Closing Bell: ASX rides high as gold, silver, copper, and iron ore surge; Nuix jumps 25pc

ASX rides high on gold, silver, copper, and iron ore surge; Nuix jumps 25pc. Picture Getty

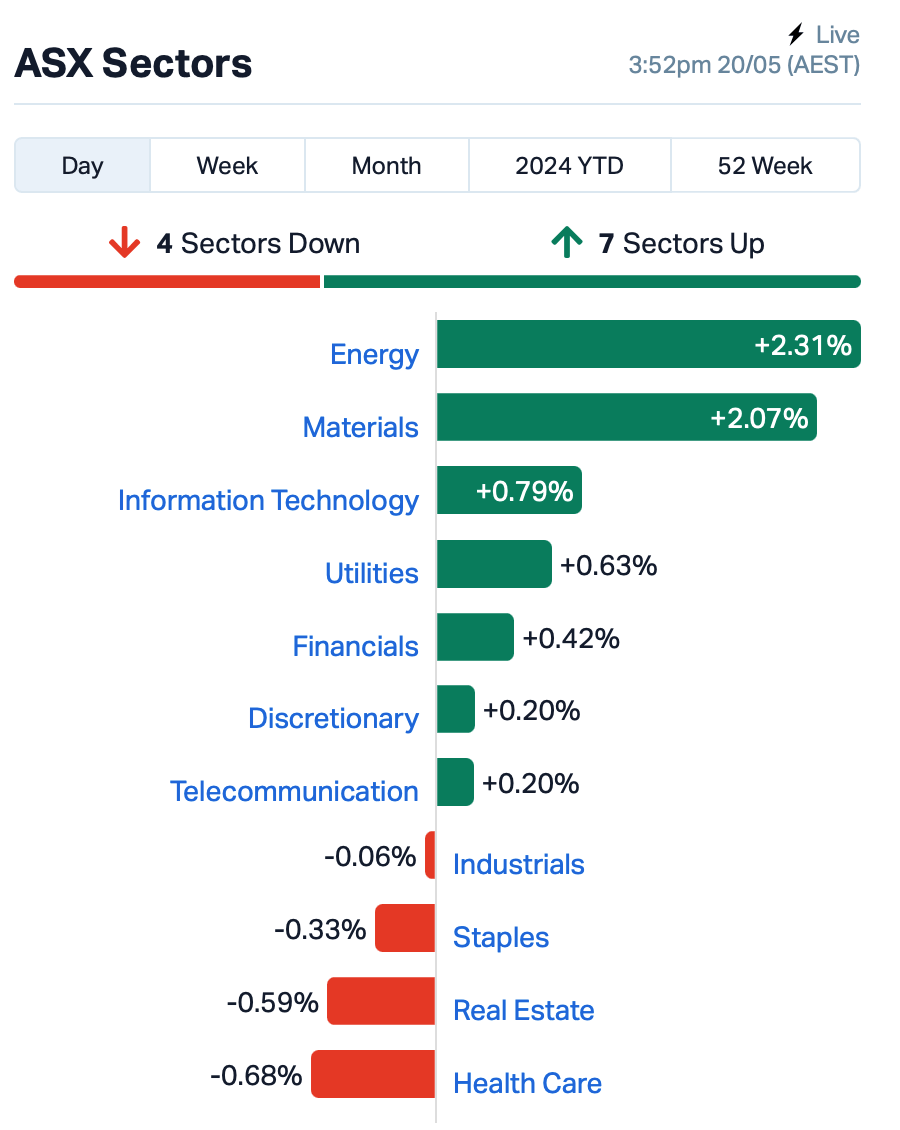

- ASX 200’s rally was driven mainly by gold/silver and iron ore stocks

- Gold prices hit record high as China continues to buy bullion

- Asian markets rose due to high commodity prices and new stimulus measures

The ASX 200 index rose by +0.7% on Monday, just points shy of its record high of 7,896 set on March 28.

