CLOSING BELL: Local markets dragged lower by central bank angst; lithium minnows and New Hope offer some hope

Via Getty

- The ASX 200 benchmark falls 0.5% as central bank boogeymen spook investors

- Energy pretty much on its own out front of the rest of the sectors

- Small caps led by lithium and new metal minnows with some sturdy new finds

Local markets have slid again on Tuesday. The Real Estate Sector, the blue chip miners and big bad banks all weighing heavily following a tepid session on Wall Street overnight.

That left markets at the mercy of local data and any upbeat individual stock narratives to wrestle with this afternoon’s Statement on Monetary Policy which read a lot like an insurance policy on uncertainty.

The benchmark (XJO) lost 0.5%, the Small Ords (XSO) lost 0.3% and the Emerging Co’s (XEC) index shed 0.7%.

At home, the central bank’s September monetary policy minutes were the receptacle of convenience wherein the Reserve Bank’s plonked all its unspoken doubts around the stickiness of still too high inflation and the likelihood it’ll remain a problem for some time yet. With the deterioration evidently ongoing next door at our largest trading partner, the RBA added an extra alarm to listen out for in a Chinese economy which still has the capacity to throw more cold water on our already slushy GDP outlook.

The bank’s warning is plain – this certainly wasn’t the final word on our 18 month rate driven economic comic-tragedy. The show, it seems is going to go on and on.

On Tuesday ASX-listed REITs continued to slide, several now within sight of 12 month lows as this corner of the market speaks truth to to the real hit of of higher interest rates.

Needless to say, a similar drama is playing out this very moment on Wall Street.

US stocks drifted in a directionless circle as traders stood by and watched. No point in fighting or flirting with the US Federal Reserve a few hours out from its critical decision on US interest rates.

Flat and stale was the action. The S&P 500, Dow Jones Industrial Average and the Nasdaq Composite added between 0.1% and 0.05% between them.

Other tidbits of unwelcome tidings this afternoon helped cement the mood on the local bourse.

The Aussie artificial intelligence chip maker, Brainchip Holdings dropped well over 10% as AI punters (I thought) handled news that Brainchip is about to get hoisted from the ASX 200, pretty well.

.

The BrainChip Holdings (ASX:BRN) share price is down over 10% to 24.7 cents. There’s speculation the Aussie version of a meme stock may’ve just done its dinner, with the consecutive quarters of missed targets and ordinary revenue starting to make its still meaty $400 million market cap look awfully fragile.

Elsewhere, the major miners have slipped – both the iron ore giants and the major goldies. The Big Four banks have all given back recent gains, retreating around 1% a piece on Tuesday.

Still, there’s happy news for the half-glass-full types with time to explore.

ASX Uranium stocks continue to do sweet damage to 1-year highs. Uranium prices have just kept climbing in September – the yellow cake is at its own decade-high, pushing the boundaries of decorum at a little over US$60 a pound.

The combo of at-risk and awfully-low supply, vs end-of-days climate events and persistent supply wobbles have kept driving our ASX uranium diggers into happy, lofty share price land.

Paladin Energy (ASX:PDN) just clocked a 12 month high, but then again most of them have – all the big names in the smallish sector are finding ASX trade rather fun right now, including Boss Energy (ASX:BOE), Deep Yellow (ASX:DYL), and Bannerman Energy (ASX:BMN).

Lithium and a few ASX new metals players led the small caps today, although our Nadine McGrath notes that Pilbara Minerals (ASX:PLS) has finally officially become the most shorted stock on the ASX.

It has an 11%short position, short sellers also targeting other lithium stocks including Core Lithium (ASX:CXO) , Sayona Mining (ASX:SYA), and Lake Resources (ASX:LKE).

Short sellers seem concerned lithium prices could fall in the coming years with forecasts of surplus of the battery mineral as more lithium mines globally come into production.

On the graphite front Syrah Resources isn’t going so great, down 7% and also accumulating some short-selling, while medtech Imugene (ASX:IMU) was also short 7%.

