Closing Bell: Investors rush to mining stocks after China news; while Star crashes 40pc to new low

Star Entertainment plunges over 40pc after trading halt lifted. Pic via Getty Images

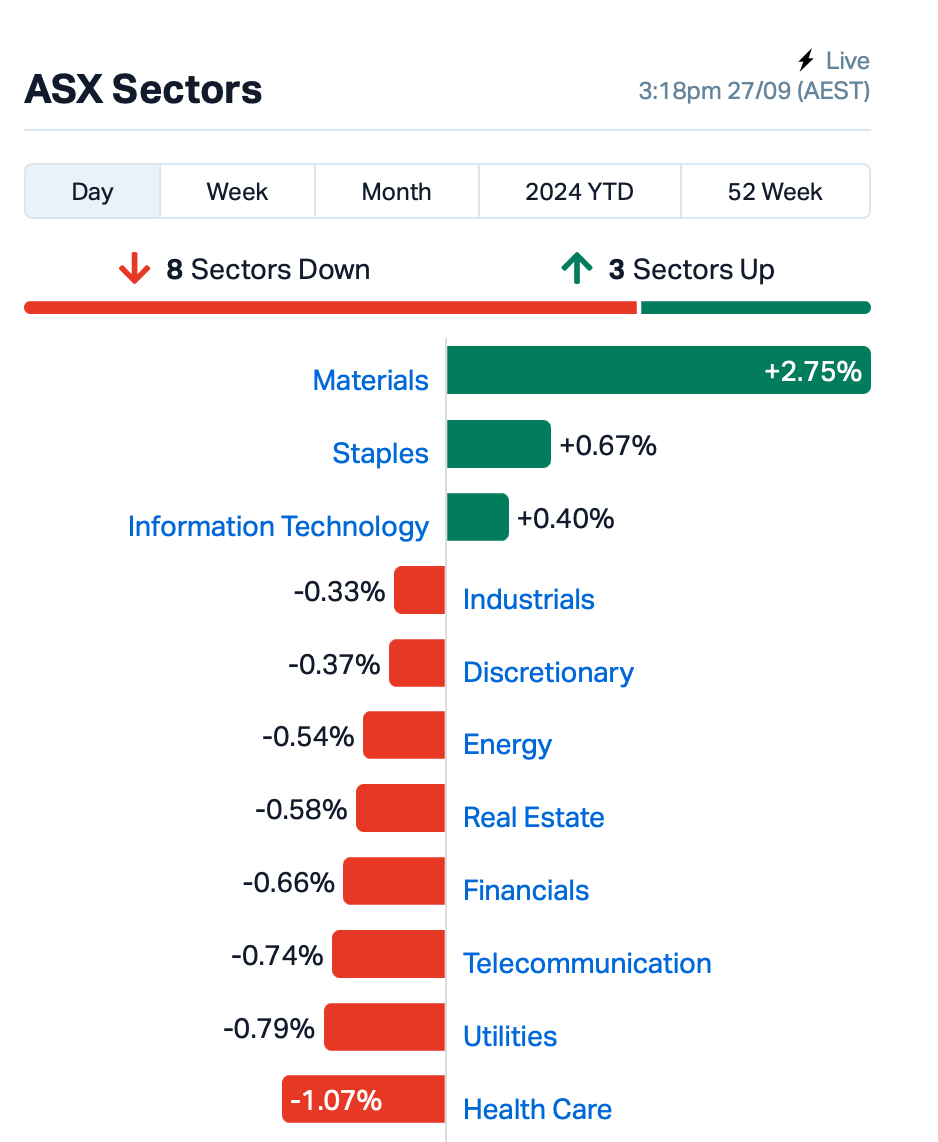

- ASX rises modestly with mining stocks leading gains

- Fortescue surges nearly 5pc as iron ore prices climb

- Star Entertainment plunges over 40pc after trading halt lifted

The ASX rose modestly by 0.1% on Friday, buoyed by a surge in mining stocks that helped offset declines across most other sectors.

Gains in Mining were fuelled by renewed optimism surrounding the demand for iron ore, copper, and lithium in the wake of China’s recent stimulus measure.

As you may recall, China’s central bank has earlier cut its key short-term interest rate and the Politburo announced plans to increase fiscal spending. Additionally, the Chinese government is providing 800 billion yuan in liquidity support for the stock market.

