Closing Bell: ASX200 makes it a hat-trick after Tech Sector triumph

Winners. Via Getty

- ASX 200 benchmark rises almost 0.6%

- Tech Sector recovers Wednesday’s losses, after Nasdaq positivity

- Miners lead small cap gains, ERW, RDN, AZS winning at home in Andover South

The Australian share market was up and about early on Thursday, thanks to a few standout earnings reveals and the flow through of after market positivity after Nvidia’s landmark Q2 fireworks.

Weak business activity reads just about everywhere had Wall Street leaping at the idea of no more Fed rate rises. The Dow Jones, S&P 500, Nasdaq 100 and the volatile Russell 2000 all ended higher.

With The Fed’s ‘higher for longer’ about to be tested at Jackson Hole, the after market trifecta for Nvidia (NVDA) – way-stronger-than-expected earnings, revenue and guidance – paved the way for some confident trading here and across the region.

By C.O.B the gains were booked, the benchmark up 0.6%

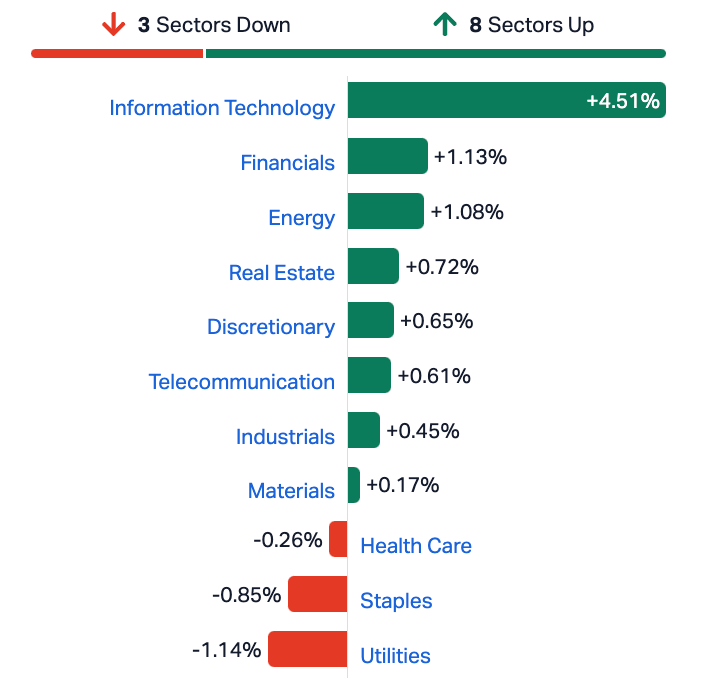

Unsurprisingly the local Tech Sector led the field on the back of strength in the Nasdaq, which – aside from Nvidia itself – was the most visible beneficiary of the US chipmaker’s stock surge, after dropping an epic Q2 report in aftermarket trade in NY.

Gold and lithium miners were also stronger, the lithium majors like Pilbara Minerals (ASX:PLS) and Liontown Resources (ASX:LTR) were up between 2 and 3%.

While the ASX200 has landed its 3rd straight session of gains, bringing some late respectability to the scoreboard in August, (which at Friday’s low saw the ASX200 down 4.40%), a word of warning from Tony Sycamore at IG.

“Before traders consider rushing to add to long positions in the ASX200 at August’s discounted prices, a reminder that the worst month of the year, September, is just around the corner.

“Over the past five years, the ASX200 has recorded an average monthly loss of 2.91% in September. For those who prefer a larger sample size, the reading isn’t much better, with the ASX200 averaging a decline of 2.29% in September over the past ten years.”

Thanks Tony. Bummer.

The ASX Small Ordinaries Index (XSO) was ahead by circa 0.3% again near the close, while the ASX Emerging Companies Index (XEC) was ahead by almost 0.5%

RIPPED FROM THE HEADLINES

Fitch has downgraded to junk the credit rating of a subsidiary of Chinese property giant Country Garden, citing “heightened liquidity pressure” at the troubled firm.

Country Garden, China’s largest private developer in terms of sales last year, has amassed more than $US150bn in debt and said this month it had failed to make two bond payments, meaning it now risks a default.

The firm’s cash flow woes have fuelled fears that the firm could collapse, which many warn could have catastrophic repercussions for the Chinese financial system and economy

Staying in the region, the Bank of Korea kept its rate unchanged at 3.5% during its August rates decision, as widely expected, maintaining rates for the fifth straight time as inflation continued to ease.

