Closing Bell: ASX phones in more gains as prices plunge in Beijing and records tumble in New York

Via Getty

- ASX200 trims gains to end circa 0.3pc higher

- Sectors in the money include Utilities and IT

- Small cap winners led by Alliance Nickel and Sarytogan Graphite

A fresh batch of fat Q4 profit reports in the US overnight was apparently all the Australian sharemarket needed to jump out of bed and get all up in the face of Thursday.

At 4pm on February 8, the S&P/ASX200 was up 22.5 points or 0.3% to 7,638

The Aussie benchmark lifted for a second straight post-RBA session with punters again checking the index’s high watermark during the day for any signs of a fresh record high.

That was not forthcoming, although the local gains tracked the record setting US benchmark and not the progress of deflating Chinese consumer prices, which is a good thing since the latter just came in at near 14-year lows.

Down by an annual 0.8% over January, the Chinese CPI totally outstripped market forecasts of a 0.5% slide driven by collapsing food prices.

The index has retreated for four straight months now – the longest losing streak since October 2009, while next door, Chinese producer prices fell for a 16th straight month.

Naturally, any bad news in China is terrific news if you’re a fan of iron ore companies and the stuff they used to sell in such tremendous amounts there.

The signs of economic weakness out of Beijing – of which there are many – simply reinforce the prevailing view that China must yield to the temptation and just start stimulating everything. The majors were all higher, but not dancing on your grave high.

Meanwhile, there’s also been a whole heap of local earnings reports, winners include Industrials like Transurban Group (ASX:TCL) – hella good net profits, which jumped to $230mn.

There’s excitement across the Utilities sector, too, after the normally futile utile, AGL Energy (ASX:AGL), posted a stat profit of $576mn for the half year to December, higher gas prices helping supercharge HY net profit and presaging a handy bump in the interim divvy.

Other earnings releases today: REA Group (ASX:REA) , Charter Hall (ASX:CHC) , Mirvac (ASX:MGR) , and Unibail-Rodamco-Westfield (ASX:URW).

The other focus clapper puller on Thursday to my mind has come direct from lithium central where all your favourite names enjoyed a rare second straight day of blind generosity, proving that sentiment is more than just a feeling.

Liontown Resources (ASX:LTR) climbed over 5%, Vulcan Energy (ASX:VUL) added 4%. IGO (ASX:IGO) found 3%.

