Closing Bell: Hairy morning trade leaves markets with more of a trim than a buzz cut, XEC goes the fade with long bangs

News

News

Another tense morning of selling on the ASX200 has eased off in afternoon trade, although the small cap index will be leaving the barber’s at 4pm short twenty bucks and looking a lot less wiser, giving up another 1.6 per cent.

Global markets have been largely shite. Wall Street recovered late but shed circa 2 per cent. In Europe, all major indices finished down more than 2 per cent. And across our region the Hang Seng has done well to trim earlier falls to under 2%.

At home, the resources sector was the main focus of selling in the AM. Iron ore prices and energy stocks retreated as oil prices dropped well over a per cent as China’s mirthless COVID-lockups continue.

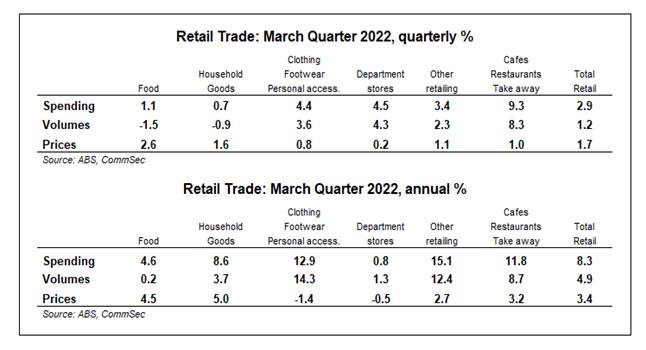

Meanwhile, a little good news – retail trade rose 1.6 per cent in March to record highs with spending up 9.4 per cent on the year.

In the March quarter, spending rose 2.9 per cent with volumes up 1.2 per cent and prices up 1.7 per cent.

CommSec’s Craig James says, ‘the $64 question now is whether an environment of higher interest rates and inflation squashes the desire to spend.

“It is clear that Aussies got out and about over the first three months of 2022 as more states and territories elected to ‘live with Covid’,” he says.

“Spending at cafes, restaurants and takeaway outlets soared 9.3 per cent in the quarter with most of this increase in ‘new’ spending rather than the result of higher prices.”

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Last | % | Volume |

|---|---|---|---|---|

| IPTRA | Impact Minerals - Rights 13-May-22 | 0.002 | 100% | 5,007,137 |

| ARE | Argonaut Resources | 0.004 | 33% | 1,429,057 |

| AYA | Artryalimited | 0.865 | 24% | 191,578 |

| CBR | Carbon Revolution | 0.555 | 23% | 497,279 |

| DTZ | Dotz Nano Ltd | 0.35 | 21% | 939,940 |

| G6M | Group 6 Metals Ltd | 0.21 | 20% | 6,268,661 |

| REC | Rechargemetals | 0.33 | 20% | 783,403 |

| CLE | Cyclone Metals | 0.006 | 20% | 5,807,683 |

| TMK | TMK Energy Limited | 0.012 | 20% | 9,004,811 |

| MMA | Maronanmetalslimited | 0.335 | 20% | 439,148 |

| BMT | Beamtree Holdings | 0.3 | 18% | 368,944 |

| DAF | Discovery Alaska Ltd | 0.041 | 17% | 103,000 |

| AR9 | Archtis Limited | 0.145 | 16% | 1,565,572 |

| HIQ | Hitiq Limited | 0.088 | 16% | 30,658 |

| PNV | Polynovo Limited | 1.065 | 15% | 5,212,847 |

| LRS | Latin Resources Ltd | 0.12 | 14% | 38,879,879 |

| MKL | Mighty Kingdom Ltd | 0.08 | 14% | 141,154 |

| IAM | Income Asset | 0.165 | 14% | 85,150 |

| HXL | Hexima | 0.335 | 14% | 182,666 |

| BGT | Bio-Gene Technology | 0.21 | 14% | 133,488 |

| COB | Cobalt Blue Ltd | 0.81 | 13% | 4,402,908 |

| BRX | Belararoxlimited | 0.78 | 13% | 184,724 |

| MMG | Monger Gold Ltd | 0.35 | 13% | 346,840 |

| GLV | Global Oil & Gas | 0.027 | 13% | 28,771,008 |

| PNM | Pacific Nickel Mines | 0.09 | 13% | 1,000,500 |

Carbon Revolution (ASX:CBR) nabbed a $12m Commonwealth Modern Manufacturing Initiative Grant for its Mega-line project – which is expected to increase the carbon fibre wheel manufacturer’s capacity to supply its carbon fibre wheels to the rapidly growing global EV market by 75,000 wheels to a total of 155,000 wheels per annum.

