Closing Bell: ASX hits top form on China hopes; copper hits five-month high

ASX hits the mark today. Picture via Getty Images

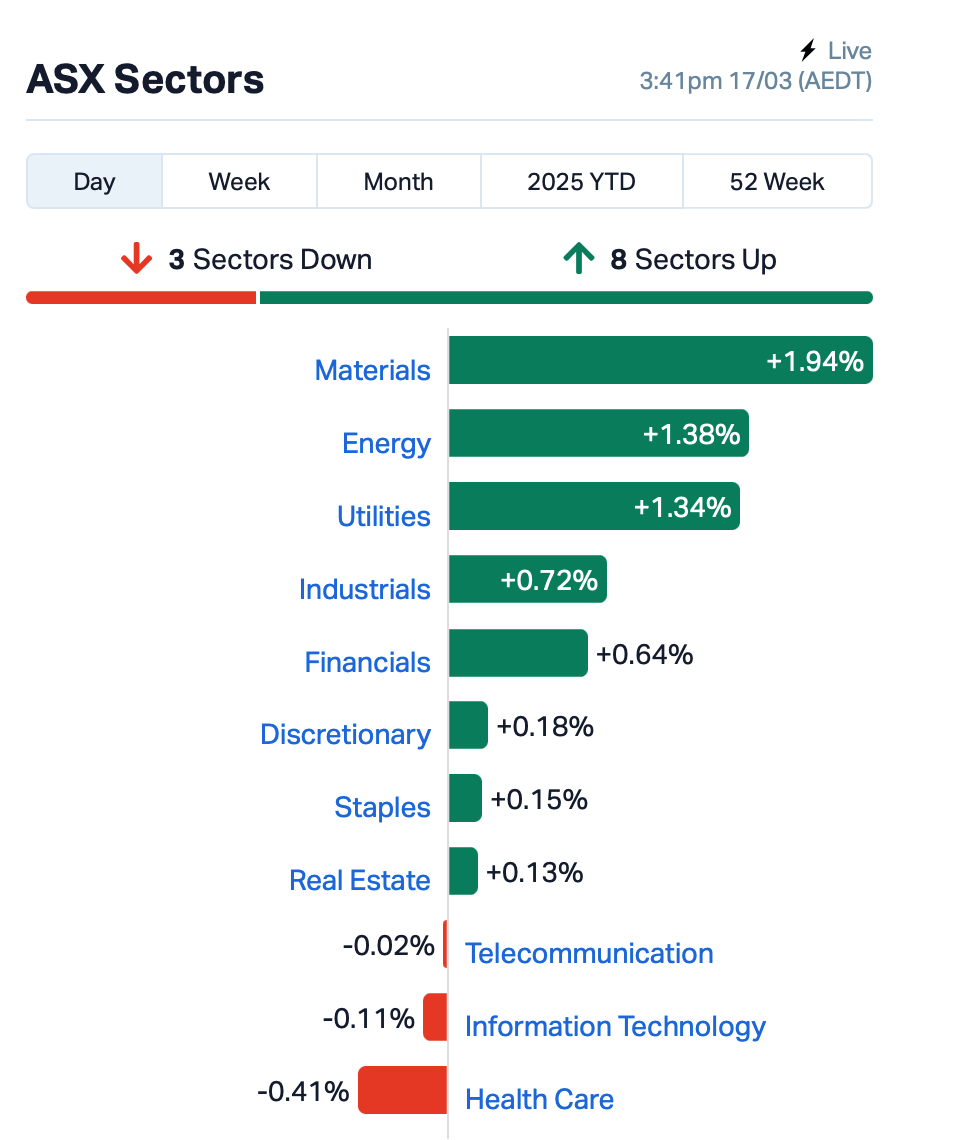

- ASX rises on global optimism and China boost

- Energy and miners shine, Mineral Resources jumps after upgrade

- Copper hits five-month high, gold edges up

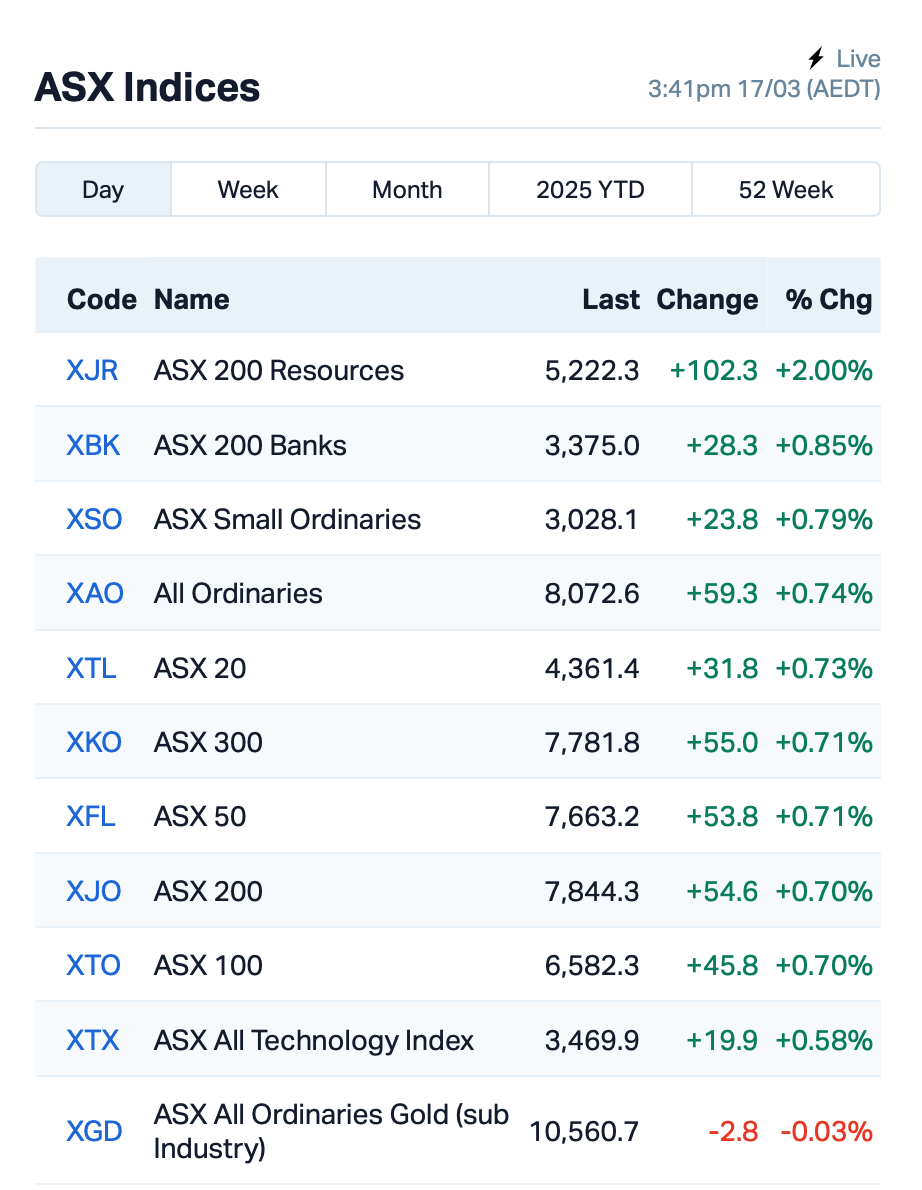

The ASX kicked off the week with a 0.75% bump as global sentiment surged.

Today’s rebound was mainly buoyed by China’s promise to ramp up measures to boost consumption, alongside a positive mood on Wall Street after the US avoided a government shutdown.

Wall Street had a decent rally on Friday, but its main index, the S&P 500, still ended up in correction territory, down 10% from its recent peak.

US Treasury Secretary Scott Bessent, ex-hedge fund guru, said he isn’t sweating the recent market slump that’s knocked trillions off equities.

“I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal. I‘m not worried about the markets,” Bessent told NBC on Sunday.

On the ASX, energy stocks led the charge today, with miners like Rio Tinto (ASX:RIO), Fortescue (ASX:FMG) and BHP (ASX:BHP) all making strong gains.

This is despite a slight dip in iron ore prices today as new data from China showed its property market is still struggling after a couple years of stagnation.

Mineral Resources (ASX:MIN) shot up 11% after UBS upgraded the stock to “buy”, while Woodside Energy Group (ASX:WDS) also rose on the back of rising oil prices and news of a long-term LNG supply deal with China.

Elsewhere in commodities, copper prices rose after China’s fresh stimulus news, hitting a five-month high and pushing ASX copper-related stocks higher.

On the gold front, bullion prices also edged higher hovering near their record high, driven by persistent concerns about Trump’s trade policies.

So with all that happened, here’s where things stood heading into today’s close:

Stealing the headline today was Spartan Resources (ASX:SPR), which surged 9% after confirming its merger with Ramelius Resources (ASX:RMS).

Spartan believes merging with Ramelius makes perfect sense because it will create a top-tier Aussie gold producer with plenty of exploration upside.

The combined group will have 12.1 million ounces of gold in resources and 2.6 million ounces in reserves, with plans to boost production to over 500,000 ounces by FY30.

Watch later: Break it Down: Spartan and Ramelius to tie the knot on $2.4b deal

And finally… it will be a packed week ahead with a bunch of central bank policy meetings, including the US Federal Reserve.

Most are expecting it to leave rates unchanged when the meeting wraps up on Wednesday.

