Closing Bell: Global conflict vs. local markets (2-0), rain did not stop play

News

Like my brave suburb near the airport, the ASX 200 is sinking on Tuesday. Only, the XJO is down around half a per cent, while we haven’t been this wet since 1820. It’s all about perspective.

At 3.15pm (Sydenham time) the ASX Emerging Companies (XEC) index is more than 2% underwater – mad oil prices and mad decisions in Ukraine doing their dampening thing in the small cap space as well.

Materials and energy names weighed, offsetting a decent run for defensives and the major healthcare stocks.

Commodities, meanwhile remain the plaything of the market gods – iron ore, up circa 7% (that’s way over $US160), and wheat – according to CBA’s director of agri-strategy Tobin Gorey – is teetering on the edge of a new record high…

And then there’s nickel.

In the words of our deputy editor, Samuel ‘The Accountant’ Jacobs, overnight there was a parabolic move in nickel prices, prompting even the National Australia Bank to get hyperbolic, saying “nickel has stolen the limelight,” rising as much as 90% since Friday’s close.

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| NTL | New Talisman Gold | 0.002 | 100% | 2,193,043.00 |

| TZN | Terramin Australia | 0.032 | 45% | 4,044,109.00 |

| TMS | Tennant Minerals Ltd | 0.067 | 37% | 79,795,515.00 |

| ANL | Amani Gold Ltd | 0.002 | 33% | 999,275.00 |

| EPM | Eclipse Metals | 0.032 | 33% | 4,256,826.00 |

| VMG | VDM Group Limited | 0.002 | 33% | 204.00 |

| RAB | Adrabbit Limited | 0.028 | 33% | 751,810.00 |

| NOR | Norwood Systems Ltd. | 0.015 | 25% | 1,664,228.00 |

| GGX | Gas2Grid Limited | 0.0025 | 25% | 3,500,000.00 |

| AVW | Avira Resources Ltd | 0.006 | 20% | 14,577,462.00 |

| HHR | Hartshead Resources | 0.025 | 19% | 13,760,041.00 |

| BKY | Berkeley Energia Ltd | 0.24 | 17% | 51,892.00 |

| TGH | Terragen | 0.175 | 17% | 98,112.00 |

| MCT | Metalicity Limited | 0.007 | 17% | 776,300.00 |

| KCN | Kingsgate Consolid. | 1.58 | 17% | 3,360,745.00 |

| CG1 | Carbonxt Group | 0.29 | 16% | 471,323.00 |

| ECG | Ecargo Hldg | 0.029 | 16% | 94,580.00 |

| PG1 | Pearl Global Ltd | 0.023 | 15% | 514,212.00 |

| ESR | Estrella Res Ltd | 0.031 | 15% | 32,922,910.00 |

| BSA | BSA Limited | 0.105 | 14% | 181,547.00 |

| WIN | Widgienickellimited | 0.415 | 14% | 3,245,552.00 |

| REC | Rechargemetals | 0.125 | 14% | 143,040.00 |

| NSX | NSX Limited | 0.07 | 13% | 534,223.00 |

| SVY | Stavely Minerals Ltd | 0.41 | 12% | 790,483.00 |

| SBM | St Barbara Limited | 1.59 | 12% | 14,173,482.00 |

Also up is Carlingup Nickel owner, the WA-based explorer NickelSearch (ASX:NIS) which say’s its done with a big aircore drilling program, and now it’s all about RC and diamond drilling for its flagship Carlingup in Ravensthorpe.

Staying with the diggers, Tennant Minerals (ASX:TMS) is cracking on, flagging a ‘spectacular’ copper strike at its Bluebird copper-gold project in Tennant Creek, NT.

Closing higher, Terramin Australia (ASX:TZN), running zinc and gold projects in South Australia and a JV in Algeria where its joint venture partners have “formally endorsed the Tala Hamza zinc project and agreed to proceed with the development of the project”.

“The ‘Decision to Mine’ clears the path for the issue of the mining permit by the Algerian mining regulator,” the company said.

