Closing Bell: Crisis of confidence takes fragile markets down, Dundas hits ultramafic magic

News

News

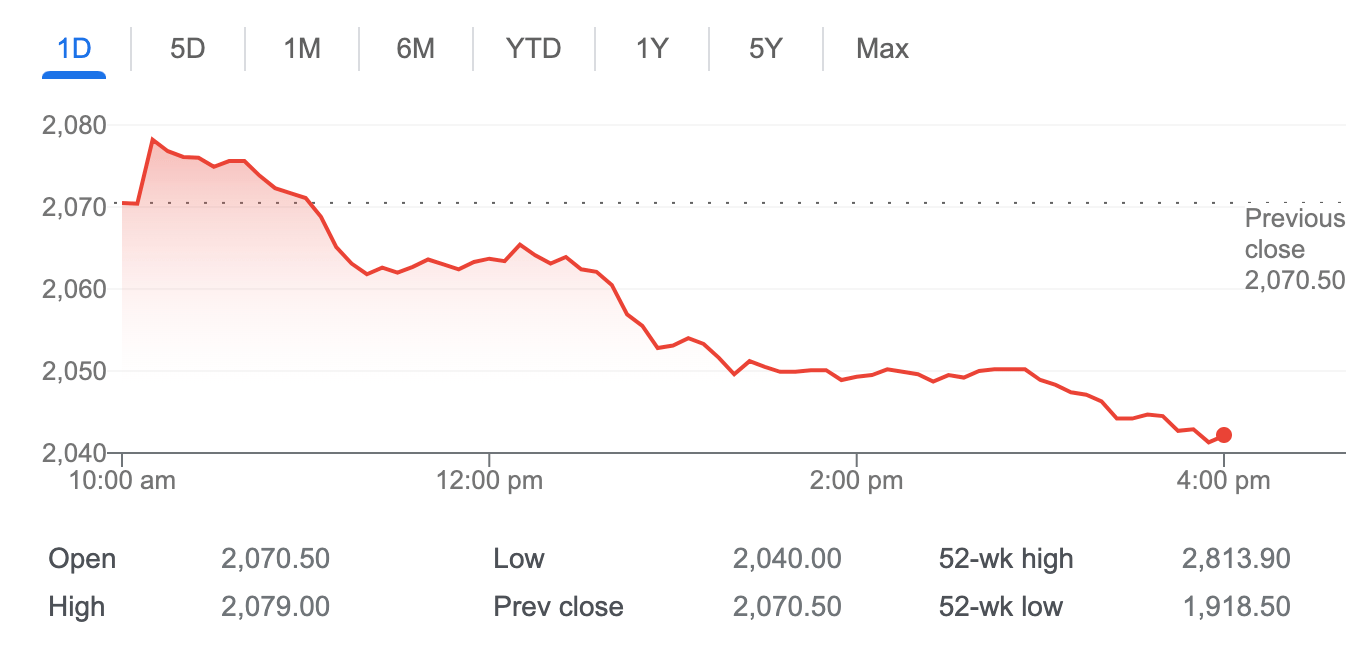

- ASX 200 abandoned play after decent start

- Small cap index gives back 1.3%

- Dundas shares jump on ultramafic magic

Local markets disappointed me today.

So rather than start on an ill note, let’s take a quick spin around the Asia-Pacific hood for a look-see.

Home of a tall building with a number for a name (I forget, gimme a sec), we head to Taiwan , where the TWSE benchmark index dropped more than 4% on its return to trade after a holiday, as investors weighed the impact of new American rules on Taiwan’s butt-kicking chipmakers, most particularly:

Taiwan Semiconductor Manufacturing (TSMC) down -7.9%.

