China’s house of cards is falling and that might not be so bad for ASX iron ore

Here we go. Via Getty

Evan as iron ore prices logged another solid week of gains, making it 12 in a row of price rises, the main engine of iron ore demand – China’s troubled housing sector – saw sales continue to slide in October, a traditionally peak month for the mega-sized real estate sector.

Beijing’s slap-dash idea of supportive property policies has thus far failed to ignite an eerie and ailing residential property market.

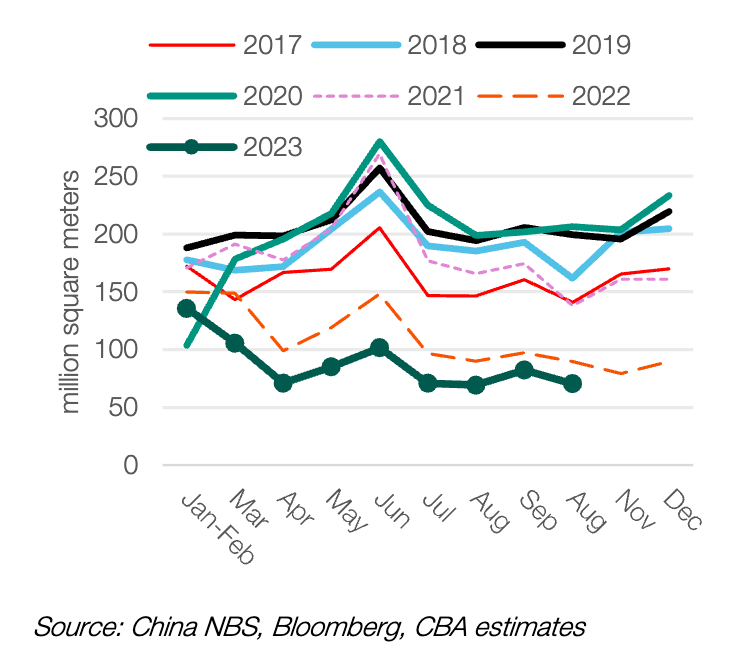

Commercial housing sales in October absolutely crashed – down some 28.5% from September to 77.73 million square meters, according to data recently released by China’s National Bureau of Statistics (NBS).

It’s hard to sit back and enjoy the annual real estate boom months of China’s Golden September or Silver October these maudlin days.

The two months of the year which traditionally go off for surging property sales volumes and fast rising prices is suddenly but a memory, when on September 28, the founder and chairman of the Chinese property Goliath, Evergrande Group Hui Ka Yan was confirmed to be under arrest and in police custody.

By then, Evergrande Group had of course already filed for bankruptcy anyway.

While this move succeeds in extending the life of Evergrande, it is assumed to be effectively insolvent and a dead property giant walking.

For near decades, China’s monthly residential housing and commercial property sales have consistently come in over the 100 million sqm mark.

No longer.

In 2023 so far combined monthly sales have only topped that 100mn sqm level three times – in March, June and September.

But the awful truth is China’s property sector, despite the expected fireworks many hoped might come with the few policy tweaks out of Beijing, appears asleep at the wheel.

Year-to-date, total commercial property sales by sqm fell -7.8% on the PCP.

Residential housing sales fell -7.8%, and commercial properties fell -6.8%. Residential housing sales by value decreased -4.9%, and commercial properties were down -3.7%, according to the last week’s NBS drop.

In painfully drawn out baby-step decisions, Beijing has eventually rolled out a series of quasi-supportive policies which officials seem to guesstimate might help boost the ailing residential property market. The last quarter has seen the biggest cities relax downpayment obligations, trimming the stamp duty requirements for new apartments.

These gave September’s home sales a short and sharp – but all too brief – kick with sales climbing beyond the magical 100 million sqm mark, but the numbers are already in decline.

China’s first-tier mega cities — Beijing, Shanghai, Guangzhou and Shenzhen — tweaked their respective real estate policies to allow more homebuyers to qualify for lower down payments and mortgage rates.

In short – it didn’t work.

Property investment is a mug’s game right now. And developers still on one leg have neither the confidence nor a clear green light from Beijing to throw money at the situation.

In a property world where the only way is up, real estate investment across China fell by almost 10% year-to-date on the already poor showing in 2022, while all the funds raised by property developers fell by -17% YoY.

Even more troubling, investment in China’s property market for October alone is down -15% on 2022. Floor space sales in square metres shrunk by a fifth, circa -20%/yr again last month.

Both data points indicate how confidence among developers, builders and buyers is still super low, despite whatever Beijing pulls out of its hat and throws at the problem.

As Bloomberg noted last week, Beijing’s not finished with the dumb ideas.

Officials have dusted off a plan to toss some one trillion yuan (circa US$140 billion) of cheap money to China’s dilapidated urban village sector. The idea is to renovate and regurgitate an affordable housing program which has provided the market with a super sugar hit in the past.

The idea is the PBoC would inject funds through local banks which is basically a cheap form of policy loans for targeted areas such as housing and infrastructure — and special loans.

Economists are out for lunch on this thinking.

