Closing Bell: ASX ends higher but iron’s ordinary problem isn’t going away

Iron ore prices aren't going to get better overnight. Via Getty

- Local markets give up early gains then regains them, closing 0.22pc higher

- Consumer Discretionary stocks offset losses in materials and Energy

- Small Caps led by LBT Innovations

It’s hard to stay afloat when BHP sinks to a near nine-month nadir, but that’s what the local benchmark has done, after US markets rose following a toppy enough US CPI read which added a few votes to an earlier-than-later US Fed rate cut.

At 4.15pm on Wednesday March 13, the S&P/ASX200 ended 17 points or 0.22% higher to…

This afternoon in Sydney the local market couldn’t avoid getting sucked down an after-lunch hole – shaped a lot like iron ore prices, which have plunged to, or at least near, six-month lows.

However, consumer stocks in particular didn’t stand around gawking, with a late surge pulling the benchmark from more losses.

For the moment, however, we have to admit we’ve an iron ore problem.

On Wednesday sentiment across the Singapore exchange, iron ore futures accelerated their incessant declines on Tuesday – shedding around 4% and closing in on the US$100 mark.

In Dalian, iron ore futures extended falls to a five-month low on Tuesday, also pressured by weakening sentiment and the curtailed current demand from Beijing, which refuses to pump its ailing economy with the usual infrastructure spend.

Those precipitous declines led the ASX to give up most of it’s morning gains by mid arvo.

BHP and Fortescue were both significantly lower, the former heading into bargain territory.

Consider this chart (below) for a sec. That’s BHP and the benchmark Aussie (XJO) over the past 12 months.

It’d be interesting to see when was the last time the XJO index took such a high road on the world’s largest miner.

Usually their fates – not to mention the country’s economy – are tightly intertwined.

Still among the local miners – and it’s been a tough day at the office for Core Lithium (ASX:CXO) which dropped abysmal results and lost its chief executive in the wash-up.

Rising all day has been Greenvale Energy (ASX:GRV) which says it’ll go with a staged development approach to bitumen production at its Alpha torbanite project in Central Queensland.

The company is very excited about the initial results of its latest liquefaction test program. Actually, looking at the charts, there’ll be more of GRV and all that in small cap winners (below).

And among the big names and big goldies, the biggest – Newmont Corporation (ASX:NEM) was down more than 2%, despite the price of gold hovering at circa $2,155 an ounce on Wednesday, after shedding more than 1% while US traders awaited the impact of slightly-higher-than-anticipated US inflation data.

The top performing stocks across the XJO this index were Liontown Resources (ASX:LTR) and Strike Energy (ASX:STX), up 5.70% and 3.26% respectively.

Over the past five days, the index is virtually unchanged, but is currently 1.58% below its 52-week high.

These local stocks went ex-divvy today:

Bisalloy (ASX:BIS) is paying 8 cents fully franked

Brambles (ASX:BXB) is paying 23.09 cents 35 per cent franked

Downer EDI (ASX:DOW) is paying 6 cents unfranked

Data#3 (ASX:DTL) is paying 12.6 cents fully franked

Glennon SML Co Ltd (ASX:GC1) is paying 1 cent fully franked

IVE Group (ASX:IGL) is paying 9.5 cents fully franked

Imdex (ASX:IMD) is paying 1.5 cents fully franked

Mercury NZ (ASX:MCY) is paying 8.7258 cents unfranked

Pepper Money (ASX:PPM) is paying 5 cents fully franked

Perpetual (ASX:PPT) is paying 65 cents 35 per cent franked

Thorney Opp Ltd (ASX:TOP) is paying 1.05 cents fully franked

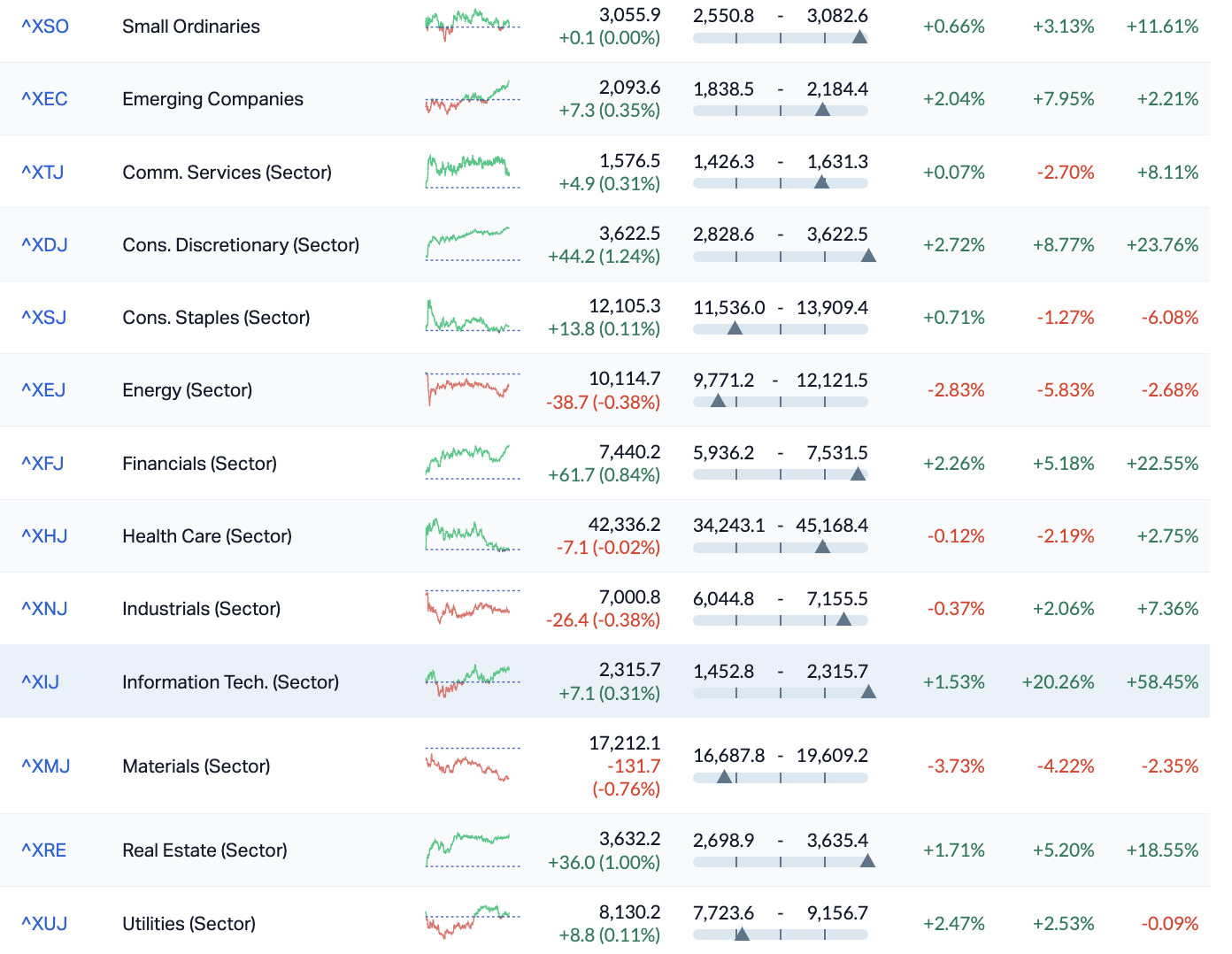

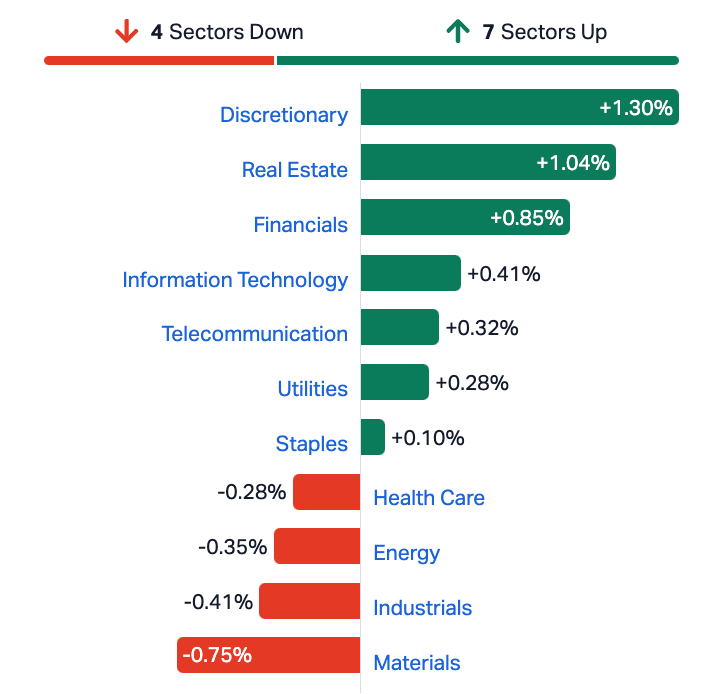

ASX Sectors at 3.30pm on Wednesday

Eight of 11 sectors are positive after solid US gains led by tech giants.

The retreat by resources companies couldn’t offset broader gains across Consumer Discretionary, Financials and the Real Estate sector, all really outperforming on Wednesday, with the big banks and blue chip consumer stocks like JB HiFi (ASX:JBH) et al doing well.

Around the ‘hood…

