Closing Bell: ASX touches peak, gold miners shine, and vanadium stocks in the spotlight

Gold miners shine and vanadium stocks in the spotlight. Picture Getty

- ASX hits all-time high before retreating slightly

- Gold miners surge as prices near record high

- Hong Kong falls on weak China data; Yen rises

The ASX briefly hit an all-time high on Monday before paring gains. At the close of the day, the benchmark ASX 200 index was up 0.3%.

The local market followed Wall Street’s lead, buoyed by rising investor enthusiasm ahead of the US Federal Reserve’s first interest rate cut in more than four years.

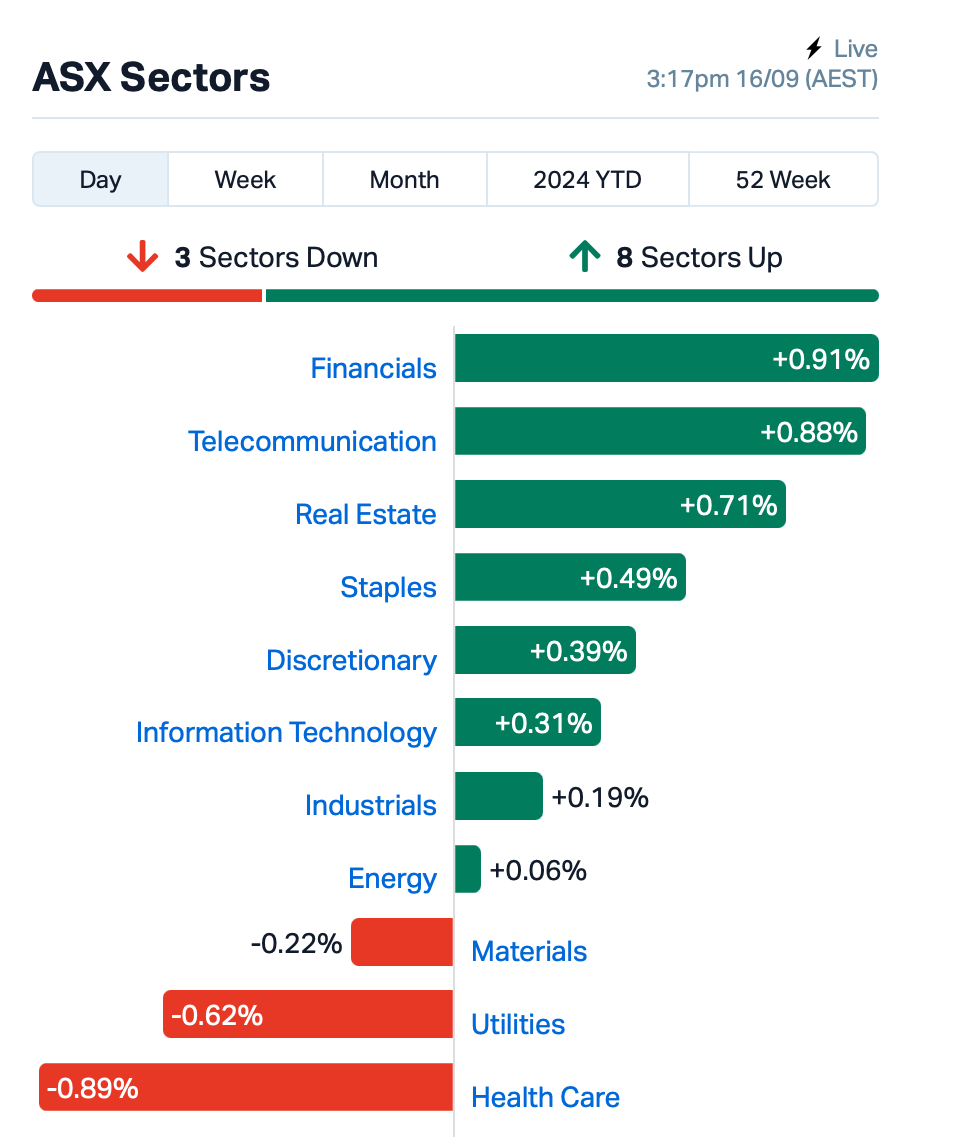

Out of the 11 ASX sectors, eight saw gains today. Banks led the way, while Health and Utilities sectors lagged behind.

