Closing Bell: Bank and tech stocks power ASX as copper gains momentum

The ASX has been energised by wins in the financial and tech sector, as well as building momentum in copper stocks. Pic: Getty Images

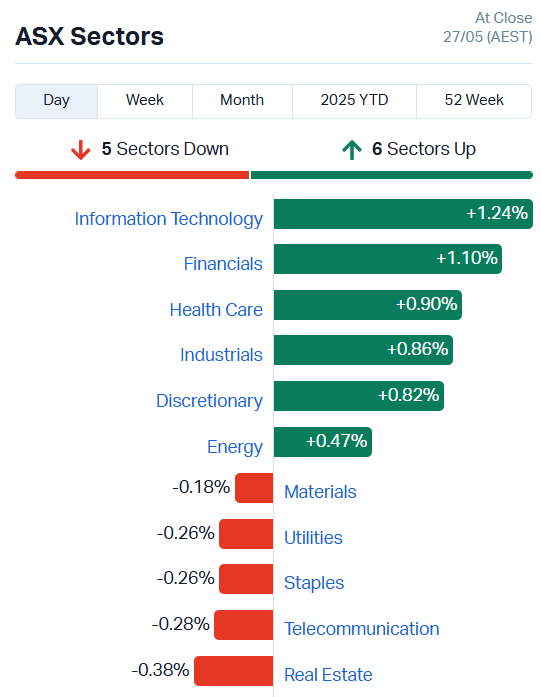

- ASX lifts 0.56pc on tech and financials strength

- Mine closure, takeover offer perks up copper stocks

- Lucrative software contracts boost tech sector

The ASX gained momentum throughout the day, lifting from just 0.14% at lunchtime to add 0.56% by the end of the day.

The Info Tech and Financials sectors led the bourse higher, with some added support from copper stocks. More on that in a moment.

Several software companies made big moves on the ASX today.

Infocus Group (ASX:IFG) rocketed up 60% alongside I Synergy (ASX:IS3), up 33%, and OpenLearning (ASX:OLL) gained 28%.

You can read more about IFG and OLL in our ASX Winners section below.

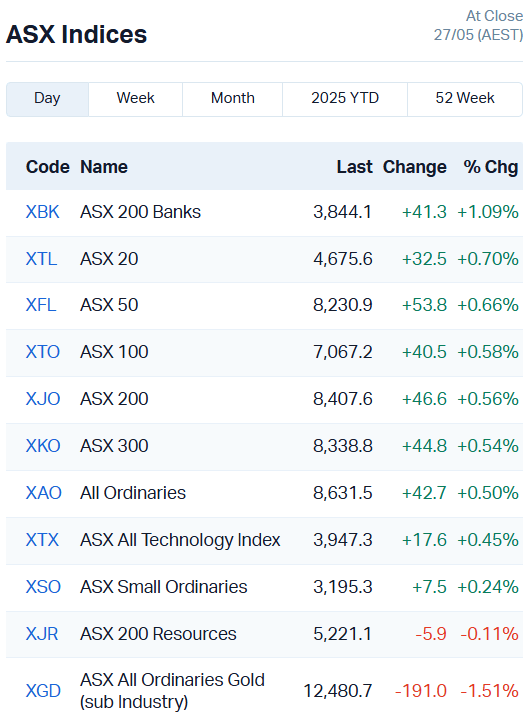

Our ASX 200 Bankers put in a solid effort as well, lifting the index 1.04%.

Bendigo Bank (ASX:BEN) gained 1.44%, Westpac (ASX:WBC) 1.7% and ANZ (ASX:ANZ) 1.4%.

Copper on the rise

Despite a lacklustre performance from the Resources sector today, the ASX Small Ords is up 0.22%, in no small part due to rising copper stocks.

The bellwether metal has been in the spotlight since Ivanhoe Mines was forced to suspend operations at its Kakula copper mine in the DRC earlier this month. Seismic activity in the region has made it too dangerous to continue operations.