Asian-Pacific stockmarkets have come on mixed this afetrnoon as investors had differing responses to a spectacularly inconclusive US CPI inflation report.

From this far away when the inflation rate surprises on the upside, but the core inflation (minus petrol etc), eases more than expected, then everyone has to spend a session wrestling with their own demons – and we certainly have a few of those here in Asia.

After three straight days of gains, the Hang Seng has been the scene of some rare profit taking after the Hong Kong index clocked a 16 week high on Tuesday.

In South Korea there’s some slight gains on the Kospi after the local jobless rate came in much lower at 2.6% for February, (down from 3% in January). The kettles cooling in Japan and in mainland China both Shanghai and Shenzhen were slightly down with a few hours to play.

In the States…

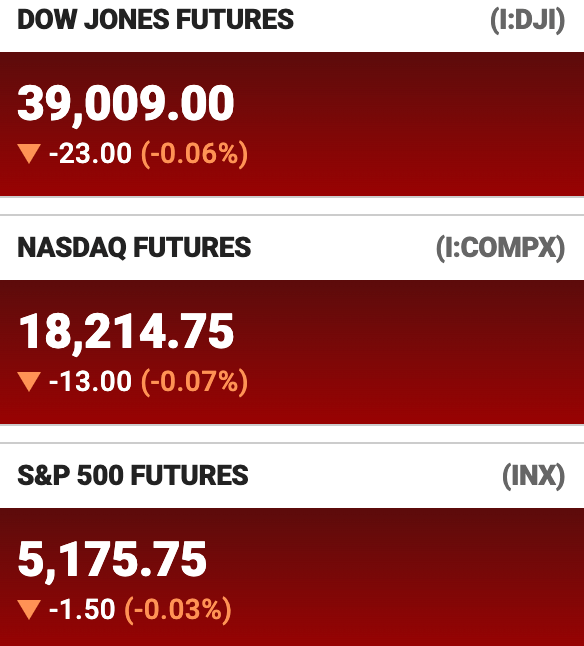

US stocks couldn’t help but skewer another record close, as expectations for a June rate cut solidified despite the February read from the US Bureau of Labor Statistics which shows US inflation is still easing from its 2022 peak, but remains problematic.

