Closing Bell: Soft landing chatter picks up as Tech and Real Estate stocks surge

Soft landing pic via Getty Images

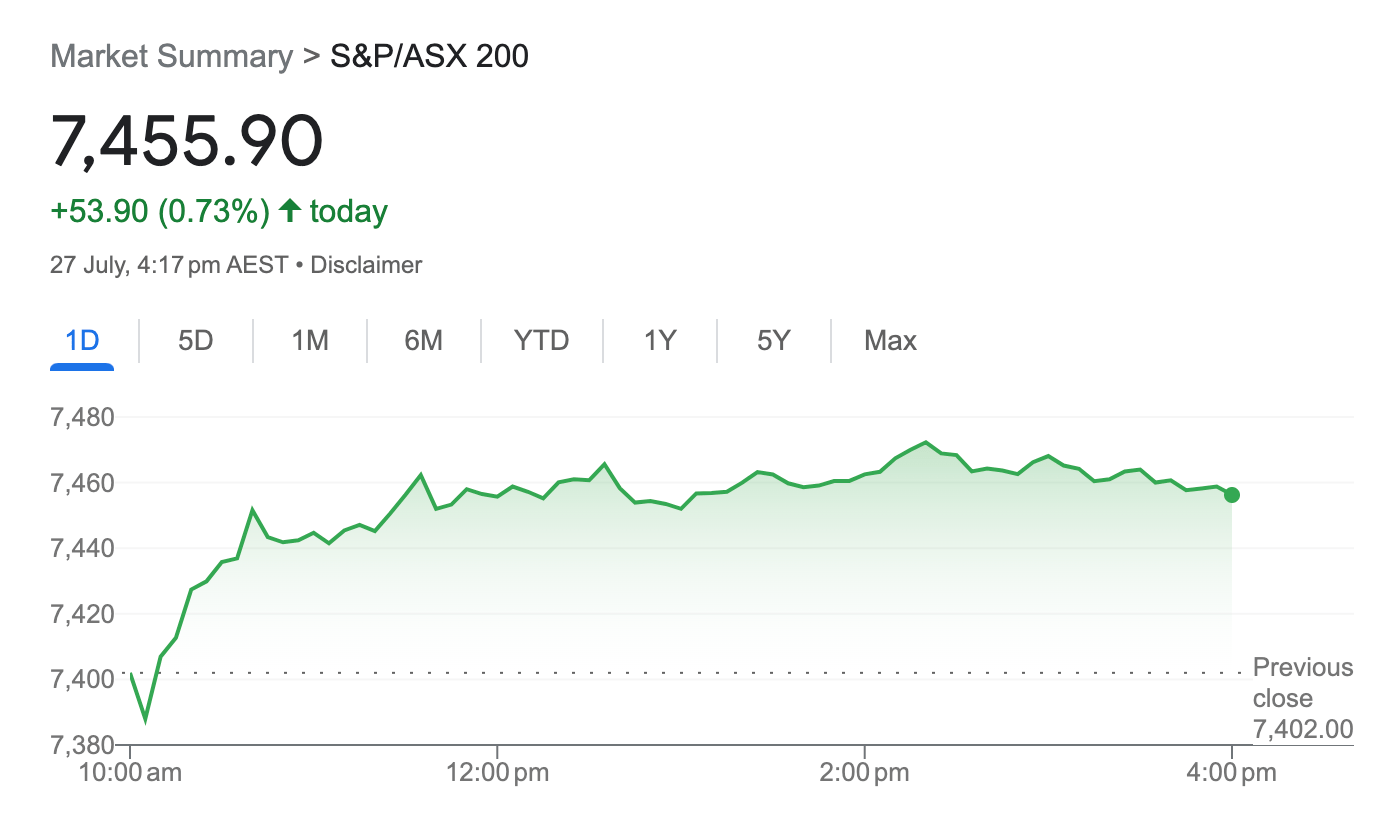

- The ASX 200 had another fine day, ending with a 0.73% gain overall

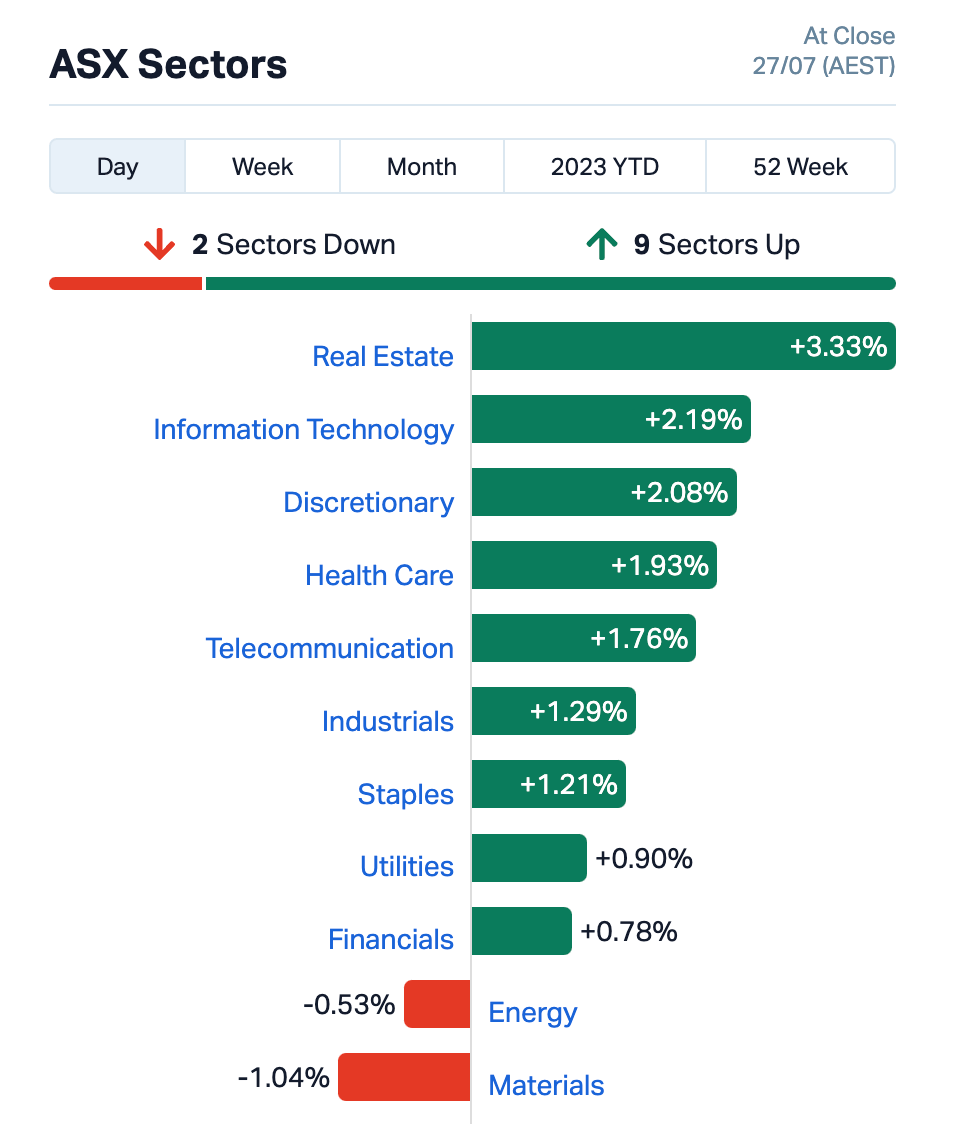

- Sectors wise, Tech and Real Estate were the winners, while Materials dipped as a whole, partly due to Rio and Fortescue

- Standout small-cap performers: R3D, PAC, and the juicy OJC

The green scene continued for the ASX today, after the US Federal Reserve delivered exactly what world markets were expecting with a 25bps hike and some “carry on, as you were, nothing much to see here”-style messaging.

