Closing Bell: ASX rises despite tech meltdown; Domino’s fires everyone, stock jumps

Via Getty

- ASX 200 benchmark climbs 0.5%

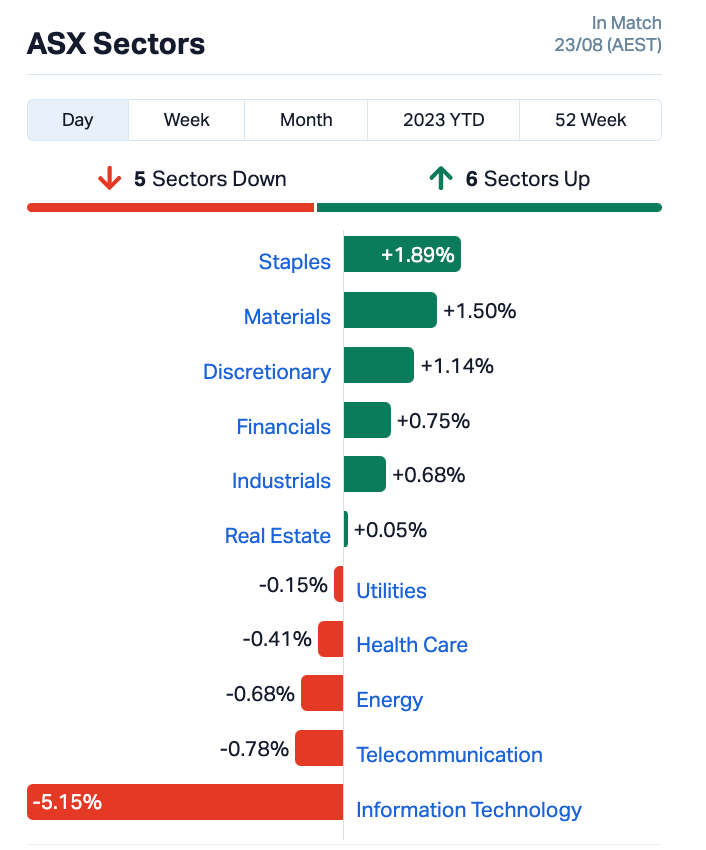

- Tech Sector plunges 5.5% while Consumer stocks and iron ore majors save day

- Small cap gains led by huge day at 4DS

The Australian share market extracted some green from a dull Wednesday wicket after the Wallys on Wall Street dropped their bundles of confidence overnight.

The S&P/ASX 200 was up 0.3%, at the bell, blocking out an absolute cherry of a slump from yield-slapped Tech stocks.

And the miners turned up for once on Wednesday, which was nice.

As did – the real stars for me this week – an ever odder assortment of consumer stocks, who’ve been spilling their staples with a lot of discretion in what’s already been a hectic week for retail-facing ASX earnings.

We even got to see what happens when a consumer staple chooses to make a consumer discretionary of itself.

Absolute staple, Domino’s Pizza (ASX:DMP) jumped by almost 10% this morning as wealthy investors celebrated the company’s choice between axe or cheese as DMP jettisoned 200 staff, rather than allow the price of pizza to help offset some inflation-fuelled rising costs.

Forever CEO Don Meiji’s been running that ship pretty well for a pretty long-time, but even one iceberg can ruin your record. This one was inflation and trying to park the cost onto deliveries.

That just stopped people ordering, moving DMP from a consumer staple to a consumer discretionary.

Costs rose, FY23 net profit performed a 74% cliff dive and punters have to live with an absurdly cheese-reduced dividend. But – oh it was a joy to see the stock rise on mass job cuts.

That meal done, we turned to the online cosmetics platform Adore Beauty (ASX:ABY) which stole some gains after revealing a decent near 6% bump on its sales were up by 5.9% in the first months of the 2024 financial year despite wobbly consumer confidence.

Revenue, earnings and gross profit margins fell away pretty seriously for ABY, and even the online retailer’s active customer numbers fell to 801,000, down 8% on last year.

