Closing Bell: ASX slips as MinRes rebounds, RBA holds; and are traders exiting ‘Trump trades’?

Are traders exiting ‘Trump trades’? Picture via Getty Images

- Aussie shares slip as RBA holds rates steady

- MinRes rebounds, Domino’s Don Meij quits

- Investors rethink Trump comeback as Harris leads in Iowa

Aussie shares slipped into the red on Tuesday, falling 0.4% as sentiment remained subdued after the Reserve Bank of Australia kept the cash rate steady at 4.35%.

Overnight, US markets dipped as bond prices rose and the US dollar weakened. Investor nerves are frayed ahead of Tuesday’s start to in-person voting in what’s shaping up to be a nail-biting US presidential race.

Locally, all eyes were on the RBA and Knight’s Choice, an outsider that won the 2024 Melbourne Cup in a photo finish, with Warp Speed second and Okita Soushi third.

With inflation still too high, the RBA expectedly held rates steady for a seventh meeting in a row.

The central bank has lifted rates 13 times since 2022 to curb inflation, but a red-hot jobs market has left it with little choice but to stay put.

A lot will now hinge on RBA governor Michele Bullock’s comments, who has started speaking to the media at 3:30pm today.

“We continue to think that the RBA will be the last developed market, with the exception of Japan, to cut policy rates in this cycle,” said Harvey Bradley at Insight Investment.

“In part, this is because the RBA were more cautious than other central banks in the hiking cycle and did not take policy rates to as restrictive levels as peers.”

“We do, however, think Australian government bonds offer attractive relative value, given a higher implied terminal rate and a better fiscal backdrop than peers.”