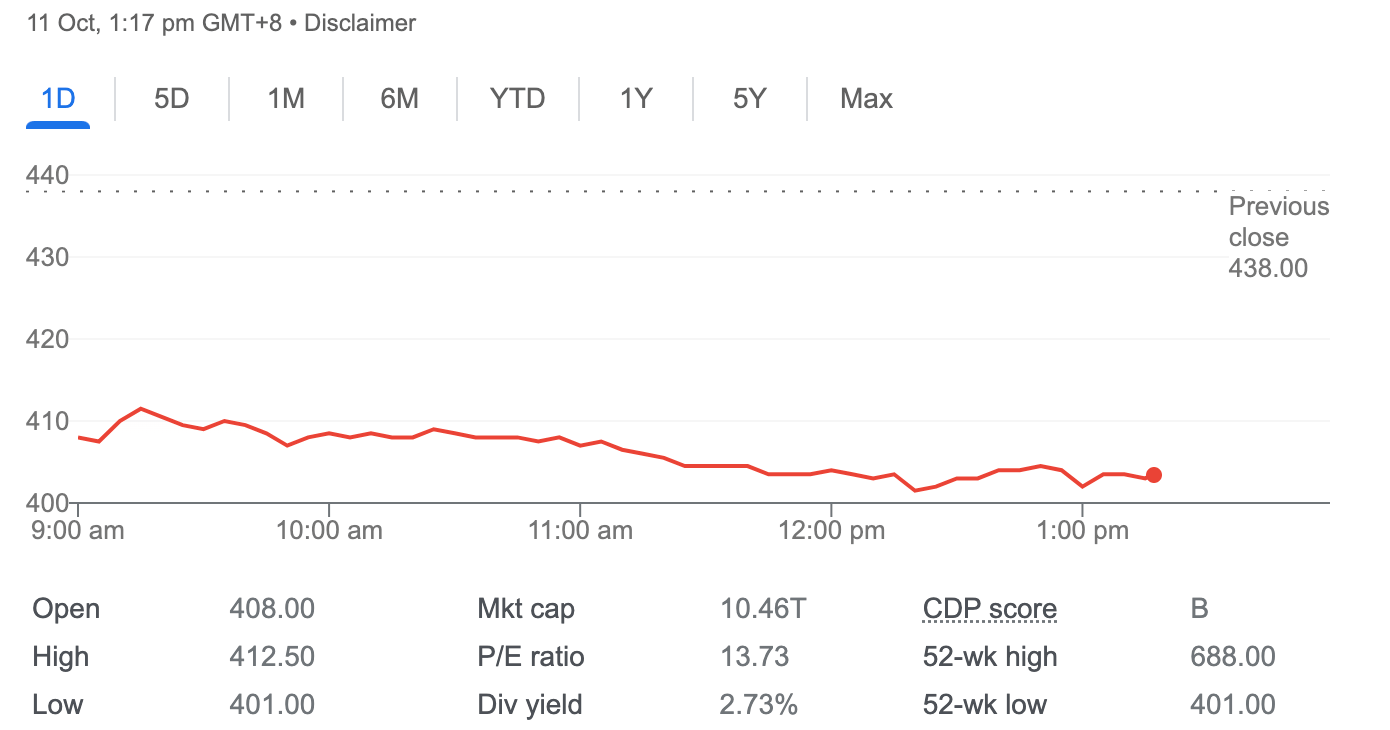

That meant this:

Taiwan Capitalisation Weighted Stock Index (TPE: TAIEX) down -4%.

Japan and South Korea’s markets also got back into business after a bit of a holiday on Monday.