Which, was more than US Senate Majority Leader Mitch McConnell was able to squeeze out in his presser overnight. (Although we suspect, from watching the video, squeezing something out might’ve been half his problem. See Gregor’s Lunch Wrapping for more on that beaut little nugget.)

Soft landing chatter – hopium?

Mild recession, eh? Luke-warm take: maybe we’ve actually already been in one for some time? In any case, here’s something from a Goldman Sachs analyst today, who is of the belief that Australia’s increasingly not-so-bad-after-all macro climate just lately might see us all have a nice, fluffy-pillowed soft landing.

Or, at least a fall from a two-storey building onto some cardboard boxes, picking up a few bruises and paper cuts.

Per a report in The Australian today:

“Over recent weeks our proprietary data surprise indicator has improved to its most positive reading in a year, alongside upside data surprises across the labour market, retail sales, building approvals, housing finance, and above-average surveyed business conditions,” said chief Goldman economist for Australia and NZ, Andrew Boak.

“While our current activity indicator suggests growth momentum is below trend – at an estimated 1.5 per cent annualised rate – growth compares favourably to global peers and suggests economic expansion is ongoing.”

That said… he reckons the RBA probably has another 25bps rate hike left in it this year. Guess he wouldn’t be surprised to see that pop up on his special data surprise indicator? Which, we’re hoping works like a jack-in-the-box holding a small printed read-out.

Meanwhile, the soft landing bantz has started up again in the US of A…

Me and the soft landing fam rn: https://t.co/nNEOxrvle6 pic.twitter.com/CZ38xQ2hUY

— Joey Politano 🏳️🌈 (@JosephPolitano) July 26, 2023

As for hard landings believers… and if you miss The X-Files and enjoy conspiracies about aliens crashing to Earth and such and such, here’s something especially for you…

Wow!

A witness just testified in front of Congress that the government has recovered “non-human” pilots from UFOs.

What. A. Time. To. Be. Alive. https://t.co/dWydIrRBYb

— Anthony Pompliano 🌪 (@APompliano) July 26, 2023

TO MARKETS

The ASX 200 formed a classic “Stepped on an oyster shell but quickly recovered for a perfect arcing cast” pattern on the technical charts today, ending in the green to the tune of +0.73%.

Sectors wise, here’s the visual, thanks to Market Index…

A few standouts in the larger end of Bourse City, before we take you to ASX Funky Town, further below…

• Sandfire Resources (ASX:SFR): +9.4% > A strong gain there for the near $3bn resources company (despite the sector being down overall, partly thanks to the likes of Fortescue Metals Group (ASX:FMG) and Rio Tinto (ASX:RIO) taking 2.6% dips today). And it’s based on a positive quarterly report, which you can read about here.

• Megaport (ASX:MP1): +13.79% > The biggish-gun ($1.68bn market capped) interwebby tech group is up nicely today. Which tends to happen when you deliver your first ever quarterly positive net cash result.

Yep, Megaport delivered FY23 normalised earnings of $20.2m, within its upgraded guidance range of $19m-$21m provided on July 11. Reported full year earnings totalled $25.2m, also within the upgraded guidance range of $24m-$26m. And net cash at June 30 was $33.3m, up $2.3m over the quarter, too.

• Insignia Financial (ASX:IFL): +7.6% > More quarterly report goodness, in which the firm’s Funds Under Management and Administration (FUMA) increased by $3.7 billion (+1.3%) to $295 billion as at 30 June 2023.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| R3D | R3D Resources Ltd | 0.04 | 60% | 441,200 | $2,950,759 |

