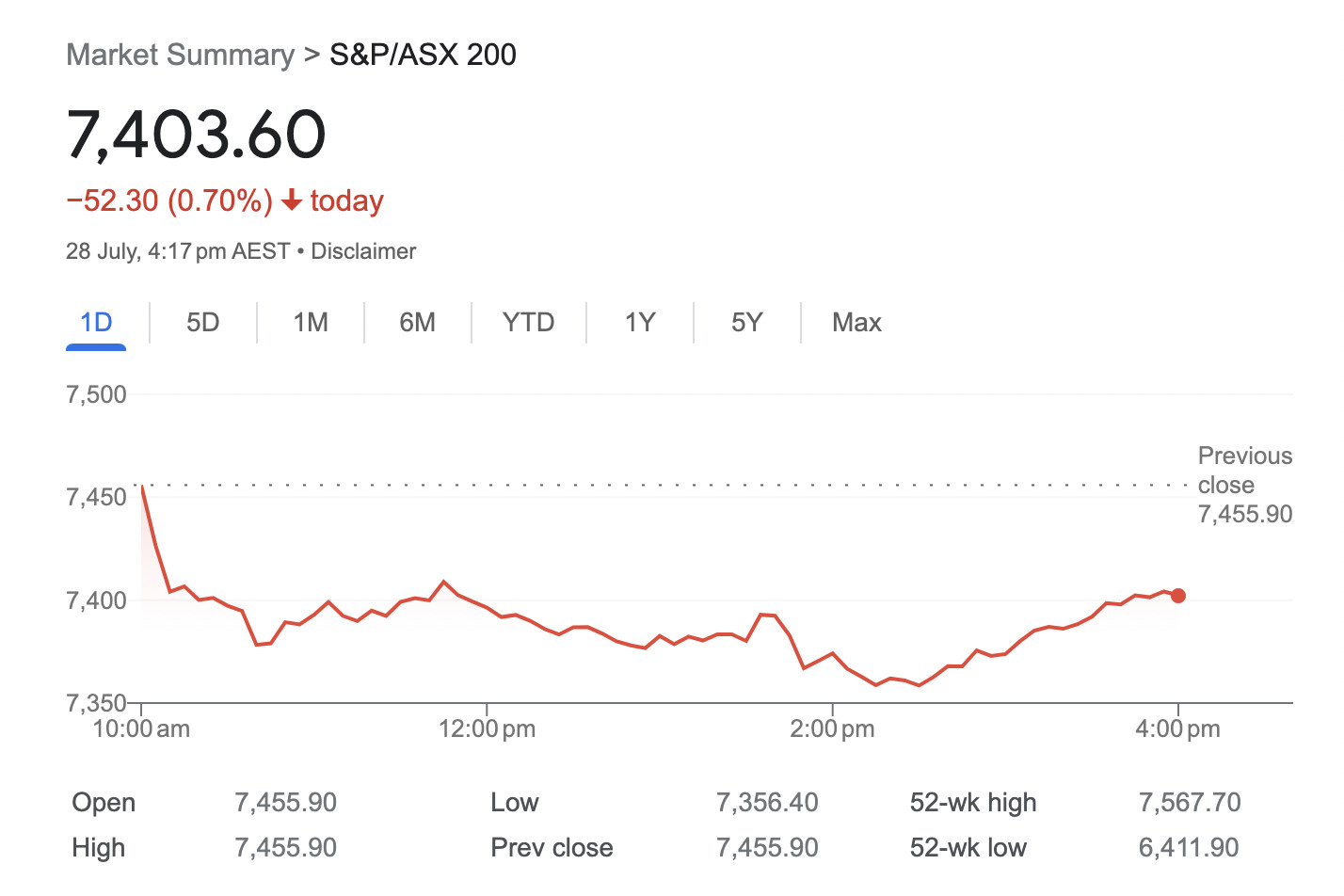

- The ASX 200 dipped -0.70% today, on the back of a retail dive and rising cost-of-living chatter