Between the mine closure, a mystery offshore suitor reportedly making a bid for Mac Copper (ASX:MAC) – and its Eva copper mine – and an 18.72% increase in the price of copper in the year to date, things are heating up in the copper sector.

New Frontier Minerals (ASX:NFM) jumped 8.33%, Capstone Copper Corp (ASX:CSC) 6.84% and Sandfire Resources (ASX:SFR) gained 3.09%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AAU | Antilles Gold Ltd | 0.005 | 67% | 15213082 | $6,379,103 |

| IFG | Infocusgroup Hldltd | 0.008 | 60% | 67667183 | $1,312,134 |

| BLZ | Blaze Minerals Ltd | 0.003 | 50% | 2000000 | $3,133,896 |

| BMO | Bastion Minerals | 0.0015 | 50% | 3500000 | $903,628 |

| HCD | Hydrocarbon Dynamics | 0.003 | 50% | 3272 | $2,156,219 |

| CVR | Cavalierresources | 0.24 | 45% | 215576 | $9,543,966 |

| HIO | Hawsons Iron Ltd | 0.023 | 44% | 15472718 | $16,264,022 |

| SHN | Sunshine Metals Ltd | 0.01 | 43% | 21162190 | $14,613,514 |

| DTM | Dart Mining NL | 0.004 | 33% | 16546044 | $3,594,167 |

| IS3 | I Synergy Group Ltd | 0.004 | 33% | 9982 | $1,502,190 |

| TKL | Traka Resources | 0.002 | 33% | 500000 | $3,188,685 |

| VPR | Voltgroupltd | 0.002 | 33% | 650000 | $16,074,312 |

| WYX | Western Yilgarn NL | 0.027 | 29% | 221901 | $2,888,783 |

| AMS | Atomos | 0.005 | 25% | 117861 | $4,860,074 |

| ROG | Red Sky Energy. | 0.005 | 25% | 3883451 | $21,688,909 |

| TOU | Tlou Energy Ltd | 0.02 | 25% | 208928 | $20,777,349 |

| G50 | G50Corp Ltd | 0.155 | 24% | 199011 | $20,074,707 |

| RCE | Recce Pharmaceutical | 0.355 | 20% | 647981 | $77,290,529 |

| OLL | Openlearning | 0.018 | 20% | 1109582 | $7,240,120 |

| FG1 | Flynngold | 0.03 | 20% | 1573084 | $9,782,912 |

| GGE | Grand Gulf Energy | 0.003 | 20% | 484002 | $7,051,062 |

| IPT | Impact Minerals | 0.006 | 20% | 1535016 | $19,776,650 |

| RC1 | Redcastle Resources | 0.006 | 20% | 4245850 | $3,717,835 |

| WBE | Whitebark Energy | 0.006 | 20% | 2799435 | $3,436,668 |

| ARC | ARC Funds Limited | 0.115 | 20% | 25098 | $4,939,409 |

Making news…

InFocus Group Holdings (ASX:IFG) has locked in a juicy US$3.25 million contract to build an end-to-end iGaming platform for Taiwanese outfit TG Solutions. It’s the second big win for InFocus in the digital gaming space. The platform will be white-labelled for TG’s customers and packed with features like real-time odds (inspired by Polymarket), crypto payments, tokenised rewards, digital collectibles, and AI-powered analytics.

A software-as-a-service agreement with one of the largest private universities in the Philippines will net OpenLearning (ASX:OLL) a minimum of $400k over 5 years, with potential for up to $250k per year in SaaS fees.

National University has indicated its intention to roll out OLL’s learning management system to its 85,000 students across all campuses in the coming years.

Antilles Gold (ASX:AAU) has signed two offtake deals for all the gold and copper-gold concentrate from its Nueva Sabana mine in Cuba. The buyer is a major global commodities trader, and the gold pricing has come in 12% above what was in the original feasibility study. The contracts run for the mine’s 4.5-year life, with shipments expected every two weeks and fast payments based on global metal prices.

