Closing Bell: China wraps ASX in its momentarily muscular economic embrace

Via Getty

- Benchmark ASX 200 index hits +0.2% higher at closing bell

- ASX Sectors led by Energy, as oil prices continue to wander north

- Small caps led by IAM, NOX, LPI on buy-ins, takeovers and excellent drugs

It looks like the ASX200 is coming home with the biscuits, up 0.2% at 4pm in Sydney on Wednesday.

That result was unlikely after US stocks were first rattled by strong retail sales data and then chip giants were rocked by further White House restrictions on trade with China.

However, an absolute shirtload of fairly positive Chinese economic data today has seen the Middle Kingdom’s economic recovery win a little circumspect momentum, as Q3 GDP reads came in slower, but largely topped almost all analyst expectations.

On Wall Street, the big end of tech town – Nvidia and other major chip companies fell dramatically overnight after the States imposed a new round of trade obstacles aimed at further knee-capping China’s ability to deliver better artificial intelligence and semiconductor chips.

The US Department of Commerce slugged Nvidia et al with tighter, more restrictive measures such as special licensing requirements for shipments to circa 40 countries to lock out any resales to China.

Nvidia, which has been dominating the AI chip market, was the hardest hit, shedding -5%, which – once you’re a trillion dollar market cap company – can erase well over US$53bn in value.

US bond yields went on an other burn higher overnight after US retail data once again described a US consumer either resilient or unable to just stop spending – rates added fuel to fears of more Federal Reserve upward tweaking.

The yield on US 10-year Treasuries moved closer to 5% (up 15 bps to 4.85%).

Meanwhile, year-on-year, China’s gross domestic product grew by 4.9% in the third quarter, China’s National Bureau of Statistics (NBS) said on Wednesday.

That was a solid beat on the Reuters’ consensus estimates of a rise of around 4.5%, Nikkei pegged 4.4%.

The wavering Aussie dollar also moved higher tracking the benchmark ASX200 on the slew of better-than-expected China data, with retail sales industrial production and unemployment all outperforming (admittedly low) market expectations.

The Aussie dollar’s no longer that far from 64 US cents.

China’s GDP also lifted by 1.3% on the previous quarter, as rumblings at home and abroad are growing into a dull roar for Beijing to unpack the stimmy and increase its policy support to add some spark to China’s tepid growth trajectory.

The year-on-year best also compares with that messy period of rolling lockdowns across the country last year, just before Xi Jinping’s ascension to a third term and the rolling back of his zero-COVID pandemic controls.

The NBS said in a statement: “We should be aware that the external environment is becoming more complex and grave while the domestic demand remains insufficient and the foundation for economic recovery and growth needs to be further consolidated.”

At home, Whitehaven Coal (ASX:WHC) shares spiked on news of a definitive sale agreements with BHP (ASX:BHP) and Japan’s Mitsubishi Development to acquire absolutely 100% of both the Daunia and Blackwater coal mines in what WHC calls “a highly attractive and transformative acquisition”.

Some very upbeat bullies from the ASX release:

• Whitehaven to acquire 100% of the Daunia and Blackwater metallurgical coal mines from BMA for an aggregate

cash consideration of US$3.2 billion1 comprising:

– US$2.1 billion upfront consideration payable on completion, and

– US$500 million, US$500 million and US$100 million in separate tranches of deferred consideration payable on the first, second and third anniversary of the completion date, with annual contingent payments capped at US$350 million.

• To be funded via a combination of available cash, a US$900 million bridge facility and cashflows of Whitehaven’s enlarged business over FY2025, FY2026 and FY2027.

• Highly attractive acquisition for Whitehaven and is expected to be materially earnings accretive, with upfront and deferred payments together implying an acquisition multiple of 1.8x EV / FY2024F EBITDA using spot prices and 2.9x using broker consensus coal prices

• Delivers significant value upside with attractive growth opportunities in Queensland’s Bowen Basin, including synergies with Whitehaven’s Winchester South development project.