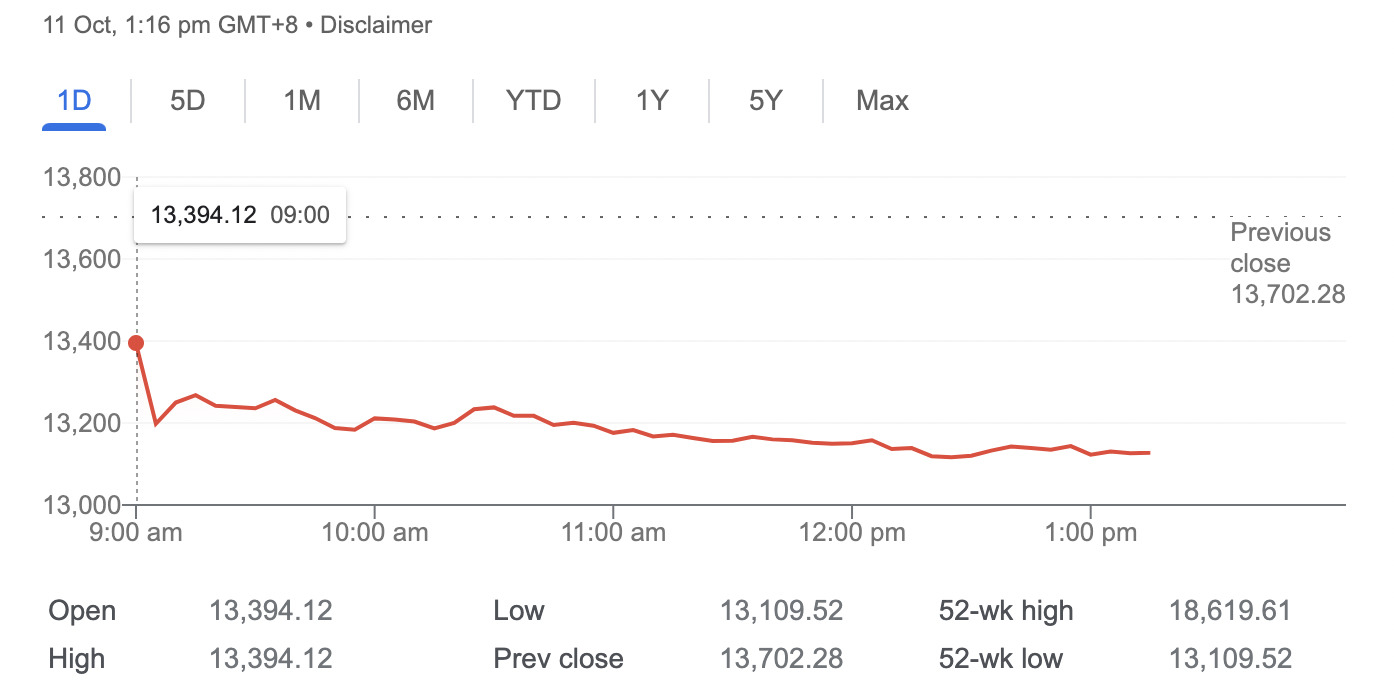

The Nikkei 225 fell 2.6% and the Topix lost 2%. In South Korea, the Kospi fell 2.3% and the Kosdaq fell hardest of all, down 4.3%.

