CLOSING BELL: Local markets dip 0.86pc on Chinese developer woes and other bad bets

News

News

It’s not been a tremendously bright day for the ASX, which got off to a rocky start to sink as low as -0.45% at lunchtime today.

But even a pint and a parmy at the pub wasn’t enough to renergise investor spirit, so this afternoon has been a rather dismal slow-mo cow-walk to the knacker’s, leaving the benchmark on -0.86% by close of play.

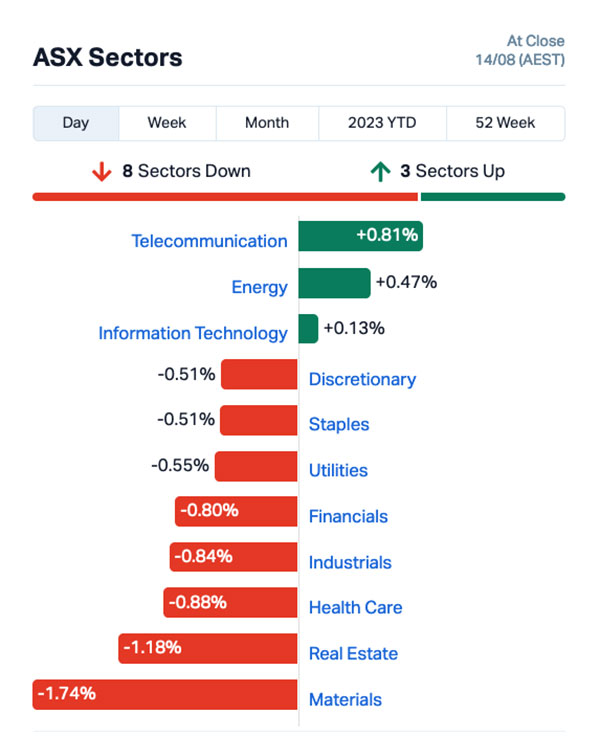

One solitary sector dared show its head above the barricades today, as the Telcos took a rare opportunity to shine while the broader market retreated to nurse heavy casualties.

Up the pointy end of town, telco Tuas (ASX:TUA) pumped out a no-news 8.7% jump, which most likely has its origins in something happening overseas that I’ve not had the time to unravel just yet – but given that the bulk of Tuas’ business is wrapped up in the Singapore mobile market, it’s odds-on that’s where it’s happening.

Meanwhile, Baby Bunting (ASX:BBN) is also up 8.7% this afternoon, after the company released its earnings report to say that while total sales were up 1.7% to $515.8 million, statutory NPAT is down 49.5% vs pcp to $9.9 million.

The company also released its FY23 Modern Slavery Statement, which I skimmed quickly just now, revealing the company continues to believe that slavery is, in fact, a Bad Thing.

And JB HiFi (ASX:JBH) has dipped today, after it posted a net profit after tax of $525 million, down 3.7% from $545 million last financial year.

The company has blamed the fall on a rising cost of doing business, which hit 12.1% over the past financial year, following (I suspect) the soaring cost of lip rings, nose piercings and ill-advised face and neck tattoos for the company’s customer-facing employees.

If you noticed a sharp dip on the bourse in the middle of the day, you’re not alone – it’s kinda hard to miss a 0.2% slump in the space of about 10 minutes, because that kind of action is the kind of thing to give even the hardest, most seasoned market watchers an on-the-spot coronary if the reason’s not immediately clear.

This one, however, is being blamed on some pretty bad news out of China, after investors in one of the country’s largest real estate developers hit the panic button and sparked a 15% sell-off to HK$0.83 in Hong Kong.

In a very worrying sign, the company announced on the weekend it would suspend trading in 11 of its onshore bonds from today, without offering any indication of when trading would resume.

The company’s offshore bonds also took a hammering, leaving a few of them down as low as 6 cents on the dollar – as the company is apparently scrambling to sort out the restructuring of significant debt that left it unable to pay bond coupons last week totalling $22.5 million.

And it seems that owning an Aussie casino is just about the worst thing in the world at the moment, after Aussie-listed Kiwi company Skycity (ASX:SKC) dropped news that it’s preparing to drop a bundle.

The company has informed investors that it’s had to put aside a $45 million provision for legal costs and potential penalties, because Australia’s casino regulators at AUSTRAC are highly likely to hit it with some very bad news around potential anti-money-laundering breaches.