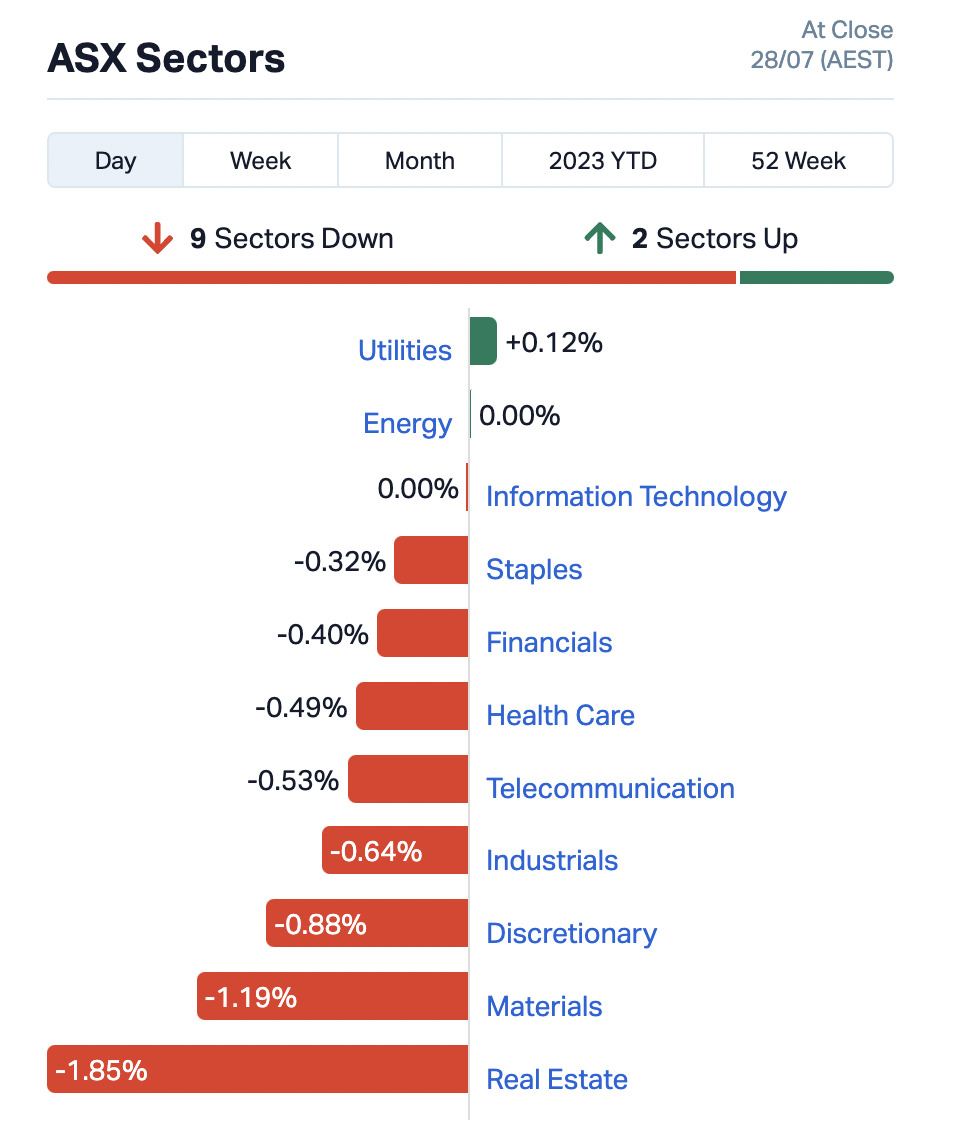

- Sectors wise, Real Estate and Materials were hit hardest

- Standout small caps: 3DP and PET fared okay. EEL and CCE, among several others, didn’t

Today, the Australian Bureau of Statistics helped shoot down the ASX’s good overall weekly form with a fistful of data. Namely, the latest retails sales figs, which showed that retail trade in Australia dipped by 0.8% in June, after a 0.8% rise in May and 0.1% fall in April.

Chart from @ABSStats shows retail sales across industries in June

ABS: "Retail turnover fell sharply in June due to weaker than usual spending on end of financial year sales."#ausecon #auspol #commsec @CommSec #business #Australia pic.twitter.com/MhetBIJtkE— CommSec (@CommSec) July 28, 2023

The NRA – not the shooty one, the other one, the National Retail Association – noted that mounting cost-of-living pressures facing Aussie consumers have contributed, as you’d probably expect.