Sunshine Metals (ASX:SHN) is picking up the high-grade Sybil gold project in Queensland, locking in a $1.225 million deal from an unrelated, private party. Sybil is near Charters Towers and has strong early hits, including 7m at 10.6g/t gold and rock chips grading up to 907g/t. It hasn’t seen much action in 20 years, but SHN reckons it looks a lot like the nearby 4Moz Pajingo system.

Western Yilgarn (ASX:WYX) has secured exploration licences for two new bauxite projects which have demonstrated high-grade bauxite averaging more than 35% aluminium and 4% reactive silica content.

The company says the Cardea 1 and 2 projects provide scalability, with a resource within trucking distance of a multi-user railway at a time of record high alumina and bauxite prices.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNR | Lanthanein Resources | 0.001 | -50% | 113750 | $4,887,272 |

| PAB | Patrys Limited | 0.001 | -50% | 247068 | $4,114,895 |

| AOK | Australian Oil. | 0.002 | -33% | 726153 | $3,005,349 |

| CZN | Corazon Ltd | 0.001 | -33% | 460000 | $1,776,858 |

| RNX | Renegade Exploration | 0.002 | -33% | 1000000 | $3,865,090 |

| VML | Vital Metals Limited | 0.002 | -33% | 1319010 | $17,685,201 |

| FCT | Firstwave Cloud Tech | 0.013 | -24% | 628457 | $29,129,818 |

| CXU | Cauldron Energy Ltd | 0.007 | -22% | 36424475 | $13,152,641 |

| AW1 | Americanwestmetals | 0.04 | -22% | 6894360 | $30,382,869 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 2914029 | $7,870,957 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 1521029 | $4,349,768 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 2912253 | $9,929,183 |

| HLX | Helix Resources | 0.002 | -20% | 465000 | $8,410,484 |

| JAV | Javelin Minerals Ltd | 0.002 | -20% | 100000 | $15,115,373 |

| MOH | Moho Resources | 0.004 | -20% | 289645 | $3,727,070 |

| NRX | Noronex Limited | 0.013 | -19% | 1287388 | $8,934,163 |

| SRK | Strike Resources | 0.036 | -18% | 8950 | $12,485,000 |

| RON | Roninresourcesltd | 0.16 | -18% | 50000 | $7,873,127 |

| AUR | Auris Minerals Ltd | 0.005 | -17% | 300141 | $2,859,756 |

| MEL | Metgasco Ltd | 0.0025 | -17% | 373000 | $4,372,760 |

| PCL | Pancontinental Energ | 0.01 | -17% | 1639004 | $97,639,030 |

| PGY | Pilot Energy Ltd | 0.005 | -17% | 14753090 | $11,898,450 |

| VEN | Vintage Energy | 0.005 | -17% | 3325339 | $11,982,791 |

| NHE | Nobleheliumlimited | 0.011 | -15% | 895267 | $7,793,825 |

| FGR | First Graphene Ltd | 0.028 | -15% | 2149856 | $24,710,847 |

IN CASE YOU MISSED IT

RareX (ASX:REE) has tapped global advisory firm WSP to lead environmental and social planning for the Mrima Hill Critical Minerals Project in Kenya, with the support of local teams and experts.

The company has embedded socio-economic priorities in the fundamentals of the rare earth and niobium project, with a keen focus on delivering on social and environmental stewardship expectations using local knowledge, local teams and local companies.

Lumos Diagnostics’ (ASX:LDX) continues to grow US Medicare coverage for FebriDx, its rapid point-of-care diagnostic test to differentiate between bacterial and non-bacterial acute respiratory infections.

Optiscan (ASX:OIL) has also turned heads in the biotech world today, having progressed its cloud-based telepathology streaming software project to a minimum viable product stage.

Trading halts

Agrimin (ASX:AMN) – cap raise

ALS (ASX:ALQ) – cap raise

Gold Mountain (ASX:GMN) – rights issue update

Loyal Lithium (ASX:LLI) – ASX query & proposed acquisition

MAC Copper (ASX:MAC) – potential control transaction

Prospech (ASX:PRS) – cap raise

At Stockhead, we tell it like it is. While RareX, Lumos Diagnostics, Western Yilgarn and Optiscan are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.