Recharge orders a red metal chaser for Brandy Hill South

ASX juniors are lining up to fill a void in mid-tier copper production. Pic: Getty Images

- Recharge Metals begins a low-cost induced polarisation survey at the Brandy Hill South project

- Previous exploration has pointed towards evidence of a porphyry copper system

- Company believes success could quickly turn the project into a high-value asset

Special Report: Recharge Metals has begun an IP survey to firm up drill targets on its hunt for a porphyry copper system at the Brandy Hill South project in the Murchison region of WA.

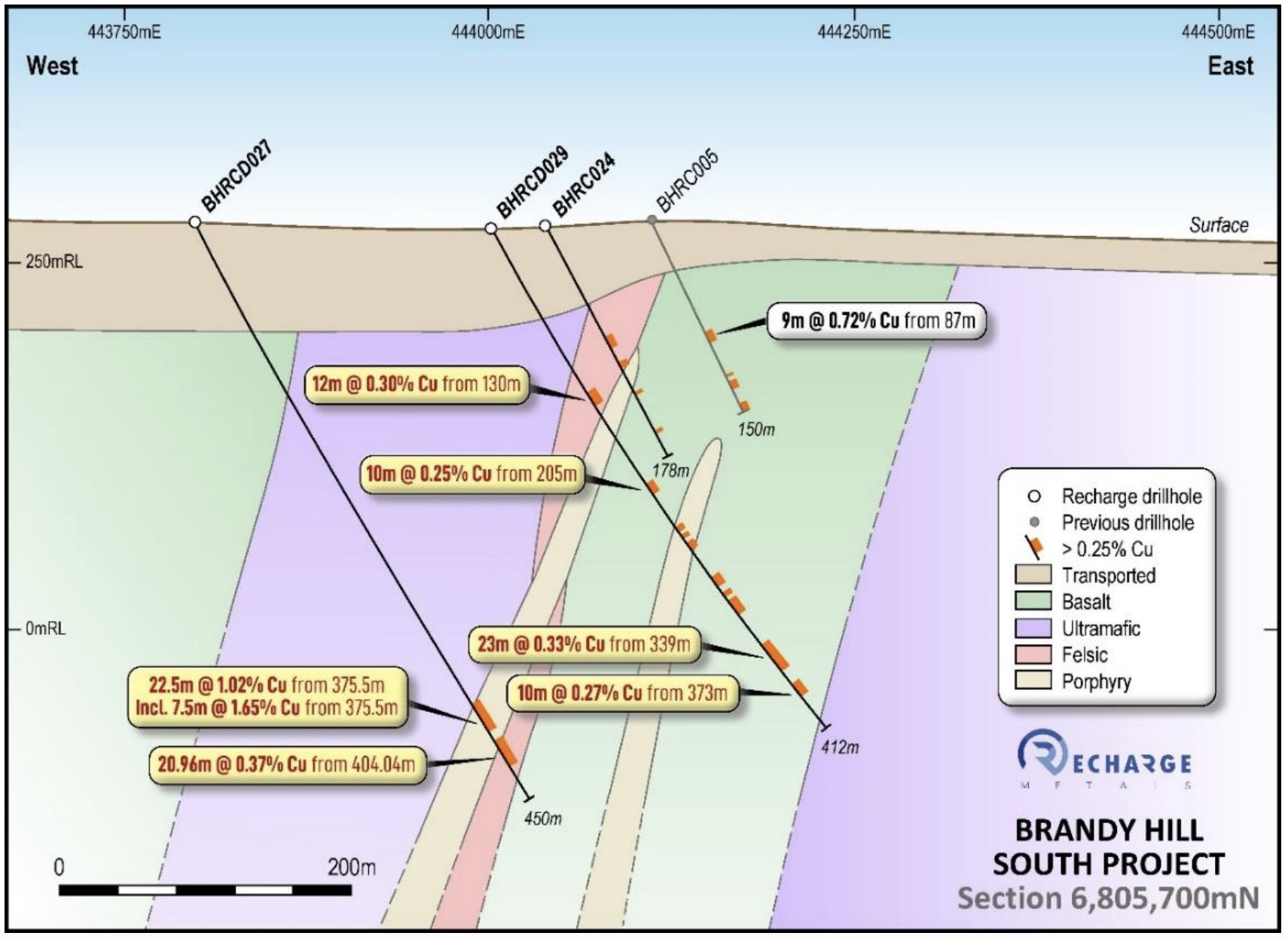

The Recharge Metals (ASX:REC) survey is aiming at identifying sulphide rich zones associated with copper endowment after previous drilling confirmed significant mineralisation within the project area.

Copper mineralisation has so far been defined over 500m of strike and remains open both along strike and at depth, and this small-scale survey is marked for expansion if it returns more evidence of a porphyry copper system.

Given its location in a well-served mining district and a rising tide for copper explorers, Recharge believes success could quickly prove Brandy Hill South as a high-value asset.

Recharge managing director Felicity Repacholi said a technical review completed last year informed the formulation of a relatively simple and low-cost program to advance the project.

“With strong results at Brandy Hill South, including 33m at 0.97% copper, the commencement of this IP survey is an exciting step forward in our exploration efforts, and seeks to identify sulphide-rich zones that could host significant copper mineralisation,” Repacholi said.

“Copper is one of the key commodities in the global energy transition yet relatively few new projects have emerged in recent times. Should exploration be successful, we anticipate substantial interest in Brandy Hill South going forward.

“We are pleased to be undertaking work programs to advance our Brandy Hill South Project whilst we continue to progress work at our flagship Carter Uranium Project in the US, with plans to be drilling later in the year.”

Mid-tier metals

Repacholi’s point about the lack of new copper projects coming online is a salient one.

The lower-hanging fruit is being mined out and exploration spending by the majors has stagnated.

Copper is increasingly territory for the big fish, but finding high-quality deposits in stable jurisdictions has presented a challenge and the risk appetite of the majors for exploration and development has fallen off.

That’s left it to junior explorers to make the finds that could fill the void and, concurrently, lead to major upticks in their valuations as larger players circle copper development stories like moths to a flame.

And while the grades drilled at Brandy Hill South may not jump off the page, grade is not always king when it comes to copper, and high-tonnage porphyry deposits which can run for decades are increasingly the target for Australian operations.

This article was developed in collaboration with Recharge Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.