If that’s not enough, SKC has also punted another $45.6 million off the books through a writedown in the value of its Adelaide casino, because (I’m guessing) it’s in Adelaide.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LU7 | Lithium Universe Ltd | 0.057 | 90% | 47,329,230 | $11,655,657 |

| NRX | Noronex Limited | 0.02 | 54% | 5,308,042 | $4,576,664 |

| XTC | Xantippe Res Ltd | 0.0015 | 50% | 1,049,648 | $11,480,100 |

| EEL | Enrg Elements Ltd | 0.007 | 40% | 3,366,812 | $5,046,171 |

| AGR | Aguia Res Ltd | 0.033 | 32% | 280,000 | $10,846,356 |

| MBK | Metal Bank Ltd | 0.041 | 28% | 946,467 | $8,847,537 |

| MGA | Metalsgrovemining | 0.14 | 27% | 2,599,821 | $4,092,055 |

| ADS | Adslot Ltd. | 0.005 | 25% | 3,451,880 | $13,066,471 |

| BPP | Babylon Pump & Power | 0.005 | 25% | 2,000,000 | $9,831,085 |

| FFG | Fatfish Group | 0.017 | 21% | 198,604 | $15,234,784 |

| MEM | Memphasys Ltd | 0.017 | 21% | 947,580 | $13,433,285 |

| ZMM | Zimi Ltd | 0.035 | 21% | 60,779 | $3,233,352 |

| PNX | PNX Metals Limited | 0.003 | 20% | 45,173 | $13,451,562 |

| OAK | Oakridge | 0.155 | 19% | 17,555 | $2,235,438 |

| WC8 | Wildcat Resources | 0.26 | 18% | 13,365,591 | $146,425,752 |

| BNO | Bionomics Limited | 0.013 | 18% | 6,601,802 | $16,156,090 |

| 1CG | One Click Group Ltd | 0.021 | 17% | 3,404,882 | $11,067,848 |

| BEX | Bikeexchange Ltd | 0.007 | 17% | 1,825,979 | $7,134,901 |

| EXL | Elixinol Wellness | 0.014 | 17% | 648,845 | $5,483,896 |

| CTP | Central Petroleum | 0.059 | 16% | 265,253 | $37,199,669 |

| SRJ | SRJ Technologies | 0.075 | 15% | 1,082,524 | $8,498,084 |

| CUF | Cufe Ltd | 0.015 | 15% | 2,544,175 | $12,949,461 |

| FIN | FIN Resources Ltd | 0.015 | 15% | 625,000 | $8,073,460 |

| BCA | Black Canyon Limited | 0.155 | 15% | 3,335 | $8,033,498 |

| CAV | Carnavale Resources | 0.008 | 14% | 10,356,621 | $23,334,862 |

Top of the pops for the day is the barn-storming newbie Lithium Universe (ASX:LU7), which listed today off the back of an oversubscribed $4.5 million IPO at $0.02, and it’s seen a chunk of action since hitting the GO! button this morning.

The company’s joined a long list of ASX diggers on the hunt for lithium in the James Bay region of Canada, and at the time of writing, had climbed to $0.06 per share after hitting the market running at $0.048 this morning.

Also crushing it today was Noronex (ASX:NRX), which has climbed 53.86% on last week’s news that drilling at the company’s 100% owned Fiesta and Blowhole projects has commenced on schedule, following up on earlier drilling that hit intercepts including 8m @ 2.5% Cu and 9m @ 1.8% Cu, 82 g/t Ag.

And in third spot, it’s MetalsGrove Mining (ASX:MGA), up 36.3% today on some fabulous news from the company’s Arunta Project area in the Northern Territory.

MetalsGrove says drilling has hit high-grade carbonatite rare earth (REE) grades of up to 7,000*ppm (0.70%) TREO, 35% MREO/TREO, 28% NdPr/TREO and 36% Y₂O₃/TREO.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MGU | Magnum Mining & Exp | 0.038 | -34% | 46,678,617 | $41,713,822 |

| CCE | Carnegie Cln Energy | 0.001 | -33% | 19,804,869 | $23,463,861 |

| ATH | Alterity Therap Ltd | 0.006 | -25% | 329,221 | $19,519,181 |

| MTH | Mithril Resources | 0.0015 | -25% | 2,549,864 | $6,737,609 |

| BIR | BIR Financial Ltd | 0.05 | -21% | 259,000 | $18,054,911 |

| ADR | Adherium Ltd | 0.004 | -20% | 125,000 | $24,997,042 |

| CTN | Catalina Resources | 0.004 | -20% | 2,061,078 | $6,192,434 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 1,050,063 | $14,368,295 |