“For the Fed, we expect the median dot to show just one cut this year and two next,” said Jonathan Millar at Barclays.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap 88E 88 Energy Ltd 0.00 100% 6,575,686 $28,933,812 BEZ Besragoldinc 0.07 84% 5,750,515 $15,373,091 TOU Tlou Energy Ltd 0.01 75% 2,798,034 $10,388,675 SMP Smartpay Holdings 0.80 51% 985,816 $128,230,036 ALR Altairminerals 0.00 50% 4,265,227 $8,593,488 DNA Donaco International 0.04 40% 28,952,395 $37,061,681 ALM Alma Metals Ltd 0.00 33% 443,875 $4,759,036 ASP Aspermont Limited 0.00 33% 700,000 $7,410,035 ERL Empire Resources 0.00 33% 228,777 $4,451,740 PRM Prominence Energy 0.00 33% 1,000,000 $1,167,529 SCP Scalare Partners 0.22 33% 134,940 $5,755,662 ICE Icetana Limited 0.02 29% 183,223 $6,133,997 PUA Peak Minerals Ltd 0.01 29% 2,894,652 $17,864,772 BUX Buxton Resources Ltd 0.03 28% 1,352,492 $5,557,062 THR Thor Energy PLC 0.02 25% 3,033,047 $8,505,478 DTM Dart Mining NL 0.01 25% 3,810,292 $2,751,056 HLX Helix Resources 0.00 25% 2,164,891 $6,728,387 OLY Olympio Metals Ltd 0.05 23% 391,392 $3,826,964 IBX Imagion Biosys Ltd 0.02 21% 978,719 $2,818,780 SCN Scorpion Minerals 0.02 21% 404,546 $9,484,918 NTI Neurotech Intl 0.04 21% 10,882,479 $30,221,536 HOR Horseshoe Metals Ltd 0.02 20% 458,946 $10,050,100

Payments fintech SmartPay (ASX:SMP) said it has received two non-binding takeover offers, one from Tyro Payments and another from an international company. Tyro’s offer is to buy all of Smartpay’s shares for NZ$1.00 each, with most of the payment in Tyro shares and some in cash. Both proposals are still early stages and depend on due diligence and final agreements. Smartpay’s board is letting both parties do some due diligence to figure out which offer’s best, but there’s no guarantee a deal will go ahead.

Altair Minerals (ASX:ALR) has made an exciting discovery at Irka Sur, part of its Venatica West project. The company found high-grade copper across a massive 700m strike, with samples showing copper grades up to 2.9%, plus significant gold and silver. This confirms that the area has huge potential, Altair said, and it’s all open for further exploration. The 16m outcrop of exposed porphyry averaged 1.8% copper, with the mineralisation continuing below surface.

Gaming and hospitality stock Donaco International (ASX:DNA) has entered into a deal with On Nut Road Limited (ONR) for a takeover where ONR’s offering $0.045 per share in cash. ONR’s been an investor since 2019 and already holds nearly 13% of Donaco. This offer is a 50% premium on the recent share price. Donaco’s board said it’s all for it and recommends shareholders vote for the deal, but it still depends on an independent expert’s opinion and approval from shareholders and the court.

And Buxton Resources (ASX:BUX) has brought on Gervaise Heddle as non-executive chair. Heddle has a solid track record, having led Greatland Gold through the discovery of the Havieron gold-copper deposit in WA, which saw its share price shoot up over 10,000%. He’ll be bringing his expertise in leading exploration companies and engaging investors to Buxton, which is focused on developing its own early-stage exploration projects like Centurion and Madman in WA.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RFA | Rare Foods Australia | 0.01 | -33% | 361,739 | $5,711,648 |