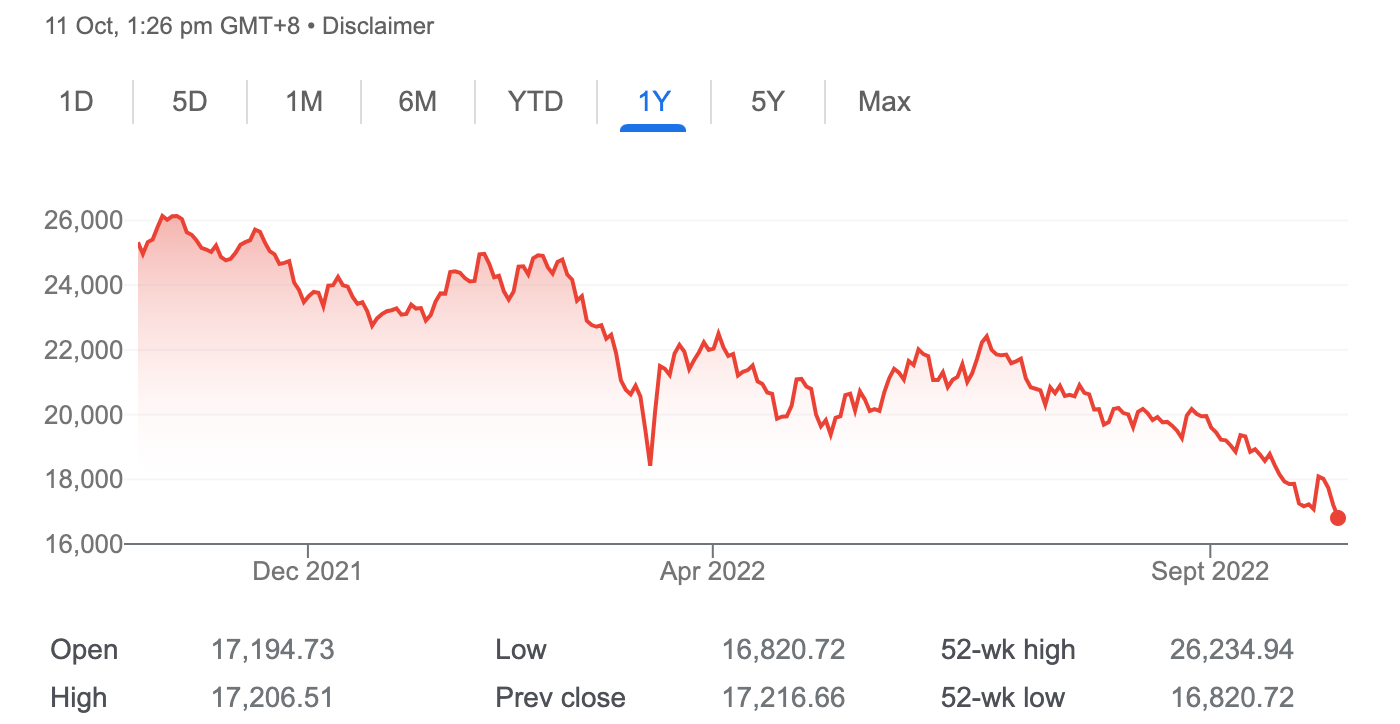

Meanwhile in Happy Honkers, the Hang Seng Index has taken a brief dip below 17,000 points for the first time since February 2009, circa the ol’ GFC.

There’s a confluence of fears at play – but COVID-cases on the up-, a Shanghai on the lockdown and a US President keen to crush semiconductor business in China.

Mainland Chinese indices – the Shanghai and the Shenzhen composites are maudlin and equivocating around parity.

Which brings us home already. Yay.

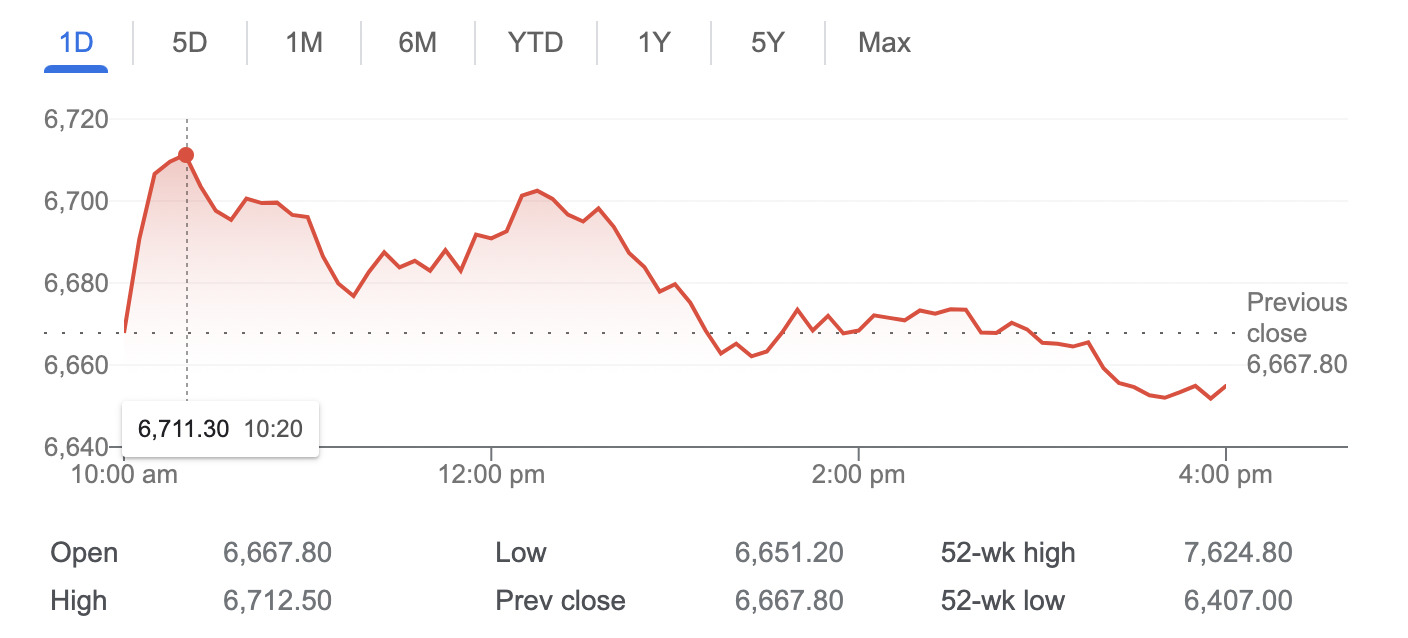

The “benchmark” (my quotations) ASX 200 was given every opportunity to stand on its own today.