WTI crude futures have fallen below US$79 per barrel making it a 4th straight session of walkbacks, as business activity quietened down across developed markets, adding to worries about the direction of energy demand.

PMI reads have business activity in the states just about flatlining for August, while the Poms and the EU are still contracting

There’s also likely some water treading ahead of the annual Fed symposium in Jackson Hole – why buy now when policymakers could guide your next move with some interest rate insights?

Gold rose to around $1,920 an ounce, recovering further from 5-month lows as the same crap PMI reads encouraged hopes that Jackson Hole might be where the central banks say enough is enough on interest rates.

Bond yields were slammed, with the 30-year falling at its fastest pace since the regional banking crisis

And on Wall Street, Bloomberg’s reporting that the estimated wealth of US chipmaker Nvidia’s founder and CEO Jensen Huang jumped some $US4.2 billion after NVDA’s blockbuster earnings and outlook overnight. He’s suddenly among the top 25 richest people on the planet.

Huang’s total fortune to $US46.1 billion, according to the Bloomers’ Billionaires Index.

At home, the Intergenerational Report is out and says the next unfortunate generation is unlikely to boldly go where the last ones went – in short, released by the federal government, the report shows:

- the number of Australians aged 65 and older is projected to double in 40 years; and

- the budget will fall back to deficit this year and stay there for er… 40 years.

Albo’s Treasurer Jim Chalmers says he might have to put together a “defining decade” to recast our future in his own light.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ERW | Errawarra Resources | 0.2 | 67% | 8,363,560 | $7,260,480 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 4,452,378 | $15,642,574 |

| CLE | Cyclone Metals | 0.0015 | 50% | 102,570 | $10,264,505 |

| ICR | Intelicare Holdings | 0.015 | 36% | 54,131 | $2,298,069 |

| GCR | Golden Cross | 0.004 | 33% | 10,492 | $3,291,768 |

| SIS | Simble Solutions | 0.008 | 33% | 865,636 | $3,617,704 |

| TYM | Tymlez Group | 0.004 | 33% | 2,704,604 | $3,714,586 |

| VAL | Valor Resources Ltd | 0.004 | 33% | 550,000 | $11,485,004 |

| RDN | Raiden Resources Ltd | 0.025 | 32% | 187,314,207 | $39,050,110 |

| SBR | Sabre Resources | 0.044 | 29% | 810,690 | $9,910,530 |

| BP8 | Bph Global Ltd | 0.0025 | 25% | 895,821 | $2,669,460 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 3,529 | $11,494,636 |

| LSA | Lachlan Star Ltd | 0.01 | 25% | 463,299 | $10,552,102 |

| MXC | Mgc Pharmaceuticals | 0.0025 | 25% | 110,180 | $7,784,719 |

| PIL | Peppermint Inv Ltd | 0.01 | 25% | 2,363,239 | $16,302,855 |

| TOY | Toys R Us | 0.01 | 25% | 1,551,710 | $7,383,344 |

| WRK | Wrkr Ltd | 0.027 | 23% | 909,718 | $27,974,959 |

| OSL | Oncosil Medical | 0.011 | 22% | 1,363,312 | $17,782,570 |

| IGN | Ignite Ltd | 0.073 | 22% | 534,469 | $5,374,931 |

| EPY | Earlypay Ltd | 0.18 | 20% | 1,276,609 | $43,489,304 |

| AVM | Advance Metals Ltd | 0.006 | 20% | 2,187,309 | $2,942,794 |

| MOM | Moab Minerals Ltd | 0.012 | 20% | 4,570,451 | $6,819,635 |

| PNX | PNX Metals Limited | 0.003 | 20% | 348,494 | $13,451,562 |

| TKL | Traka Resources | 0.006 | 20% | 1,899,998 | $4,356,646 |

| FTL | Firetail Resources | 0.155 | 19% | 327,889 | $12,512,500 |

It’s Digger’s Day here at Stockhead.

First to the niche hunter of halloysite kaolin,Andromeda Metals (ASX:ADN)which jumped nicely today on news of an updated Definitive Feasability Study for its Great White Project (GWP), at Streaky Bay on the Eyre Peninsula in South Australia.

The Great White Project Net Present Value (NPV) has apparently increased by 65% to $1,010mn, and average annual earnings before interest tax depreciation and amortisation (EBITDA) is up by circa 60% to $130mn.