But – and it’s a big one in the flogging cheap stuff online game – Adore’s returning customer base grew by 4% to a record high of 490,000 and the mobile app accounted for a quarter of all revenue during the last three months of the year. The target is 30%, but 25% ain’t bad either.

Adore explained its squeezed margins were all about lower operating costs, rising inflation, and just putting money back into the business. The old more for less, explanation.

Then ABY ended its presso by emphasising the benefits already in the post with improving in profit margins, marketing efficiencies, and employee costs etc.

Investors dug it. The stock rose an improbable 5%.

On the debit side Wisr (ASX:WZR) looked worse for wear (but is now a little Wisr) after its chair went the way of its CEO.

First up, the now-former chief exec Anthony Nantes, it turns out, is the subject of unspecified criminal charges at the hands of the always gentle NSW Police.

The fallout smashed the fintech when news broke as well as the fact chair John Nantes, (yeah, they’re bros), is taking a two-month leave of absence.

Wisr announced last week that Anthony Nantes was being replaced as CEO with immediate effect by then CFO Andrew Goodwin.

However, the news has smothered WZR’s big efforts to slash expenses and a decent bump Q4 revenue. The loan book grew 19% while operating cash flow was positive to the tune of $2.6 million and EBITDA of $900,0000 in Q4 FY23, following an easing off on the high pace of loan origination.

So everyone’ll probs miss the more than 20% cut in operating expenses, with revenue jumping 39% compared to last Q4.

By close the Consumer Staples Sector was up by 1.9%, the Materials Sector by 1.5%, but InfoTech took a bullet, down 5.5%.

The ASX Small Ordinaries Index (XSO) was ahead by 0.3% near the close, while the ASX Emerging Companies Index (XEC) was as flat as my new KGN TV.

RIPPED FROM THE HEADLINES

The iron ore business is back a bit, futures in Dalian and Singers rose sharply this morning, which is why the big guns – BHP, Rio Tinto and Fortescue – did so well in arvo trade.

China’s production cutbacks aren’t really that deep, and they look like being partly offset by the Party’s slow-ass issuance of more than 1.5bn yuan of special financing bonds, which almost always end in infrastructure projects of immense size and uselessness.

I’m not really into bonds because, well, they’re almost the opposite of small caps. That said, with the 10-year US Treasury yields at their highest since circa 2006, it’s probably a good time to add duration to your fixed-income portfolio.

That’s not me. It’s some expert at Charles Schwab I heard very early this morning on CNBC (on my new KGN telly!)

The yield on the 10-year rose to 4.35% on Monday and was last seen slinking about near 4.32%.

Bond yields move inversely to prices. And if they rise, we usually see Tech stocks get kicked. It’s like fiscal physics.

Have treasury yields peaked, asked CNBC. Surely they have, right?

If I were a betting man, this guy from Charles Schwab said (he was fixed income strategist Cooper Howard, thanks Googs)….

“I think the odds favour lower rather than higher.”

Not super helpful, I thought.

Asia-Pacific economy’s been ‘rather mixed’ lately says jaded analyst

Rajiv Biswas, APAC Chief Economist at S&P Global Market Intelligence says global real GDP growth (forecast for 2023) has just edged higher – again!

From 2.4% to 2.5% in August – primarily owing to upward revisions to the US forecast (*bad math in America); the 2024 global growth forecast is unchanged at 2.4%, also supported by an upward revision to the US forecast.

Rajiv Biswas said the recent news across our Asia-Pacific region has been “rather mixed”.

Obviously not a soccer fan.

“Mainland China is facing growing headwinds from declining exports, weak domestic demand and a protracted slump in residential construction.

With CPI and PPI inflation also showing declines in mid-2023, the People’s Bank of China has announced a 15 basis point rate cut in August to try to provide additional monetary policy stimulus.

Reflecting the continuing economic challenges, mainland China’s pace of economic growth is expected to moderate from 5.2% in 2023 to 4.8% in 2024.

On the other hand, check out India’s economy.

That rice-hoarding economy is continuing to show rapid expansion.

S&P MI expects GDP growth to clock in at a pace of 5.9% in FY 2023 and 6.1% in FY 2024.