The rally was mainly driven by gold/silver stocks, with large caps Evolution Mining (ASX:EVN), Newmont (ASX:NEM) and Northern Star (ASX:NST) all rising by between 3-5%.

Precious metals had a fantastic Friday, with silver hitting an 11-year high and gold nearing its all-time peak from April. Copper’s strong performance is boosting silver, too, since it’s used in industrial stuff like solar panels.

The gold price rally continued today, trading now around at $2,437/oz as the Chinese central bank continues to buy up bullion to reduce its reliance on US dollars.

Elsewhere, iron ore mining stocks also over-performed, with BHP (ASX:BHP) and Rio Tinto (ASX:RIO) adding +2% each on optimism that China will introduce more stimulus to support its weak property market.

Energy stocks climbed after a helicopter carrying Iran’s President Ebrahim Raisi, his foreign minister, and other officials crashed in the mountains of northwest Iran on Sunday. All onboard have been confirmed dead.

The nickel diggers were back in favour today, with global prices surging as the French authorities failed to quell spreading violence across New Caledonia.

Meanwhile, Star Casino’s operator, The Star Entertainment Group (ASX:SGR) surged by +20% after the company revealed that it has has caught the eye of overseas groups interested in acquiring it.

This includes a group of investors featuring Hard Rock Hotels & Resorts (Pacific), which The Star knows is a local partner of Florida-based Hard Rock.

China hopes

Across Asia today, stock markets also went up, driven by commodity-related companies as copper and gold prices hit highs.

The risk sentiment in Asia is at a heightened level after China rolled out a bunch of measures to help its struggling property market on Friday – like cutting minimum down payments for mortgages and lifting interest rate floors for first and second homes.

And this morning, the People’s Bank of China (PBoC) announced that it has kept its one-year loan prime rate (LPR), Beijing’s benchmark lending rate, steady.

Even though this was expected, it shows the bank is supporting Beijing’s weekend promises to tackle the ongoing property crisis.

Looking ahead tonight, there aren’t any big economic reports coming out in the US, but two Fed Reserve officials will be speaking.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RMX | Red Mount Min Ltd | 0.00 | 100% | 500,000 | $3,423,577 |

