Resources Top 5: Aussie lithium stock LPI surges on strong rumour of copper giant takeover

"Did you hear Jenny from accounts has been nicking office plants again?" (Getty Images)

- Lithium Power International cops ASX speeding ticket as speculation of $315 million takeover abounds

- Meanwhile, M2M, OD6, REC and MIO are double-digits up on… nothing that’s making fresh headlines

Here are the biggest resources winners in early trade, Thursday October 12.

Lithium Power International (ASX:LPI)

(Up on takeover rumours)

The ASX highway patrol pulled up this $261m market-capping pure-play lithium explorer this morning with a speeding ticket after it sped up the local bourse.

There’s no specific, official news from the company on that just yet… but…

A pretty strong guess centres around potential M&A news brewing for the company over in Chile, where state copper company Codelco has been eyeing a deal with LPI.

In fact, Bloomberg reported overnight that the two companies are approaching a deal at around 50 cents a share or around $315 million, and this is certainly fuelling the froth. “An announcement of a deal could come as soon as next week,” wrote the media outlet.

Codelco challenges America’s Freeport McMoran for the status as the world’s largest producer of copper, so this would be a pretty damn big coup for ASX-listed LPI, which is massively down from its ATH of 91c, which it hit in April 2022.

As our Josh wrote late last month, “Lithium Power owns the Maricunga brine project in Chile, which a study in early 2022 suggested would produce 15,200t of lithium carbonate a year for two decades at a development cost of a touch under $1 billion.”

The Codelco speculation has been going on for a while now, and late last month LPI confirmed that it has indeed been in discussion with the Chliean company.

Discussions are underway between $LPI and Codelco regarding a potential transaction. Codelco has been granted due diligence, but there is no certainty a deal will be finalised. https://t.co/5AgKY2gLZF pic.twitter.com/Q3H6CYBoKp

— Lithium Power (@LithiumPowerLPI) September 27, 2023

Per a recent statement:

“Lithium Power confirms that it is in discussions with Codelco regarding a potential transaction. However, at this stage, discussions between Lithium Power and Codelco are incomplete and no agreement on terms has been reached.

“Codelco has been granted due diligence and is continuing to undertake its due diligence investigations. Lithium Power notes that there is no certainty that the discussions with Codelco will lead to consummation of a transaction.

“Lithium Power will continue to keep the market fully informed, in accordance with its continuous disclosure obligations.”

All good, LPI… please let us know when you have further details, mmkay? That’d be great, thanks.

LPI share price

Mt Malcolm Mines (ASX:M2M)

(Up on no news)

Gold-exploration minnow ($3.27m market cap) Mt Malcolm’s share price is on the rise, although like so many other resources stocks today, any news to specifically attribute to it seems slow to arrive.

Late September, however, the goldie had something big to share. Per our report from a few weeks ago:

The company has defined an exploration target of up to 150,000t at 15 g/t at the Golden Crown prospect, one of the centrepieces of its strategy to build a shallow, high-grade resource that will deliver sustainable gold production.

The 275km2 Malcolm project consists of several, mostly contiguous tenements in the mineral-rich Leonora region that have – for the first time – been consolidated under one single owner.

The area is regarded as a Tier 1 gold province, with numerous multimillion ounce mines currently operating in the district.

The company is now progressing a two-fold strategy with a focus on shallow, high-grade gold deposits to realise early cash flow via shallow mining.

Meanwhile, M2M has said it will continue to advance the medium-term development opportunity at the emerging flagship Calypso gold discovery.

M2M share price

OD6 Metals (ASX:OD6)

(Up on no news)

OD6 is up some 20% over the past 24 hours as we type. The last major news event for this rare earths hunter that we’re seeing came in September.

That was in the shape of ‘outstanding’ drill results at the company’s Prop prospect within the wider Splinter Rocks project near Esperance in WA.

Splinter Rocks is emerging as one of the largest, highest-grade clay-hosted rare earth projects in Australia.

Per our recent report:

OD6 Metals recently received results from 78 holes with grades up to 4,159ppm Total Rare Earth Oxides (TREO) and thickness up to 56m at consistently high grades, confirming the significance of the Prop discovery.

The company unveiled a 344Mt maiden resource at 1,308ppm TREO in July, less than one year after first drilling a handful of near-surface 60-70m thick mineralised clay basins.

Unlike hard rock resources, clay rare earths contain the right rare earth elements needed for permanent magnets – a booming market thanks to their use in EVs and wind turbines.

These deposits are potentially easier and more cost effective to mine.

OD6 share price

Recharge Metals (ASX:REC)

(Up on no news)

Lithium-exploring small cap Recharge is double-digits up at the time of writing, although there’s not much to see today that’s brand new in terms of market-moving announcements.

We’ll refer you to the company’s big news then from last week…

Per our special report:

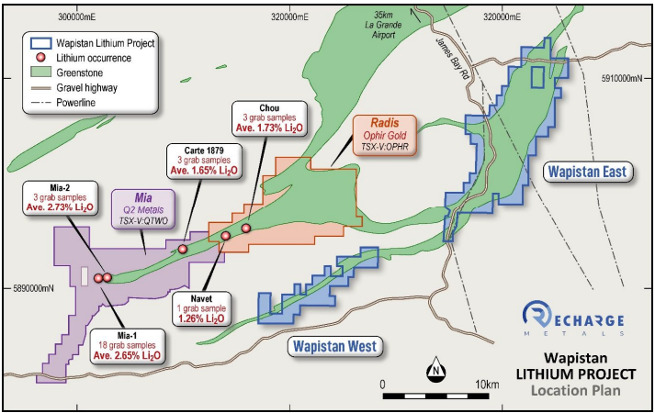

The company has sampled two of four promising lithium targets at its Wapistan project in Quebec’s James Bay region, and results are pending.

REC added to its James Bay landholding with the late June acquisition of Wapistan, a piece of unexplored ground 10km from Q2 Metals’ (TSX-V:QTWO) Mia lithium project and Ophir Gold’s (TSX-V:OPHR) Radis lithium project.

Wapistan is also 120km north of REC’s flagship Express lithium project, providing the opportunity to work on the two projects simultaneously.

The company has now moved to test four high priority target areas at Wapistan after exploration at Mia and Radis confirmed spodumene-bearing pegmatites.

This successful exploration work proved to be the catalyst for both Ophir and Q2 to be re-rated over the past year – up 350% and 740% respectively.

It also provides encouragement that the pegmatite targets identified at Wapistan have the potential to host lithium-bearing pegmatites.

REC share price

Macarthur Minerals (ASX:MIO)

(Up on no news)

Throw us a bone here, would you MIO? Nope, fresh news for ressie gainers seems to have gone MIA today.

This dual-listed WA iron-ore hunter (it’s also on the Toronto Venture exchange – TSX-V:MMS) last gave the ASX some info of significance with a “notice of initial substantial holder – Copulos Group”, in September.

Stephen Copulos is a big-name investor, so it was a good sign for Macarthur a month ago, and it’s still a good sign now.

Copulos once served on the board of graphite play Black Rock Mining (ASX:BKT) and is known for numerous investments (eg. Myer (ASX:MYR), Middle Island Resources (ASX:MDI)) across a different array of sectors.

MIO share price

At Stockhead we tell it like it is. While Recharge Metals, Od6 Metals and Mt Malcolm Mines are Stockhead advertisers at the time of writing, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.