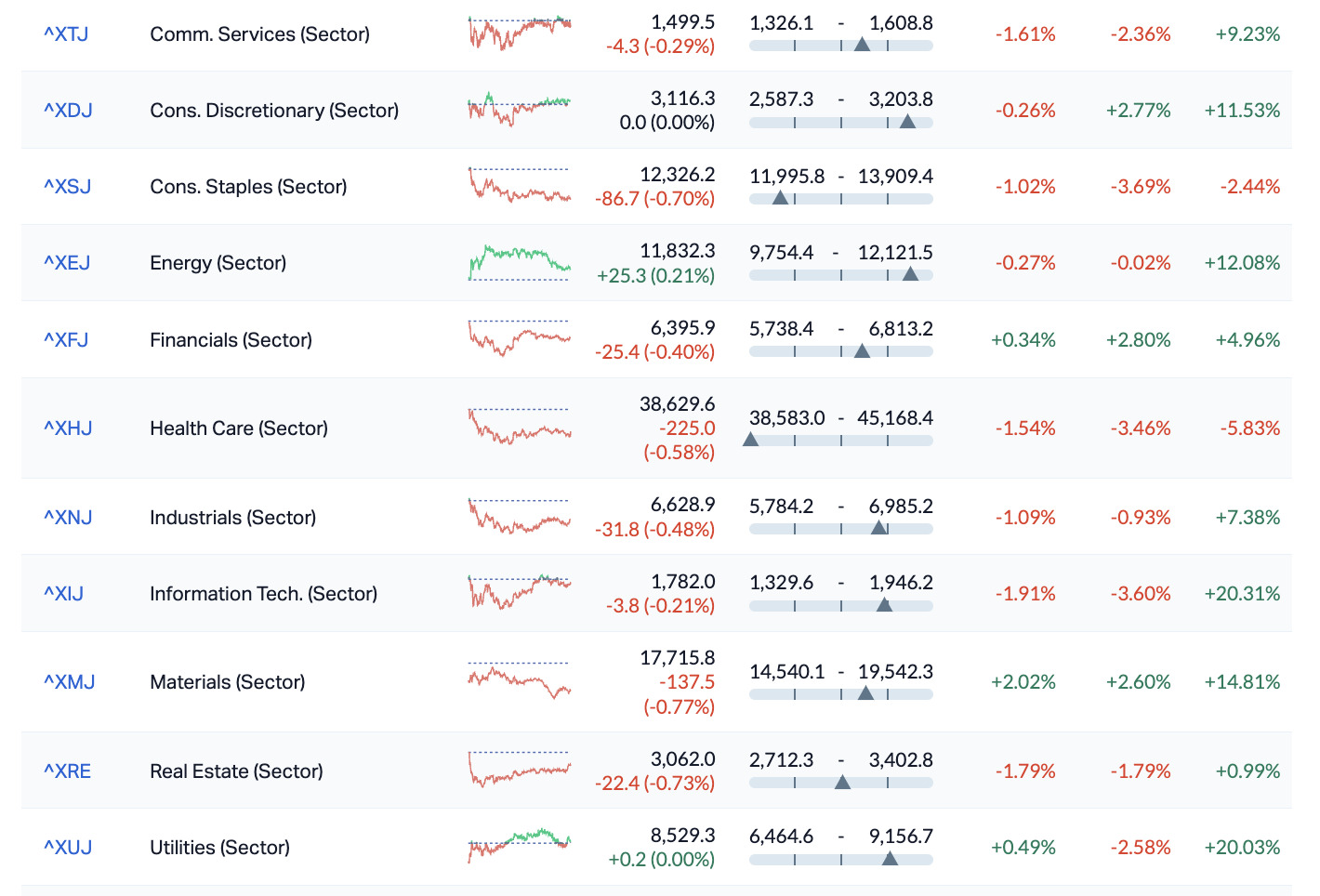

ASX Sectors on Tuesday Sept. 19

RIPPED FROM THE HEADLINES

WTI crude futures rose above $91 per barrel on Tuesday, hovering at the highest levels in over ten months amid expectations of a widening market deficit in the fourth quarter due to dwindling supply.