| SVY | Stavely Minerals Ltd | 0.05 | 58% | 5,481,143 | $12,604,023 |

| CT1 | Constellation Tech | 0.00 | 50% | 2,522,693 | $1,474,734 |

| AUC | Ausgold Limited | 0.04 | 35% | 34,319,910 | $59,699,671 |

| AHN | Athena Resources | 0.00 | 33% | 21,561,443 | $3,211,403 |

| CTN | Catalina Resources | 0.00 | 33% | 131,575 | $3,715,461 |

| LSR | Lodestar Minerals | 0.00 | 33% | 504,586 | $3,035,096 |

| COD | Coda Minerals Ltd | 0.17 | 31% | 1,199,958 | $21,397,889 |

| CBH | Coolabah Metals Limi | 0.06 | 30% | 509,342 | $4,527,292 |

| GNM | Great Northern | 0.01 | 30% | 200,724 | $1,546,291 |

| ERG | Eneco Refresh Ltd | 0.01 | 29% | 99,000 | $1,906,508 |

| EYE | Nova EYE Medical Ltd | 0.30 | 28% | 1,952,235 | $52,629,353 |

| CUS | Coppersearchlimited | 0.12 | 28% | 140,658 | $8,674,828 |

| NXL | Nuix Limited | 2.99 | 26% | 2,871,633 | $769,998,511 |

| ALR | Altairminerals | 0.01 | 25% | 12,243,105 | $14,352,977 |

| ESR | Estrella Res Ltd | 0.01 | 25% | 4,810,997 | $7,037,487 |

| IBG | Ironbark Zinc Ltd | 0.01 | 25% | 5,228,120 | $6,375,490 |

| MHC | Manhattan Corp Ltd | 0.00 | 25% | 3,039,445 | $5,873,960 |

| OAU | Ora Gold Limited | 0.01 | 25% | 1,061,571 | $23,224,004 |

| PNX | PNX Metals Limited | 0.01 | 25% | 9,489,068 | $23,880,859 |

| GDC | Global Data Grp | 2.90 | 24% | 1,318,107 | $180,045,624 |

| ASO | Aston Minerals Ltd | 0.02 | 23% | 6,961,309 | $16,835,835 |

| I88 | Infini Resources Ltd | 0.22 | 23% | 201,722 | $6,647,082 |

| LRV | Larvottoresources | 0.12 | 22% | 6,763,447 | $24,527,275 |

| KLI | Killiresources | 0.05 | 21% | 73,847 | $3,472,252 |

Coolabah Metals (ASX:CBH) is back on the ASX. Last week Coolabah announced the application for quotation of a whole bunch of new securities on the ASX, including over 5 million options and 22 million ordinary shares in a move which signals a potential expansion and growth phase for the diversified explorer. This follows the acquisition of the Mundi Mundi project in NSW, which boasts x2 historical fluorite mines. Fluoride-ion batteries also have the potential to displace lithium-ion batteries as they have a potential eight-fold increase in energy density relative to lithium-ion batteries, according to CBH.

Still with the diggers – and a re-interpretation of historical data at Stavely Minerals’ (ASX:SVY) Junction Prospect has reportedly identified an immediate shallow discovery opportunity.

A new set of eyes apparently has seen copper-gold-silver lode-style mineralisation intersected previously at Junction including “chalcopyrite, bornite and covellite and is very similar to the mineralisation at the Cayley Lode (9.3Mt at 1.23% Cu, 0.23g/t Au, 7g/t Ag).” That news dropped late last week, with SVY saying drilling will start as soon as a rig can be mobilised.

Stocks in the ever-troubled software firm Nuix (ASX:NXL) have genuinely surged on what looks genuinely good news. NXL has lifted full year guidance by more than a full third this morning after “general positive trading into the second half” that includes a significant multi-year win. Nuix says it’ll likely beat its previously stated strategic target of growing statutory revenue by around 10%. Nuix says it expects statutory EBITDA to come in more than 35% on last year. Underlying EBITDA, which excludes non-operational legal costs, is likely to be in the range of $63m-$68m, up more than 36%.

Gold explorer Nagambie Resources (ASX:NAG)’ share price hasn’t enjoyed the best year to date, but today it rose on some welcome news. The company has announced a maiden JORC resource for the shallow, high-graded gold mineralisation at its namesake gold and antimony mine in central Victoria. Some specifics. The company’s talking an Inferred Resource here, of 415,000 tonnes averaging 11.5g/t gold equivalent and comprising 3.6g/t gold plus 4.3% antimony. It also notes that the in-ground metal content of 153,000 ounces gold equivalent, comprises 47,800 ounces gold plus 17,800 tonnes antimony and the average 11.5g/t gold equivalent resource grade is 230% of the mineable cut-off grade of 5.0g/t AuEq.

Here’s another, bigger, goldie faring well today. As Reubs highlighted earlier in Top 10 at 10, Ausgold (ASX:AUC) has appointed veteran company maker John Dorwood as exec chairman to drive towards first production from the 3Moz Katanning project in WA’s South West. “Ausgold’s growth potential and dominant ownership in the southwest Yilgarn Craton reminds me of Fronteer Gold, where I was VP-corporate development, which opened up a new frontier with its 2Moz Long Canyon gold project in under-explored eastern Nevada,” he says.

Ironbark Zinc (ASX:IBG) was up today after the company revealed some key dates related to the financing and commencement of production at the project. The company notes that its licence for the Citronen project have been renewed with the Greenland government, and that plans are in place to essentially extend out financing until the end of the year for the project, with focus on a “much-revised asset investment plan in the second half of 2024″. Production, meanwhile, is earmarked to kick off by the end of 2026.

