Closing Bell: ASX dips with MinRes and Viva tumbling; but Prodigy Gold hits jackpot

MinRes and Viva E dropped, but Prodigy Gold rose 50pc. Picture via Getty Images

- The ASX fell on new expectations for rate cuts

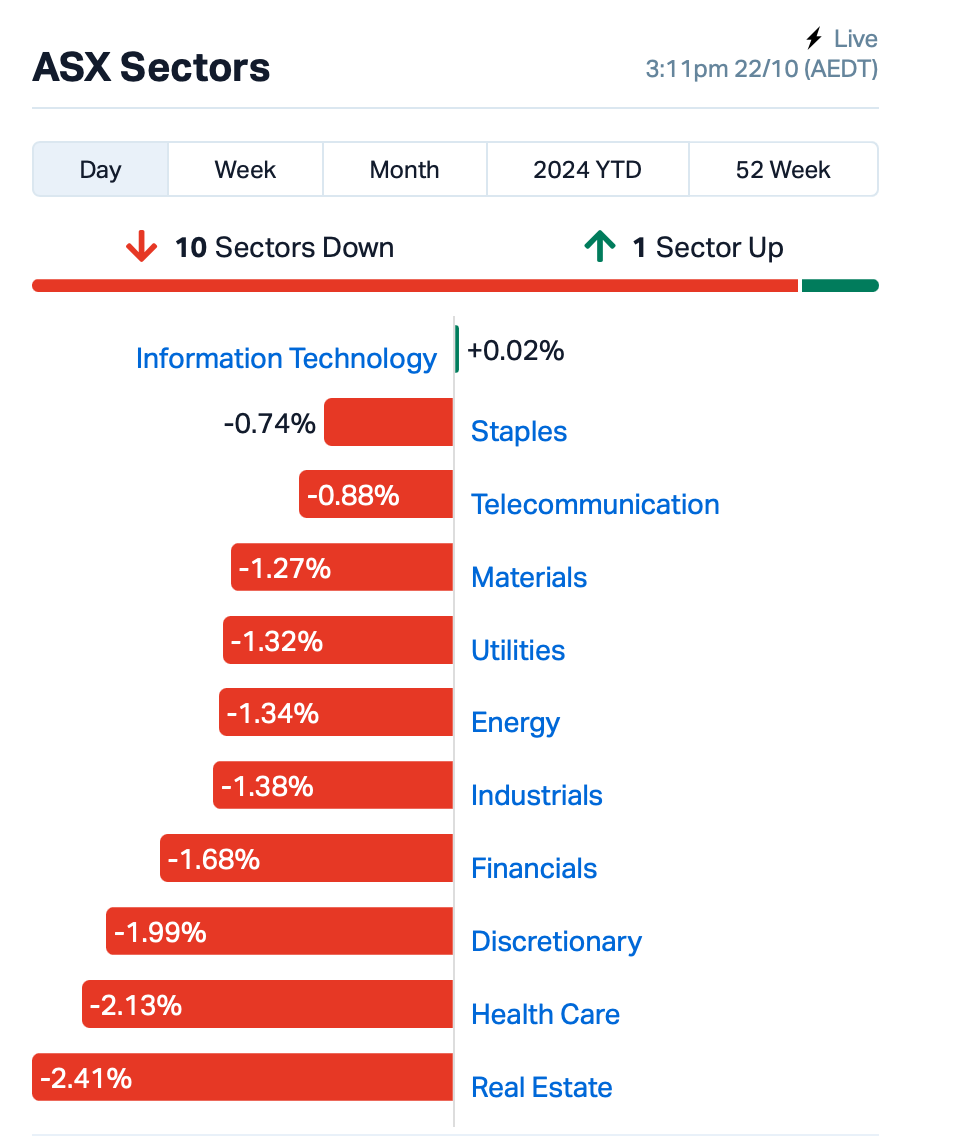

- All 11 ASX sectors fell, with real estate and healthcare hit hardest

- MinRes and Viva Energy dropped, Prodigy Gold rose 50pc

The ASX slid by 1.66% from near record highs in a broad sell-off on Tuesday, mirroring the movements on Wall Street overnight.

Investors adjusted their expectations for rate cuts after three Federal Reserve officials emphasised the importance of a cautious approach to lowering interest rates.

Amongst them was Kansas City Fed President Jeff Schmid, who said, “My preference would be to avoid outsized moves.”