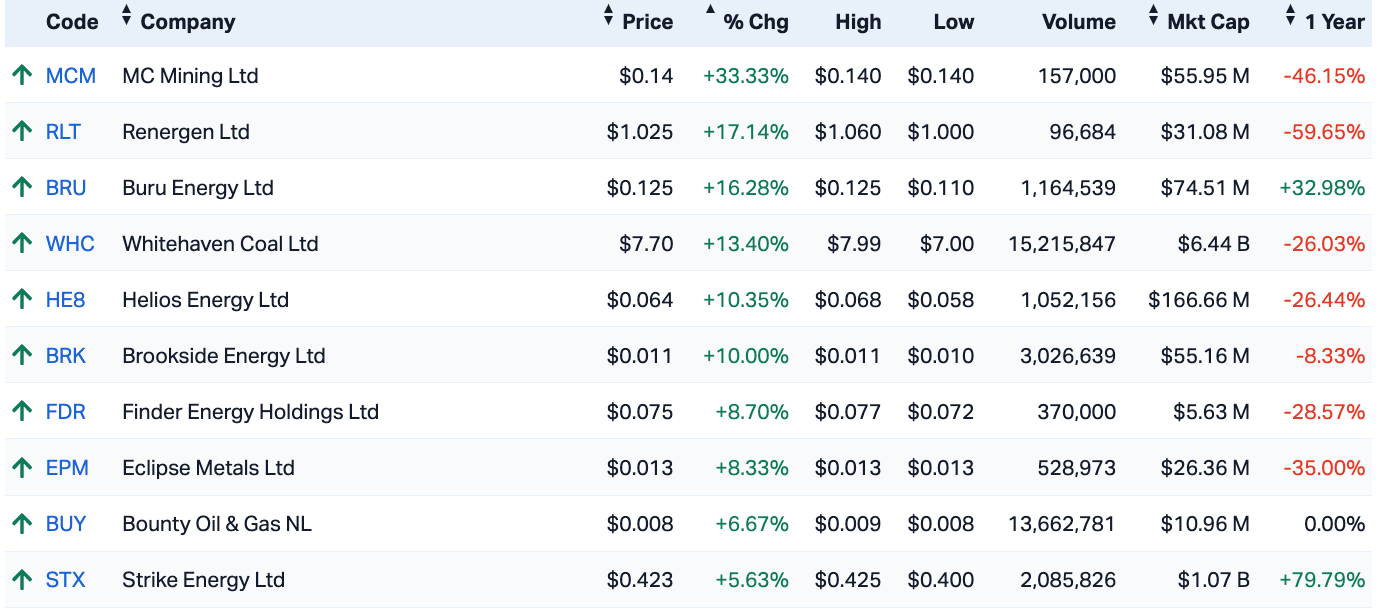

With oil futures also rising quickly, it was little surprise that the Energy sector led market gains on Wednesday.

Here’s their best:

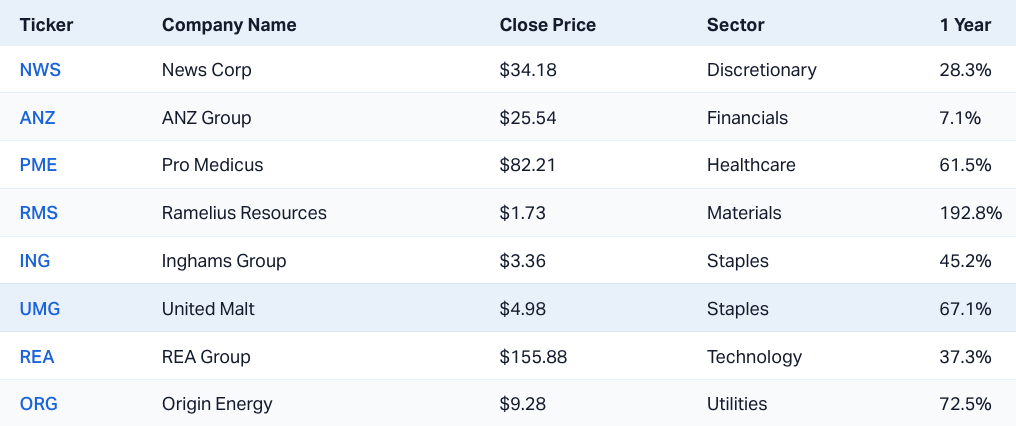

And now some ASX companies at 52 week highs:

And, well, some ASX companies at 52 week lows:

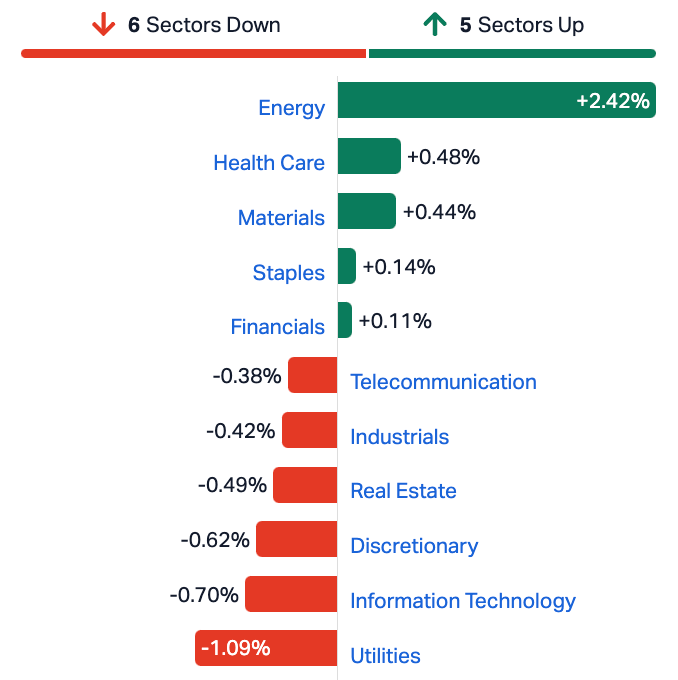

ASX Sectors on Wednesday

Random small cap wrap

The manganese developer Firebird Metals (ASX:FRB) says it’s received firm commitments to raise A$8 million through a strongly supported, heavily oversubscribed Placement at $0.125, which represents a 14% discount to the last close of price of $0.145 on Friday 13.

As part of the Placement, Firebird has secured a:

Cornerstone investment of A$1.7 million from Canmax Technologies, whereupon Canmax will become FRB’s biggest shareholder with a 9.9% interest.

Canmax is ‘a diverse industrial conglomerate, that has rapidly become China’s leading lithium chemical producer supplying both Chinese and International Li-ion battery producers.’

Firebird directors have applied for $1.68 million in the placement, subject to shareholder approval, along with strong support from sophisticated investors and the existing top 20 shareholders.

Firebird MD Peter Allen says the placement puts Firebird in a very strong position to deliver FRB’s ‘LMFP battery growth strategy and execute our vision of becoming a global leader in the manganese industry’, with both mining and downstream processing to deliver into the Li-ion and Na-ion battery sectors.

XReality Group (ASX:XRG) is into a strategic capital raise made of an institutional placement followed by a rights issue to eligible shareholders, looking to raise up to $3.65 million for the purposes of ‘expedite(ing) the sales of Operator XR Military and Law Enforcement technology in the US market’.

Key bullies from the release include:

• $3.15 million exclusive offer to current shareholders

• Offer price of $0.035 represents a 22% discount to closing price on 13th October 2023.

• A $500K completed placement to new Institutional investors.

• Eligible shareholders will be entitled to 1 new share for every 5 shares they currently hold.