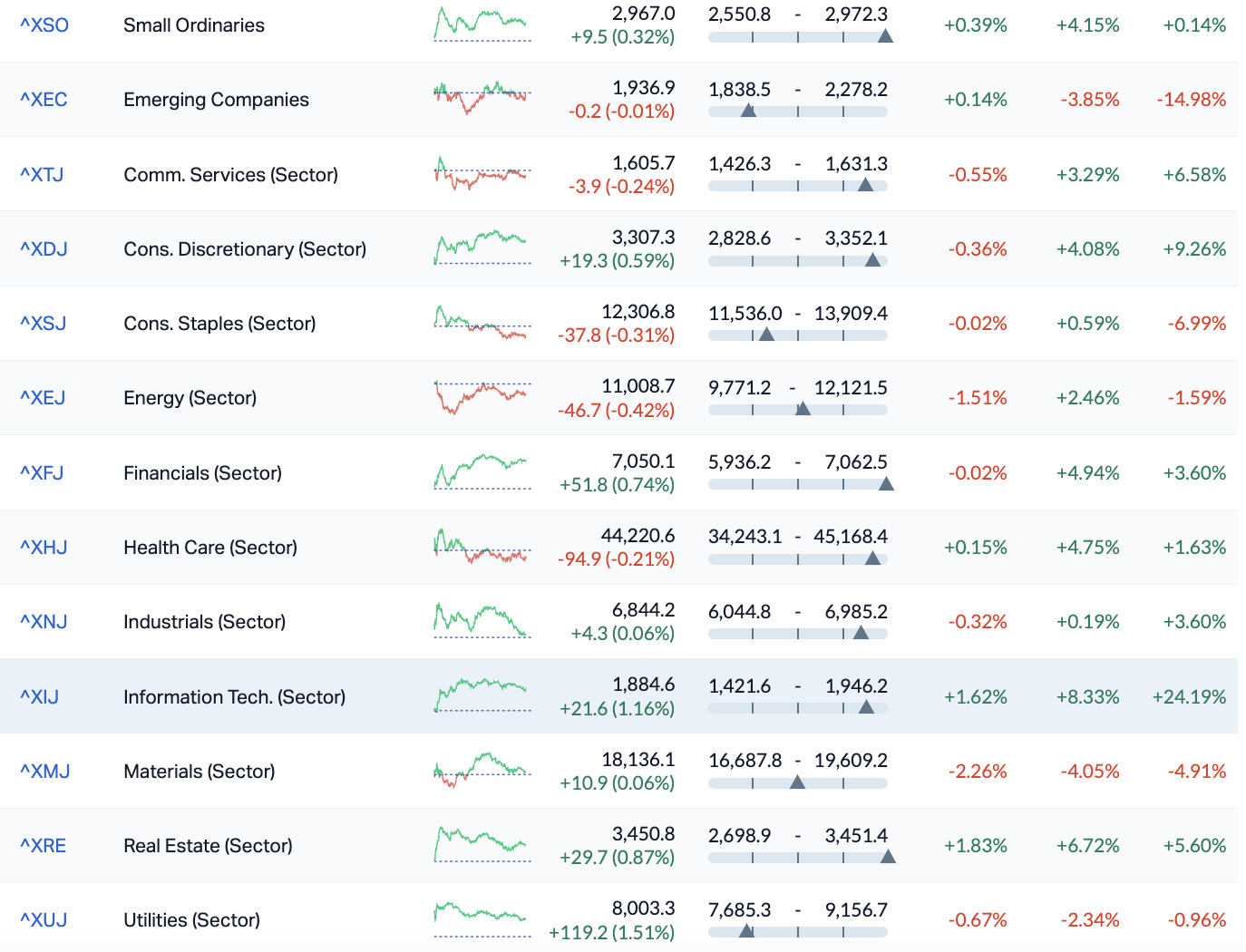

ASX Sectors on Thursday

![]()

Meanwhile, in the States…

Yup. It was yet another record result for the S&P 500 which finished a basis point away from breaching the mythical 5,000 mark.

The benchmark rose 0.8% while the Nasdaq Composite ended a moment away from its own gargantuan apex of 16,058, clocked back in the good ol’ pandemic days

An exciting night of corporoate earnings drove traffic stateside, Disney added Wall Street earnings to the list of expectations it’s beaten with a stick, lifted by record results at its theme parks and continued cost-cutting efforts. The home of Star Wars climbed 7% in after hours trade.

Same holds for the wonderful sounding Chipotle Mexican Grill, the restaurant chain surging added more than 7% after it beat earnings estimates.

On the flipside, the home of big cars closed about 6% lower after choosing to scale back its commitment to its dollar-sucking, brand-breaking, loss-making Electrical Vehicle segment.

The icing on an exciting cake was the spectacular and unforeseen 35% collapse in the share price of social media platform Snap.

Investors just snapped, they’ll be saying.

US Futures are mixed in Sydney (at 3.30pm on Thursday).

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| DXNDA | DXN Limited | 0.025 | 67% | 55,161 | $2,773,340 |