Bond yields jumped significantly across the globe following the remarks, and traders in Australia have now pushed back expectations for the first RBA rate cut from April to May next year.

All 11 ASX sectors were flashing red today, with rates-sensitive sectors like Real Estate and Discretionary feeling the pinch. Bank and Real Estate stocks were also under pressure.

To single stocks news, Mineral Resources (ASX:MIN) fell 3.5%, extending a more than 10% drop from Monday after a report suggested its managing director, Chris Ellison, may have evaded taxes for years.

Viva Energy (ASX:VEA) fell by over 5% after warning about weaker retail conditions, lower tobacco sales, and rising business costs. Viva runs a network of service stations, primarily under the Shell brand.

After plunging by 11% yesterday, WiseTech Global (ASX:WTC) rebounded by 4% today.

The company has been in the limelight after its board announced that it was looking into allegations against founder Richard White. White had allegedly paid a substantial amount to privately resolve a dispute with a woman he allegedly had a sexual relationship with. But a report on the AFR today suggested that settlement has been confirmed, reportedly in the millions of dollars.

Audinate (ASX:AD8) plunged around 7% after it indicated it might not meet its full-year gross profit target.

Meanwhile, several recent developments within the lithium space have boosted investor sentiment for the battery metal including Rio’s proposed acquisition of Arcadium Lithium for US$6.7b and the closure of a massive Chinese lepidolite mine owned by the world’s largest battery maker.

Although lithium prices remain under pressure, China’s stimulus efforts have started to pave the way for potential upside with the West keen to diversify its battery supply chains away from the Middle Kingdom, which could bode well for Australian producers.

These difficult market conditions haven’t stopped some lithium juniors from kicking on and proving up their resources, as seen today with the release of Mandrake Resources (ASX:MAN)’s maiden inferred 3.3Mt lithium carbonate equivalent (LCE) resource at the Utah lithium project.

MAN said this milestone confirms the company’s position as a top tier US lithium asset, ideally positioned in the Paradox Basin with well access, abundant existing infrastructure, access to strong local workforce and an established regulatory environment.

And… Japanese traders are watching the national election set for this Sunday closely, as support for Prime Minister Shigeru Ishiba’s coalition appears to be weakening. Across the region today, Asian stock markets fell for a second consecutive day. The MSCI AC Asia Pacific Index dropped by 1%, with markets in Japan declining while Chinese markets showed slight gains.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.002 | 100% | 9,977,361 | $4,497,970 |