| GTG | Genetic Technologies | 0.002 | -20% | 309 | $28,854,145 |

| NTM | Nt Minerals Limited | 0.008 | -20% | 1 | $8,006,989 |

| GSM | Golden State Mining | 0.038 | -19% | 5,964,567 | $8,981,149 |

| RTR | Rumble Res Limited | 0.14 | -18% | 1,826,581 | $108,247,392 |

| NMR | Native Mineral Res | 0.025 | -17% | 200,000 | $4,408,946 |

| SPX | Spenda Limited | 0.0075 | -17% | 2,135,961 | $32,978,675 |

| AUK | Aumake Limited | 0.005 | -17% | 5,432,039 | $8,923,557 |

| AVM | Advance Metals Ltd | 0.005 | -17% | 3,122,028 | $3,531,352 |

| NAE | New Age Exploration | 0.005 | -17% | 2,123,886 | $8,615,393 |

| PRX | Prodigy Gold NL | 0.005 | -17% | 50,000 | $10,506,647 |

| SI6 | SI6 Metals Limited | 0.005 | -17% | 1,137,497 | $11,963,157 |

| TRT | Todd River Res Ltd | 0.01 | -17% | 7,459,984 | $7,818,570 |

| AJQDA | Armour Energy Ltd | 0.11 | -15% | 3,005 | $12,795,489 |

| ASQ | Australian Silica | 0.055 | -15% | 74,877 | $18,307,925 |

| TON | Triton Min Ltd | 0.023 | -15% | 2,512,943 | $42,156,601 |

| RAC | Race Oncology Ltd | 0.865 | -14% | 777,461 | $163,068,780 |

| USL | Unico Silver Limited | 0.1 | -13% | 94,979 | $34,045,933 |

Amaero International (ASX:3DA) has responded to an ASX price query regarding the change in the price of 3DA’s securities since 04 August 2023 from a low of $0.140 to a high of $0.230, which is kind of a lot.

Especially considering that 3DA hasn’t said much more than “boo!” to the ASX since it delivered a fairly pedestrian earnings report last month, other than to give everyone a quick look at the company’s presentation to the ShareCafe Small Cap “Hidden Gems” Webinar on… 04 August.

The company has replied with the now-standard “nuthin’ to see here, folks”, and that, I suspect, will be the last we hear about it.

Meanwhile, there’s trouble a-brewin’ down at the old mill, after EcoGraf (ASX:EGR) took umbrage at the ASX equivalent of a diss track from Renascor Resources (ASX:RNU) last week.

Renascor announced that it’s “lodged an opposition to a pending patent application relating to the purification of graphite. Renascor considers the pending patent application to be overly broad and relating to processing procedures that are not sufficiently novel or inventive to merit patent protection.”

EcoGraf saw that and has decided that them’s fightin’ words, on the basis that the patent application referred to here is the same patent application made by EcoGraf and referred to in its ASX announcement dated 08 November, 2021.

As such, EcoGraf would like it known that “after an extensive examination, the written opinion of the Examiner at the International Preliminary Examining Authority is that all 25 of the patent claims are novel and inventive”, which then “paves the way for the grant of the patent”.

And so, after reviewing the Evidence in Support (filed by Renascor), EcoGraf filed its Evidence in Answer, and the opponents have filed their Evidence in Reply – which is why a delegate of the Commissioner of Patents has been appointed to consider the matter and IP Australia is expected to hold a hearing on the matter later this year.

I’ll keep you posted if I remember to.

Far East Gold (ASX:FEG) – Capital raising.

Clime Investment Management (ASX:CIW) – Announcement to the market regarding a strategic agreement between the company and a significant party. Must be nice… I haven’t been to a significant party in ages.

Azure Minerals (ASX:AZS) – Preparing a response to recent media speculation.

Resource Mining (ASX:RMI) – Capital raising.

Evolution Energy Minerals (ASX:EV1) – Announcement in relation to a material transaction.

Splitit Payments (ASX:SPT) – Announcement concerning a significant transaction, including an application for the removal of Splitit from the Official List of ASX.