| AXP | AXP Energy Ltd | 0.00 | -33% | 178,620 | $9,862,021 |

| AYM | Australia United Min | 0.00 | -33% | 187,325 | $5,527,732 |

| CR9 | Corellares | 0.00 | -25% | 2,058,706 | $1,870,974 |

| CTN | Catalina Resources | 0.00 | -25% | 61,227 | $5,265,048 |

| RLT | Renergen Limited | 0.57 | -25% | 58,012 | $22,744,482 |

| HIQ | Hitiq Limited | 0.03 | -21% | 231,414 | $12,463,123 |

| 1AD | Adalta Limited | 0.01 | -20% | 2,414,677 | $6,321,116 |

| AAU | Antilles Gold Ltd | 0.00 | -20% | 15,000,439 | $10,601,880 |

| BYH | Bryah Resources Ltd | 0.00 | -20% | 952,956 | $3,134,004 |

| CZN | Corazon Ltd | 0.00 | -20% | 2,184 | $2,961,431 |

| ARC | ARC Funds Limited | 0.10 | -17% | 18,403 | $5,417,734 |

| ERA | Energy Resources | 0.00 | -17% | 1,119,369 | $1,216,188,722 |

| T3D | 333D Limited | 0.01 | -17% | 411,259 | $1,057,101 |

| VFX | Visionflex Group Ltd | 0.00 | -17% | 330,227 | $10,103,581 |

| ELT | Elementos Limited | 0.05 | -15% | 302,006 | $14,404,043 |

| EM2 | Eagle Mountain | 0.01 | -14% | 150,000 | $7,945,261 |

| MEL | Metgasco Ltd | 0.00 | -14% | 10,210,538 | $5,101,554 |

| SPQ | Superior Resources | 0.01 | -14% | 2,778,999 | $15,189,047 |

| STM | Sunstone Metals Ltd | 0.01 | -14% | 688,486 | $36,050,025 |

| PFT | Pure Foods Tas Ltd | 0.03 | -14% | 11,000 | $3,927,343 |

| AUG | Augustus Minerals | 0.03 | -13% | 40,403 | $4,529,274 |

| VMT | Vmoto Limited | 0.08 | -13% | 772,710 | $35,777,858 |

| ENV | Enova Mining Limited | 0.01 | -13% | 8,260,635 | $9,845,149 |

IN CASE YOU MISSED IT

Perpetual Resources (ASX:PEC) is expanding the exploration program at its Itinga tin project in Brazil after recent sampling confirmed high-grade tin mineralisation, with results exceeding 20% tin. The program will include geological mapping, trenching, and soil sampling to identify priority drill targets amid rising global tin prices.

US midwest natural hydrogen explorer Top End Energy (ASX:TEE) has kicked off an independent assessment of prospective resources at its Serpentine project in Kansas. The company has engaged Teof Rodrigues & Associates to lead the evaluation, which will help guide well site selection and communicate the project’s resource potential to stakeholders.

Bubalus Resources (ASX:BUS) has appointed a drilling contractor for its upcoming maiden program at the Crosbie South gold project in Victoria, with drilling set to begin by late April. The 1000-metre campaign will target high-grade rock chip trends (up to 19.1 g/t) and geophysical anomalies, with results expected in the coming months.

Mithril Silver and Gold (ASX:MTH) has struck several high-grade gold and silver veins in pursuit of a resource update at its Copalquin project in Mexico. Best hits include 3.35m at 26.5g/t gold and 1,046g/t silver from 215.15m, and 5m at 5.08g/t gold and 22.1g/t silver from 108.06m.

South Australian copper miner Hillgrove Resources (ASX:HGO) is kicking off development of its Nugent deposit after appointing key contractors. The appointments come off the back of a $16 million capital raising. Works are to begin early April this year with first ore expected in the December quarter.

It’s more gold on the cards for explorer Koonenberry Gold (ASX:KNB) after intersecting visible goods in the inaugural diamond drilling program at its Enmore project in New South Wales. The visible gold was found in the third and fourth drill holes, occurring in multiple zones from depths of 146m onwards.

Medallion Metals (ASX:MM8) is the belle of the ball as it fields multiple offtake and funding proposals for its Ravensthorpe-Forrestania development in Western Australia. MM8 plans to produce a copper-gold concentrate at the project, with some inquests amounting to up to $50 million.

Battery developer Altech Batteries (ASX:ATC) passed a significant milestone today after receiving environmental and construction approval for its 12 MWh CERENERGY GridPack production facility in Saxony, Germany. CERENERGY batteries use a sodium chloride solid state formula, an alternative to the typical lithium-ion battery.

Prospect Resources (ASX:PSC) has received two large-scale mining licences for its flagship Mumbezhi copper project in northwest Zambia. This licence spans for 25 years and is renewable for successive 25-year periods.

Many Peaks Minerals (ASX:MPK) has uncovered a previously undetected high-grade gold shoot at its Ferké gold project in Côte d’Ivoire following diamond drilling. Best results show 11m at 2.16g/t gold from 53m and 45m at 8.58g/t from 104m, including 25m at 14.8g/t from 116m and 7m at 1.58 g/t from 153m.

The drill bit is underway at New Age Exploration’s (ASX:NAE) Wagyu gold project in the Pilbara. The company will burrow 3000m of reverse circulation drilling with contractor Strike Drilling taking half of its payment in equity. This program follows on from high-grade intercepts measuring up to 15.6g/t gold from air core drilling.

North American explorer Sierra Nevada Gold (ASX:SNX) is homing in on where to drill next after completing a gravity survey at its Warrior project in Nevada. The company says it has identified five high-priority targets and confirmed two epithermal systems via geochemical and spectral studies.

At Stockhead, we tell it like it is. While Perpetual Resources, Sierra Nevada Gold, New Age Exploration, Many Peaks Minerals, Prospect Resources, Altech Batteries, Medallion Metals, Koonenberry Gold, Hillgrove Resources, Mithril silver and Gold, Top End Energy and Bubalus Resources are all Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.