Treasurer Jim Chalmers said the news was a “really welcome development”.

“What happens here and what is decided here has big consequences for our own economy, our own workers and businesses and investors, and for our country more broadly.”

Fortescue (ASX:FMG) surged by nearly 5% as iron ore prices continued to rise on the China news, hitting US$100.30 per tonne. Rio Tinto (ASX:RIO) and BHP (ASX:BHP) jumped around 3% each.

Star Entertainment Group (ASX:SGR) dominated headlines today after plunging 44% and reaching a record low as the stock came out of a trading halt.

This follows a four-week suspension prompted by the release of a report highlighting “governance and cultural concerns” within the company. Star is also facing a $1.4 billion write-down of its casino assets.

Still in large caps, Endeavour Group (ASX:EDV), a hospitality and beverages company, fell by 4% after the announcement that its CEO, Steve Donohue, would be departing.

Vulcan Energy Resources (ASX:VUL) rose 4% as it announced key advancements in financing its Zero Carbon Lithium Project. Vulcan said it has fully acquired Geox GmbH, which operates geothermal wells and renewable energy assets near Vulcan’s lithium extraction plant.

What else happened today?

Stock markets in Asia were on the rise, boosted by China’s latest stimulus measures and positive vibes from the US economy.

China’s CSI 300 Index is set for its biggest weekly gain since 2008 after officials promised to support growth and stabilise the property sector.

Meanwhile, Hong Kong’s tech index is at a year-high, and hopes are high for more stimulus to keep the rally going.

In Japan, the yen weakened while bond futures rose, amid expectations of a new PM who opposes interest rate hikes.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | 100% | 4,926,059 | $12,689,365 |

| DOU | Douugh Limited | 0.005 | 67% | 29,968,882 | $3,246,207 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 216,667 | $793,283 |

| IVX | Invion Ltd | 0.003 | 50% | 10,583,988 | $13,533,183 |

| WEL | Winchester Energy | 0.002 | 50% | 2,375,000 | $1,363,019 |

| CAN | Cann Group Ltd | 0.063 | 40% | 3,381,389 | $21,089,992 |

| RIL | Redivium Limited | 0.007 | 40% | 13,293,101 | $13,734,274 |

| DGR | DGR Global Ltd | 0.018 | 38% | 4,472,068 | $13,568,015 |

| 4DX | 4Dmedical Limited | 0.605 | 36% | 7,260,845 | $182,686,368 |

| ATH | Alterity Therap Ltd | 0.004 | 33% | 131,237 | $15,961,008 |

| NTM | Nt Minerals Limited | 0.004 | 33% | 3,501,057 | $3,052,209 |

| OVT | Ovanti Limited | 0.004 | 33% | 13,392,722 | $4,669,045 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 200,978 | $3,507,439 |

| VEN | Vintage Energy | 0.009 | 29% | 1,142,158 | $11,686,719 |

| FBM | Future Battery | 0.023 | 28% | 983,831 | $11,976,407 |

| NYR | Nyrada Inc. | 0.073 | 26% | 1,822,992 | $10,568,104 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 892,265 | $57,867,624 |

| CYQ | Cycliq Group Ltd | 0.005 | 25% | 1,956,082 | $1,782,067 |

| TEG | Triangle Energy Ltd | 0.005 | 25% | 12,604,156 | $8,320,536 |

| RTR | Rumble Res Limited | 0.047 | 24% | 4,743,967 | $28,744,631 |

| NC6 | Nanollose Limited | 0.021 | 24% | 30,000 | $2,924,108 |

| G50 | G50Corp Ltd | 0.160 | 23% | 436,160 | $15,718,300 |

| NSM | Northstaw | 0.015 | 22% | 63,157 | $1,714,178 |

Douugh (ASX:DOU) was charging hard on news that it has signed a binding agreement to acquire US B2B fintech services platform R-DBX, in a deal that the company says will provide it with a stable positive income stream which in 2023 generated $1.1 million. Douugh has also secured $1 million in working capital via a loan from US-based Relentless Fintech Partners.

4D Medical (ASX:4DX) was up on news that it has signed a comprehensive distribution agreement with Philips, to help the company establish a transformative commercialisation pathway in the United States. Under the terms of the deal, Philips will have exclusive distribution rights to the 4DMedical suite of products with US government customers and non-exclusive rights with all other US customers.

