Closing Bell: ASX fends off losses in resources and tech with defensive rotation

"Just a flesh wound"? ASX traders have taken cover behind the usual suspects of telecoms, utilities and the major banks as the mood turns bearish. Pic: Getty Images

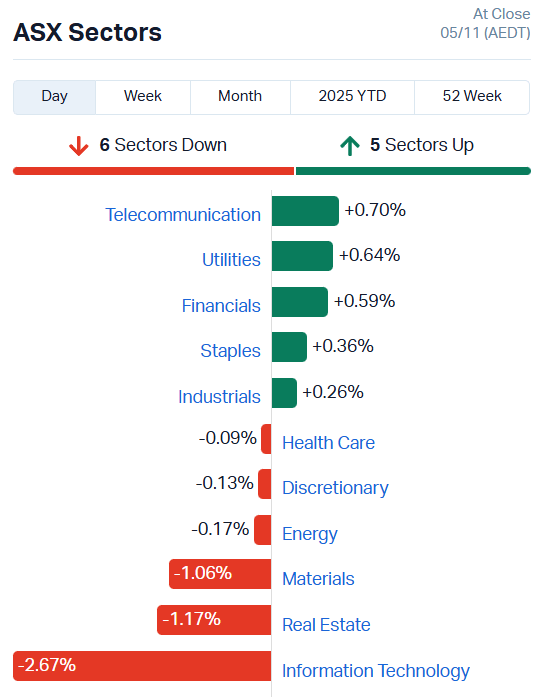

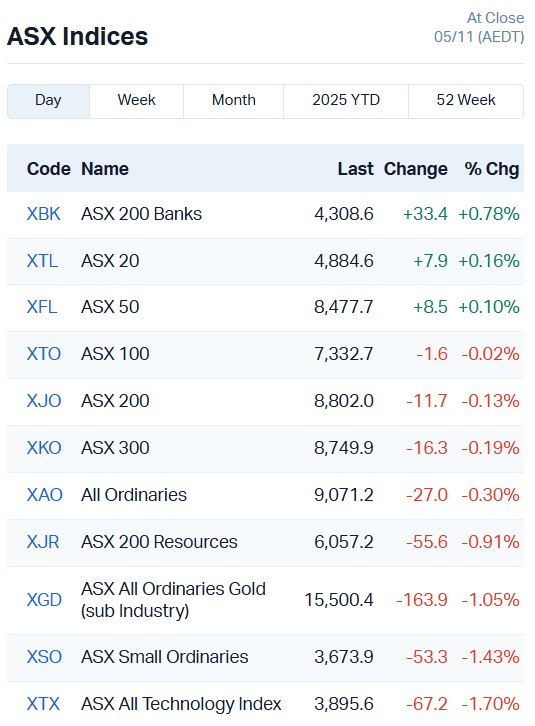

- ASX recovers from session lows of -0.91pc to fall -0.13pc

- Info tech, commodities weakness undercut market

- Banks, defensive sectors mount resistance

ASX battens down the hatches

It was looking like we were in for another 90-point routing on the ASX 200 today but a rotation into defensive stocks warded off the worst of the damage.

By trade’s end, the ASX had fallen just 11 points or 0.13%, with 6 of 11 sectors lower.

A plunge in tech stocks on Wall Street last night spooked local tech investors, who were partially responding to a new short position from Michael Burry.

The Scion Capital founder of ‘Big Short’ fame has taken another crack at betting against the general market consensus, taking short positions on Palantir and Nvidia.

He’s not the only one who sees something decidedly fragile and spherical about the current state of the stock market.

Goldman Sachs and Morgan Stanley are also on the lookout for that tell-tale froth, predicting a 10-20% pull back in stocks within the next 12-24 months.

They reckon “bubble” is too strong a word though… at least for now.

At home, investors are definitely feeling the pressure.

Traditionally defensive sectors like telecoms, utilities and the big banks are getting some love amongst the fear.

Commonwealth (ASX:CBA) has climbed 1.29%, NAB (ASX:NAB) 1.69%, Telstra Group (ASX:TLS) 1.45% and supply chain logistics company Brambles (ASX:BXB) 2.18%.

Resources ripped to ribbons

It’s been an absolute bloodbath on the ASX for resources today.

Gold, iron ore, copper, uranium, critical minerals… none have been spared the bear’s claws.

A rising US dollar, fears over a Tech bubble on Wall Street and higher oil prices have all smashed commodity prices as traders run for safer options.

The damage is shockingly widespread today:

- Copper – Aeris Resources (-15.7%), Bougainville Copper (-13.79%), Capstone Copper (-5.02%), Sandfire Resources (-0.57%), 29 Metals (-8.6%).

- Gold – Antipa Minerals (-8.93%), Genesis Minerals (-1.22%), Greatland Resources (-1.09%), Bellevue Gold (-3.06%), Ramelius Resources (-1.54%).