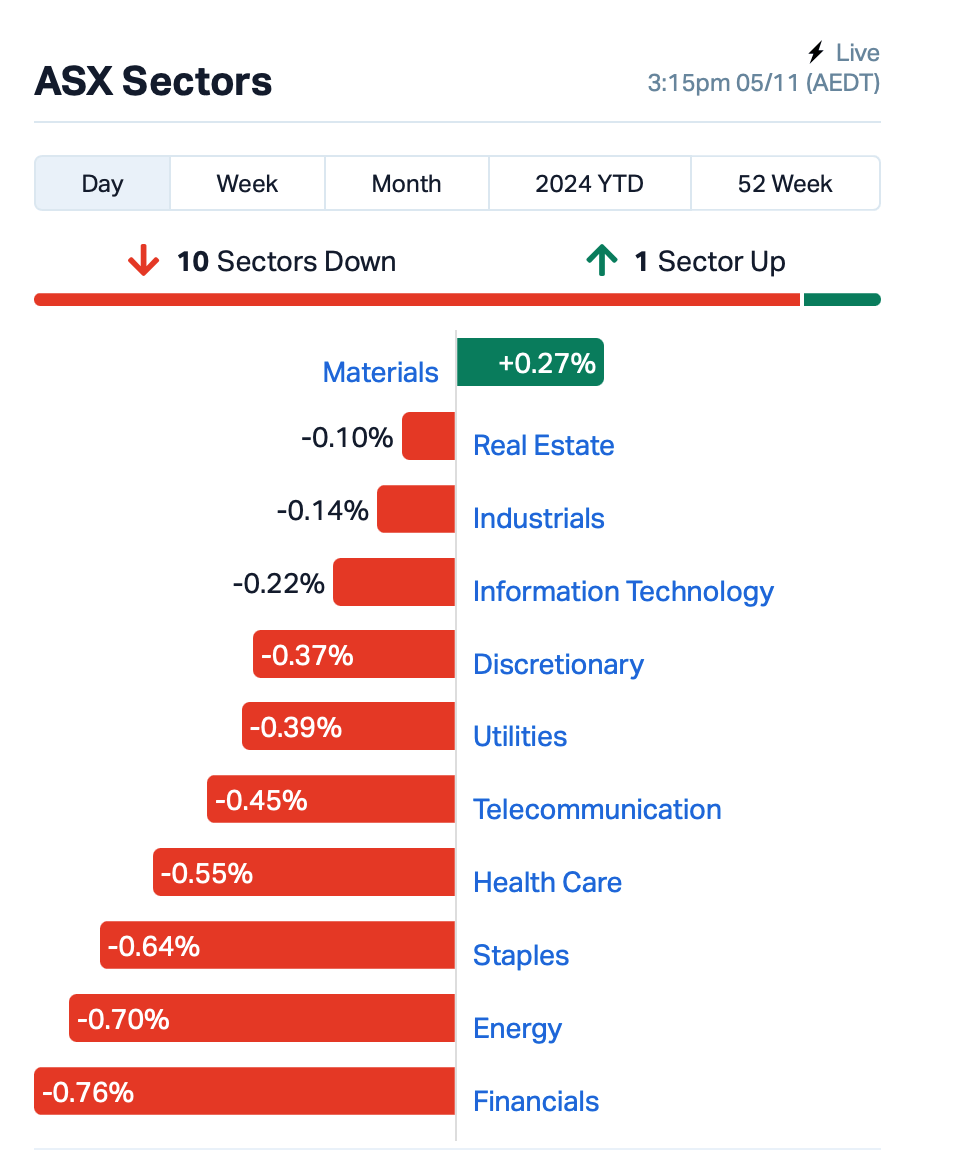

To the ASX, and 10 sectors were flashing red at 3.15pm today.

Mining was the only one in the green after Mineral Resources (ASX:MIN) bounced back 3% following a sharp drop yesterday on news of founder Chris Ellison’s upcoming exit.

Still in the large caps space, Domino’s Pizza Enterprises’ (ASX:DMP) shares were down almost 7% after CEO Don Meij announced he’s stepping down after 22 years at the helm.

Lifestyle Communities (ASX:LIC) jumped as high as 12% after HMC Capital, the activist investor group led by dealmaker David Di Pilla, revealed it had taken a 2.7% stake in the company.

Traders exit Trump trade?

Good news out of China today: data shows the country’s service sector grew at its fastest pace since July, signalling that consumer demand may be picking up after recent stimulus efforts.

This helped to lift Chinese stocks, with the CSI 300 index jumping over 1%.

Meanwhile, investors are scaling back bets on a Trump comeback as a new poll shows Vice President Kamala Harris leading in Iowa, a traditionally red state.

The shift hit the US dollar, which slid to a two-week low, and sent 10-year Treasury yields down 12 basis points.

Even Bitcoin, a so called Trump trade, dipped as markets reassess Harris’ chances in the presidential race.

The US election is today (US time), so the results will mostly unfold on Wednesday, November 6 (Aussie time).

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MNC | Merino and Co | 1.450 | 62% | 70,118 | $47,503,530 |

| IBG | Ironbark Zinc Ltd | 0.003 | 50% | 393,320 | $3,667,296 |

| 8IH | 8I Holdings Ltd | 0.008 | 33% | 142,000 | $2,088,965 |

| AL8 | Alderan Resource Ltd | 0.004 | 33% | 1,400,000 | $5,727,876 |

| ASR | Asra Minerals Ltd | 0.004 | 33% | 425,000 | $6,694,674 |

| EXL | Elixinol Wellness | 0.004 | 33% | 309,868 | $4,680,214 |

| AGD | Austral Gold | 0.028 | 27% | 132,073 | $13,470,850 |

| AD1 | AD1 Holdings Limited | 0.005 | 25% | 1,794,960 | $4,389,394 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 20,197 | $5,296,765 |