• For every 2 new shares acquired, shareholders will be granted 1 free attaching option with an exercise price of $0.05, expiring 31 January 2025.

• $2M of proceeds will be used to accelerate growth into the US market.

• Remainder of proceeds including exercised options will be used to reduce debt and provide additional working capital.

DevEx Resources (ASX:DEV) has updated uranium results from the expanded 2023 drilling campaign at its 100%-owned Nabarlek uranium project, located in the Alligator Rivers Uranium Province (ARUP) in the Northern Territory.

DevEx Managing Director, Brendan Bradley says the drilling campaign continues to build momentum, with significant uranium mineralization returned in the two recent step-out holes.

“These holes were drilled along strike from the exciting intercept of 4.6m at 0.32% eU3O8 reported last month.

“Importantly, the new intercepts are located in the same stratigraphic position at the unconformity between the overlying sandstone and the underlying Cahill Formation. This is a geological host position that is highly significant in some of the world-class uranium deposits of the district. Intensive step-out drilling is underway and we are looking forward to what this can deliver.”

Ripped from the headlines

The price of gold has jumped above US$1,930 an ounce, clocking its highest levels in almost a month on fears of a wider Middle Eastern conflict sparked a rush to solid, safe haven assets. Tensions in the region have lurched from bad to worse following reports of mass casualties after a hospital was destroyed in Gaza.

WTI crude futures jumped 2% to above US$88 per barrel on Wednesday, hitting their highest levels in two weeks – again – as fears of a wider conflict in the Middle East compounds the larger-than-expected draw downs in US crude stockpiles. With supply-side concerns already high, the escalations of Middle East tensions hit new and worrying notes after a Gaza City hospital was reportedly destroyed with as many as 500 unconfirmed dead.

As previously mentioned, US President Joe Biden and his administration have tightened porous export controls for cutting-edge US artificial intelligence tech, in a further update to existing restrictions that it hopes will severely limit the ability of Nvidia and other manufacturers to sell the technology to China.

US Commerce secretary Gina Raimondo said the goal of the update was to curb China’s access to advanced chips that “could fuel breakthroughs in artificial intelligence” that are critical for the Chinese military.

Still on China, retail sales and industrial production data for September, as well as the jobless rate have also beaten fairly low market expectations, while over at the central bank – the People’s Bank of China has kept its one-year medium-term lending facility rate at 2.5% in a widely expected decision.

The PBoC recently said it would “resolutely prevent currency overshooting risks and keep the yuan basically stable at reasonable and balanced levels,” choosing to hold firm as the Wednesday data drop paints the preferred picture of a wobbly economy getting straightened out right when needed.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.0015 | 50% | 2,568,611 | $10,264,505 |