Gold miners caught bids as gold prices neared Friday’s all-time high. The bullion price has been climbing on the back of a weaker US dollar and expectations of lower interest rates.

In the large end of town, Lendlease (ASX:LLC) rose 2% after selling its US East Coast construction operations to Consigli Building Group. The sale is expected to be financially neutral over two years, with the goal of simplifying operations and boosting profitability.

Mineral Resources (ASX:MIN) rose over 1% after announcing its first gas and oil resource estimates for the Lockyer Gas and Erregulla Oil projects.

Lockyer boasts a 435 PJ contingent gas resource and significant exploration potential, with development planning already underway. Erregulla, meanwhile, has a 31.6 MMboe contingent oil resource, marking one of Western Australia’s largest onshore oil discoveries.

Elsewhere, goldies were led by St Barbara (ASX:SBM), which rose by 8% and Evolution Mining (ASX:EVN), which was up by 5%.

What else is happening?

Across the region today, almost all stock markets moved higher.

Hong Kong stocks, however, took a hit following weak Chinese economic data, leaving traders wondering if China will step in with more stimulus.

The Japanese yen is rising again, hitting its highest point since July 2023 thanks to hopes of a Fed Reserve rate cut.

In India, Bajaj Housing Finance’s shares soared after the country’s biggest IPO of the year.

Meanwhile earlier today, US Secret Service agents stopped a man with an AK-47-style rifle near Trump’s golf course, but Trump was unharmed. The FBI is investigating this as another potential assassination attempt.

Trump has assured his supporters that he is safe and remains determined as the country heads into a heated election.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.002 | -33% | 130,313 | $1,189,924 |

| CT1 | Constellation Tech | 0.001 | -33% | 1,749,109 | $2,212,101 |

| ICU | Investor Centre Ltd | 0.004 | -33% | 137,334 | $1,827,068 |

| SI6 | SI6 Metals Limited | 0.001 | -33% | 1,692,751 | $3,553,289 |

| TKL | Traka Resources | 0.001 | -33% | 8,747,444 | $2,918,488 |

| NRZ | Neurizer Ltd | 0.003 | -25% | 4,875,000 | $8,724,477 |

| OAR | OAR Resources Ltd | 0.002 | -25% | 453,729 | $6,601,669 |

| POS | Poseidon Nick Ltd | 0.003 | -25% | 3,544,148 | $16,727,902 |

| TIG | Tigers Realm Coal | 0.003 | -25% | 24,000 | $52,266,809 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 13,789,052 | $7,307,139 |

| EFE | Eastern Resources | 0.004 | -20% | 1,137,270 | $6,209,732 |

| EXL | Elixinol Wellness | 0.004 | -20% | 103,088 | $6,605,912 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 3,178,740 | $3,969,071 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 296,941 | $11,058,736 |

| GNM | Great Northern | 0.013 | -19% | 498,613 | $2,474,065 |

| IBX | Imagion Biosys Ltd | 0.023 | -18% | 50,530 | $998,103 |

| OPL | Opyl Limited | 0.014 | -18% | 10,000 | $2,902,149 |

| M24 | Mamba Exploration | 0.015 | -17% | 330,663 | $3,385,481 |

| BGE | Bridgesaaslimited | 0.010 | -17% | 225,000 | $1,472,765 |

| PUR | Pursuit Minerals | 0.003 | -17% | 824,681 | $10,906,200 |

| WHK | Whitehawk Limited | 0.011 | -15% | 323,743 | $6,345,464 |

| OEQ | Orion Equities | 0.150 | -14% | 6,000 | $2,738,615 |

Vanadium Resources (ASX:VR8) and Australian Vanadium (ASX:AVL)

In an exclusive deal, VR8 has partnered with China Energy International Group (CEIG) for the engineering, construction and financing of its 76.8Mt at 0.72% vanadium Steelpoortdrift project in South Africa which includes a solar plant and other services.