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| SMRR | Stanmore Resources - Rights 14-Mar-22 Def | 0.47 | -37% | 361,555.00 |

| TSC | Twenty Seven Co. Ltd | 0.0035 | -22% | 19,876,454.00 |

| RBR | RBR Group Ltd | 0.004 | -20% | 1,594,020.00 |

| AFW | Applyflow Limited | 0.0025 | -17% | 3,500,000.00 |

| BUD | Buddy Tech | 0.005 | -17% | 18,529,232.00 |

| ESH | Esports Mogul Ltd | 0.005 | -17% | 1,939,476.00 |

| EVE | EVE Health Group Ltd | 0.0025 | -17% | 5,111,908.00 |

| ROO | Roots Sustainable | 0.005 | -17% | 5,940,136.00 |

| HMI | Hiremii | 0.046 | -16% | 665,000.00 |

| MXI | Maxiparts Limited | 2.045 | -16% | 259,742.00 |

| PEB | Pacific Edge | 0.77 | -15% | 4,000.00 |

| TNY | Tinybeans Group Ltd | 0.45 | -15% | 39,260.00 |

| ENV | Enova Mining Limited | 0.017 | -15% | 1,000.00 |

| IEC | Intra Energy Corp | 0.017 | -15% | 649,410.00 |

| FME | Future Metals NL | 0.235 | -15% | 5,601,560.00 |

| M2M | Mtmalcolmminesnl | 0.094 | -15% | 53,409.00 |

| MBK | Metal Bank Ltd | 0.006 | -14% | 2,104,224.00 |

| MR1 | Montem Resources | 0.043 | -14% | 1,069,003.00 |

| K2F | K2Fly Ltd | 0.155 | -14% | 702,738.00 |

| FIN | FIN Resources Ltd | 0.025 | -14% | 437,001.00 |

| BGT | Bio-Gene Technology | 0.22 | -14% | 1,030,857.00 |

| CPM | Coopermetalslimited | 0.44 | -14% | 654,974.00 |

| C29 | C29Metalslimited | 0.16 | -14% | 13,800.00 |

| JPR | Jupiter Energy | 0.032 | -14% | 738,565.00 |

| TOY | Toys R Us | 0.13 | -13% | 181,959.00 |

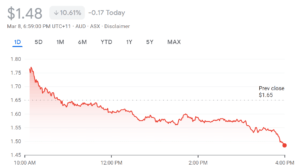

Then again there’s nickel. But in this case Nickel Mines (ASX:NIC) which really enjoyed the first 15 minutes of Tuesday, backers of the Indonesia-based producer could’ve been forgiven for expecting a festival having started the day up 4% crunching its all time high of $1.77 as exuberance for the metal took off.

That’s not how it played out, as nickel gamblers cashed their NIC chips and split, the stock closing well over 10% lighter.

It’s all very down and dirty on Tuesday, the miners coming out to play.

First up, the diamond miner Lucapa Diamond Company (ASX:LOM) which raised $12.5 million, thanks to cornerstone funding from Tribeca Investment Partners.

The offer was priced at 7.5 cents per share, a discount of ~4% to the volume weighted average price of Lucapa shares during the previous 5-day trading period. Following a significant and rapid increase in diamond prices in 2021, funds will be used to expedite its drilling programs.

After digging around herself a bit, Stockhead’s Nadine McGrath ID’d some very nice looking gems from Lucapa mines in Angola, Lesotho and also up in the Northern Territory.

Meanwhile, the ill-named gold miner Emerald Resources (ASX:EMR) says it now has a 49.41% stake in WA junior goldie Bullseye following expiry of withdrawal rights at 5pm WST on March 7.

It was the company’s intention to issue Emerald shares to accepting Bullseye shareholders as soon as practical…

But, yes, there’s a but: the Takeovers Panel wants to look into a further application by China’s Hong Kong Xinhe International Investment Company (this one goes back to 2018, so no rush team) around Emerald’s recommended and unconditional takeover of Bullseye.

And finally, good news for AusQuest Limited (ASX:AQD) which has some positive results from its maiden drilling program at the Los Otros Porphyry in southern Peru, which is subject to a strategic alliance agreement with a wholly-owned subsidiary of South32 (ASX:S32).

Here’s Alejandro Amenábar’s Los Otros with Nicole Kidman being freaky en Espagnol!

Totally freaky, in any language, AQD says advanced argillic alteration (AAA) indicative of a lithocap environment, often associated with prophyry copper deposits, was intersected in every drill hole indicating the presence of an extensive alteration system within the volcanic stratigraphy at… Los Otros (The Others).

Its just an odd choice for a mine, is all.

Sacgasco Limited (ASX:SGC) – Suspended from Quotation – pending capital raise

Incannex Healthcare Limited (ASX: IHL) – Trading Halt – ahead of stage 2 clinical trials results