“We are proud to be generating opportunities for our skilled workforce in Geelong and working with local partners on delivering our Mega-line,” CEO Jake Dingle said.

GME Resources (ASX:GME) is up strongly on nerry a word – its main asset is the advanced ‘NiWest’ nickel cobalt project next door to Glencore’s Murrin Murrin Operations.

NiWest, which hosts one of the highest-grade undeveloped nickel laterite resources in Australia, was recently dusted off due to improved battery metals sentiment.

An updated prefeasibility study (PFS) has now started and the update would consider the impact of higher nickel and cobalt prices since the original PFS was completed mid-2018.

“Nickel is currently trading above US$15/lb compared to the US$8/lb assumption applied in the PFS, which returned projected free cashflow of A$3.34 billion and NPV8 of A$791 million,” GME says.

The updated PFS should be completed in the current quarter.

Surefire Resources (ASX:SRN) has identified high priority targets after reviewing historical data and aeromagnetic surveys at its Perenjori West project in Western Australia. Surefire identified 15 priority gold and base metals targets along with a previously unrecognised and unexplored ultramatic belt identified. Surefire recently acquired a tenement in the area, which covers a largely concealed greenstone.

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| EN1DA | Engage:Bdr Limited | 0.01 | -60% | 456,030 |

| NME | Nex Metals Explorat | 0.025 | -34% | 39,084 |

| YPB | YPB Group Ltd | 0.001 | -33% | 6,668,960 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 1,280,325 |

| IVO | Invigor Group Ltd | 0.03 | -25% | 389,000 |

| OLH | Oldfields Holdings | 0.05 | -23% | 90,000 |

| POL | Polymetals Resources | 0.105 | -22% | 14,060 |

| SCT | Scout Security Ltd | 0.031 | -21% | 980,000 |

| 99L | 99 Loyalty Ltd. | 0.033 | -20% | 211,219 |

| MBX | Myfoodieboxlimited | 0.145 | -19% | 10,000 |

| BTR | Brightstar Resources | 0.021 | -19% | 4,598,475 |

| IEC | Intra Energy Corp | 0.013 | -19% | 1,418,203 |

| AMM | Armada Metals | 0.11 | -19% | 120,216 |

| WGR | Westerngoldresources | 0.11 | -19% | 54,500 |

| NET | Netlinkz Limited | 0.051 | -18% | 29,578,936 |

| MTR | Metal Tiger | 0.33 | -18% | 1,000 |

| FGR | First Graphene Ltd | 0.1075 | -17% | 2,154,847 |

| NYM | Narryermetalslimited | 0.15 | -17% | 140,000 |

| SBW | Shekel Brainweigh | 0.125 | -17% | 77,612 |

| AXP | AXP Energy Ltd | 0.005 | -17% | 597,673 |

| GGX | Gas2Grid Limited | 0.0025 | -17% | 3,947,500 |

| JLG | Johns Lyng Group | 6.85 | -17% | 2,404,100 |

| 3MF | 3D Metalforge | 0.021 | -16% | 470,903 |

| RAB | Adrabbit Limited | 0.032 | -16% | 141,499 |

| XRG | Xreality Group Ltd | 0.039 | -15% | 1,041,323 |

Tombola Gold (ASX:TBA) has announced its received firm commitments to raise $10.5 million through a strongly supported placement to institutional and sophisticated investors.

The shares were issued at price of 6 cents per share, representing a 5% premium to the 15-day VWAP and 7.7% discount to the last close price of 6.5 cents. Tombola said it’s now fully financed into initial gold production from its flagship Mt Freda Goldmine in Q3 CY22.

RC Funds (ASX:ARC) has announced its will acquire the investment management rights to Lanyon Investment Company (ASX:LAN). RC working alongside and in partnership with Chairman David Prescott. will seek to restructure Lanyon such that it will be managed by ARC and become a subsidiary of ARC. The company plans to rename Lanyon ARC Emerging Managers Limited and said it will remain a listed investment company.

Australian Mines (AUZ:ASX) – trading halt, pending an announcement concerning proceedings commenced by ASIC

Aguia Resources (ASX:AGRO) – trading halt in relation to the Public Civil Action regarding the Company’s Três Estradas Phosphate Project

Dart Mining NL (ASX:DTM) – trading halt pending a placement

Amaero International (ASX:3DA) – trading halt pending a capital raising