| LPD | Lepidico Ltd | 0.003 | 25% | 2,805,826 | $17,178,250 |

| TMK | TMK Energy Limited | 0.003 | 25% | 20,916,198 | $16,784,811 |

| EPM | Eclipse Metals | 0.006 | 20% | 250,000 | $11,264,278 |

| PPG | Pro-Pac Packaging | 0.020 | 18% | 1,477,424 | $3,088,691 |

| AAU | Antilles Gold Ltd | 0.004 | 17% | 31,016 | $5,567,228 |

| BMG | BMG Resources Ltd | 0.014 | 17% | 43,006,748 | $8,205,566 |

| IPB | IPB Petroleum Ltd | 0.007 | 17% | 1,653,340 | $4,238,418 |

| PIL | Peppermint Inv Ltd | 0.007 | 17% | 5,940,289 | $12,728,150 |

| TYX | Tyranna Res Ltd | 0.004 | 17% | 491,050 | $9,863,776 |

| ASE | Astute Metals NL | 0.032 | 14% | 517,160 | $14,841,054 |

| DOU | Douugh Limited | 0.008 | 14% | 864,468 | $7,574,482 |

| SP8 | Streamplay Studio | 0.008 | 14% | 773,633 | $8,054,366 |

| ASV | Assetvisonco | 0.024 | 14% | 335,256 | $15,526,593 |

| MXO | Motio Ltd | 0.025 | 14% | 400,000 | $6,013,028 |

| BUS | Bubalus Resources | 0.130 | 13% | 116,852 | $4,181,889 |

| IRX | Inhalerx Limited | 0.027 | 13% | 237,255 | $5,068,360 |

Wool producer Merino and Co (ASX:MNC) jumped over 60% this morning before the company’s shares were put on voluntary trading halt.

In a statement, Merino said: “Trading in the securities of the entity will be temporarily paused pending a further announcement.”

Augustus Minerals (ASX:AUG) has acquired the Music Well Gold Project, located 35km north of Leonora in Western Australia’s Leonora/Laverton Greenstone Belt.

The project covers 1,345 km² and is surrounded by major gold mines, including Northern Star’s Thunderbox Mine (4.2 million ounces of gold resources) and Genesis Minerals’ Hub Project (0.7 million ounces). The region has a gold endowment of over 12 million ounces and substantial ongoing production. Augustus aims to explore the area over the next two years, with geophysics, soil sampling, and rock chipping already completed.

Meanwhile Ghana’s Minerals Income Investment Fund (MIIF) is set to invest approximately US$2 million in the Kambale Graphite Project. This includes US$500,000 in Castle Minerals (ASX:CDT) and US$1.5 million in its subsidiary Kambale Graphite. The investment marks a significant step forward for the project, with MIIF becoming the largest equity shareholder in Castle.

The Ghanaian government is keen to develop a local supply chain for critical minerals, including graphite and lithium, supporting both the Kambale project and Atlantic Lithium. This investment positions Kambale to be part of the growing EV and energy storage supply chains in the US and Europe.

Recce Pharmaceuticals (ASX:RCE) is making significant progress in its Phase II clinical trial for RECCE 327 Topical Gel (R327G), targeting Acute Bacterial Skin and Skin Structure Infections (ABSSSI).

With 20 of 30 patients dosed, the trial is on track to be completed by the end of 2024. Early results are promising, with all patients showing either a complete cure or notable improvement after treatment. Importantly, there have been no serious adverse events reported. The positive outcomes reinforce the potential of R327G as a new solution for complex bacterial infections, including diabetic foot infections.

Imugene (ASX:IMU) announced a milestone in its Phase 1 MAST (Metastatic Advanced Solid Tumours) trial, with a bile tract cancer patient now maintaining a complete response for over two years.

The first cohort of three patients in the Bile Tract Cancer Expansion of the VAXINIA trial has been cleared, with no safety concerns or dose-limiting toxicities. The trial is now open for full enrolment of up to 10 patients. In addition, VAXINIA has received FDA Fast Track and Orphan Drug Designation for its treatment of bile tract cancer, speeding up the development process and offering incentives like market exclusivity upon approval.

BMG Resources (ASX:BMG) has secured $1.5 million through a placement of shares to advance drilling at its Abercromby Gold Project. The funds will support further drilling to expand and upgrade the resource, particularly at the Capital Deposit, which remains open for extension. Drilling will also target regional areas to the south, where high-grade gold has been identified. Additionally, metallurgical studies show good gold recoveries from conventional processing. The placement will issue 150 million shares, with the first tranche of 74 million shares to be issued shortly.

Peppermint Innovation (ASX:PIL) has secured a flexible funding package of up to $3 million through a convertible note issue to Obsidian Global. The initial tranche of $750,000 has been drawn down, with further funds available over the next 18 months, subject to mutual agreement. The notes are interest-free (except in case of default) and have a 36-month maturity.