A partly-binding MoU, VR8 says, will pave the way for additional value-add opportunities in the energy sector as the ASX junior runs towards a financial investment decision for the project in Q3 next year.

The growing demand for vanadium redox flow batteries (VRFBs) in large-scale energy storage is expected to play a significant role in the future. So too the market for vanadium nitrogen for the development of high-quality steel, quoth the US Geological Survey.

Meanwhile, AVL has announced the successful deployment of its vanadium electrolyte tech in a vanadium flow battery (VFB sans the redox) for WA electricity retailer Horizon Power.

A 220-kilowatt-hour VFB that can produce up to 78kW of power is being installed at Horizon’s Kununurra site for acceptance testing in energy storage.

The $24.5m VR8 shot up 13.2% today on the bourse, trading at 4.3c, while AVL also went up the ranks >7% to 1.5c a share.

Also on the vanadium train, Neometals (ASX:NMT) has scored a big win after its 88%-owned European subsidiary Recycling Industries Scandinavia (RISAB) executed an agreement with EU co-funded EIT RawMaterials to support the development of its VRP1 vanadium recovery project in Finland.

EIT RawMaterials will provide $829,000 in grant funding to progress project financing and will become a minority shareholder in RISAB. It’ll also have the option to subscribe for up to a further €10m in RISAB equity at the pre-money valuation of €50m.

VRP1 is already expecting improved economics from an additional €15m conditional investment grant from the EU backed Finnish State NextGeneration fund, which could see it benefit from a potential new 20% investment tax credit in Finland.

The VRP1 feasibility study had confirmed the potential for lowest-quartile operating costs, with a low-to-negative carbon footprint. A binding offtake is in place for 100% of its vanadium pentoxide products to Glencore International, the mining and commodities trading behemoth.

The Trelavour hard rock project in Cornwall, which will employ Lepidico (ASX:LPD)’s proprietary hydrometallurgical lithium processing technologies under licence, has been designated as a Nationally Significant Infrastructure Project (“NSIP”) by the United Kingdom government.

That’s a notable endorsement of its lithium processing tech that will run through LPD’s $17.7m demonstration plant that will process lithium mica mineralisation into battery-grade lithium hydroxide.

Commercial lithium production – manufactured far more sustainably than by conventional chemical conversion methods – is planned for 2026, subject to securing finance.

Mithril Silver and Gold (ASX:MTH) was rising on news that the company has completed a LiDAR survey over its entire 70km2 of mining concessions that cover the Copalquin gold-silver district in Durango State, Mexico, revealing a network of historical workings – including mine tunnels and prospecting pits across the site. Exploration at the site is continuing, and sampling from completed holes have been sent for assaying, with that batch of results expected soon.

Ironbark Zinc (ASX:IBG) got a speeding ticket from the ASX, and the company’s response hadn’t cleared embargo as of the time of writing.

RooLife Group (ASX:RLG) was rising on news that it has signed an agreement for the production and supply of health and wellness products, manufactured in Australia by Careline Australia, including including its most popular skincare range “featuring products with patented technology including plant and animal stem cell technology, antioxidant blends and natural essential oils”.

Future Metals (ASX:FME) got a boost from news that heritage clearance surveys have been completed across the Alice Downs Corridor and Panton North tenures. The completion of these surveys “marks a key step forward in advancing the exploration strategy within the Alice Downs Corridor” the company says.

Similarly, Lycaon Resources (ASX:LYN) was up on news that a heritage clearance survey over its high-priority Stansmore Nb-REE/IOCG target has been received, paving the way for the company’s first ever drill campaign in theWest Arunta region.

