Closing Bell: Investors wag their tails as ASX rallies hard; real estate, goldies, copper stocks all gain

ASX rallied hard on Thursday on higher unemployment rate. Picture Getty

- ASX rallied hard on Thursday on higher unemployment rate

- Real Estate sector jumped, Aristocrat was up over 10pc

- Copper futures traded in New York hit an all-time high

The ASX rallied hard on Thursday after strong gains in New York and a jump in the Aussie unemployment rate. At the close of day, the benchmark ASX200 index was up by +1.8%.

April’s headline unemployment rate ticked higher by 0.2% from March to 4.1%.

The month saw a bump of 30,300 in officially jobless people, but the employment-to-population ratio remained steady at 64%.

“This suggests that the labour market remains tight, though less tight than late 2022 and early 2023,” said Bjorn Jarvis, ABS head of labour statistics.

Local traders also hit the buy button after April’s US CPI data released overnight fuelled hopes for a Fed rate cut pivot, pushing Wall Street’s three major benchmarks to new record highs.

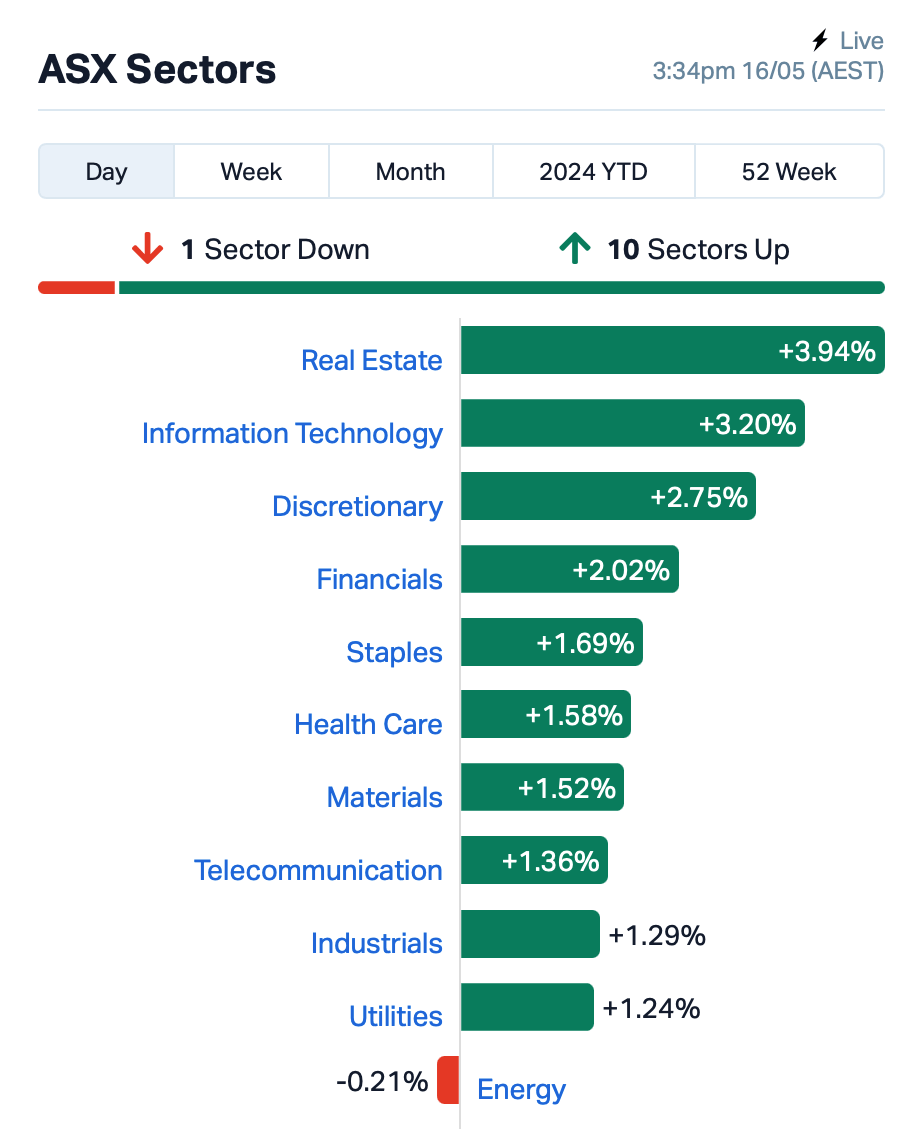

Near the close of today’s session, this is what the ASX looked like:

There were huge gains in the Real Estate sector, led by Goodman Group (ASX:GMG) and Scentre Group (ASX:SCG), which rose by +5% and 4% respectively on no specific news.