Bastion Minerals (ASX:BMO) said today that “widespread visible uranium” is present at Bastion’s Morrissey project in WA. Investors liked that news, and BMO is subsequently up a goodly amount (about 25% intraday) at the time of writing. This early-stage exploration minnow is also on the hunt for copper, gold, and various other green metals, and was in the news last week after providing updates on its hunt for high-grade rare earths and copper over in Sweden. Regarding the 15.58km2 Morrissey project in the Gascoyne region of WA, however, Bastion notes it’s completed initial mapping and sampling from which its determined the widespread uranium oxide sighting. The potential is there, says Bastion, for “economic surficial uranium, hosted at shallow depth in calcrete”.

Minerals exploration minnow, Athena Resources (ASX:AHN), was on the rise after releasing details from its Scoping Study for the company’s Bryo iron ore project and its FE1 resource. The study is suitably long and very detailed. We’ll give you the quick rundown of the exec summary of the project, based on the study. The project is deemed to be “economically robust”, with a Mineral Resource of 29.3Mt at 24.7% iron. A production target of 16.96 Mt at 26.1% iron from the MRE of 29.3Mt grading 24.7% iron has been noted, with a process rate of 2.4 Mtpa at an average grade of 26.1% Fe over an eight-year mine life “with significant potential to extend utilising additional resources”.

Memphasys (ASX:MEM) jumped on the back of news that its Felix System has outperformed a sperm preparation method comprising two of the most widely used processes, Density Gradient Centrifugation and Swim-Up (DGC+SU). The findings were from a recently completed Japanese clinical trial at the Reproduction Clinic Osaka, Japan.

The trial results showed that using the Felix System was superior to the DGC+SU methods for prepping sperm. Instead of going through the whole rigmarole of centrifugation and incubation like with the DGC+SU process, Felix is much simpler to use, with processing time taking a mere six to seven minutes.

Chimeric Therapeutics (ASX:CHM) climbed on news that it has received ethics approval for the initiation of its multi-site Phase 1/2 clinical trial of CHM CDH17 in patients with advanced gastrointestinal (GI) cancers. An ethics approval is a significant milestone in advancing the program toward study initiation under FDA regulations. CHM CDH17 is novel CAR T cell therapy that targets CDH17, a cancer target linked to some cancers like colorectal cancer, gastric cancer, and neuroendocrine tumours.

AML3D (ASX:AL3) said the US Navy’s submarine component manufacturing partner, Laser Welding Solutions, will lease additional ARCEMY metal 3D printing systems from AL3, with an option to purchase. The $0.7m order advances AML3D’s strategy to embed its ARCEMY technology in the wider US Navy supply chain.

Following a successful pilot phase, Hardi Aged Care is now moving forward with full site implementation at the Manly Vale facility. Hardi’s implementation of InteliCare Holdings (ASX:ICR)’s system in 42 rooms at Blacktown, Hardi’s second site, will now be brought forward to occur concurrently with the Manly Vale implementation. InteliCare and Hardi had entered into an agreement in February to deploy InteliCare into Hardi’s six residential aged care facilities, supporting almost 600 residents.

And… Gentrack (ASX:GTK) surged by over +20% today as the company reported its H1 update. For the first half, revenue was $102mm up 21% on pcp. EBITDA was $12.3m and tracking well against FY24 guidance. Growth is driven by recent and in-year new customers as well as upsells and upgrades for existing customers. The company’s growth in utilities meanwhile is a result of recent new customer wins alongside upselling new products to our existing customers.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VBS | Vectus Biosystems | 0.130 | -35% | 84,135 | $10,641,872 |