Free of strong Wall Street lead ins-and-expectations, this morning the SPI Futures glimmered a positive light amid the recent gloom, up about 0.2% ahead of the open and gains in their own right beckoned for the index brave enough to just reach out and take them.

At 10.20am the index was doing just that, finding its feet with Materials, always the strong suit in this top 200, leading the way.

Then this familiar pattern emerged:

Just. Not good.

Likewise, in a state of disgrace, down 1.3% was the S&P/ASX Emerging Companies (XEC).

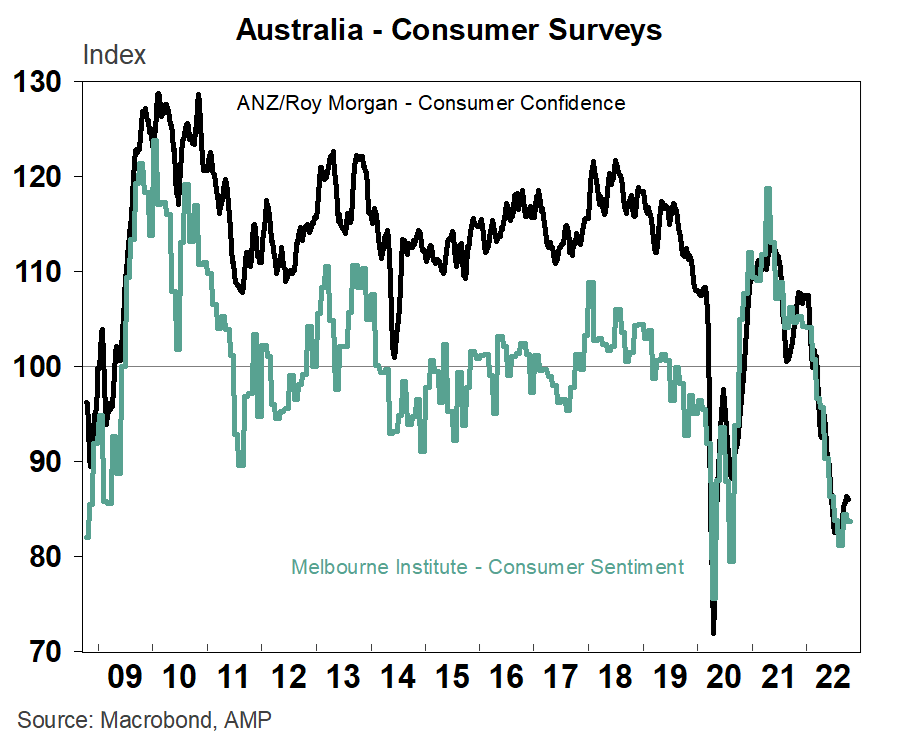

I wouldn’t go pinning this on the consumer confidence reads today, which have confidence creeping around near record lows.

eToro’s Josh Gilbert reckons the softer 25bps lift from the Reserve Bank of Australia (RBA) probably did enough to help the consumer confidence read from falling to its no. 2 -weakest reading since 1990.

The lowest level of consumer confidence, BTW, still belongs to that wonderful time when we were all first getting to know the pandemic back in April 2020.

“As the cost of living crisis eats into household budgets, and interest rate rises see mortgage payments soar, a 50bps move from the RBA has likely left consumers feeling the most pessimistic we’ve seen in years,” Josh told Stockhead.

“However, the latest decision from the RBA to slow down its rate hike cycle has inspired investors to rally behind the belief that a recession in Australia is avoidable. For the time being, retail sales remain strong despite this weakness in consumer confidence, but this won’t last forever.

“With the RBA set to continue raising rates over the next few months, confidence and retail spending could still be set to tumble.”