Consumer Discretionary’s rally was all about Aristocrat Leisure (ASX:ALL), which enjoyed a mini jackpot with the gaming giant up more than +10% on the back of a hugely positive half-year report showing 16% growth in normalised NPATA to $764 million, and news that shareholders are in line for a $0.36 divvy.

Incitec Pivot (ASX:IPL) jumped almost 6% after the company revealed its plans to sell its fertilisers business to an Indonesian buyer.

Meanwhile, Goldies also proved to be as popular as ever today, with Tech and the Banks in hot pursuit.

What’s happening elsewhere?

Copper futures traded in New York hit an all-time high last night after a short squeeze caused a rush to redirect shipments of the metal to warehouses in the US.

The surge in copper prices helped boost the Bloomberg Commodity Spot Index to hit its highest point since April last year.

Across the region, Asian shares and currencies mostly rose today on the back of the latest US inflation data.

Chinese property developer stocks were out in front as the market feels hopeful that Beijing might step in with some policy support to help buy up unsold homes from struggling builders.

To geopolitics, ‘old friend’ Putin is in China to meet President Xi who told Putin that China and Russia are still tight buddies as Putin gears up for another term.

Xi added that he was prepared “to consolidate the friendship between the two peoples for generations to come”.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.002 | 100% | 927,969 | $3,295,156 |

| HLX | Helix Resources | 0.005 | 67% | 11,443,231 | $6,969,438 |

| ILT | Iltani Resources Lim | 0.320 | 64% | 789,461 | $6,632,048 |

| ME1 | Melodiol Glb Health | 0.003 | 50% | 2,450,316 | $1,426,974 |

| SIH | Sihayo Gold Limited | 0.003 | 50% | 57,100,298 | $24,408,512 |

| RGL | Riversgold | 0.010 | 43% | 23,310,659 | $6,773,630 |

| EMS | Eastern Metals | 0.049 | 36% | 8,924,828 | $2,967,345 |

| ENT | Enterprise Metals | 0.004 | 33% | 428,905 | $2,654,163 |

| IEC | Intra Energy Corp | 0.002 | 33% | 28,500,001 | $2,536,172 |

| KPO | Kalina Power Limited | 0.004 | 33% | 3,141,048 | $7,459,182 |

| VPR | Volt Power Group | 0.002 | 33% | 300,000 | $16,074,312 |

| NTL | New Talisman Gold | 0.020 | 33% | 382,012 | $6,622,943 |

| ION | Iondrive Limited | 0.012 | 33% | 5,891,591 | $4,376,568 |

| SS1 | Sun Silver Limited | 0.565 | 33% | 10,452,241 | $29,613,575 |

| SER | Strategic Energy | 0.013 | 30% | 12,160,284 | $4,858,151 |

| ERW | Errawarra Resources | 0.175 | 25% | 7,829,617 | $13,428,894 |

| AOA | Ausmon Resorces | 0.003 | 25% | 61,875 | $2,117,999 |

| MSG | Mcs Services Limited | 0.005 | 25% | 1,000,000 | $792,399 |

| SHO | Sportshero Ltd | 0.005 | 25% | 8,511,470 | $2,471,331 |

| SIT | Site Group Int Ltd | 0.003 | 25% | 1,000,000 | $5,204,980 |

| BM8 | Battery Age Minerals | 0.130 | 24% | 507,094 | $9,634,833 |

| AGC | AGC Ltd | 0.300 | 22% | 10,901,948 | $54,444,444 |

| PGD | Peregrine Gold | 0.305 | 22% | 315,462 | $16,969,605 |

| INP | Incentiapay Ltd | 0.006 | 20% | 236,870 | $6,219,650 |

| NRZ | Neurizer Ltd | 0.003 | 20% | 1,530,322 | $4,134,896 |

Market newbie Sun Silver (ASX:SS1) was continuing its run on the heels of Wednesday’s excellent debut, with investors continuing to pile on through Thursday, pushing its price higher by another +20%.

Likewise, investors were still pumped about Australian Gold and Copper’s (ASX:AGC) lab-breakingly dense silver discovery at its Achilles project, with intercepts in excess of 3,000g/t Ag that needed to be sent overseas because the local machines took one look and broke down crying.

Errawarra Resources (ASX:ERW) continues to be extremely buoyant despite repeated queries from the ASX asking for an explanation as to why the stock is so popular at the moment, in the absence of any market sensitive news. (Although hang on a sec, ASX police – there was this news, just a few days ago. Just sayin’.)

