Closing Bell: Israel’s strikes grip markets; oil and gold spike while the ASX tumbles over 1pc

News

News

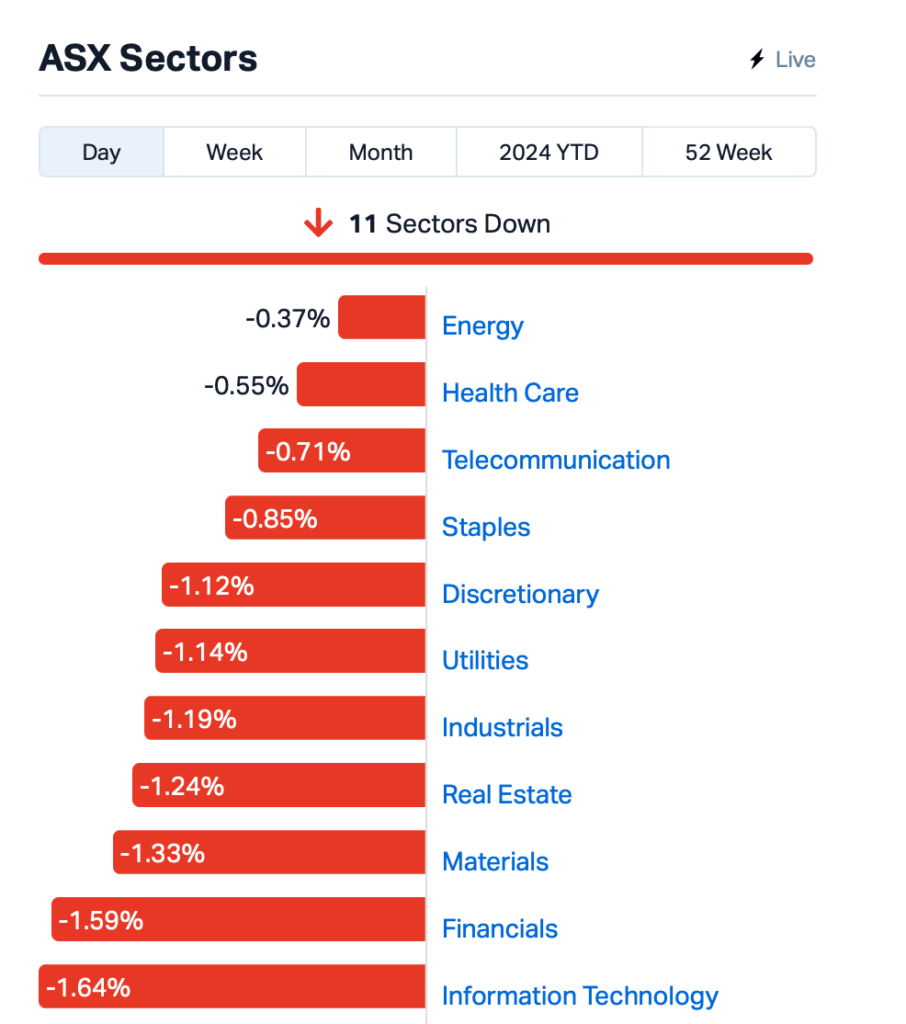

The ASX accelerated its losses this afternoon and sank to a 3-month low following reports of Israeli attacks on Iran. The benchmark ASX 200 index closed the day -1.1% lower, taking its loss for the week around -3%.

According to media reports, Israel launched a strike in the Iranian city of Isfahan at around midday AEST, as well as other targets in Syria and Iraq, in retaliation to Iran’s weekend attack. However, Iran has refuted claims of a missile attack.

“Several drones have been successfully shot down by the country’s air defence, there are no reports of a missile attack for now,” said Hossein Dalirian, spokesman for Iran’s space agency.

Oil prices reacted rapidly after the reports, with Brent crude jumping by over 2% to US$88.60/barrel.

Safe haven gold also rose slightly, trading now at US$2,381.70/ounce, pushing ASX gold stocks higher today. The ASX All Ordinaries Gold (XGD) was up by around +0.8% at the time of writing.

But movements on the ASX today were mostly driven by what happened in New York overnight, where traders sold off rates sensitive stocks following the latest US jobs report.

According to the release, the number of Americans filing new claims for unemployment benefits was unchanged last week from the week before, pointing to continued labor market strength.

“A strong labor market gives the Federal Reserve the room to put off rate cuts until inflation gets back on a sustainable path to 2%,” said Nancy Vanden Houten at Oxford Economics.

New York Fed president John Williams added fuel to fire by saying that he doesn’t see any “urgency” to cut interest rates.

Bond yields spiked following the jobs report, and the Aussie dollar has now sunk to below US64c, trading at US 63.95c.

Before today’s attack by Israel, the key for markets was how the country would retaliate to Iran’s attack on the weekend.