| GRE | Greentechmetals | 0.34 | 62% | 752,617 | $17,656,795 |

| QXR | Qx Resources Limited | 0.027 | 50% | 19,445,735 | $19,981,401 |

| RMX | Red Mount Min Ltd | 0.003 | 50% | 435,025 | $5,347,152 |

| AXN | Alliance Nickel Ltd | 0.041 | 37% | 9,068,088 | $21,775,188 |

| EM2R | Eagle Mountain - Rights 23-Feb-24 | 0.004 | 33% | 42,502 | $228,725 |

| PNX | PNX Metals Limited | 0.006 | 33% | 55,865,242 | $24,212,811 |

| EFE | Eastern Resources | 0.009 | 29% | 6,425,972 | $8,693,625 |

| MM1 | Midasmineralsltd | 0.11 | 28% | 399,173 | $7,460,263 |

| AUN | Aurumin | 0.042 | 27% | 1,227,367 | $11,828,622 |

| SGA | Sarytogan | 0.21 | 27% | 890,351 | $12,696,735 |

| MCT | Metalicity Limited | 0.0025 | 25% | 1,288,500 | $8,970,108 |

| PUR | Pursuit Minerals | 0.005 | 25% | 4,238,143 | $11,775,886 |

| RLC | Reedy Lagoon Corp. | 0.005 | 25% | 1,020,260 | $2,478,163 |

| TMX | Terrain Minerals | 0.005 | 25% | 414,718 | $5,726,683 |

| CYP | Cynata Therapeutics | 0.18 | 24% | 791,096 | $26,046,609 |

| ARN | Aldoro Resources | 0.115 | 24% | 375,586 | $12,520,008 |

| WEC | White Energy Company | 0.049 | 23% | 129,227 | $4,529,413 |

| WC1 | Westcobarmetals | 0.052 | 21% | 299,992 | $5,194,414 |

| TKM | Trek Metals Ltd | 0.036 | 20% | 673,832 | $15,392,306 |

| 3DA | Amaero International | 0.3 | 20% | 1,177,513 | $119,836,598 |

| SYR | Syrah Resources | 0.54 | 20% | 10,898,694 | $304,153,979 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 201,046 | $3,142,791 |

| GCM | Green Critical Min | 0.006 | 20% | 599,989 | $5,682,925 |

| GTR | Gti Energy Ltd | 0.012 | 20% | 5,682,634 | $20,499,471 |

Alliance Nickel (ASX:AXN) is leading the charge this morning, on news that it’s signed a non-binding term sheet with Samsung – yes, that Samsung – for the future offtake of battery grade nickel and cobalt sulphate products from the NiWest Nickel-Cobalt Project in Western Australia.

Sarytogan Graphite (ASX:SGA) is making headway today after announcing that the first batch of coincell batteries has been produced using the company’s Uncoated Spherical Purified Graphite, which the company says have been outperforming many synthetic graphite anodes that are currently used in electric vehicles.

Aldoro Resources (ASX:ARN) rose more than 34% before lunch, after telling the market it had traced intermittent intrusive dyke bearing pyrochlore (a niobium containing mineral) over 200m and at widths of up to 1m, out along the southwest margin of the Kameelburg carbonatite.

Junior goldie Kula Gold (ASX:KGD) was climbing as well, up 33% in early trade on news that it had pinned down two new gold prospects at the Marvel Loch project near Southern Cross, one of WA’s better gold fields – namely, the new Stingray gold and lithium prospect and the Boomerang gold prospect, the latter identified in drilling for kaolin three years ago in a hit of 1m at 2.6g/t from 54m.

Lanthanein Resources (ASX:LNR) was moving higher early door, after saying that an extensive soil sampling programme across its entire 77km2 granted tenement on the Forrestania Greenstone Belt has kicked off, directly adjacent to Covalent Lithium’s (SQM & Wesfarmers) Earl Grey Mine, 189Mt @1.53% Li2O.

And Chimeric Therapeutics (ASX:CHM) made early progress after it announced that the first patient in the ADVENT-AML Phase 1B clinical trial in Acute Myeloid Leukemia (AML) has received treatment with CHM 0201 in combination with Azacitidine and Venetoclax.

There was a sudden middle-of-the-day burst of interest in Cynata Therapeutics (ASX:CYP) , despite no announcements on the list, nor any headline news – as did Greentech Metals.

QX Resources (ASX:QXR) enjoyed a sizeable jump mid-day as well, after it reported that a second diamond hole has intersected multiple brine reservoirs at its 102km2 Liberty project. The results revealed that a single 443.5m drilling in the hole intersected five brine aquifers at 90m, 130m, 210m, 245m and 295m that have widths varying from just a few metres to 10m.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| DAF | Discovery Alaska Ltd | 0.019 | -30% | 157,135 | $6,324,337 |

| BMG | BMG Resources Ltd | 0.012 | -29% | 12,010,518 | $10,774,552 |

| AMT | Allegra Medical | 0.022 | -27% | 4,228 | $3,588,331 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 500,000 | $15,569,766 |

| HT8 | Harris Technology Gl | 0.014 | -22% | 61,588 | $5,384,439 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 12,500 | $3,498,278 |