| XTC | Xantippe Res Ltd | 0.0015 | 50% | 3,634,514 | $11,480,100 |

| RGS | Regeneus Ltd | 0.011 | 38% | 1,781,611 | $2,451,495 |

| ADS | Adslot Ltd. | 0.004 | 33% | 5,265,941 | $9,799,851 |

| DDT | DataDot Technology | 0.004 | 33% | 1,351,192 | $3,632,858 |

| ROG | Red Sky Energy. | 0.004 | 33% | 372,130 | $15,906,682 |

| PAC | Pacific Grp Ltd | 10.31 | 32% | 656,123 | $402,275,125 |

| TTT | Titomic Limited | 0.0155 | 29% | 7,584,807 | $10,363,373 |

| OJC | The Original Juice | 0.105 | 27% | 496,131 | $20,301,036 |

| AJQ | Armour Energy Ltd | 0.0025 | 25% | 64 | $9,842,684 |

| RBL | Redbubble Limited | 0.59 | 22% | 1,328,912 | $134,694,308 |

| ICG | Inca Minerals Ltd | 0.04 | 21% | 342,150 | $16,005,329 |

| MOH | Moho Resources | 0.012 | 20% | 300,000 | $2,595,778 |

| ASM | Ausstratmaterials | 1.4 | 19% | 1,580,902 | $196,712,168 |

| G50 | Gold50Limited | 0.225 | 18% | 4,742,731 | $10,819,170 |

| AEI | Aeris Environmental | 0.027 | 17% | 55,185 | $5,649,825 |

| AUR | Auris Minerals Ltd | 0.014 | 17% | 1,047,428 | $5,719,511 |

| CXU | Cauldron Energy Ltd | 0.007 | 17% | 1,044,582 | $5,589,412 |

| DOU | Douugh Limited | 0.007 | 17% | 278,585 | $5,903,390 |

| OPN | Oppenneg | 0.007 | 17% | 640,000 | $6,700,078 |

| YPB | YPB Group Ltd | 0.0035 | 17% | 812,000 | $2,230,384 |

| VBS | Vectus Biosystems | 0.5 | 16% | 4,607 | $22,871,493 |

| C1X | Cosmosexploration | 0.43 | 16% | 422,912 | $16,455,750 |

| PEC | Perpetual Res Ltd | 0.022 | 16% | 9,074,885 | $10,364,195 |

| CUF | Cufe Ltd | 0.015 | 15% | 125,000 | $12,559,461 |

• R3D Resources (ASX:R3D): +60% > The small miner has announced it has completed the refurbishment of a solvent-extraction crystallisation process plant at its 45,000t Tartana copper heap leach project in Queensland. It’s charging the circuits for imminent first copper sulphate pentahydrate production. That’s expected to begin in the coming week.

• Pacific Current Group (ASX:PAC): +30% > The asset manager has a non-binding indicative proposal ready for submission that would see CQC Partners acquire all of the issued ordinary shares in PAC. This is a good thing for PAC investors, apparently, which you can read more about here.

• The Original Juice Co. (ASX:OJC): +21% > The high-quality juicer and wellness beverage company is up on a positive quarterly cash flow report.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 678,089 | $20,529,010 |

| PAN | Panoramic Resources | 0.0555 | -40% | 54,954,426 | $188,684,088 |

| MEB | Medibio Limited | 0.001 | -33% | 1,206,111 | $7,725,891 |

| MTH | Mithril Resources | 0.0015 | -25% | 720,000 | $6,737,609 |

| NSB | Neuroscientific | 0.089 | -23% | 150,000 | $16,499,239 |

| CCO | The Calmer Co Int | 0.004 | -20% | 285,083 | $2,820,388 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 3,491,993 | $14,368,295 |