| PRX | Prodigy Gold NL | 0.004 | 75% | 96,617,579 | $4,664,912 |

| MTB | Mount Burgess Mining | 0.002 | 50% | 500,000 | $1,298,147 |

| PUA | Peak Minerals Ltd | 0.007 | 40% | 48,117,351 | $12,485,551 |

| NVU | Nanoveu Limited | 0.066 | 38% | 70,339,736 | $24,236,289 |

| ENT | Enterprise Metals | 0.004 | 33% | 819,874 | $3,534,952 |

| SIS | Simble Solutions | 0.004 | 33% | 450,000 | $2,260,352 |

| SLZ | Sultan Resources Ltd | 0.008 | 33% | 6,366,273 | $1,185,519 |

| TX3 | Trinex Minerals Ltd | 0.002 | 33% | 750,000 | $2,742,978 |

| MM1 | Midasmineralsltd | 0.105 | 31% | 153,502 | $8,282,374 |

| MME | Moneyme Limited | 0.138 | 25% | 2,641,222 | $88,008,632 |

| ERA | Energy Resources | 0.005 | 25% | 14,182,743 | $88,593,197 |

| IVX | Invion Ltd | 0.003 | 25% | 3,144,387 | $13,533,183 |

| TMK | TMK Energy Limited | 0.003 | 25% | 858,699 | $15,183,224 |

| TZN | Terramin Australia | 0.100 | 23% | 3,206,306 | $171,441,580 |

| AQI | Alicanto Min Ltd | 0.032 | 23% | 5,242,657 | $19,451,717 |

| PLT | Plenti Group Limited | 0.800 | 23% | 476,937 | $113,958,885 |

| EOF | Ecofibre Limited | 0.049 | 23% | 229,423 | $15,154,956 |

| NOU | Noumi Limited | 0.290 | 21% | 707,309 | $66,506,237 |

| ARD | Argent Minerals | 0.027 | 20% | 30,091,115 | $31,766,365 |

| FHS | Freehill Mining Ltd. | 0.006 | 20% | 1,000,000 | $15,392,639 |

| GTI | Gratifii | 0.006 | 20% | 3,251,643 | $10,745,981 |

| SNG | Siren Gold | 0.130 | 18% | 3,986,853 | $22,789,128 |

Prodigy Gold (ASX:PRX) said exceptional results have emerged from the Reverse Circulation drilling campaign at the Hyperion Gold Deposit, part of Prodigy Gold’s Tanami North Project. Highlights include significant intercepts such as 25m at 2.2g/t Au and 33m at 2.6g/t Au from the Hyperion and Tethys Lodes. The 17-hole, 1,770 metre programme revealed all holes intersected mineralised intervals, with most grades surpassing previous estimates. This data will be used to update the current Indicated and Inferred Mineral Resource of 8.64Mt at 1.5g/t Au. Additional drilling has also taken place at other nearby prospects, with results pending.

Nanoveu (ASX:NVU) was up on news that its current takeover target, EMASS, had completed benchmark testing for its ECS-DOT SoC (System on Chip) chipset, achieving 20x lower energy consumption compared to peers,and “setting a new benchmark for ultra-low power performance in edge AI applications”. Nanoveu is currently in the process of acquiring 100% of EMASS, subject to shareholder approval.

MONEYME (ASX:MME) was up on news it has executed its first asset-backed securities deal in the auto asset class, with the MME Autopay ABS 2024-1 Trust – the second ABS transaction in FY25 and the largest term securitisation deal to date for the company. The Aaa (sf) and AAA (sf) credit ratings for the Class A1 and Commission notes represent 72.4% of the collateralised notes, “reflecting strong credit quality and performance of the Autopay loans,” says MoneyME boss Clayton Howes.

New Zealand goldie Siren Gold (ASX:SNG) is off to the races after its ionic leach soil sampling program extended gold and antimony mineralisation at the Auld Creek prospect for at least 1.5km. SNG believes Auld Creek has what it takes to grow further and enhance the resource on the Reefton project, which currently stands at 558,000oz at 4.72g/t gold equivalent. The Reefton project is situated between the Globe Progress mine, which historically produced 418,000oz at 12.2g/t gold, and the Crushington group of mines that produced 515,000oz at 16.3g/t gold. Auld Creek, with a resource of 105,000oz at 3.84g/t gold and 14,500t at 1.71% antimony for a gold equivalent of 210,000oz at 7.69g/t gold, is now Siren’s largest resource at Reefton and has the potential to increase significantly as exploration proceeds.

Gratifii (ASX:GTI) was up after releasing a positive quarterly report this morning, showing 1Q FY25 cash receipts of $8.31 million, an increase of 32.7% over previous quarter and 14.4% over previous corresponding quarter. That’s put the company in a cashflow positive position, improving by about $1.1 million from 4Q FY24 supported by the increase in cash receipts and reduced investment in inventory.

Plenti Group (ASX:PLT) climbed after the company announced unaudited 1H25 Cash NPAT of $5.5 million, which is a massive increase of 260% on PCP. The company says its loan portfolio has increased to $2.28 billion, 14% above PCP and 3% above prior quarter alongside loan originations of $323.3 million, 11% above PCP and 7% above prior quarter.

MRG Metals (ASX:MRQ) was up on news that Fotinho exploration licence 11000 has been granted over a newly identified, high potential 19,865.18 ha Thorium and Rare Earth Element (REE) district in Mozambique, where historical exploration showed the presence of monazite and highly elevated Th and REE grades, with Th assays >1,000 ppm in soil and panned heavy mineral concentrate and 559 ppm in rock.

A technical review carried out across Alicanto Minerals (ASX:AQI)’s Greater Falun asset has identified compelling copper, gold and silver targets that show there is huge exploration potential still yet to be discovered.

The targets include Wolf Mountain, Stone Lake, Swamp Thing, Birch Mountain, Lustebo and Strömbo, where previous rock chip results returned 11.9% copper, 7.2g/t gold and 185g/t silver. Alicanto is in active discussions with potential strategic partners for Falun and the Greater Falun project with the aim of progressing systematic exploration in this highly prospective region.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AFA | ASF Group Limited | 0.020 | -33% | 35,000 | $23,771,926 |