However, Rajiv Biswas says an afterburner of inflation pressures in mid-2023 (that’s the fast-rising food prices I mentioned yesterday!) pushed CPI inflation back to the top of the Reserve Bank of India’s (RBI) inflation target range.

“Although inflationary pressures have moderated since the beginning of 2023 in a number of Southeast Asian countries, the downside risk of a severe El Nino weather event remains a key uncertainty for the near-term economic outlook.”

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SIH | Sihayo Gold Limited | 0.002 | 100% | 127,998 | $12,204,256 |

| 4DS | 4Ds Memory Limited | 0.13 | 97% | 111,595,790 | $107,747,853 |

| RDN | Raiden Resources Ltd | 0.0205 | 71% | 255,272,889 | $24,663,227 |

| AJQ | Armour Energy Ltd | 0.135 | 53% | 267,395 | $9,074,570 |

| AL8 | Alderan Resource Ltd | 0.01 | 43% | 940,805 | $4,316,863 |

| NZS | New Zealand Coastal | 0.002 | 33% | 5,411,293 | $2,481,015 |

| PRX | Prodigy Gold NL | 0.007 | 27% | 4,008,856 | $9,631,093 |

| BPP | Babylon Pump & Power | 0.005 | 25% | 1,893,000 | $9,831,085 |

| EDE | Eden Inv Ltd | 0.005 | 25% | 4,436,140 | $11,987,881 |

| HNR | Hannans Ltd | 0.01 | 25% | 955,228 | $21,796,838 |

| NC6 | Nanollose Limited | 0.069 | 23% | 200,145 | $8,337,637 |

| DRX | Diatreme Resources | 0.027 | 23% | 3,572,020 | $82,054,701 |

| MYE | Metarock Group Ltd | 0.14 | 22% | 2,726 | $34,613,990 |

| ZLD | Zelira Therapeutics | 1.12 | 22% | 7,304 | $10,439,383 |

| IGN | Ignite Ltd | 0.06 | 20% | 2,004,800 | $4,479,109 |

| FAU | First Au Ltd | 0.003 | 20% | 800,000 | $3,629,983 |

| GMN | Gold Mountain Ltd | 0.0095 | 19% | 4,598,134 | $18,152,629 |

| WYX | Western Yilgarn NL | 0.255 | 19% | 1,496,869 | $10,676,363 |

| CKA | Cokal Ltd | 0.13 | 18% | 684,937 | $118,684,388 |

| JGH | Jade Gas Holdings | 0.041 | 17% | 538,032 | $35,217,147 |

| HOR | Horseshoe Metals Ltd | 0.014 | 17% | 295,617 | $7,721,744 |

| OAU | Ora Gold Limited | 0.007 | 17% | 47,491,653 | $28,138,770 |

| RDS | Redstone Resources | 0.007 | 17% | 1,150,000 | $5,228,271 |

| YPB | YPB Group Ltd | 0.0035 | 17% | 250,124 | $2,230,384 |

| ODM | Odin Metals Limited | 0.022 | 16% | 291,700 | $14,233,320 |

Closing at almost +100%, Aussie semiconductor-friendly 4DS Memory (ASX:4DS) took the small-cap cake, ate it and then laughed at the other kids today in a massive performance critics called massive.

I actually wrote a pretty good story about it and you can read that here.

Also killing it softly was Raiden Resources (ASX:RDN) on news the digger’s found a ~3.5km long, 600m wide pegmatite field at its Andover South tenements with individual pegmatites outcropping up to 30m widths.

The Andover South project, if you’ve been paying attention to Stockhead for a while now, is right next door to where Azure Minerals (ASX:AZS) has been drilling out lithium for fun just lately. Wake-riding and nearology a-go-go.