While the central bank’s previous use of the funding tool (in 2014 and 2019) did actually inspire a property turnaround and subsequent economic growth, it also super fried China’s already overcooked home prices.

According to Bloomers, the value of China’s residential property grew 17% and then 36% in the two years following its initial implementation.

Construction starts measured by floor area fell 23.2% year-on-year, and total ongoing construction area dropped 7.3%.

The latest data shows that the real estate market “is still in a transitional period,” a spokesmen for the stats bureau told Chinese media last week.

More succinctly, it means developers are spending less on buying land and building housing because no one’s buying it anymore.

Iron or steel: The outlook for ASX diggers

China is still a beast for the iron ore. Beijing hoovers up the steelmaking ingredient more than any other nation on the planet which is why it’s also way out ahead as the world’s biggest steel producer.

And, yes, circa 70% of this comes from Aussie producers.

In Singapore over the weekend, SGX iron ore futures ended at $US128.35, after popping over the $US130 a tonne parapet for a mid-week look-around.

Iron ore prices have risen by a third in the past three months, starting from $US96.28 a tonne on August 15.

According to the CBA’s best commodity economist Vivek Dhar, the indicator he believes is most aligned with steel and iron ore demand is the floor space measurement for newly constructed houses and that crashed -21% YoY in October, accelerating fast from the -15% contraction in September.

China’s new construction starts (square metres) –monthly

China’s floor space of newly constructed houses has declined ~24% yr-on-yr in the first ten months of 2023, after plunging ~39% yr-on-yr in 2022, Vivek says.

“The ongoing deterioration in China’s property sector last month is noteworthy because it means that government efforts to stabilise the sector from September via mortgage easing rules has had little effect.

“The result gives weight to our thesis that any meaningful stabilisation in the property sector, particularly on the construction side, is unlikely until next year.

And even then, Vivek warns, there’s growing risks that stabilising China’s house of cards could be a much tougher gig than anyone’s expecting.

Where is China going?

So, China’s headline activity data for October painted a mixed picture for the commodity‑intensive economy.

China’s industrial output rose by 4.6% YoY last month, up from 4.5% in September.

In seasonally adjusted terms, China’s industrial output rose by 0.39%/mth in October – a slight acceleration from the 0.36%/mth increase in September. Meanwhile, China’s Fixed Asset Investment (FAI) rose by 2.9%/yr (year‑to‑date).

“The outcome was below both the September result and expectations of 3.1%/yr (year‑to‑date),” Vivek notes.

Meanwhile, in seasonally adjusted terms, China’s FAI lifted 0.1%/mth – marking a second consecutive month of slowing growth.

China’s infrastructure investment was flat in October, with spend only increasing 1.4% year-to-date.

The tea leaves are all mixed up, but CBA is not alone in anticipating ‘a relative burst of activity.’

As Stockhead Legend Josh Chiat reported late last week, Goldman Sachs has followed its bullish call on iron ore prices, ramping up 2024 forecasts by 22%b to US$110/t, by lifting price targets on a suite of Australia’s largest mining companies.

Goldman’s ASX iron ore buys – Rio Tinto (ASX:RIO), BHP (ASX:BHP) and Champion Iron (ASX:CIA) – have seen their price targets (PT) lifted from $126.50, $46.50 and $7.20 a share respectively to $136.10, $49.90 and $8.30 a share.

Josh says Fortescue (ASX:FMG) remains a sell for Goldman on valuation, but its price target has been lifted from $16.30 to $18.10 recognising FMG’s lower grade iron ore looks stronger over the short term.

MinRes (ASX:MIN), meanwhile has seen its PT cut from $51 to $49 and remains a sell, but that is heavily due to lower lithium prices.

Goldman Sachs are seeing a 40Mt deficit in the iron ore market in 2023, with a balanced market rather than a surplus seen in 2024 on the basis of lower than expected supply out of here and the other major producer, Brazil.

“Also of note is iron ore inventories in China remain low, with stocks at steel mills at just 16 days currently (vs. a 24 day 5-year average) and port stocks are at 5-year lows, before expected seasonal restocking ahead of the Chinese New Year in early/mid Feb 2024,” GS said in note on Thursday.

“Since policymakers lifted the fiscal deficit ratio for 2023 from 3.0% to 3.8% in late October, we think it is likely that China’s infrastructure spending will accelerate in coming months. It’s worth noting that China looks likely to achieve the ~4.3%/yr growth required this quarter to meet its annual economic growth target of

around 5%.”

CBA on Friday suggested that officials in Beijing are still pretty keen to wop out the stimulus, especially since President Xi has gone and emphasised China’s renewed focus on economic growth in 2024.

“This renewed focus on economic growth is well flagged by the mid‑year decision to increase the fiscal deficit ratio. Such a decision has only been made during the 1997‑98 Asian Financial Crisis and the 2008 Global Financial Crisis,” CBA suggests.

“The prospect of more infrastructure spending, even with the longer timeframe for a turnaround in China’s property sector, likely means a pick‑up in China’s commodity demand in H1 2024.”

But with a rider…

“That being said, we still think spot iron ore prices of $US132/t (62% Fe, CFR China) are too optimistic on China’s steel demand hopes, suggesting downside risks to prices.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.