| ROG | Red Sky Energy. | 0.004 | -20% | 3,535,222 | $26,511,136 |

| SCL | Schrole Group Ltd | 0.15 | -19% | 7,294 | $6,651,684 |

| CAG | Caperangeltd | 0.13 | -19% | 7,270 | $15,185,328 |

| MPA | Mad Paws | 0.098 | -18% | 540,154 | $43,273,187 |

| XF1 | Xref Limited | 0.115 | -18% | 340,728 | $26,064,680 |

| WNR | Wingara Ag Ltd | 0.019 | -17% | 110,311 | $4,037,478 |

| M24 | Mamba Exploration | 0.044 | -17% | 1,023,677 | $3,396,361 |

| IMR | Imricor Med Sys | 0.455 | -17% | 205,482 | $92,060,383 |

| NYR | Nyrada Inc. | 0.021 | -16% | 202,250 | $3,900,218 |

| AJX | Alexium Int Group | 0.011 | -15% | 76,065 | $8,595,740 |

| SCT | Scout Security Ltd | 0.011 | -15% | 412,604 | $3,021,556 |

| SHN | Sunshine Metals Ltd | 0.011 | -15% | 4,398,504 | $15,912,110 |

| ECG | Ecargo Hldg | 0.04 | -15% | 123 | $28,916,750 |

| NKL | Nickelxltd | 0.041 | -15% | 115,354 | $4,215,128 |

| SCN | Scorpion Minerals | 0.018 | -14% | 584,677 | $8,598,580 |

| BCT | Bluechiip Limited | 0.006 | -14% | 1,961,766 | $5,567,617 |

| IS3 | I Synergy Group Ltd | 0.006 | -14% | 485,521 | $2,128,563 |

| LRL | Labyrinth Resources | 0.006 | -14% | 1,036,002 | $8,312,806 |

| SNS | Sensen Networks Ltd | 0.025 | -14% | 132,933 | $22,395,876 |

In Case You Missed It – PM Edition

Frontier Energy (ASX:FHE) has taken a key step forward in the Stage 1 development of its Waroona renewable energy project, consisting of a a 120MWdc (megawatts of direct current) solar facility with an integrated four-hour 80MW battery, with the appointment of Leeuwin Capital Partners as debt advisors.

PNX Metals (ASX:PNX) has uncovered high-grade uranium, such as 15m @ 1.35% U3O8 from 210m, which included a much higher-grade interval of 1.5m @ 10.2% U3O8 from 215m, during a review of historical, previously unreported drilling results, demonstrating significant potential to extend the high-grade mineralisation at its Thunderball deposit in the Northern Territory.

Geochemical sampling and geophysical interpretation has identified two new promising gold prospects at Kula Gold’s (ASX:KGD) Marvel Loch project near Southern Cross, WA, located north of the historical >600,000oz Nevoria gold mine and east of Minjar Gold’s 3Moz Marvel Loch gold mine.

Radiometric data across Miramar Resources’ (ASX:M2R) Bangemall project in WA’s Gascoyne region has picked out multiple uranium anomalies stretching over +100km of strike, and across several of M2R’s tenements.

QX Resources (ASX:QXR) has reported that a second diamond hole has intersected multiple brine reservoirs at its 102km2 Liberty project, after the 443.5m drilling in the hole intersected five brine aquifers at 90m, 130m, 210m, 245m and 295m that have widths varying from just a few metres to 10m.

Lanthanein Resources (ASX:LNR) has kicked off a soil sampling program across the entire 77km2 granted tenements at the Lady Grey project to provide greater coverage on granite contact areas adjacent to the world-class Early Grey lithium mine.

Torque Metals (ASX:TOR) is getting set to deliver a mineral resource estimate, following the definition of an exploration target for its New Dawn lithium project across 40% of two development-ready mining licences.

TRADING HALTS

BluGlass (ASX:BLG) – pending the release of an announcement in relation to a capital raising to fund ongoing working capital requirements.

The Calmer Co International (ASX:CCO) – pending an announcement to the market in connection with a capital raise.

DomaCom (ASX:DCL) – pending the release of an announcement to market in relation to the funding referred to in the ASX Announcements on 31 January 2024 and 5 February 2024.

Blue Star Helium (ASX:BNL) – pending the release of an announcement regarding an update on drilling.

NeuRizer (ASX:NRZ) – pending release to the market regarding the appointment of a new director.

Credit Intelligence (ASX:CI1) – pending an announcement in relation to receipt of a letter from the Hong Kong Official Receiver’s Office.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.