As Stockhead’s gallant crypto-commods guru and man about town Robert Badman noted, Raiden has completed its latest fact-finding mission, confirming the go-ahead to acquire an 80% interest in five more lithium tenements – nearby the privately held Welcome Exploration project and adjoining the stupendously-hot-right-now Azure Minerals Andover lithium discovery in the Pilbara.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DXN | DXN Limited | 0.001 | -50% | 3,250,000 | $3,446,680 |

| EMU | EMU NL | 0.001 | -50% | 2,050,000 | $2,900,043 |

| CLE | Cyclone Metals | 0.001 | -33% | 124,843 | $15,396,757 |

| MRQ | Mrg Metals Limited | 0.002 | -33% | 195,000 | $6,557,756 |

| MXC | Mgc Pharmaceuticals | 0.002 | -33% | 3,144,438 | $11,677,079 |

| CVB | Curvebeam Ai Limited | 0.33 | -31% | 4,862,968 | $87,774,718 |

| EEL | Enrg Elements Ltd | 0.005 | -29% | 3,810,714 | $7,069,755 |

| VAL | Valor Resources Ltd | 0.003 | -25% | 24,799,245 | $15,313,339 |

| FTL | Firetail Resources | 0.135 | -23% | 915,155 | $16,843,750 |

| MRI | Myrewardsinternation | 0.012 | -20% | 4,520,689 | $5,831,275 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 1,096,125 | $14,368,295 |

| ENT | Enterprise Metals | 0.004 | -20% | 224 | $3,997,355 |

| SRY | Story-I Limited | 0.004 | -20% | 500,000 | $1,882,024 |

| WTC | Wisetech Global Ltd | 70.16 | -19% | 3,902,793 | $28,735,464,293 |

| ESK | Etherstack PLC | 0.3 | -19% | 329,967 | $48,750,091 |

| AKG | Academies Aus Grp | 0.265 | -18% | 160,123 | $43,099,702 |

| TOY | Toys R Us | 0.009 | -18% | 5,399,977 | $10,152,099 |

| JCS | Jcurve Solutions | 0.035 | -17% | 157,766 | $13,790,424 |

| AVM | Advance Metals Ltd | 0.005 | -17% | 212,388 | $3,531,352 |

| LRL | Labyrinth Resources | 0.005 | -17% | 1,104,218 | $7,125,262 |

| M4M | Macro Metals Limited | 0.0025 | -17% | 524,535 | $5,961,233 |

| MCT | Metalicity Limited | 0.0025 | -17% | 12,942,828 | $11,208,257 |

| PUA | Peak Minerals Ltd | 0.0025 | -17% | 304 | $3,124,130 |

| SGC | Sacgasco Ltd | 0.005 | -17% | 2,512,973 | $4,641,496 |

| SKN | Skin Elements Ltd | 0.005 | -17% | 1,311,694 | $3,416,917 |

Tough day at the office for fintech Pepper Money (ASX:PPM), which found a cliff almost 20% to jump off this morning – easily its worst day since listing.

Costs were again the culprit, but PPM also found itself hemmed in by a tighter housing market and stiffer competition for loans from legacy banks.

Mortgage originations fell by almost 60% on last year’s fearsome $1.7bn haul.

And although earnings missed expectations, PPM delivered richer asset finance originations, which jumped to $1.8bn.

LAST ORDERS

Avecho (ASX:AVE) is in a bit of a Trading Halt this arvo as Peak and CPS are try their hands at raising $4-6.5 via a placement. All up, $11 million is on the cuff to fund a ‘pivotal clinical trial’ evaluating the use of its cannabinoid (CBD) soft-gel capsule to treat insomnia.

My bet is it’ll work.

The Aussie biotech based down in Melbourne says there’s an entitlement offer (one new share for every one existing share held by eligible shareholders) at an issue price of $0.006 a pop.

The offer includes three free attaching new options for every two new shares subscribed for.

Proceeds from the raise will be used to fund a randomised, placebo-controlled phase three trial planned to test the effectiveness of the CBD gel which apparently comes in AVE’s proprietary capsule. It seems a shoe-in from here.

TRADING HALTS

Gold 50 (ASX:G50): Proposed capital raise

Venus Metals (ASX:VMC): Pending news regarding the Youanmi lithium project

Avecho (ASX:AVE): Proposed capital raise

Triton Minerals (ASX:TON): Regarding the grant of a further Mining Concession in Mozambique

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.