Nevertheless, the read was close enough to expectations for traders to get back to pumping the AI-Big tech stocks, ignoring that the US Federal Reserve’s 2% inflation target is still a fair whack away.

The S&P 500 rose 1.1% to 5175.27, a record closing high and just shy of the intraday record high of late last week.

The Dow Jones Industrial Average gained 235.83 points, or 0.61%, to end at 39,005.49.

The Nasdaq Composite found 1.55% to 16,265.64.

Right out front again was Nvidia (NVDA) which surged 7.2%, while Oracle jumoped 11%, making Larry Ellison a whole lot richer, after dropping impressive quarterly numbers which beatWall Street expectations.

Elsewhere, Microsoft gained 2.6%, and Meta, 3.3%.

Behind it all, this from the US Dept. of Numbers:

In February, the US Consumer Price Index (CPI) for All Urban Consumers increased 0.4%, seasonally adjusted (SA), and rose 3.2% over the last 12 months, not seasonally adjusted (NSA).

The index for all items less food and energy increased 0.4% in February SA; up 3.8% over the year NSA.

US Futures at the close in Sydney on Wednesday:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LBT | LBT Innovations | 0.028 | 100% | 145,689,207 | $17,651,426 |

| SIH | Sihayo Gold Limited | 0.0015 | 50% | 499,999 | $12,204,256 |

| VAL | Valor Resources Ltd | 0.003 | 50% | 813,286 | $9,178,027 |

| SEN | Senetas Corporation | 0.024 | 41% | 2,065,254 | $26,711,817 |

| DVL | Dorsavi Ltd | 0.018 | 38% | 779,767 | $7,756,601 |

| SFG | Seafarms Group Ltd | 0.004 | 33% | 145,500 | $14,509,798 |

| IS3 | I Synergy Group Ltd | 0.013 | 30% | 114,459 | $3,040,804 |

| ASP | Aspermont Limited | 0.009 | 29% | 366,000 | $17,189,443 |

| GRV | Greenvale Energy Ltd | 0.09 | 29% | 289,367 | $30,814,726 |

| LRL | Labyrinth Resources | 0.005 | 25% | 4,219,387 | $4,750,175 |

| KNG | Kingsland Minerals | 0.26 | 21% | 815,928 | $10,648,779 |

| 88E | 88 Energy Ltd | 0.006 | 20% | 14,274,131 | $125,620,313 |

| PNX | PNX Metals Limited | 0.006 | 20% | 5,559,062 | $26,903,124 |

| AQC | Auspaccoal Ltd | 0.08 | 18% | 3,774,644 | $34,881,796 |

| 1MC | Morella Corporation | 0.0035 | 17% | 1,526,633 | $18,536,398 |

| NRZ | Neurizer Ltd | 0.0035 | 17% | 13,661,349 | $4,504,232 |

| SRZ | Stellar Resources | 0.014 | 17% | 5,723,996 | $17,235,397 |

| EQS | Equitystorygroupltd | 0.029 | 16% | 53,965 | $1,065,370 |

| NIS | Nickelsearch | 0.03 | 15% | 4,922,918 | $5,552,104 |

| HMD | Heramed Limited | 0.023 | 15% | 911,410 | $7,064,996 |

| SGQ | St George Min Ltd | 0.023 | 15% | 2,101,003 | $19,770,809 |

| KNI | Kunikolimited | 0.27 | 15% | 380,018 | $20,314,403 |

| COD | Coda Minerals Ltd | 0.11 | 15% | 36,975 | $13,667,652 |

| HOR | Horseshoe Metals Ltd | 0.008 | 14% | 70,000 | $4,525,351 |

| PAA | Pharmaust Limited | 0.36 | 14% | 1,386,059 | $123,035,355 |

Nearest in the healthcare and small cap space – and up a stonking 40% on some midweek HR, is Dorsavi (ASX:DVL).

The board must be really pleased to have announced the appointment of Gernot Abl to itself as Non-Executive Director, effective immediately.