| GES | Genesis Resources | 0.007 | 40% | 800,000 | $3,914,206 |

| IAM | Income Asset | 0.135 | 35% | 96,208 | $28,002,082 |

| CTN | Catalina Resources | 0.004 | 33% | 865,591 | $3,715,461 |

| MCM | Mc Mining Ltd | 0.14 | 33% | 157,000 | $41,964,846 |

| NWF | Newfield Resources | 0.18 | 33% | 415,610 | $119,076,378 |

| LPI | Lithium Pwr Int Ltd | 0.53 | 28% | 54,009,153 | $261,133,587 |

| CBR | Carbon Revolution | 0.15 | 25% | 975,978 | $25,458,301 |

| CT1 | Constellation Tech | 0.0025 | 25% | 1,000,000 | $2,942,401 |

| SCL | Schrole Group Ltd | 0.32 | 23% | 9,500 | $9,273,572 |

| PSC | Prospect Res Ltd | 0.0905 | 22% | 5,654,091 | $34,207,200 |

| PIL | Peppermint Inv Ltd | 0.018 | 20% | 52,264,322 | $30,567,853 |

| RLT | Renergen Limited | 1.05 | 20% | 117,789 | $26,535,229 |

| TAL | Talius Group Limited | 0.012 | 20% | 10,000 | $22,861,393 |

| NOX | Noxopharm Limited | 0.115 | 20% | 6,634,545 | $28,054,843 |

| AUN | Aurumin | 0.031 | 19% | 1,676,143 | $7,759,520 |

| MKG | Mako Gold | 0.019 | 19% | 563,263 | $9,216,131 |

| AIV | Activex Limited | 0.02 | 18% | 6,663 | $3,663,544 |

| JCS | Jcurve Solutions | 0.04 | 18% | 97,535 | $11,163,677 |

| SXL | Sthn Cross Media | 0.855 | 17% | 1,796,001 | $175,126,379 |

| FBM | Future Battery | 0.105 | 17% | 1,137,556 | $45,891,539 |

| NSM | Northstaw | 0.035 | 17% | 12,121 | $3,603,810 |

| FGL | Frugl Group Limited | 0.014 | 17% | 49,283 | $11,472,744 |

| FHS | Freehill Mining Ltd. | 0.0035 | 17% | 1,023,878 | $8,534,403 |

| LRL | Labyrinth Resources | 0.007 | 17% | 916,666 | $7,125,262 |

Income Asset Management Group (ASX:IAM) has gone and merged with Tactical Global Management Limited (TGM), a company in which IAM already held a 25% stake, and Alpha Vista Financial Services (AVFS).

TGM and AVFS have advised that they will be ‘undertaking a strategic merger that combines their complementary intellectual property and leverages AVFS’ s AI capabilities and TGM’s 25 years of asset management experience’.

TGM shareholders will receive a 10% equity stake in the merged entity, resulting in the Group holding 2.5% of that entity. In time, TGM can earn additional equity in the merged entity and cash bonuses, subject to performance hurdles.

“TGM has been working closely with AVFS for two years, to develop market-leading joint products, such as a downside protection overlay for equity investments that incorporates AI signals, and the merger will accelerate the growth of the combined entity globally,” IAM told the ASX late on Wednesday.

IAM says it has waived the majority of its rights to this additional equity and cash bonuses, and in exchange other TGM shareholders will accept the cancellation of 15 million performance rights issued to them on 26 October 2021, as part of the consideration for the Group’s acquisition of shares in TGM.

IAM says its stake in the merged entity on completion of the merger is valued at $3,125,000, ‘which is similar to the book value of $3,679,856 for the TGM investment reflected in the Group’s accounts.’

The transaction has been supported by a $5 million placement into AVFS.

Noxopharm (ASX:NOX) enjoyed a morning launch even Elon Musk would’ve been pleased with – adding some 50% before lunchtime after new data shows that SOF-VAC, its proprietary asset, significantly reduces mRNA-driven inflammation in animal testing.

In the animal study, inflammation was reduced by around 50% when comparing the inflammation induced by mRNA alone, versus mRNA plus SOF-VAC.

This is an important finding, says NOX, as many side effects of mRNA vaccines are due to inflammation.

The company added that the ability of SOF-VAC to reduce the inflammatory side effects of mRNA has several potential benefits.

And as Stockhead previously and ingeniously reported on this matter, the Chilean state copper titan Codelco had been eyeing a deal with Lithium Power International (ASX:LPI) in what looks a great deal for LPI shareholders.

LPI has now confirmed it’s entered into a binding scheme implementation deed with Corporación Nacional del Cobre de Chile (Codelco). It’s a deal that will see Codelco acquire 100% of LPI’s issued capital, valuing the company at approximately A$385 million.

Me mate Robert Baddest Man wrote this morning that Codelco challenges America’s Freeport McMoran for the status as the world’s largest producer of copper.

He backed it up with this X/Tweet thingy saying it’s all a very big coup for LPI.