Black Canyon (ASX:BCA) has been boosted by news that drilling has intersected high grade manganese at the W2 prospect at Wandanya, 80km south of the Woodie Woodie Mine in WA. The company says that Portable XRF (pXRF) analysis indicates grade ranges of between 15% to 55% Mn, but – arguably more importantly – the geology of the find “expands the scope to explore for additional high-grade mineralisation along strike where the company has mapped 1.75km of intermittent high grade outcropping manganese”.

Nyrada (ASX:NYR), a drug development company specialising in novel small molecule therapeutics, was climbing on news of the successful completion of a dog toxicology study for its lead candidate, NYR-BI03. The study provided continuing data to support safety and tolerability of the drug, and Nyrada says it is on track to commence first in-human Phase I clinical trial for NYR-BI03 in late CY2024.

Cobalt Blue (ASX:COB) was up on yesterday’s annual report. After booking a $30m impairment to the value of its assets earlier this year and facing oversupply in the cobalt market, COB had a pretty severe drop in share price of 67% in the last year.

An annual report released yesterday has started to lift spirits – and the stock price again – after stating concentrated commitments to its corporate governance and making significant strides in its operations.

This includes the initiation of the Kwinana Cobalt Refinery Study and the commencement of engineering work by Tetra-Tech, while also partnering with Iwatani Corp for potential collaboration on the refinery and its Broken Hill project.

Nothing brewing lately with Loyal Lithium (ASX:LLI) and the last announcement to the market was about partnering with McGill University to access a C$1m research grant to advance its lithium projects in Canada.

It’s got a field program underway at its flagship Trieste project in Quebec’s prolific James Bay lithium district where 10 geo’s are are conducting field prospecting and are due to wrap up the program today. They’ve been concentrating on five resistivity trends across an extensive 22km stretch that align with all six known spodumene-bearing pegmatite dyke outcrops within the project area that showed up to 2.2% Li2O near surface.

Polymetals Resources (ASX:POL) continues to skyrocket after receiving an upgraded ~$30m funding in a loan facility and offtake agreement with long term partner UK-based commodities trader Ocean Partners for its Endeavour base metals mine in mid-September.

The mine developer remains on track to restart Endeavour which comes in with a pre-tax NPV8% of $414m, IRR of a whopping 345% and free cash flow of $609m over the 10-year mine plan with an average annual EBITDA of $89m over the first five years.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SGR | The Star Ent Grp | 0.255 | -43% | 230,852,832 | $1,290,906,395 |

| 1TT | Thrive Tribe Tech | 0.001 | -33% | 15,000,000 | $917,432 |

| VML | Vital Metals Limited | 0.002 | -33% | 917,025 | $17,685,201 |

| AAU | Antilles Gold Ltd | 0.003 | -25% | 1,645,619 | $7,422,971 |

| CTO | Citigold Corp Ltd | 0.003 | -25% | 443,395 | $12,000,000 |

| MEL | Metgasco Ltd | 0.003 | -25% | 761,940 | $5,790,347 |

| RNE | Renu Energy Ltd | 0.002 | -25% | 1,979,250 | $1,608,268 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | 300,000 | $1,929,431 |

| MPP | Metro Perf.Glass Ltd | 0.066 | -22% | 43,181 | $15,757,137 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 540,000 | $2,516,434 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 2,168 | $7,929,526 |

| SFG | Seafarms Group Ltd | 0.002 | -20% | 10,000 | $12,091,498 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 10,010 | $16,439,627 |