Cettire (ASX:CTT) rose 9% after an article in the AFR published last night suggested that the White House has proposed cutting the duty-free import threshold, which could impact the company’s pricing advantage. According to the AFR, the new regulations aim to curb abuse of the de minimis exemption, which allows imports valued under $800 to enter duty-free, and could impact platforms like Cettire. Investors are on edge as they await the company’s audited accounts, following concerns about its duties and taxes practices and potential disruptions from the proposed legislation.

Austal (ASX:AUB) also rose 9% after announcing that Austal USA has secured a US$450 million contract from General Dynamics Electric Boat. This contract will allow Austal USA to expand its shipyard in Mobile to support the U.S. Navy’s submarine programmes. The new facility, set to be completed by 2026, will create around 1,000 jobs and help in fabricating and outfitting submarine components. Austal’s CEO, Paddy Gregg, praised the contract as a sign of growing confidence in Austal USA’s role in supporting the U.S. Navy’s needs.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.002 | -33% | 130,313 | $1,189,924 |

| CT1 | Constellation Tech | 0.001 | -33% | 1,749,109 | $2,212,101 |

| ICU | Investor Centre Ltd | 0.004 | -33% | 137,334 | $1,827,068 |

| SI6 | SI6 Metals Limited | 0.001 | -33% | 1,692,751 | $3,553,289 |

| TKL | Traka Resources | 0.001 | -33% | 8,747,444 | $2,918,488 |

| NRZ | Neurizer Ltd | 0.003 | -25% | 4,875,000 | $8,724,477 |

| OAR | OAR Resources Ltd | 0.002 | -25% | 453,729 | $6,601,669 |

| POS | Poseidon Nick Ltd | 0.003 | -25% | 3,544,148 | $16,727,902 |

| TIG | Tigers Realm Coal | 0.003 | -25% | 24,000 | $52,266,809 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 13,789,052 | $7,307,139 |

| EFE | Eastern Resources | 0.004 | -20% | 1,137,270 | $6,209,732 |

| EXL | Elixinol Wellness | 0.004 | -20% | 103,088 | $6,605,912 |

| MOM | Moab Minerals Ltd | 0.004 | -20% | 3,178,740 | $3,969,071 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 296,941 | $11,058,736 |

| GNM | Great Northern | 0.013 | -19% | 498,613 | $2,474,065 |

| IBX | Imagion Biosys Ltd | 0.023 | -18% | 50,530 | $998,103 |

| OPL | Opyl Limited | 0.014 | -18% | 10,000 | $2,902,149 |

| M24 | Mamba Exploration | 0.015 | -17% | 330,663 | $3,385,481 |

| BGE | Bridgesaaslimited | 0.010 | -17% | 225,000 | $1,472,765 |

| PUR | Pursuit Minerals | 0.003 | -17% | 824,681 | $10,906,200 |

| WHK | Whitehawk Limited | 0.011 | -15% | 323,743 | $6,345,464 |

| OEQ | Orion Equities | 0.150 | -14% | 6,000 | $2,738,615 |

IN CASE YOU MISSED IT

Argent Minerals (ASX:ARD) has started maiden drilling to test 13 high priority regional targets at the Kempfield NW, Sugarloaf Hill, Henry and Golden Wattle prospects within its Kempfield polymetallic project in NSW.

Celsius Resources (ASX:CLA) has entered binding financing agreements with Hong Kong-based investment company Patras Capital for a $1.5m placement and up to $10m committed equity facility to help fund its flagship Maalinao-Caigutan-Biyog (MCB) copper-gold project in the Philippines.

Dimerix (ASX:DXB) has entered into a collaboration with the UK’s National Registry of Rare Kidney Diseases (RaDaR) – the largest kidney association in the world – to prospectively identify suitable patients for its ACTION3 Phase 3 trial of lead drug, DMX-200, to treat focal segmental glomerulosclerosis (FSGS).

Legacy Minerals’ (ASX:LGM) ongoing review of the Drake project in NSW has uncovered extensive, high-grade antimony and gold rock chips over the Lunatic Field ~190km north of the Hillgrove mine – home ot one of the world’s 10 largest antimony resources.