Per a report in The Australian this afternoon, NRA CEO Greg Griffith said: “Department stores were hit hardest, experiencing 0.5 per cent decline sales, followed by clothing, footwear and personal accessory retailing which fell 2.2 per cent,” adding:

“Food retailing was the only industry to experience an increase in sales, by 0.1 per cent, but this can be attributed to rising food prices.”

Griffith reckons consumers are only forking out for “non-discretionary spending, if not for special occasions”. Ah, so that’s why PEPE the frog coin is down again this week, then.

Is it all bad? Nah, chin up. It’s been a good week on the whole, and there’s still chatter about soft landings, and the RBA potentially rate-hike pausing again in August, which the sales figures could play nicely into, actually.

Although, not everyone is convinced…

UBS economist George Tharenou reportedly still expects the RBA will hike rates in August, but says it is now a “closer call”, writes Megan Neil in aforementioned national masthead The Aus (with which Stockhead shares a locker room).

UBS expects another 25 basis point hike by the RBA, taking the cash rate to a peak of 4.35 per cent.

Other notables have swung into that camp in the past day or so, including analysts at CBA, although they’re generally of the belief that if the RBA does hike again next month, it’ll likely be the last one for this cycle.

TO MARKETS

In technical analysis speak, the ASX200 today formed a near-perfect, classical “The Dog Just Peed on The Wall in Our Tiny Inner West Sydney Courtyard and Now It’s Left a Wet, Acrid Trail that’s Annoyingly Run Under the Barbecue” formation.

All in all, a -0.70% finish was a disappointing end to what was otherwise a pretty solid week on the bourse. Gregor can put an arm round your shoulder and help you remember the good times, with his weekly wrap.

Here on Closing Bell, however, we’re living for the now, because…

Zooming in a little tighter, we have the sectors.

How’d they go? We could go into it, but it turns out we’re not paid by the word here at Stockhead, so it’s far easier on a Friday to post the Market Index visual instead.

But if you do need us to explain it, it was a bit like both Jonny Bairstow and Mick Hucknall. Simply (almost), and annoyingly, red. With only Utilities and Energy barely scraping out of the angry ranga narrative.

Here are a few specific standouts in the larger end of Bourse City, before we take you to ASX Funky Town, further below…

Winning:

• Summerset Group Holdings (ASX:SNZ): +6.85% > This $2.33bn operator and developer of retirement villages in New Zealand is up on no particular news that we can see. Unless perhaps they’ve just installed gigantic, cinema-sized HD tellies along with fully stocked beer fridges in every room so that elderly All Blacks fans can enjoy the latest Bledisloe drubbing in greater comfort. (Go, the Wallabies. We believe. Honest.)

• SiteMinder (ASX:SDR) :+21% > We mentioned this $1.18bn “open hotel ecommerce company” earlier in the day, but it’s still up and its good quarterly financial form still applies. Eddy has more intel on it here, actually.

Not Winning:

• Perpetual (ASX:PPT): -7.10% > on no specific news today for the Sydney-based asset manager.

• Capricorn Metals (ASX:CMM): -8.51% > despite delivering “an outstanding second year of full operations“.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| 3DP | Pointerra Limited | 0.205 | 116% | 27,278,970 | $64,391,589 |

| CLE | Cyclone Metals | 0.0015 | 50% | 37,000 | $10,264,505 |

| CT1 | Constellation Tech | 0.003 | 50% | 293,428 | $2,942,401 |

| MEB | Medibio Limited | 0.0015 | 50% | 806,481 | $5,150,594 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | 12,766,804 | $6,147,446 |