| ME1 | Melodiol Glb Health | 0.002 | -33% | 5,859,629 | $2,140,462 |

| EMS | Eastern Metals | 0.036 | -28% | 1,262,042 | $4,121,312 |

| BFC | Beston Global Ltd | 0.003 | -25% | 25,680 | $7,988,188 |

| NAE | New Age Exploration | 0.003 | -25% | 9,835,000 | $7,175,596 |

| TD1 | Tali Digital Limited | 0.002 | -25% | 65,419 | $6,590,311 |

| M4M | Macro Metals Limited | 0.028 | -22% | 43,016,788 | $116,354,403 |

| MHJ | Michael Hill Int | 0.495 | -20% | 1,364,785 | $238,466,857 |

| RGL | Riversgold | 0.008 | -20% | 7,885,440 | $9,676,615 |

| RML | Resolution Minerals | 0.002 | -20% | 250,693 | $4,025,055 |

| ROG | Red Sky Energy. | 0.004 | -20% | 232,253 | $27,111,136 |

| GLN | Galan Lithium Ltd | 0.235 | -19% | 9,076,561 | $119,782,759 |

| RSH | Respiri Limited | 0.030 | -19% | 360,016 | $39,215,150 |

| AON | Apollo Minerals Ltd | 0.022 | -19% | 1,658,649 | $18,801,258 |

| KGD | Kula Gold Limited | 0.009 | -18% | 1,342,332 | $5,351,081 |

| BEO | Beonic Ltd | 0.025 | -17% | 24,000 | $12,734,848 |

| WNR | Wingara Ag Ltd | 0.015 | -17% | 57,142 | $3,159,765 |

| LPD | Lepidico Ltd | 0.003 | -17% | 2,785,302 | $25,767,358 |

| MTL | Mantle Minerals Ltd | 0.003 | -17% | 875,328 | $18,592,338 |

| NRZ | Neurizer Ltd | 0.003 | -17% | 3,594,504 | $4,961,875 |

| PHL | Propell Holdings Ltd | 0.010 | -17% | 314,423 | $3,340,057 |

| IMI | Infinitymining | 0.046 | -16% | 41,739 | $6,531,436 |

| SGA | Sarytogan | 0.210 | -16% | 235,442 | $19,487,477 |

| JGH | Jade Gas Holdings | 0.043 | -16% | 120,000 | $80,418,543 |

| NTL | New Talisman Gold | 0.018 | -14% | 22,917 | $9,272,121 |

Jewellery retailer Michael Hill (ASX:MHJ) dropped almost -20% after reporting a challenging first half.

MHJ said first half sales rose by +10.2% in Australia vs the pcp, however this growth was driven mainly by the inclusion of the Bevilles brand in FY24. Sales performance in the core Michael Hill brand remained negative to last year.

The New Zealand segment meanwhile remains its most challenged segment, with deeper economic pressures significantly impacting consumer behaviour and discretionary spend over there. Sales in NZ dropped by -10.3% in H1 vs pcp.

IN CASE YOU MISSED IT

Brazilian Critical Minerals (ASX:BCM) has received firm commitments for a $2m placement to accelerate exploration aimed at improving the resource confidence of its giant >1 billion tonne Ema rare earths project.

Copper Search (ASX:CUS) is ready to begin a highly anticipated drill program next month looking for South Australia’s next major copper find after whittling down 40 geophysical anomalies to two priority targets.

CuFe (ASX:CUF) has raised $3m through a share placement to fast track exploration for copper, niobium and lithium at its Tennant Creek, West Arunta and North Dam projects in Australia.

Equinox Resources (ASX:EQN) has returned exceptionally high REE grades from surface clay and channel sample results at its Mata da Corda project and wrapped up a maiden drill campaign at the highly prospective Rio Negro prospect at Campo Grande.

Offshore and domestic institutional and sophisticated investors have oversubscribed for Galan Lithium’s (ASX:GLN) $14m placement to fund development of its flagship Hombre Muerto West (HMW) lithium-brine project in Argentina.