Mithril Silver and Gold (ASX:MTH)‘s LIDAR survey over its Copalquin gold and silver project in Mexico has more than doubled the number of previously known historical mines and workings, which is indicative that a large epithermal gold-silver system is present.

OzAurum Resources (ASX:OZM) is looking to commercialise its WA gold assets by signing an agreement with Line Hydrogen and BIM Metals (together LHBM) to complete the Mulgabbie North gold heap leach feasibility study, which will be fully funded by LHBM. The agreement includes a 50:50 profit share arrangement.

QMines (ASX:QML) has picked up a new strategic tenement over the highly sought after Striker prospect at its flagship Mt Chalmers copper and gold project in Queensland that hosts a copper-lead-zinc anomaly.

Raiden Resources (ASX:RDN) has received Program of Work approval for drilling at the E47/4061 and E47/4062 tenements within its Andover South project. High-grade lithium pegmatites of up to 3.8% Li2O have been mapped over more than 4km of strike.

CuFe (ASX:CUF) has completed a maiden wide-spaced reverse circulation drilling program at its North Dam lithium, rare earths and niobium project east of Kambalda, WA, that intersected multiple large pegmatites.

Pegmatites intersected by the 18 hole program totalling 2068m vary in mineralogy and had down-hole thicknesses ranging from 10-47m with a top intersection of 85m. The first batch of downhole samples have been dispatched to a Perth laboratory for assaying with results for all holes expected to be received in October.

Lumos Diagnostics (ASX:LDX) has appointed Thermo Fisher Scientific’s Fisher Healthcare as the US distributor for its FebriDx rapid point-of-care respiratory test for a viral from bacterial acute respiratory infection.

The test was cleared in July 2023 by the US Food and Drug Administration for use by healthcare professionals with patients presenting in urgent care or emergency care settings and is intended to be used in conjunction with clinical signs and symptoms, including other clinical and laboratory findings, to evaluate patients for acute respiratory infection.

“We are very pleased to announce this partnership with Fisher Healthcare for FebriDx distribution,” LDX managing director Doug Ward said. “We look forward to working together to accelerate the growth of FebriDx via their network of customers across the US.”

TRADING HALTS

Actinogen Medical (ASX:ACW) – pending an announcement regarding a capital raising and share purchase plan.

BPM Minerals (ASX:BPM) – pending an announcement regarding drill results from the Claw Gold Project.

Petratherm (ASX:PTR) – pending an announcement regarding capital raising initiatives.

Spacetalk (ASX:SPA) – pending an announcement in connection with a placement and accelerated offer.

Bowen Coking Coal (ASX:BCB) – pending an announcement concerning a potential debt and equity financing event.

Beacon Minerals (ASX:BCN) – pending an announcement of a proposed capital raising.

Sun Silver (ASX:SS1) – pending an announcement to the market in relation to the outcome of a capital raising.

Titan Minerals (ASX:TTM) – pending the release of an announcement in relation to a joint venture transaction.

Future Battery Minerals (ASX:FBM) – pending the release of an announcement in relation to the Nepean Nickel Project Sale.

Altair Minerals (ASX:ALR) – pending an announcement by the Company to the market in relation to exploration results from the Wee MacGregor Copper Gold Project.

Bindi Metals (ASX:BIM) – pending the release of an announcement regarding an acquisition and capital raising.

Redcastle Resources (ASX:RC1) – pending an announcement in relation to a capital raising.

Winsome Resources (ASX:WR1) – pending the release of an announcement disclosing the details of a Scoping Study.

Western Mines Group (ASX:WMG) – pending an announcement on significant assay results.

Asara Resources (ASX:AS1) – pending the release of an announcement regarding a placement.

Auckland International Airport (ASX:AIA) – pending an announcement regarding a placement.

At Stockhead, we tell it like it is. While CuFe, Lumos Diagnostics, Argent Minerals, Celsius Resources, Dimerix, Legacy Minerals, Mithril Silver and Gold, OzAurum Resources, QMines and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.