So that’s nice. Thanks Josh.

Diana Mousina at AMP says confidence is likely to remain low in an environment of high interest rates and above-average inflation.

Why do we care, I mean, honestly… isn’t it all a confidence game?

Diana again:

“Recent negative confidence readings are a leading indicator of future weakness in household consumption as impacts of interest rates hit consumer mortgage repayments (which lag rate changes by 2-3 months) and as consumers take time to adjust spending.”

So everyone’s going to stop spending, which has been the whole rates v inflation play all along.

AMP now expects a slowing in retail spend into the end of the year and in 2023, with Aussie GDP growth slowing to under 2% year on year by December 2023.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CL8R | Carly Holdings Ltd | 0.003 | 50% | 77,127 | $232,644 |

| SHH | Shree Minerals Ltd | 0.013 | 44% | 61,243,546 | $11,146,382 |

| WBE | Whitebark Energy | 0.002 | 33% | 282,950 | $9,697,329 |

| NET | Netlinkz Limited | 0.024 | 26% | 10,979,588 | $62,204,284 |

| BBX | BBX Minerals Ltd | 0.069 | 25% | 22,275 | $26,769,681 |

| CLE | Cyclone Metals | 0.0025 | 25% | 1,372,000 | $12,233,474 |

| NTL | New Talisman Gold | 0.0025 | 25% | 20,518 | $6,254,451 |

| LRV | Larvottoresources | 0.255 | 24% | 662,152 | $8,514,163 |

| DUN | Dundasminerals | 0.865 | 24% | 8,942,078 | $27,127,492 |

| TTI | Traffic Technologies | 0.016 | 23% | 332,694 | $9,388,212 |

| CMD | Cassius Mining Ltd | 0.036 | 20% | 331,782 | $12,112,227 |

| BMG | BMG Resources Ltd | 0.025 | 19% | 15,333 | $8,105,825 |

| REM | Remsensetechnologies | 0.19 | 19% | 179,714 | $5,263,852 |

| BTR | Brightstar Resources | 0.02 | 18% | 258,042 | $10,996,635 |

| NUH | Nuheara Limited | 0.175 | 17% | 133,211 | $20,579,299 |

| EDE | Eden Inv Ltd | 0.007 | 17% | 1,229,931 | $16,267,368 |

| GTG | Genetic Technologies | 0.0035 | 17% | 77,931 | $27,701,895 |

| RBR | RBR Group Ltd | 0.0035 | 17% | 1,764,441 | $3,862,861 |

| E25 | Element 25 Ltd | 0.845 | 17% | 354,563 | $110,715,018 |

| CBL | Control Bionics | 0.18 | 16% | 42,500 | $7,801,290 |

| STP | Step One Limited | 0.325 | 16% | 161,823 | $51,895,281 |

| FIJ | Fiji Kava Limited | 0.022 | 16% | 230,482 | $5,290,365 |

| AAJ | Aruma Resources Ltd | 0.075 | 15% | 327,079 | $10,202,498 |

Dundas Minerals (ASX:DUN), which has hit Mafic-Ultramafic Magic at its Central exploration site in the Albany-Fraser Orogen region of Western Australia.

Extensive massive, semi-massive, highly disseminated and disseminated sulphides were intersected from 32m to 423.40m (downhole), and sulphidic quartz veins from 43.5m to 412.1m. A total of 358.37m of sulphides (visual estimation) was intercepted, inclusive of:

- 4.26m massive sulphide averaging 88% volume estimate (including: 1.44m from 209.68-

211.12m @90% estimated volume, and 1.29m from 253.41-254.70m @95% estimated volume);- 4.96m semi massive sulphide averaging 55% volume estimate (including: 1.60m from 154.60-156.20m @50% estimated volume, and 0.81m from 163.10-163.91m @55% estimated volume);

- 7.60m matrix/net, blebby & stringer sulphide averaging 40% volume estimate (including: 3.3m from 149.40-152.70m @40% estimated volume, and 2.2m from 194.30-196.50m @40% estimated volume);

- 136.16m highly disseminated sulphide averaging 17% volume estimate (including: 15.5m from 115.00-130.50m @15% estimated volume, and 12.65m from 350.25-362.90m @12% estimated volume); and

- 205.39m disseminated sulphide averaging 5% volume estimate (including: 16.31m from 302.48-318.79 @3% estimated volume, and 11.75m from 260.92-272.67m @5% estimated volume).