Saudi Arabia and Russia have already made plain they’ll be extending cuts to the tune of a combined 1.3 million bpd, right through to the new year.

Now the US Energy Information Administration said on Monday that US oil output from top shale-producing regions is on track to decline for the third straight month to 9.393 million barrels per day in October, the lowest since May.

Meanwhile, Saudi Arabia’s Prince Abdulaziz bin Salman – the out-front Energy Minister dismissed the OPEC+ moves to further trim the cartel’s production, saying markets were being guided to limit volatility and warning about global economic and demand uncertainties.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.002 | 100% | 3,402,136 | $15,642,574 |

| JNO | Juno | 0.115 | 44% | 358,763 | $10,852,640 |

| OKR | Okapi Resources | 0.165 | 38% | 4,180,863 | $25,210,322 |

| YPB | YPB Group Ltd | 0.004 | 33% | 250,000 | $2,230,384 |

| CDR | Codrus Minerals Ltd | 0.092 | 31% | 6,961,637 | $5,305,300 |

| MAG | Magmatic Resrce Ltd | 0.066 | 27% | 364,929 | $15,896,025 |

| ODE | Odessa Minerals Ltd | 0.015 | 25% | 14,303,723 | $11,365,342 |

| EFE | Eastern Resources | 0.01 | 25% | 10,345,103 | $9,935,572 |

| ROG | Red Sky Energy. | 0.005 | 25% | 540,224 | $21,208,909 |

| DES | Desoto Resources | 0.13 | 24% | 846,660 | $6,292,283 |

| DRA | DRA Global Limited | 1.7 | 21% | 25,508 | $76,504,355 |

| NIS | Nickelsearch | 0.057 | 21% | 11,651,514 | $4,494,628 |

| BUR | Burleyminerals | 0.2 | 21% | 383,362 | $16,713,965 |

| RDN | Raiden Resources Ltd | 0.035 | 21% | 145,963,738 | $66,391,435 |

| EEL | Enrg Elements Ltd | 0.006 | 20% | 1,137,599 | $5,049,825 |

| EMU | EMU NL | 0.003 | 20% | 4,692,869 | $3,625,053 |

| SUM | Summitminerals | 0.155 | 19% | 916,083 | $4,607,439 |

| PVT | Pivotal Metals Ltd | 0.019 | 19% | 4,109,899 | $8,713,605 |

| VTI | Vision Tech Inc | 0.355 | 18% | 144,413 | $9,515,166 |

| COY | Coppermoly Limited | 0.013 | 18% | 150,568 | $5,831,396 |

| OLY | Olympio Metals Ltd | 0.2 | 18% | 466,839 | $8,696,359 |

| ADY | Admiralty Resources. | 0.007 | 17% | 40,623 | $7,821,475 |

| CAV | Carnavale Resources | 0.007 | 17% | 33,791,521 | $20,001,310 |

| FAU | First Au Ltd | 0.0035 | 17% | 450,000 | $4,355,980 |

| GMN | Gold Mountain Ltd | 0.007 | 17% | 3,574,934 | $13,614,472 |

Lithium play Juno Minerals (ASX:JNO), up some 45% at the close on Tuesday, still riding the waves made by last week’s positivity around news that infill soil sampling results have been full of promise for lithium prospectivity south of its Mount Ida Magnetite Project.

Copper cap, Magmatic Resources (ASX:MAG) is closing Tuesday with almost 30% in the pocket afger kicking off a new diamond drilling program at its greater Corvette and Kingswood prospect within Magmatic Resources’ 100%-owned Myall Project

MAG told the ASX that the program is targeting shallow mineralisation immediately below the transported cover, with 8-10 holes expected to be completed to an average depth of 250 metres over the coming 4-6 weeks, while the processing of diamond core will start nowish too,

The current phase of exploration has the potential to rapidly expand the significant metal endowment already defined at Myall, which includes 354,000 tonnes of copper metal-equivalent.