| PET | Phoslock Env Tec Ltd | 0.023 | 44% | 10,486,896 | $9,990,248 |

| BFC | Beston Global Ltd | 0.01 | 43% | 3,417,980 | $13,979,328 |

| GTE | Great Western Exp. | 0.062 | 38% | 1,003,516 | $11,371,415 |

| MCT | Metalicity Limited | 0.002 | 33% | 2,000 | $5,604,129 |

| GLA | Gladiator Resources | 0.015 | 25% | 304,205 | $6,554,039 |

| ERL | Empire Resources | 0.005 | 25% | 600,200 | $4,451,740 |

| GTG | Genetic Technologies | 0.0025 | 25% | 284,000 | $23,083,316 |

| ICN | Icon Energy Limited | 0.005 | 25% | 328,539 | $3,072,055 |

| MXC | Mgc Pharmaceuticals | 0.0025 | 25% | 3,419,243 | $7,784,719 |

| DTM | Dart Mining NL | 0.039 | 22% | 5,128 | $5,513,191 |

| SDR | Siteminder | 4.28 | 21% | 3,064,032 | $970,983,354 |

| ABE | Ausbondexchange | 0.175 | 21% | 75,450 | $5,619,200 |

| BCC | Beam Communications | 0.205 | 21% | 302,622 | $14,691,727 |

| TMB | Tambourahmetals | 0.33 | 20% | 2,709,053 | $11,624,031 |

| AHN | Athena Resources | 0.006 | 20% | 8,938,516 | $5,352,338 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 117,979 | $14,639,386 |

| RIM | Rimfire Pacific | 0.007 | 17% | 1,811,333 | $12,031,468 |

| SIT | Site Group Int Ltd | 0.0035 | 17% | 125,000 | $7,807,471 |

| B4P | Beforepay Group | 0.55 | 15% | 12,645 | $16,726,473 |

| AD1 | AD1 Holdings Limited | 0.008 | 14% | 324,717 | $5,757,983 |

Despite supporting the All Blacks having only lived in New Zealand for about 0.5% of his long and Nitflux-worthy drama-filled (ask him sometime) life, Gregor’s a good bloke. And I say that, because he is, but also because he quickly banged out this next bit about today’s leading small-cap winners to save me some time…

Some winning small-caps standouts today:

• Pointerra (ASX:3DP): +100% > The SaaS tech company shot up today on news out of the US that existing Pointerra customer Entergy, a Fortune 500 company, has selected Pointerra’s US EPC partners for its 10-year, US$15 billion grid resilience CAPEX program. That deal will see Pointerra’s AI-driven analytics platform used to identify and prioritise grid assets requiring remediation or replacement across the 10-year term of the program.

• Phoslock (ASX:PET): +50% > Phoslock delivered its June quarterly today, revealing a net cash outflow from operating activities of $0.62 million – much better than the prior quarter, which recorded approximately $3.2 million in operating cash outflow.

• Great Western Exploration (ASX:GTE): +37.8% > GTE’s been climbing this week on Monday’s news that the company had kicked off RC drilling at the Firebird gold project, testing a large soil anomaly. The large Ultrafine+ soil anomaly has an extent of 3.7km x 450m, with the current round of RC drilling designed to test below recent anomalous broad-spaced aircore drill results from highly weathered Archean Greenstone volcanic sediments and mafic units.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAL | Jameson Resources | 0.051 | -28% | 25,288 | $27,797,288 |

| EEL | Enrg Elements Ltd | 0.008 | -27% | 14,079,132 | $11,101,577 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 2,720,665 | $31,285,147 |

| MTM | MTM Critical Metals | 0.069 | -25% | 6,656,297 | $8,928,299 |

| HXL | Hexima | 0.019 | -21% | 1,081,339 | $4,008,951 |

| GFN | Gefen Int | 0.004 | -20% | 55,889 | $641,399 |

| ADD | Adavale Resource Ltd | 0.016 | -19% | 8,854,052 | $11,071,703 |

| 1AG | Alterra Limited | 0.009 | -18% | 6,758,549 | $7,662,078 |

| 8IH | 8I Holdings Ltd | 0.023 | -18% | 232,198 | $10,005,968 |

| NME | Nex Metals Explorat | 0.014 | -18% | 701 | $5,993,053 |

| RML | Resolution Minerals | 0.005 | -17% | 4,563,029 | $7,543,751 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 260,000 | $29,019,595 |