This funding will strengthen Peppermint’s balance sheet, support its operations in the Philippines, and drive growth initiatives, including product development and market expansion. CEO Chris Kain said the convertible note structure allows the company to access capital without diluting shareholder value, with the flexibility to either repay or convert the notes to equity as needed.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RNE | Renu Energy Ltd | 0.001 | -50% | 643,560 | $3,454,657 |

| PEK | Peak Rare Earths Ltd | 0.120 | -37% | 2,119,338 | $50,621,825 |

| OAR | OAR Resources Ltd | 0.001 | -33% | 828,300 | $4,951,252 |

| RIE | Riedel Resources Ltd | 0.001 | -33% | 407,333 | $3,335,753 |

| SBM | St Barbara Limited | 0.343 | -26% | 30,864,507 | $376,437,076 |

| AKN | Auking Mining Ltd | 0.003 | -25% | 37,337 | $1,565,401 |

| BP8 | Bph Global Ltd | 0.003 | -25% | 37,800 | $1,586,566 |

| GTI | Gratifii | 0.003 | -25% | 1,129,441 | $18,707,347 |

| CLEDA | Cyclone Metals | 0.017 | -23% | 739,670 | $14,012,861 |

| SMN | Structural Monitor. | 0.540 | -22% | 214,360 | $94,777,746 |

| BCM | Brazilian Critical | 0.008 | -20% | 883,977 | $8,691,913 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 790,000 | $2,516,434 |

| INP | Incentiapay Ltd | 0.004 | -20% | 768,229 | $6,326,200 |

| SRN | Surefire Rescs NL | 0.004 | -20% | 21,709,609 | $9,931,539 |

| LU7 | Lithium Universe Ltd | 0.011 | -19% | 6,225,025 | $7,666,830 |

| ADR | Adherium Ltd | 0.009 | -18% | 2,978,465 | $8,344,380 |

| AMM | Armada Metals | 0.010 | -17% | 872,368 | $8,785,331 |

| MEL | Metgasco Ltd | 0.005 | -17% | 799,686 | $8,745,520 |

| NOX | Noxopharm Limited | 0.110 | -15% | 855,367 | $37,990,934 |

| PVE | Po Valley Energy Ltd | 0.035 | -15% | 625,331 | $47,517,426 |

| AOK | Australian Oil. | 0.003 | -14% | 886,000 | $3,506,240 |

IN CASE YOU MISSED IT

Green Critical Minerals (ASX:GCM) has appointed Professor Andrew Ruys as head of research and development to accelerate the commercial readiness of the very-high density graphite production technology that it recently acquired.

Optiscan (ASX:OIL) has signed a deal with Monash University to develop the next-gen gastrointestinal flexible endomicroscope and Edge-AI-enabled technology, which will be able to automate detection and analysis of cancerous and precancerous lesions.

Recce Pharmaceuticals’ (ASX:RCE) Phase II clinical trial of RECCE 327 is nearing a key dosing milestone with 20 of 30 patients, all meeting the primary endpoints of the study with either a cure or notable improvement after using the topical gel. Data has shown a strong therapeutic response to date.

The environmental licence for Bubalus Resources’ (ASX:BUS) Nolans East rare earths project has been approved by the Northern Territory Department of Lands, Planning and Environment. With this in place, the company has paid the required security to the Department of Industry, Tourism and Trade, which issued the statutory Notice of Authority to Commence Mining Activities.

BUS is continuing discussions with the owner of the pastoral station on which Nolans East falls to agree a Land Access Agreement due to a recent change of ownership. All heritage approvals have already been received for the planned drilling at Nolan’s East pending securing the Land Access Agreement.

Raiden Resources (ASX:RDN) has started drilling at its Arrow gold project after securing all necessary regulatory approvals and heritage survey approvals.

The planned 3500m aircore drill program will test a range of geochemical and geophysical targets in the search for Hemi-style gold mineralisation. All gold drilling is financed by joint venture partner Mallina Co Pty Ltd with RDN retaining 100% of the lithium-caesium-tantalum rights.

“The commencement of drilling at the Arrow gold project marks the third drilling program to commence in this quarter, which is proving to be a very exciting time for the company and the shareholders,” managing director Dusko Ljubojevic said.

“With the ongoing drilling programs on the Andover South lithium project and the Mt Sholl copper-nickel-PGE deposit, our shareholders now gain discovery potential on an exciting project within an emerging tier one gold district.”

Trading halts

Intelligent Monitoring Group (ASX:IMB) – equity raising

Labyrinth Resources (ASX:LRL) – pending an announcement regarding drilling results

Merino & Co (ASX:MNC) – pending an announcement

At Stockhead, we tell it like it is. While Bubalus Resources, Green Critical Minerals, Optiscan, Raiden Resources and Recce Pharmaceuticals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.