And if you needed another indicator at just how hot copper is as a commodity right now, Helix Resources (ASX:HLX) was up quite a long way this morning after revealing to the market that a frill campaign has commenced to test a “highest priority” geophysics anomaly at the Canbelego copper project.

Junior explorer Riversgold (ASX:RGL) has all its golden ducks lined up at its highly prospective Northern Zone gold project, about 25km east of Kalgoorlie in Western Australia. More specifically, it has the drill rigs contracted (one reverse circulation, the other air core) and ready to spin hard into some hard rock next week. Earlier in the week, the company announced a placement of $1.85 million to help fund the step-out drilling program at the project, where its aim is to define a maiden, JORC-compliant gold resource.

Bastion Minerals (ASX:BMO), an early-stage exploration minnow on the hunt for copper, gold, and green metals, provided an update on its rare earths activities in Sweden, where it holds the highly prospective, high-grade REE Gyttorp project and eight additional applications in the area. Bastion is currently conducting field work to evaluate the REE prospectivity as well as the copper potential at the sites. It has reason to be positive, with previous exploration in Gyttorp identifying high-grade REE, including an open ended, 500+ metre trend that Bastion says may well extend over more than a kilometre. The company’s previous results include up to 7.27% Total Rare Earth Elements (TREE) +Yttrium (Y).

And speaking of copper again, here’s Sunstone Metals (ASX:STM), a gold’n’copper explorer focused on a historically rich hunting ground for those metals – Ecuador. The company’s shares jumped after an announcement of strong gold-copper trench assays. Results from surface trenching include: 40.4m at 0.86g/t gold and 524ppm copper (open on all sides), and 21.0m at 0.34g/t gold and 714ppm copper (open on all sides).

And… Atomo Diagnostics (ASX:AT1) says the just-announced Federal Budget will significantly support HIV Self-Testing in the country, and will be a big tailwind for its business. The Government announced on Tuesday that people with or at risk of HIV will receive unprecedented support of $43.9 million through better prevention, testing, workforce training and information. This means that more people in at-risk groups will get free HIV self-test kits through the expanded national HIV self-test mail-out program. The Government also intends to expand the South Australia-based HIV testing vending machine pilot to every state and territory, meaning that more people around Australia will get wider access to HIV testing.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PIL | Peppermint Inv Ltd | 0.009 | -40% | 55,980,114 | $31,820,375 |