| KPO | Kalina Power Limited | 0.013 | -19% | 12,772,416 | $39,782,304 |

| CUL | Cullen Resources | 0.005 | -17% | 98,254 | $4,160,411 |

| IBG | Ironbark Zinc Ltd | 0.003 | -17% | 42,850 | $5,500,943 |

| STM | Sunstone Metals Ltd | 0.005 | -17% | 344,966 | $25,955,422 |

| CXU | Cauldron Energy Ltd | 0.021 | -16% | 3,400,549 | $30,925,766 |

| 1AI | Algorae Pharma | 0.006 | -14% | 6,659,307 | $11,811,763 |

| JRV | Jervois Global Ltd | 0.012 | -14% | 10,132,155 | $37,838,693 |

| BNL | Blue Star Helium Ltd | 0.004 | -13% | 5,280,068 | $9,724,426 |

| BAS | Bass Oil Ltd | 0.071 | -11% | 2,069,057 | $23,234,525 |

IN CASE YOU MISSED IT

Things are heating up for ADX Energy (ASX:ADX), with the European gas producer announcing plans to kick off drilling at its promising light oil discovery in Austria at the Welchau-1 well, discovered earlier in the year.Today, it’s also been confirmed that ADX has spudded the Lichtenberg-1 gas exploration well. It will take about 30 days to drill down to a measured depth of 2,900 metres, hoping to hit the first Oligocene reservoirs at 2,000 metres, with the main target at around 2,500 metres.

The first 4.5 million euros in well costs is covered through a farm-in with MND Austria. CEO Paul Finks says the potential success at LICT-1 could quickly open up a new production and revenue stream for both ADX and its partner MND.

American West Metals (ASX:AW1) is seeing a positive kick in its share price after reporting encouraging assays from the Cyclone prospect within its Storm project in Canada.The standout hit was 22.9m at 8.5% copper and 17.8 g/t silver, struck south of the current resource, highlighting the potential for resource expansion.

Over in Serbia, Strickland Metals (ASX:STK) is reaping the rewards with a stunning 50m hit at 5.6 g/t AuEq at Rogozna.It’s just another indication of the world-class potential of STK’s 5.4 Moz gold equivalent Rogozna project in South East Europe.The latest intercepts extend the strike of high-grade mineralisation at the Medenovac prospect to 150m long, with a maiden resource estimate expected in early 2025.

With the countdown clock on for drilling at Andover South, Raiden Resources (ASX:RDN) has completed structural interpretation on the Andover complex. Managing director Dusko Ljubojevic said the results will help pinpoint further target areas and streamline exploration across the entire project area.

Queensland Pacific Metals (ASX:QPM) is making great strides with its first production well drilling campaign in Teviot Brook South. Five of the proposed seven lateral wells are complete, totalling over 8,800 metres of in-seam drilling so far. Two wells are already in production, and the company expects to complete and commission the other three by the end of October. All of this is 100% funded under the Dyno Nobel Development Funding Facility.

Strata Minerals (ASX:SMX) (formerly NickelX) has completed the acquisition of the Penny South gold project in WA. The project resides in a world-class gold district, just 550 metres south of one of Australia’s highest-grade producing gold mines, owned by Ramelius Resources (ASX:RMS). The company will now work through reviewing all available data for Penny South.

Pan Asia Metals (ASX:PAM) has started the first IP survey to be conducted at its Rosario copper project in Chile, where it is on the hunt for “Manto” style mineralisation. It’s a big diversification play for the explorer, which boasts a number of lepidolite and tungsten prospects in Southeast Asia. Rosario is just 10km north of Antofagasta’s large El Salvador mine, with initial IP lines run by contractor Quantec Geoscience to focus on the historical Salvadora and Royal copper mines, testing for blind evidence of copper mineralisation beneath the surface.

“As previously announced, this is the first ever IP survey at Rosario,” PAM boss Paul Lock said.

“Given the presence of small scale historical mines, in conjunction with the high grade rock chip and channel samples, and Rosario’s proximity to the famous El Salvador mine 10km to the south, we have a high level of confidence that the IP survey will produce interesting results.

“The IP survey will be closely followed by an inaugural drill program. Of further appeal is the fact that access is very good.”

A 2500m drill program is expected to follow in November.

Also looking to drill is Raiden Resources (ASX:RDN), which could be sinking the rod into the Andover South lithium project in the Pilbara as soon as this weekend. It’s completed structural interpretation on the Andover complex over the fence from Gina Rinehart, Mark Creasy and SQM’s monster Andover pegmatite, one of the largest hard rock lithium discoveries in the world.

“We undertook this exercise with the objective of understanding the district scale structural setting and the relationship between the observed mineralisation at Andover South to the setting of the Andover Deposit, which is located to the north-east of our target area,” RDN MD Dusko Ljubojevic said.

“The district scale controls on mineralisation, inferred from this exercise will assist us to plan and refine our analysis on an ongoing basis with the aim of defining further target areas and aligning our planned exploration activities through the entire project area.”