“Which is massively down share-price-wise, from its ATH of 91c, which it hit in April 2022.”

merge with its own development in the salt flat to enable a world-class lithium initiative. The purchase is set to be completed in Q1 2024 and aligns with Codelco's strategy for becoming a major supplier of critical metals for the global energy transition, in line with

— 🟡TNC🟡 (@topnewschile) October 17, 2023

Prospect Resources (ASX:PSC) also jumped this morning after reporting a significant new discovery from the Phase 3 diamond drilling programme at its Step Aside Lithium Project in Zimbabwe.

Two scout drill holes returned wide intercepts of strongly mineralised pegmatite from shallow depths, with hole CDD055 returning assays showing 23.08m at 1.03% Li2O from 45m, including 11m at 1.51% Li2O from 54m.

The company also notes that assays are pending for an approximately 40m thick intercept returned from hole CDD056 and abundant coarse spodumene crystals are visible in logged core from both holes.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AVM | Advance Metals Ltd | 0.003 | -40% | 11,778,740 | $2,942,794 |

| BP8 | Bph Global Ltd | 0.001 | -33% | 50,319 | $2,423,345 |

| CCP | Credit Corp Group | 11.995 | -30% | 3,389,180 | $1,172,791,929 |

| MTH | Mithril Resources | 0.0015 | -25% | 2,166,000 | $6,737,609 |

| DAL | Dalaroometalsltd | 0.039 | -25% | 773,109 | $3,952,000 |

| SPX | Spenda Limited | 0.011 | -21% | 12,009,323 | $51,481,256 |

| AHN | Athena Resources | 0.004 | -20% | 7,175,153 | $5,352,338 |

| IRX | Inhalerx Limited | 0.035 | -19% | 5,000 | $8,159,979 |

| INV | Investsmart Group | 0.145 | -17% | 490 | $24,939,918 |

| AD1 | AD1 Holdings Limited | 0.005 | -17% | 691,136 | $4,935,414 |

| LSR | Lodestar Minerals | 0.005 | -17% | 10,371,350 | $12,140,384 |

| MEL | Metgasco Ltd | 0.01 | -17% | 1,177,061 | $12,766,641 |

| DCL | Domacom Limited | 0.011 | -15% | 327,800 | $5,661,523 |

| W2V | Way2Vatltd | 0.011 | -15% | 776,731 | $8,249,649 |

| LIO | Lion Energy Limited | 0.017 | -15% | 529,582 | $8,582,637 |

| MMI | Metro Mining Ltd | 0.017 | -15% | 16,197,410 | $87,305,207 |

| NVO | Novo Resources Corp | 0.16 | -15% | 190,449 | $7,101,398 |

| AMM | Armada Metals | 0.018 | -14% | 52,684 | $2,699,929 |

| CZN | Corazon Ltd | 0.012 | -14% | 5,000 | $8,618,371 |

| GCM | Green Critical Min | 0.006 | -14% | 2,100 | $7,956,095 |

| HCD | Hydrocarbon Dynamic | 0.006 | -14% | 13,375 | $4,547,661 |

| LVT | Livetiles Limited | 0.006 | -14% | 162,378 | $8,239,774 |

| LSADD | Lachlan Star Ltd | 0.086 | -14% | 9 | $13,190,127 |

| CAZ | Cazaly Resources | 0.031 | -14% | 2,522,615 | $14,220,108 |

| ANR | Anatara Ls Ltd | 0.025 | -14% | 78,862 | $3,477,796 |

TRADING HALTS

Paterson Resources (ASX:PSL) – Pending an announcement regarding exploration results from the drilling program at the Grace Project

Talisman Mining (ASX:TLM) – Pending release of an announcement in relation to exploration results at the Company’s Lachlan Project in NSW

Whitehaven Coal (ASX:WHC) – Pending it releasing an announcement in regards to a material acquisition (see above)

Dart Mining (ASX:DTM) – Pending the release of a placement announcement

Stellar Resources (ASX:SRZ) – Pending announcement of a capital raising

Estrella Resources (ASX:ESR) – Pending announcement of a capital raising

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.