“The 2023 DFS represents the outcome of a rigorous commercial and business strategy review for commercialising our construction ready project, to meet rising market demand,” said Bob Katsiouleris, CEO and Managing Director of Andromeda.

Black Mountain Energy (ASX:BME), is cash-richer by circa $10.7 mn, and the stock jumped by more than a third, following the sale of 100% of its acreage and its title and interest in the MIA 64 FEE 2H well in the Permian basin.

BME dropped about US$2 million for the site in January of this year, spent about US$1.4 million poking around the project, before off-loading it for a weirdly precise US$6,873,308 this week.

Math guru Gregor reckons that makes for a 102% profit, but he’s as good with numbers as he is at swallowing cars, so it might be worth double-checking.

Carrying on up the ASX is Wednesday’s warrior Raiden Resources (ASX:RDN) adding 32% today on the news that it’s all over an outcropping and interpreted pegmatites of up to 30m width at surface at its prized Andover South project. Yes, it’s the one right next door to all the excitement at, Azure Minerals (ASX:AZS).

And it didn’t take long for Errawarra Resources (ASX:ERW), to find another 20% after merely flying a helicopter over its E47/4352 tenement in the West Pilbara region of Western Australia.

Yes. Errawarra’s tenement is next door and along strike from the Azure/Raiden pegmatite finds. It’s all coming together.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EMS | Eastern Metals | 0.038 | -27% | 668,015 | $3,460,071 |

| 1AG | Alterra Limited | 0.007 | -22% | 3,592,243 | $6,268,973 |

| GIB | Gibb River Diamonds | 0.028 | -22% | 110,000 | $7,614,340 |

| OPN | Oppenneg | 0.011 | -21% | 362,500 | $15,633,515 |

| RNX | Renegade Exploration | 0.008 | -20% | 2,540,655 | $9,531,238 |

| THR | Thor Energy PLC | 0.004 | -20% | 7,173,116 | $7,296,457 |

| JDO | Judo Cap Holdings | 1.025 | -19% | 9,910,998 | $1,398,482,638 |

| HIQ | Hitiq Limited | 0.024 | -17% | 792,247 | $7,736,599 |

| HVY | Heavymineralslimited | 0.125 | -17% | 75,941 | $6,350,288 |

| IVX | Invion Ltd | 0.005 | -17% | 629,642 | $38,529,793 |

| LML | Lincoln Minerals | 0.005 | -17% | 97,899 | $8,524,271 |

| LNU | Linius Tech Limited | 0.0025 | -17% | 30,362 | $12,689,372 |

| RBR | RBR Group Ltd | 0.0025 | -17% | 989 | $4,855,214 |

| SI6 | SI6 Metals Limited | 0.005 | -17% | 36,964 | $11,963,157 |

| ABE | Ausbondexchange | 0.13 | -16% | 231,032 | $6,006,731 |

| MRI | Myrewardsinternation | 0.011 | -15% | 1,144,997 | $5,053,772 |

| CI1 | Credit Intelligence | 0.14 | -15% | 495,846 | $13,777,361 |

| FRX | Flexiroam Limited | 0.023 | -15% | 2,790,211 | $17,933,176 |

| ELE | Elmore Ltd | 0.003 | -14% | 12,661,699 | $4,897,843 |

| SIO | Simonds Grp Ltd | 0.155 | -14% | 63,564 | $64,783,161 |

| NGS | NGS Ltd | 0.013 | -13% | 832,218 | $3,768,411 |

| TTT | Titomic Limited | 0.02 | -13% | 1,579,624 | $19,909,816 |

| BFC | Beston Global Ltd | 0.007 | -13% | 4,328,254 | $15,976,375 |

| BVR | Bellavistaresources | 0.14 | -13% | 79,521 | $6,075,602 |

| GW1 | Greenwing Resources | 0.175 | -13% | 29,374 | $34,554,171 |

TRADING HALTS

Antipa Minerals (ASX:AZY): Proposed capital raise

Opthea (ASX:OPT) : Proposed capital raise

VRX Silica (ASX:VRX) : Proposed capital raise

BCAL Diagnostics (ASX:BDX): Concerning a share placement

Halo Food (ASX:HLF): Concerning a material announcement regarding HLF’s strategic review

Melbana Energy (ASX:MAY): Pending an announcement in relation to the current drilling program being conducted in Block 9, Cuba

Zenith Minerals (ASX:ZNC) : Pending the release of an announcement in respect of a sale of a project

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.