- Iron ore – Rio Tinto (-1.21%), Fortescue (-2.54%), Champion Iron (-0.54%), Mount Gibson Iron (-4.17%), Mineral Resources (-3.41%).

- Uranium – Boss Energy (-5.5%), Paladin Energy (-8.93%), Deep Yellow (-3.93%), Bannerman (-7%), Cauldron (-10.53%).

- Critical minerals – Brazilian Rare Earths (-12.32%), Arafura (-5.66%), Lynas (-3.25%), Iluka Resources (-3.56%), St George Mining (-12.38%), Meteoric Resources (-10.26%).

For all that, there were some notable exceptions.

Nova Minerals (ASX:NVA) climbed 1.2% after a US analyst doubled their price target for NVA’s American shares.

Santana Minerals (ASX:SMI) also added 2% after securing a 30-year mining permit for its Bendigo-Ophir Gold Project in New Zealand.

Finally, gold and silver miner Tolu Minerals (ASX:TOK) managed to climb 1.82% on no fresh news.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MRZ | Mont Royal Resources | 0.285 | 595% | 8188708 | $7,738,518 |

| BUY | Bounty Oil & Gas NL | 0.003 | 50% | 1855020 | $3,122,944 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 9150000 | $5,280,668 |

| VBC | Verbrec Limited | 0.155 | 35% | 2469172 | $33,599,557 |

| CR9 | Corellares | 0.005 | 25% | 625777 | $4,030,279 |

| AN1 | Anagenics Limited | 0.006 | 20% | 1173209 | $2,481,602 |

| MML | Mclaren Minerals | 0.024 | 20% | 2058189 | $3,974,696 |

| IMC | Immuron Limited | 0.093 | 19% | 2091644 | $21,009,597 |

| HAL | Halo Technologies | 0.045 | 18% | 64325 | $11,093,702 |

| GR8 | Great Dirt Resources | 0.23 | 18% | 160259 | $5,723,496 |

| SRR | Saramaresourcesltd | 0.047 | 18% | 10296605 | $14,768,281 |

| 1AD | Adalta Limited | 0.0035 | 17% | 388583 | $5,676,588 |

| IMI | Infinitymining | 0.014 | 17% | 7507358 | $5,076,189 |

| MPR | MPR Australia Ltd | 0.007 | 17% | 1621442 | $2,062,220 |

| BDG | Black Dragon Gold | 0.057 | 14% | 885355 | $15,977,470 |

| VBS | Vectus Biosystems | 0.165 | 14% | 161324 | $7,733,333 |

| EZZ | EZZ Life Science | 2.51 | 13% | 187639 | $105,196,236 |

| LEG | Legend Mining | 0.009 | 13% | 1015997 | $23,315,817 |

| SPQ | Superior Resources | 0.009 | 13% | 1088856 | $18,991,862 |

| AM5 | Antares Metals | 0.01 | 11% | 305532 | $4,633,676 |

| RKB | Rokeby Resources Ltd | 0.005 | 11% | 4078993 | $8,219,525 |

| OLL | Openlearning | 0.052 | 11% | 1452741 | $25,576,066 |

| TTX | Tetratherix Limited | 4.73 | 10% | 449 | $114,277,702 |

| IS3 | I Synergy Group Ltd | 0.011 | 10% | 321719 | $17,356,651 |

| PGY | Pilot Energy Ltd | 0.0055 | 10% | 1561070 | $10,793,300 |

In the news…

Mont Royal Resources (ASX:MRZ) returned to the ASX in style, rocketing up more than 60% on the offer price of 20c after relisting to the market following a transformational merger.

After combining with TSXV-listed Commerce Resources, the dual-listed stock has re-emerged as a Canadian-focused critical mineral company.

Its flagship asset is the Ashram rare earth and fluorspar deposit in Québec, which holds a mineral resource of 73.2 million tonnes at 1.89% total rare earth oxide (TREO) (indicated) and 131.1Mt at 1.91% TREO (inferred).

Verbrec (ASX:VBC) is on the up after inking an agreement to acquire Alliance Automation, expanding its automation, control, digital industry, machine learning and cyber security offering.

The two companies already share a client base, with Alliance deriving 41% of its revenue (A$62 million in FY25) from common customers, which should present a fairly straightforward opportunity for VBC to expand its capabilities and client base.

Immuron (ASX:IMC) has ticked off an important milestone for its IMM-529 trial in individuals with Clostridioides difficile (C-dif) infections, securing FDA approval for its investigational new drug application.

IMC will now initiate a randomized, double blind, placebo-controlled Phase 2 clinical trial for IMM-529, scheduled for the first half of 2026.

Great Dirt Resources (ASX:GR8) has hit pay dirt at its Doherty and Basin manganese projects in NSW, with rock chips assaying up to 51.8% manganese.