That’s from one hole as Gregor notes, so unsurprising Dundas is trading some 40% the better.

And RemSense (ASX:REM) has climbed 21.8% on news that it’s hit a major milestone, with the company announcing its virtual plant is now as one with the IBM Maximo Application Suite (MAS) following a joint development by the two companies.

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AHQR | Allegiance Coal Ltd | 0.001 | -80% | 9,885,661 | $3,358,561 |

| DDD | 3D Resources Limited | 0.001 | -33% | 2,495,012 | $6,647,808 |

| SIH | Sihayo Gold Limited | 0.002 | -33% | 265,497 | $18,306,384 |

| TMGR | Trigg Minerals Ltd | 0.002 | -33% | 3,308,312 | $170,014 |

| WML | Woomera Mining Ltd | 0.016 | -30% | 26,652,965 | $15,797,161 |

| CAI | Calidus Resources | 0.34 | -28% | 9,666,962 | $207,946,310 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 100,000 | $30,205,147 |

| LNU | Linius Tech Limited | 0.003 | -25% | 4,395,870 | $9,522,132 |

| NWM | Norwest Minerals | 0.031 | -24% | 3,592,700 | $9,106,403 |

| ECG | Ecargo Hldg | 0.014 | -22% | 197,162 | $11,074,500 |

| BBN | Baby Bunting Grp Ltd | 3.11 | -20% | 4,029,935 | $516,586,691 |

| ACW | Actinogen Medical | 0.1 | -17% | 7,705,749 | $215,507,258 |

| EQX | Equatorial Res Ltd | 0.15 | -17% | 32,362 | $22,670,164 |

| TIG | Tigers Realm Coal | 0.015 | -17% | 7,692,467 | $235,200,643 |

| DW8 | DW8 Limited | 0.005 | -17% | 85,782,537 | $16,425,272 |

| LRL | Labyrinth Resources | 0.02 | -17% | 803,733 | $20,960,802 |

| BEZ | Besragoldinc | 0.042 | -16% | 3,016,004 | $12,050,131 |

| MEL | Metgasco Ltd | 0.021 | -16% | 9,835,055 | $23,250,067 |

| ALY | Alchemy Resource Ltd | 0.028 | -15% | 17,486,924 | $31,451,516 |

| IS3 | I Synergy Group Ltd | 0.045 | -15% | 55,376 | $14,228,456 |

| ICR | Intelicare Holdings | 0.034 | -15% | 78,575 | $4,818,652 |

| MEI | Meteoric Resources | 0.012 | -14% | 1,976,527 | $21,368,163 |

| MRD | Mount Ridley Mines | 0.006 | -14% | 5,846,053 | $41,661,008 |

| RAN | Range International | 0.006 | -14% | 116,998 | $6,575,032 |

| SKN | Skin Elements Ltd | 0.03 | -14% | 209,588 | $15,162,954 |

During a capital raising presentation Metgasco (ASX:MEL) says its share price is way, way undervalued based on the R’s: reserve / resource position and proximity to revenue.

This is their math, shown to potential investors:

“$22 million (Enterprise Value at 2.4 cent SP) divided by 31.77 bcf (2P Vali +2C Odin resource)= $0.69 /gj …significantly below standard industry valuation bench marks.”

And that is probably why MEL shed about 20% today.

Athena Resources (ASX:AHN) – Oh Athena! Goddess of battle strategy and wisdom! Grant this company more money, because it’s having a capital raise and it would be sad if no one turned up.

Culpeo Minerals (ASX:CPO) – Culpeo is also holding a capital raise, because there’s nothing better than some extra scratch when you’re feelin’ kinda foxy.

Cygnus Gold (ASX:CY5) – Aaaand, yep. It’s another capital raise, this one starring Cygnus, the swan that swims the Milky Way.

Valor Resources (ASX:VAL) – And finally, Valor’s called Time Out on Buying Bits of us because there’s news on the way from Surprise Creek… something the severely underwater residents of NSW know a little something about.