Experts said that if Israel followed up with similarly ambitious attacks, which it has now, other nations become embroiled in the conflict, notably the US.

“Then we would likely see a flight to safety in markets, whereby investors flock to the safe-havens at the expense of high-risk assets,” said Matthew Ryan, Head of Market Strategy at global financial services firm Ebury.

“The threat to global oil supply would also likely trigger a sharp move upwards in oil prices, which could comfortably jump above $100 a barrel should investors fear a wider regional war.”

Asian stock markets were also mainly down today as traders got caught off-guard.

“The escalation in geopolitical risks was unexpected,” said Charu Chanana of Saxo Capital Markets.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BLZ | Blaze Minerals Ltd | 0.006 | 50% | 3,057,221 | $2,514,233 |

| DY6 | Dy6Metalsltd | 0.052 | 41% | 1,355,761 | $1,495,201 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 4,524 | $3,264,346 |

| NGS | NGS Ltd | 0.008 | 33% | 1,686,275 | $1,507,364 |

| RIL | Redivium Limited | 0.004 | 33% | 125,000 | $8,192,564 |

| ARD | Argent Minerals | 0.021 | 31% | 10,443,150 | $20,668,144 |

| AI1 | Adisyn Ltd | 0.026 | 30% | 403,371 | $3,526,992 |

| MCT | Metalicity Limited | 0.003 | 25% | 8,060,694 | $8,970,108 |

| TX3 | Trinex Minerals Ltd | 0.005 | 25% | 699,780 | $6,979,637 |

| WBE | Whitebark Energy | 0.016 | 23% | 380,293 | $2,496,004 |

| PPY | Papyrus Australia | 0.011 | 22% | 92,793 | $4,434,233 |

| EXR | Elixir Energy Ltd | 0.140 | 22% | 9,367,088 | $130,254,784 |

| AU1 | The Agency Group | 0.030 | 20% | 214,382 | $10,714,415 |

| 8IH | 8I Holdings Ltd | 0.012 | 20% | 8,416 | $3,573,560 |

| ADD | Adavale Resource Ltd | 0.006 | 20% | 83,164 | $5,079,898 |

| ATH | Alterity Therap Ltd | 0.006 | 20% | 5,031,797 | $26,190,089 |

| HLX | Helix Resources | 0.006 | 20% | 2,377,494 | $11,615,729 |

| NRZ | Neurizer Ltd | 0.006 | 20% | 5,080,995 | $7,507,054 |

| RML | Resolution Minerals | 0.003 | 20% | 1,677,613 | $4,024,992 |

| VEN | Vintage Energy | 0.012 | 20% | 15,032,977 | $10,869,403 |

| X2M | X2M Connect Limited | 0.051 | 19% | 130,934 | $11,468,845 |

| SRR | Saramaresourcesltd | 0.026 | 18% | 522,000 | $1,824,220 |

| FTL | Firetail Resources | 0.040 | 18% | 195,303 | $5,062,789 |

| TMB | Tambourahmetals | 0.079 | 18% | 169,539 | $5,557,004 |

Today’s standout winner on the ASX was DY6 Metals’ (ASX:DY6) which announced that soil and rock chip sampling has returned up to 3.22% total rare earth oxides (TREO) and 0.75% niobium in the recently acquired licence EL0705 at its flagship Machinga project in Malawi.

Adisyn (ASX:AI1) was also tracking well this morning, with the defence sector IT company top of mind for many investors, thanks to the investor prezzo the company dropped on Monday.

Cyprium Metals (ASX:CYM) was rising steadily, as the copper focused company welcomes an experienced new board appointment, Scott Perry, as a non-executive director and chair of the Audit Committee.

And gold explorer Metalicity (ASX:MCT) was climbing this morning, announcing that drilling is set to commence at its Yundamindra project – the first drilling activity there in 10 years. However, Metalicity’s rise this morning was most likely due to investors being reminded that historical exploration at the site returned assays including 8m @ 56.36g/t Au from 44m, which the company announced back in 2019.

Cyprium Metals (ASX:CYM) , the owner of the mothballed Nifty copper mine in WA, has secured the services of Scott Perry, a storied industry veteran with a bunch of wins under his belt. Perry – who will be CYM’s non-exec director and chair of the audit committee – has been president & CEO at TSX-NYSE listed mid-tier Centerra Gold and chair of the World Gold Council’s audit committee from 2015-2021.

Firetail Resources (ASX:FTL) says assays are now trickling in from a maiden 5000m drilling campaign at Picha’s Cumbre Coya copper target. “The confirmation of the continuation of the mineralisation over 170m with the structure open in all directions gives us huge encouragement for what we may have here,” exec chair Brett Grosvenor says. Results are pending for the third and fourth holes, which were drilled down to depths of 245m and 573m respectively.

Godolphin Resources (ASX:GRL) has acquired the remaining 49% of the Narraburra project in central west NSW from partner EX9, giving it full control of the highly prospective rare earths project following the recent maiden resource estimate of 94.9Mt at 739ppm TREO plus yttrium oxide.