Gernot has more than 20 years of entrepreneurial, business strategy, and investment experience and is currently Executive Director of Lithium Universe (ASX:LU7) and is the Chair of Live Verdure (ASX:LV1)

Gernot is also on the board of and advises several medium and high-growth businesses, ranging from early-stage pre-revenue companies through to early-stage ASX-listed companies.

“… As a leading provider of AI-enabled sensor technology, I believe dorsaVi is uniquely placed to capitalise on digitisation trends in the healthcare sector, utilizing their FDA clearance and AI expertise to grow recurring revenue.

“I am eager to contribute to dorsaVi’s commercial success and expand on the core technology they have today.”

That’s nice, too.

Meanwhile, killing Wednesday as well is Greenvale Energy (ASX:GRV) with happy early results from its liquefaction test program 4 which reportedly support “a long-life” project at Alpha.

With GRV planning a staged approach to bitumen production, Greenvale’s Alpha deposit is currently being analysed on several fronts in preparation for the delivery of a PFS, with these latest early results supporting the initial 100,00tpa bitumen processing plant.

GRV chief executive Mark Turner says the company hopes to increase bitumen production at Alpha to 200,000tpa, potentially positioning the deposit to meet a portion of rapidly growing demand for bitumen and blended products for local supplier and infrastructure needs.

“We are now well and truly at the pointy end of bringing everything together for the Alpha Project PFS.”

“The liquefaction test program 4 is progressing well and delivering very promising results, supporting the design premise for a facility initially capable of producing 100ktpa of bitumen and blended products over a 20-year plant life with significant expansion potential beyond that to 200,000tpa.”

GRV’s added more than 20% near the close.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CPM | Coopermetalslimited | 0.14 | -49% | 6,554,211 | $21,547,804 |

| SKN | Skin Elements Ltd | 0.003 | -40% | 2,500,000 | $2,947,430 |

| OSX | Osteopore Limited | 0.33 | -37% | 129,362 | $5,370,918 |

| ADS | Adslot Ltd. | 0.002 | -33% | 102,100 | $9,673,487 |

| FAU | First Au Ltd | 0.002 | -33% | 52,575,146 | $4,985,980 |

| PUA | Peak Minerals Ltd | 0.002 | -33% | 25,000 | $3,124,130 |

| NTM | Nt Minerals Limited | 0.005 | -29% | 250,000 | $6,019,320 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | 5,183,482 | $12,677,188 |

| CTO | Citigold Corp Ltd | 0.003 | -25% | 829,523 | $12,000,000 |

| HCD | Hydrocarbon Dynamic | 0.003 | -25% | 28,692 | $3,234,329 |

| MIOR | Macarthur Minerals - Rights 15-Mar-24 | 0.003 | -25% | 1 | $133,003 |

| RMI | Resource Mining Corp | 0.028 | -24% | 5,292,071 | $21,916,869 |

| AMD | Arrow Minerals | 0.0055 | -21% | 42,172,952 | $53,086,356 |

| ALV | Alvomin | 0.1 | -20% | 87,783 | $11,641,289 |

| ECT | Env Clean Tech Ltd. | 0.004 | -20% | 852,821 | $14,321,552 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 706,717 | $9,195,678 |

| MCT | Metalicity Limited | 0.002 | -20% | 858,589 | $11,212,634 |

| RMX | Red Mount Min Ltd | 0.002 | -20% | 24,795,597 | $6,683,940 |

| ROG | Red Sky Energy. | 0.004 | -20% | 504,439 | $27,111,136 |

| WHK | Whitehawk Limited | 0.025 | -17% | 17,781,959 | $13,252,788 |

| CNJ | Conico Ltd | 0.0025 | -17% | 373,011 | $4,710,285 |

| MHC | Manhattan Corp Ltd | 0.0025 | -17% | 299,500 | $8,810,939 |

| PNM | Pacific Nickel Mines | 0.04 | -17% | 386,988 | $20,076,149 |

| RGS | Regeneus Ltd | 0.005 | -17% | 220,000 | $1,838,621 |

| JAL | Jameson Resources | 0.026 | -16% | 225,587 | $13,507,733 |

ICYMI – PM Edition

Kingsland Minerals (ASX:KNG) now boasts Australia’s largest inferred contained graphite deposit after unveiling a maiden resource of 14.2Mt @ 7.3% TGC for its Leliyn project in the Northern Territory.