Godolphin Resources (ASX:GRL) has started Phase 3 metallurgical testing that includes production of a mixed rare earth carbonate product using samples from its Narraburra rare earths project in NSW.

iTech Minerals’ (ASX:ITM) metallurgical testing has achieved high-purity fine flake graphite suitable for purified spherical graphite production, meeting the requirements of a reasonable likelihood of economic extraction.

Western Yilgarn (ASX:WYX) has cranked up the potential prospectivity of its Ida Holmes Junction project in WA following a Phase 4 auger drill program, which extended existing targets and identified two new ones.

White Cliff Minerals (ASX:WCN) is all set for the upcoming field program at its Great Bear Lake project in Canada’s Northwest Territories after allocating priority targets.

Anax Metals (ASX:ANX) has noted that assays from an infill auger geochemistry program at its Mt Short joint venture tenement operated by 70% owner Woomera Mining (ASX:WML) have defined two lithium anomalies with grades of up to 296ppm lithium. The work, which followed up on priority targets defined by auger programs completed on the tenement earlier this year. Results from this program will be used to plan aircore drilling that will be conducted later this year after the harvest period.

Sampling of brine sourced from the thick Mississippian Units at Anson Resources’ (ASX:ASN) recently completed Bosydaba#1 well at its Green River project in southeastern Utah have returned grades of up to 139 parts per million lithium and 4604ppm bromine. This similar to the Mississippian grades in the Paradox lithium project resource and confirms that the massive, supersaturated brine aquifer at Green River is lithium and bromine rich. Adding interest, the Mississippian Units at Green River are more than 790ft thick and have lower salt concentrations, which will be beneficial to the proposed lithium extraction process.

Miramar Resources (ASX:M2R) could expand its strategic Eastern Goldfields tenement portfolio after securing an exclusive option to acquire an exploration licence application about 90km east of Kalgoorlie. EL25/654 (Application) abuts Global Lithium Resources’ (ASX:GL1) Manna lithium project and Kairos Minerals’ (ASX:KAI) recent rare earths discovery at the Black Cat prospect. It is also adjacent to the company’s existing Randalls and overlies the confluence of three major regional structures, the Avoca, Jubilee and Yilgangie Faults. M2R believes the new licence application has the potential to host gold, lithium and REE mineralisation, but has been underexplored, with minimal previous drilling.

Raiden Resources (ASX:RDN) has received the final heritage report for its Andover North project in WA’s Pilbara region that affirms that key prospects are clear of heritage concerns. This paves the way for the company to finalise drilling programs across the project with three Programs of Work (PoW) already submitted for tenements E47/4061, E47/3849 and E47/4063. Drilling will begin once the PoWs are approved and the company will submit PoWs for the remaining tenements once the tenements are granted.

Venture Minerals (ASX:VMS) has appointed Philippa Leggat has its new managing director following the resignation of Andrew Radonjic. Leggat has over 20 years of experience in advancing domestic and international mineral projects along the value chain and joined the company as a non-executive director in 2023 to lead the board renewal process. She has served as an executive director and advisor to ASX listed companies engaged in capital raising, exploration, development and project evaluation, giving her a track record in negotiating value accretive project acquisitions, identifying and communicating an organisation’s competitive advantages to raise its profile.

Victory Metals (ASX:VTM) has raised $2.5m through an oversubscribed placement of shares priced at 22c each – a 12.3% discount to the 15-day volume weighted average price.

Proceeds from the placement will be used to advance its North Stanmore heavy rare earths project near Cue, Western Australia.

This includes completion of an updated resource estimate, further project study work and metallurgical testing.

TRADING HALTS

N/A

At Stockhead, we tell it like it is. While Anax Metals, Anson Resources, Miramar Resources, Raiden Resources, Venture Minerals, Victory Metals, Brazilian Rare Earths, Copper Search, CuFe, Equinox Resources, Galan Lithium, iTech Minerals, Western Yilgarn and White Cliff Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.