Codrus Minerals (ASX:CDR) is ahead strongly on Tuesday as well. The REE play’s been sharing some upbeat exploration drilling results at its Karloning REE project in WA.

CDR’s best so far:

20m grading 1,554ppm TREYO from 8m, including 4m grading 2,014ppm TREYO from 18m in hole KGAC057, and 14m grading 1,423ppm TREYO from 12m, including 2m grading 1,931ppm TREYO from 16m in hole KGAC058.

Also enjoying momentum out of last week, Okapi Resources (ASX:OKR) has been rising steadily throughout the day, adding 38%at the close.

And finally, Raiden Resources (ASX:RDN) is up more than 21% after notching high-grade lithium and rubidium samples and a new 50m wide mineralised pegmatite at Andover South, grading up to 2.42% Li2O.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MEB | Medibio Limited | 0.001 | -33% | 50,000 | $9,151,116 |

| MRQ | Mrg Metals Limited | 0.002 | -33% | 611,554 | $6,557,756 |

| MKL | Mighty Kingdom Ltd | 0.009 | -25% | 172,400 | $3,914,635 |

| MDI | Middle Island Res | 0.019 | -21% | 54,276 | $3,375,797 |

| CYQ | Cycliq Group Ltd | 0.004 | -20% | 24,781 | $1,787,583 |

| DEL | Delorean Corporation | 0.025 | -19% | 26,654 | $6,687,348 |

| HOR | Horseshoe Metals Ltd | 0.009 | -18% | 479,802 | $7,078,265 |

| MSI | Multistack Internat. | 0.005 | -17% | 111,604 | $817,824 |

| OAK | Oakridge | 0.083 | -16% | 7,739 | $1,702,372 |

| LIN | Lindian Resources | 0.21 | -16% | 8,961,591 | $284,913,074 |

| RCW | Rightcrowd | 0.021 | -16% | 962,572 | $6,585,448 |

| VN8 | Vonex Limited. | 0.018 | -14% | 975,493 | $7,598,401 |

| GCR | Golden Cross | 0.003 | -14% | 694,160 | $3,840,396 |

| LBT | LBT Innovations | 0.012 | -14% | 396,596 | $4,982,605 |

| LRL | Labyrinth Resources | 0.006 | -14% | 44,254 | $8,312,806 |

| NET | Netlinkz Limited | 0.006 | -14% | 12,220,084 | $24,713,699 |

| TAS | Tasman Resources Ltd | 0.006 | -14% | 105,000 | $4,988,685 |

| JAY | Jayride Group | 0.086 | -14% | 19,500 | $20,363,780 |

| TTM | Titan Minerals | 0.037 | -14% | 7,027,323 | $65,104,952 |

| GMR | Golden Rim Resources | 0.025 | -14% | 118,894 | $17,156,063 |

| 8IH | 8I Holdings Ltd | 0.02 | -13% | 42,034 | $8,219,188 |

| FLC | Fluence Corporation | 0.135 | -13% | 607,058 | $100,835,875 |

| WC8 | Wildcat Resources | 0.375 | -13% | 15,332,091 | $286,215,553 |

| 5EA | 5Eadvanced | 0.35 | -13% | 1,012,372 | $121,598,712 |

| VMS | Venture Minerals | 0.0105 | -13% | 2,140,249 | $23,400,156 |

TRADING HALTS

Invictus Energy (ASX:IVZ) – Pending an update in relation to a capital raising.

Cannindah Resources (ASX:CAE) – Pending the release of an announcement to the market in relation to a capital raising.

Sunshine Metals (ASX:SHN) – Pending the release of an announcement to the market in relation to a capital raising.

Diablo Resources (ASX:DBO) – Pending the release of an announcement to the market in relation to a capital raising.

Castle Minerals (ASX:CDT) – Pending news of a capital raise in the form of a placement.

Bridge SaaS (ASX:BGE) – Pending an announcement in relation to a capital raising.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.