Sunshine Metals (ASX:SHN) has delivered another eye-catching intersection of 20m @ 18.21g/t gold from 114m at the Liontown prospect, part of its Ravenswood Consolidated project near Charter Towers in North Queensland, while also successfully extended the gold-copper rich footwall beyond 260m.

Meanwhile, Mt Malcolm Mines (ASX:M2M) has turned up the highest gold intersection ever recorded – a whopping 61.39g/t – at its Golden Crown prospect near Leonora.

NickelSearch (ASX:NIS) has signed land access agreements with a private landholder and two occupiers, paving the way for the first lithium-focused drilling program to begin shortly at Carlingup.

MTM Critical Metals (ASX:MTM) has exercised its option to licence the patented Flash Joule Heating technology, which can extract critical minerals such as rare earths, titanium, nickel, cobalt and lithium from waste material.

In the first assays from Silver Mountain in over four years, Eagle Mountain Mining (ASX:EM2) has uncovered up to 2,170ppm uranium and 23,114ppm thorium, signalling the potential for deeper high-grade mineralisation at the Arizona-based project.

Haranga Resources (ASX:HAR) is also eyeing a resource upgrade for its Saraya uranium project in Senegal on the back of encouraging pXRF results from eight RC holes recently drilled into two key prospects.

Parkway Corporate (ASX:PWN) is acquiring established engineering solutions provider Tankweld Group as the leading industrial water treatment technology company looks to advance its project execution and industrial manufacturing capabilities.

Neurotech International (ASX:NTI) has extended its Phase I/II clinical trials from 12 weeks to 52 weeks as it continues to explore the usage of its lead NTI164 compound to treat kids with spastic diplegia cerebral palsy.

EZZ Life Science Holdings (ASX:EZZ) is collaborating with DFS to launch seven premium products at the renowned duty-free retailer’s Auckland International Airport store, in a bid to capitalise on a rebound in Chinese tourists visiting New Zealand.

An aeromagnetic survey over St George Mining’s (ASX:SGQ) Myuna Rocks project, along strike from Arcadium Lithium’s (ASX:LTM) spodumene-producing Mt Cattlin mine, has outlined new target areas which demand immediate follow-up exploration with planning under way for a drill program in Q2/Q3 2024.

Firetail Resources (ASX:FTL) is firing on all cylinders after maiden drilling at the Cumbre Coya target, within its Picha copper project in Peru, confirmed the continuation of mineralisation over 170m with the strike open in all directions and at depth.

Raiden Resources (ASX:RDN) has been cleared to begin a heritage survey at its Andover North lithium project on April 2, focusing on areas interpreted to be underlaid by the same host rocks as the in-demand tenure held by Azure Resources (ASX:AZS) in the Pilbara and currently subject to a $1.7 billion takeover.

Marmota’s (ASX:MEU) Manna from Heaven prospect in South Australia looks to have been perfectly named after reconnaissance drilling intersected ionic clay-hosted rare earths which appear to mirror deposits found in China.

And Brazilian Critical Minerals (ASX:BCM) is basking in the first-pass leach test results at its Ema project, which produced magnet REE recoveries up to 87%.

At Stockhead, we tell it like it is. While Brazilian Critical Minerals, Eagle Mountain Mining, EZZ Life Science Holdings, Firetail Resources, Greenvale Energy, Haranga Resources, Kingsland Minerals, Marmota, Mt Malcom Mines, MTM Critical Minerals, Nickelsearch, Neurotech International, Parkway Corporate, Raiden Resources, St George Mining and Sunshine Metals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.