| CGO | CPT Global Limited | 0.110 | -35% | 11,395 | $7,122,552 |

| ICE | Icetana Limited | 0.018 | -33% | 60,000 | $7,144,968 |

| AHN | Athena Resources | 0.002 | -33% | 10,000 | $3,211,403 |

| CNJ | Conico Ltd | 0.001 | -33% | 313,085 | $2,707,643 |

| MRQ | Mrg Metals Limited | 0.001 | -33% | 92,338 | $3,787,678 |

| WLD | Wellard Limited | 0.027 | -29% | 73,000 | $20,187,512 |

| CUL | Cullen Resources | 0.006 | -25% | 1,409,090 | $4,561,386 |

| LNU | Linius Tech Limited | 0.002 | -25% | 3,583,856 | $11,093,481 |

| M2M | Mtmalcolmminesnl | 0.014 | -22% | 389,311 | $3,149,561 |

| NAC | Naos Ex-50 | 0.550 | -21% | 513,481 | $30,044,510 |

| ADY | Admiralty Resources. | 0.011 | -21% | 935,643 | $22,812,635 |

| EXL | Elixinol Wellness | 0.004 | -20% | 5,118 | $6,505,370 |

| WOA | Wide Open Agricultur | 0.021 | -19% | 10,939,206 | $4,654,609 |

| BGE | Bridgesaaslimited | 0.022 | -19% | 270,000 | $3,223,721 |

| FGL | Frugl Group Limited | 0.085 | -17% | 10,000 | $10,180,128 |

| 1MC | Morella Corporation | 0.003 | -17% | 13,268,864 | $18,536,398 |

| CAV | Carnavale Resources | 0.005 | -17% | 3,333,333 | $20,541,310 |

| GBZ | GBM Rsources Ltd | 0.010 | -17% | 153,900 | $13,880,267 |

| PRX | Prodigy Gold NL | 0.003 | -17% | 421,334 | $6,041,322 |

| T92 | Terrauraniumlimited | 0.110 | -15% | 359,883 | $7,814,921 |

| ODY | Odyssey Gold Ltd | 0.022 | -15% | 154,158 | $23,370,649 |

| CLU | Cluey Ltd | 0.068 | -15% | 5,000 | $16,129,085 |

| VBS | Vectus Biosystems | 0.200 | -15% | 50 | $12,504,200 |

Battery materials and technology company Talga Group (ASX:TLG) fell -1.5% despite providing a positive update on its Vittangi Graphite Project in Sweden. Talga said a growth plan has been launched to define larger and longer term production potential of Vittangi, amid rising demand for Li-ion battery anode material. The study has boosted JORC Exploration Target at Vittangi to 240-350 million tonnes at 20–30% graphite. New scoping study being finalised this quarter, focussing on potential for expanded mining of existing Mineral Resources.

IN CASE YOU MISSED IT

Anax Metals (ASX:ANX) and GreenTech Metals (ASX:GRE) have signed a memorandum of understanding that could see ore from the latter’s Whundo project be processed at the proposed Whim Creek processing hub. For GRE, this presents the opportunity for near-term mining at its Whundo project.

An independent metallurgical report commissioned by Ark Mines (ASX:AHK) has indicated that its Sandy Mitchell rare earths project in far north Queensland boasts all the hallmarks of a low-cost, easily accessible REE deposit.

Belararox’s (ASX:BRX) rock chip assays have provided support for a significant porphyry system to be present at the Malambo, part of its Toro-Malambo-Tambo (TMT) copper project in Argentina.

Challenger Gold (ASX:CEL) has increased the recoverable zinc at its Hualilan gold project in Argentina by 240% to 211,500t after metallurgical test work demonstrated that the metal could be recovered at a head grade as low as 0.4%.

Dateline Resources (ASX:DTR) continues to receive impressive gold results from drilling at its Colosseum gold mine in California, the latest being a thick 104.7m intersection grading 3.65g/t gold.

Maronan Metals (ASX:MMA) has raised $5.65m through a placement of shares and is looking to raise a further $1.5m through a share purchase plan. Proceeds will be used to support the exploration and development of one of Australia's largest and highest-grade silver resources.

Miramar Resources’ (ASX:M2R) reprocessed geophysical data has highlighted a well defined anomaly to the north of Northern Star’s 8 Mile Dam, increasing the possibility of an extension to the 313,000oz gold deposit into Miramar’s ground.

Queensland Pacific Metals (ASX:QPM) has raised $19.1m through an oversubscribed share placement to accelerate development of its Moranbah gas project in Queensland.

Riversgold (ASX:RGL) has contracted two drill rigs to carry out maiden drilling at its Northern Zone gold project near Kalgoorlie, WA.

Torque Metals (ASX:TOR) has completed extension drilling at its Paris gold project and is already planning to carry out further drilling to test the Observation prospect for its open pit gold potential.

Lithium Energy (ASX:LEL) and Novonix have completed their due diligence work and are proceeding with plans to spin off their Queensland graphite projects into an ASX listed company, Axon Graphite.The prospectus for Axon, which seeks to raise between $15m and $25m is expected to be lodged within the next 4-6 weeks. Axon will hold LEL’s Burke and Corella graphite projects and Novonix’s Mt Dromedary graphite deposit.

Provider of on-demand additive manufacturing services AML3D (ASX:AL3) has announced it has raised $6.9m in a capital raise. AL3 raised $3.9 million through applications from existing eligible shareholders and a well-supported shortfall placement. The company says it raised a further $3 million in an additional placement to accommodate demand from institutional, professional, and sophisticated investors in the shortfall placement. AL3 says it is now fully equipped to establish its US manufacturing hub, maintain its technological edge, and bolster its strategic position in the US defence sector.

TRADING HALTS

Galan Lithium (ASX:GLN) – pending the release of an announcement regarding a capital raising.

Si6 Metals (ASX:SI6) – pending an announcement in relation to Brazilian exploration results.

Magmatic Resources (ASX:MAG) – pending an announcement regarding a capital raising.

CuFe (ASX:CUF) – halt requested in respect of a proposed capital raising.

Peninsula Energy (ASX:PEN) – ending an announcement regarding a proposed capital raising.

Brazilian Critical Minerals (ASX:BCM) – pending a material capital raising.

At Stockhead, we tell it like it is. While Lithium Energy, Anax Metals, Ark Mines, Belararox, Challenger Gold, Dateline Resources, GreenTech Metals, Maronan Metals, Miramar Resources, Riversgold and Torque Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.