| VAL | Valor Resources Ltd | 0.004 | -20% | 101,218 | $19,015,174 |

| ATH | Alterity Therap Ltd | 0.0065 | -19% | 294,811 | $19,519,181 |

| NET | Netlinkz Limited | 0.009 | -18% | 2,976,225 | $38,835,812 |

| BUB | Bubs Aust Ltd | 0.195 | -15% | 12,346,697 | $172,812,204 |

| SKY | SKY Metals Ltd | 0.043 | -14% | 1,091,824 | $22,727,840 |

| 8VI | 8Vi Holdings Limited | 0.215 | -14% | 36,769 | $10,477,856 |

| BCB | Bowen Coal Limited | 0.125 | -14% | 17,084,223 | $309,717,952 |

| DYM | Dynamicmetalslimited | 0.22 | -14% | 230,233 | $8,925,000 |

| WMG | Western Mines | 0.51 | -14% | 1,099,369 | $35,578,670 |

| BM8 | Battery Age Minerals | 0.385 | -13% | 590,691 | $32,655,992 |

| ODA | Orcoda Limited | 0.28 | -13% | 390,303 | $54,130,262 |

| A8G | Australasian Metals | 0.15 | -12% | 55,258 | $8,860,484 |

| FMS | Flinders Mines Ltd | 0.45 | -12% | 423 | $86,112,774 |

| RVT | Richmond Vanadium | 0.415 | -12% | 44,957 | $40,517,669 |

| ADG | Adelong Gold Limited | 0.008 | -11% | 2,132,688 | $5,366,901 |

| BFC | Beston Global Ltd | 0.008 | -11% | 17,224,481 | $17,973,422 |

| IBG | Ironbark Zinc Ltd | 0.008 | -11% | 554 | $13,201,058 |

| IEC | Intra Energy Corp | 0.004 | -11% | 1,559,848 | $7,293,517 |

LAST ORDERS

Rivers of gol lithium

Quite a few lower-capped exploration companies are having decent weeks, and Riversgold (ASX:RGL) is no exception. The $12.37m-capped outfit is focused on discovering large lithium systems in the Pilbara and Yilgarn cratons of WA.

It’s latest news? Its Mt Holland lithium project (located immediately east of Covalent Lithium’s Mt Holland lithium mine) has finally got the official, Program of Works (PoW), “have at it” go-ahead for a maiden drilling campaign.

The company has engaged a drilling contractor and Julian Ford, Riversgold’s CEO, said:

“Getting the PoW finally approved plus all of the necessary access agreements put into place with DMIRS, the environmental agencies and the Covalent mine site has taken much longer than we originally anticipated, but I’m pleased to now report that we are ready to drill one of Riversgold’s key projects.”

Tech

Investigative analytics and intelligence software firm Nuix (ASX:NXL) surged by about 13% yesterday, and we couldn’t work out why at the time. It’s up a further 15% or so today, and the news is this:

Investors are apparently “piling” into the techie, according to The Australian, after it released a preliminary results update a week ago. Maybe it was flying under the radar, maybe investors were just slow to make a move on it while scouring Canadian-narrative lithium stonks instead.

In any case, Nuix is well in the black, with underlying earnings jumping 51-61 per cent to $44m-$47m, compared to FY22.

(A footnote to this, however, according to the same report: “On July 23, The Australian revealed Nuix did not disclose that financial regulator ASIC was probing share purchases by its chief executive Jonathan Rubinsztein for almost eight months.)

Copper

Inca Minerals (ASX:ICG) is up more than 21% today after revealing that Reverse Circulation (RC) drilling has now begun at MaCauley Creek in Queensland on its Wallaroo prospect.

What’s it rooting around for? Copper. Per an announcement to the ASX:

“The drilling will comprise up to 13 RC drill-holes to a depth of 150m, to test highly prospective copper targets where prospective surface rock chip geochemistry coincides with a strong magnetic signature at depth.”

TRADING HALTS

Red Mountain Mining (ASX:RMX) – Capital raising.

Strike Energy (ASX:STX) – An announcement is being drafted regarding a proposed material transaction. They’re fact checking and going through it for typos but that info will be hitting the ASX soon enough.

Talon Energy (ASX:TPD) – Talon saw what Strike’s doing and said “snap”, we’ll do that, too. A proposed material transaction announcement is on its way.

Hazer Group (ASX:HZR) – Capital raising.

Arizona Lithium (ASX:AZL) – Capital raising.

Narryer Metals (ASX:NYM) – Capital raising.

Caravel Minerals (ASX:CVV) – Capital raising.

Brightstar Resources (ASX:BTR) – Capital raising.

Astral Resources (ASX:AAR) – Capital raising.

Kincora Copper (ASX:KCC) – An announcement regarding a proposed acquisition. Oh… and some capital raising.

At Stockhead we tell it like it is. While Riversgold (RGL) is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.