Already drilling is American West Metals (ASX:AW1), which hit 22.9m at a stonking 8.5% copper and 17.8gt silver at the Cyclone prospect in its Storm project in Canada. The project in Nunavut, on the remote Somerset Island, could end up high enough in grade to support a rare DSO mining and shipping operation, something which comes with far lower start up capital than a traditional copper operation. The intercept was 75m south of a 17.5Mt resource containing 1.2% copper and 3.4g/t silver – 205,000t Cu metal and 1.9Moz of silver metal – and included a 9.1m section at a rarely sighted 14.4% copper + 21.3g/t silver.

In Queensland, Queensland Pacific Metals (ASX:QPM) is making progress on drilling its new gas production wells at the Teviot Brook South project. Five of the seven proposed lateral wells have now been completed, with 8800m of seam drilling done so far. Two wells are in production with three more to be commissioned by the end of October, all funded through a facility with customer Dyno Nobel, part of the Incitec Pivot (ASX:IPL) group.

“We’re excited at the progress we have achieved to date for our maiden production well drilling campaign. The encouraging early gas flows from the first two wells and positive production growth trends we have seen to date are very pleasing,” CEO David Wrench said.

“Furthermore, we also appreciate the continued support of IPL who have funded this drilling program and agreed to an amendment to our Corporate Guarantee Facility to directly fund the fixed charges under the existing NQGP and TPS contracts and support QPM’s financial capacity over the term of the agreement.”

In Serbia, Strickland Metals (ASX:STK) caught the eye with a drill hit of 50m at 5.6g/t gold equivalent outside its 5.4Moz gold equivalent resource at Rogozna.

Also in Europe and hot on the heels of announcing plans to resume drilling at a potential light oil discovery in Austria at its Welchau-1 well, ADX Energy (ASX:ADX) announced it had spudded the Lictenberg-1 gas exploration well on September 26.

With the first 4.5 million euros of well costs funded by farm-in partner MND Austria, it’s expected to take 30 days to drill the well to a measured depth of 2900m, with the first Oligocene reservoirs to be encountered at 2000m and the main target reservoir expected to be hit at around 2500m.

It’s thought the well could boast excellent development prospects if testing is successful. Open access pipelines run within 4km of the site, with gas pricing in the central European market sitting at a heady US$15 per MCF equivalent. LICHT-1 has a best estimate prospective resource of 21Bcf of recoverable gas, having already been mapped with 3D seismic.

ADX CEO Paul Fink said the well, following the successful drilling of the Anshof-2A oil appraisal well, is the first gas prospect drilled at the ADX-AT-I exploration licence.

“Success at LICHT-1 could lead to a rapid development of a new production and revenue stream for ADX and its partner MND. ADX believes there is a high chance of success at LICHT-1,” he said.

“Moreover, several near-by, follow up exploration prospects could lead to very significant reserves growth and long-term gas production.

“Success at LICHT-1 and the follow-up prospects identified by ADX would be a significant economic benefit to Austria and lessen Austria’s very high reliance on imported Russian gas.”

Around 97% of Austria’s gas demand was supplied from Russian sources, as of January this year.

Back to the more familiar ASX climes of WA and Strata Minerals (ASX:SMX) has completed the acquisition of the Penny South gold project. It’s located just 550m south, or three MCGs in the parlance of this wonderful AFL Grand Final week, of Ramelius Resources’ Penny gold mine. That operation has what initially appears a modest 440,000t of ore at a bonkers grade of 22g/t for 320,000oz of highly profitable gold. RMS paid over $200m for the thing. SMX is hoping lightning strikes twice.

TRADING HALTS

A2 Milk (ASX:A2M) – to respond to ASX’s price query received this morning and to inform the market regarding a potential acquisition by A2M.

Estrella Resources (ASX:ESR) – No reason given by the ASX for the halt being called.

TMK Energy (ASX:TMK) – to allow TMK to manage its continuous disclosure obligations whilst it undertakes a capital raising.

At Stockhead, we tell it like it is. While ADX Energy, American West Metals, Strickland Metals, Raiden Resources, Queensland Pacific Metals, Pan Asia Metals, Raiden Resources, American West Metals, Queensland Pacific Metals, Strickland Metals, and Strata Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.