| AQX | Alice Queen Ltd | 0.016 | -16% | 1,726,651 | $2,403,782 |

| PEB | Pacific Edge | 0.135 | -16% | 233,183 | $129,658,435 |

| BCB | Bowen Coal Limited | 0.11 | -15% | 16,012,421 | $277,678,164 |

| RGS | Regeneus Ltd | 0.011 | -15% | 2,536,851 | $3,983,680 |

| GED | Golden Deeps | 0.0085 | -15% | 22,547,581 | $11,552,267 |

| DM1 | Desert Metals | 0.053 | -15% | 149,506 | $4,497,547 |

| DOU | Douugh Limited | 0.006 | -14% | 1,013,110 | $6,887,289 |

| HAR | Harangaresources | 0.12 | -14% | 60,588 | $7,113,963 |

| HCT | Holista CollTech Ltd | 0.012 | -14% | 332,416 | $3,903,201 |

| INP | Incentiapay Ltd | 0.006 | -14% | 144,001 | $8,855,445 |

| NMR | Native Mineral Res | 0.03 | -14% | 160,636 | $5,143,770 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 3,654,261 | $12,257,755 |

| CCA | Change Financial Ltd | 0.049 | -14% | 578,893 | $35,776,699 |

LAST ORDERS

Making an impact

Impact Minerals (ASX:IPT) made an announcement today regarding a hefty R&D (Research and Development) refund of $753,000, which comes from its exploration activities completed in the financial year ending June 30, 2022.

The funding rebate bring’s Impact’s cash balance up to more than $4 million, after a recent, successful round of capital raising, which was well supported by the company’s two major German shareholders.

Impact’s Managing Director, Dr Mike Jones, said: “This R and D rebate significantly bolsters our cash balance and further demonstrates we are very well funded for at least the next 12 months both for the Pre-Feasibility Study at the Lake Hope High Purity Alumina Project as well as continued exploration activities on our Arkun Battery Minerals Project, both located here in Western Australia.”

Argie barging: Galan punches on

Galan Lithium (ASX:GLN) is forging ahead with its Argentinian lithium-exploration efforts, announcing today that it now has 100% full ownership of the Catalina tenement that borders the Catamarca and Salta Provinces.

Investors may not have recognised the importance of this yet, but Galan’s Managing Director, JP Vargas de la Vega was upbeat:

“This acquisition represents a highly significant value accretive transaction for the company,” he noted in a statement earlier today, adding:

“It resolves the security of tenure in this highly prospective area favourably for the exclusive benefit of Galan and its shareholders. As there are now no competing interests, our team can advance exploration and evaluation activities at Catalina with the objective of delineating a maiden resource.

“Furthermore, we plan to accelerate such work and look forward to keeping our shareholders informed of our progress.”

TRADING HALTS

Raiden Resources (ASX:RDN) – The company has an announcement pending, regarding first reconnaissance results from its due diligence exercise on the South Roebourne project. Trading resumption expected by Tuesday.

Strandline Resources (ASX:STA) – Capital raising.

Maximus Resources (ASX:MXR) – “There was once a dream called Rome, you could only whisper it… Maximus, let us whisper now, together, you and I…” Sorry, momentarily distracted there. Maximus is diverted from trading today, as it figures out a mineral resource estimate update at its Wattle Dam Gold Project.

Reach Resources (ASX:RR1) – Capital raising.

Anax Metals (ASX:ANX) – Capital raising.

Centaurus Metals (ASX:CTM) – Capital raising.

RemSense Technologies (ASX:REM) – Capital raising.

MRG Metals (ASX:MRQ) – Capital raising.

Viridis Mining and Minerals (ASX:VMM) – The company has a project acquisition announcement brewing.

Starpharma (ASX:SPL) – An announcement is coming, regarding a partnered program.

Yowie Group (ASX:YOW) – In not very plain English, this one has something to do with “facilitating an orderly market in the company’s securities pending a revised announcement to the market release on 27 July 2023 titled “Yowie Secures Bluey Merchandise Agreement”.

Upon further inspection, and in plainer language, the Yowie Group has secured the rights to sell Bluey-themed confectionary in Australia and New Zealand over Christmas and Easter for the next few years. Ah, now the trading halt completely makes sense. Sort of.

At Stockhead we tell it like it is. While Impact Minerals and Galan Lithium are both Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.