The sample came from a set of historical workings which continue to highlight large outcropping manganese-rich boulders of up to 70cm by 40cm by 20 cm.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AR1 | Australresources | 0.048 | -70% | 46042069 | $271,809,384 |

| MAY | Melbana Energy Ltd | 0.008 | -47% | 74603963 | $56,729,532 |

| T3D | 333D Limited | 0.072 | -28% | 700838 | $20,152,048 |

| MSG | Mcs Services Limited | 0.008 | -27% | 4236237 | $2,179,096 |

| DTI | DTI Group Ltd | 0.022 | -27% | 4642190 | $26,913,085 |

| GLA | Gladiator Resources | 0.014 | -26% | 8347827 | $15,463,195 |

| NAE | New Age Exploration | 0.003 | -25% | 5238435 | $13,231,995 |

| RDS | Redstone Resources | 0.003 | -25% | 26114423 | $4,919,927 |

| ANG | Austin Engineering | 0.21 | -25% | 16273750 | $175,583,582 |

| FRX | Flexiroam Limited | 0.019 | -24% | 10629012 | $37,934,965 |

| AFA | ASF Group Limited | 0.072 | -23% | 92502 | $73,692,971 |

| FAU | First Au Ltd | 0.007 | -22% | 2401451 | $23,593,362 |

| XPN | Xpon Technologies | 0.014 | -22% | 5813736 | $8,826,414 |

| SCN | Scorpion Minerals | 0.021 | -22% | 6278399 | $14,156,267 |

| PAT | Patriot Resourcesltd | 0.039 | -22% | 302192 | $8,251,123 |

| TMG | Trigg Minerals Ltd | 0.1075 | -20% | 48657879 | $164,504,358 |

| ALY | Alchemy Resource Ltd | 0.008 | -20% | 1042984 | $11,880,763 |

| ENT | Enterprise Metals | 0.004 | -20% | 1212000 | $7,470,753 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 60000 | $7,051,062 |

| MOM | Moab Minerals Ltd | 0.002 | -20% | 10700000 | $4,686,665 |

| NTM | Nt Minerals Limited | 0.002 | -20% | 32939 | $3,027,257 |

| SRN | Surefire Rescs NL | 0.002 | -20% | 300000 | $10,064,023 |

| ENL | Enlitic Inc. | 0.021 | -19% | 1896791 | $21,466,021 |

| TGH | Terragen | 0.017 | -19% | 98368 | $10,605,361 |

| AR3 | Austrare | 0.215 | -19% | 2899109 | $58,379,359 |

In Case You Missed It

Codeifai (ASX:CDE) has appointed a new chief strategy officer to oversee a push into quantum secure file and fund transfer ahead of AntennaTransfer.io platform acquisition.

Locksley Resources (ASX:LKY) has signed an MoU with Hazen Research to advance plans for US-based antimony production.

Red Mountain Mining (ASX:RMX) is completing the final stages for listing on the OTCQB in the United States under the ticker RMXFF.

ClearVue Technologies (ASX:CPV) has inked a deal with a major South Korean glass manufacturer to drive commercial adoption of its solar glass tech.

West Coast Silver (ASX:WCE) has hit native silver in drilling at the Elizabeth Hill silver deposit in WA.

Orthocell (ASX:OCC) has appointed its second distributor in US$75 million Canadian market for flagship nerve repair device Remplir.

Imagion Biosystems’ (ASX:IBX) collaboration with Wayne State University has delivered positive initial results on HER2 breast cancer imaging agent dosages.

Patronus Resources’ (ASX:PTN) has struck more gold at Mertondale, with high-grade hits outside the existing resource pointing to plenty of upside.

Tryptamine Therapeutics (ASX:TYP) has raised $6.1 million to advance its clinical trial for TRP-8803 for treating binge eating disorder.

NuEnergy (ASX:NGY) has achieved gas flaring at its Tanjung Enim project and a key milestone towards Indonesia’s first commercial coal bed methane production.

Octava Minerals’ (ASX:OCT) rock chip sampling at the Sweeney’s prospect has returned high grades of indium, copper, zinc, silver, tin and antimony.

Verity Resources’ (ASX:VRL) latest drilling campaign has uncovered extensions to the gold-rich Banded Iron Formation at the Monument project.

Auravelle Metals’ (ASX:AUV) regional drilling in South Australia has elevated Sheoak East to a high-priority gold target.

Green Critical Minerals (ASX:GCM) is teaming with Komex Carbon Corporate to develop graphite products for the South Korean technology and industrial markets.

Last Orders

Heavy Rare Earths (ASX:HRE) has brought Graeme Morissey onto the board as non-executive director, drawing on his experience as chief financial officer for Warriedar Resources (ASX:WA8).

WA8 is being acquired by Capricorn Metals (ASX:CMM) in a deal valued at more than $300m, freeing him up for new mineral exploration pursuits.

Trading halts

Alliance Nickel (ASX:AXN) – offtake agreement with Stellantis

Eagle Mountain Mining (ASX:EM2) – Oracle Ridge Mine option and cap raise

Verbrec (ASX:VBC) – material acquisition

Wisr (ASX:WZR) – cap raise

At Stockhead, we tell it like it is. While Nova Minerals and Heavy Rare Earths are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.