Paradigm Biopharmaceuticals (ASX:PAR) has submitted key documents to the US Food and Drug Administration (FDA) for review, aiming to advance its pivotal Phase 3 clinical trial of lead drug injectable pentosan polysulfate sodium (iPPS/Zilosul) to treat osteoarthritis (OA).

And, as a result of improved performance across the Gippsland, Otway and Cooper Basin production assets, Cooper Energy (ASX:COE)’s FY24 production guidance has now been narrowed to 60.5–64.0 TJe/d. Production expenses have also been reduced and narrowed to $57–63 million. Capital expenditure meanwhile is unchanged at $240–280 million.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TNY | Tinybeans Group Ltd | 0.051 | -46% | 800 | $7,918,064 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 644,196 | $11,649,361 |

| MRD | Mount Ridley Mines | 0.002 | -25% | 1,354,388 | $15,569,766 |

| MRQ | Mrg Metals Limited | 0.002 | -25% | 8,833,334 | $5,050,237 |

| PRM | Prominence Energy | 0.007 | -22% | 1,294,902 | $1,756,137 |

| OSX | Osteopore Limited | 0.095 | -21% | 164,089 | $1,239,443 |

| MGA | Metalsgrovemining | 0.040 | -20% | 29,292 | $1,860,025 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 3,220,390 | $15,846,485 |

| OAR | OAR Resources Ltd | 0.002 | -20% | 13,200,000 | $7,883,277 |

| ODE | Odessa Minerals Ltd | 0.004 | -20% | 250,407 | $5,216,413 |

| TNC | True North Copper | 0.084 | -20% | 6,247,713 | $43,859,503 |

| KNB | Koonenberrygold | 0.026 | -19% | 248,028 | $4,406,766 |

| FNR | Far Northern Res | 0.160 | -18% | 288,888 | $6,970,436 |

| GTG | Genetic Technologies | 0.145 | -17% | 385,611 | $20,198,018 |

| AL8 | Alderan Resource Ltd | 0.005 | -17% | 11,145,707 | $6,641,168 |

| CCZ | Castillo Copper Ltd | 0.005 | -17% | 16,949 | $7,797,032 |

| OAU | Ora Gold Limited | 0.005 | -17% | 4,948,724 | $34,836,005 |

| PRX | Prodigy Gold NL | 0.003 | -17% | 3,716,700 | $6,041,322 |

| RR1 | Reach Resources Ltd | 0.003 | -17% | 744,440 | $11,070,061 |

| HAL | Halo Technologies | 0.105 | -16% | 216,442 | $16,079,549 |

| SIX | Sprintex Ltd | 0.022 | -15% | 1,056,346 | $12,509,892 |

| RVT | Richmond Vanadium | 0.280 | -15% | 115,587 | $28,448,576 |

INOVIQ (ASX:IIQ) was down -14% today despite announcing the successful completion of an analytical validation study for its blood test for ovarian cancer. Overall, the test correctly identified 85% of all samples tested (76% of the cancer samples and 94% of the cancer free samples). The blood test is a simple and affordable combination immunoassay developed by INOVIQ using both a CA125 monoclonal antibody (used by leading diagnostic companies), combined with its SubB2M detection reagent

Drilling is now underway at Impact Minerals’ (ASX:IPT) Hyperion rare earth element (REE) prospect to test a large, +1000ppm TREO soil geochemistry anomaly. The soil anomaly of at least 3km2 includes REE anomalism of up to 5,800ppm total rare earth oxides including high value neodymium and praseodymium of up to 21% within a 3km2 area. Hyperion is a potential clay-hosted deposit hosted in weathered granite and will be tested by 40 aircore holes.

Renascor Resources (ASX:RNU) has executed the native title agreement with the Barngarla Determination Aboriginal Corporation, which paves the way to advance to the construction and operation phases of its Siviour graphite project in South Australia.

It follows the company securing a $185m loan facility from Australia’s Critical Minerals Facility scheme to fast-track development and operation of the upstream graphite concentrate operation at the project.Besides allowing the company to construct and operate the proposed mine, the agreement also allows RNU to proceed with its planned construction and operation of a desalination plant to support mining operations. Additionally, the agreement provides pathways for employment, training and contracting of members of the Barngarla people and for cultural awareness and communication.

Mayur Resources (ASX:MRL) – pending an announcement in relation to the financing of the Central Lime Project.

Midas Minerals (ASX:MM1) – pending the release of an announcement regarding a capital raising.

Emyria (ASX:EMD) – pending the release of an announcement regarding a capital raising.

At Stockhead, we tell it like it is. While Impact Minerals, Renascor Resources, DY6 Metals, Godolphin Resources and Paradigm Biopharmaceuticals are Stockhead advertisers, they did not sponsor this article.