| CHM | Chimeric Therapeutic | 0.010 | -32% | 18,842,165 | $12,672,098 |

| DOU | Douugh Limited | 0.009 | -31% | 10,786,472 | $14,066,896 |

| NXS | Next Science Limited | 0.135 | -31% | 2,998,063 | $56,971,246 |

| BPM | BPM Minerals | 0.085 | -29% | 5,148,174 | $10,064,666 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | 1,169,845 | $1,929,431 |

| NSM | Northstaw | 0.015 | -25% | 2,853,029 | $5,453,530 |

| CRR | Critical Resources | 0.007 | -22% | 828,717 | $17,673,153 |

| AS1 | Asara Resources Ltd | 0.021 | -22% | 2,218,135 | $26,909,828 |

| BEO | Beonic Ltd | 0.028 | -20% | 1,642,746 | $22,256,926 |

| TFL | Tasfoods Ltd | 0.012 | -20% | 110,840 | $6,556,433 |

| DBO | Diabloresources | 0.020 | -20% | 504,116 | $2,576,786 |

| AKN | Auking Mining Ltd | 0.004 | -20% | 1,545,076 | $1,835,323 |

| AMD | Arrow Minerals | 0.002 | -20% | 12,772,010 | $32,559,069 |

| AMM | Armada Metals | 0.009 | -18% | 817,374 | $2,288,000 |

| FSG | Field Solu Hldgs Ltd | 0.018 | -18% | 425,318 | $17,015,780 |

| IS3 | I Synergy Group Ltd | 0.005 | -17% | 774,335 | $2,137,307 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 5,973,190 | $7,609,695 |

| OVT | Ovanti Limited | 0.023 | -15% | 75,219,524 | $42,021,405 |

| ACM | Aus Critical Mineral | 0.082 | -15% | 113,193 | $3,391,320 |

| ILA | Island Pharma | 0.150 | -14% | 529,373 | $26,994,689 |

True North Copper (ASX:TNC) has appointed voluntary administrators after unsuccessful negotiations with its debt provider and potential equity investors. This decision follows the ramp-up of mining activities at the Cloncurry Copper Project, where initial oxide ore was placed onto heap leach pads. Despite promising exploration results, cash resources dwindled, prompting the directors to seek administrative support.

IN CASE YOU MISSED IT

Aroa Biosurgery (ASX:ARX) has announced cash receipts of NZ$19.9m for the September 2024 quarter, a ~35% increase on pcp (Q2 FY24) and a ~12% QoQ increase due to greater sales of Myriad, OviTex and OviTex PRS. It expects to be cash flow positive in H2 FY2025.

Investors have demonstrated their confidence in Elevate Uranium (ASX:EL8) by making firm commitments for a $25m placement priced at 32.5c per shares. Proceeds will be used to accelerate the next phase of development of its Koppies uranium project in Namibia.

Impact Minerals (ASX:IPT) has landed a $2.87 million grant from the Australian Federal Government towards the commercialisation of its innovative process to produce high purity alumina from the Lake Hope deposit in WA.

Prodigy Gold (ASX:PRX) has reported an exceptional gold strike of 10m grading 15.9g/t gold at the Hyperion deposit within its Tanami North project in the NT. Follow-up drilling is planned for the 2025 field season.

ADX Energy (ASX:ADX) is progressing drilling of its Lichtenberg-1 (LICHT-1) gas exploration well at its ADX-AT-I licence in Upper Austria. Previous operations since last report includes the logging of the well in 8 1/2 inch hole, running and cementing 7 inch casing, setting up for the new 6-inch hole size, drilling out of the casing shoe and drilling ahead in 6-inch hole to the current depth of 2140m.

LICHT-1 targets an Upper Oligocene sandstone reservoir as well as two slightly shallower and geologically similar reservoirs. The first Oligocene reservoirs are expected after around 2000m measured depth while the main target is expected at about 2500m.

Anson Resources (ASX:ASN) has ticked off its second geotechnical engineering survey for the proposed location of a DLE extraction plant or possible site for a stage 2 expansion at the Green River lithium project in southeastern Utah. This engineering study examined soil and rock types as part of the due diligence process and confirmed subsurface conditions were suitable for the proposed DLE processing plant.

Carried out by a professional engineer and professional geologist, the study consisted of seven boreholes and eight test pits, field resistivity measurements, soil samples, and geophysical surveys to determine dynamic properties of subsurface materials. The proposed site was selected based on its access to water from the Green River, which is essential for the operation of the direct lithium extraction process.

Golden Mile Resources (ASX:G88) has received commitments to raise $616,000 from institutional and sophisticated investors alongside a further $234,000 from the board of directors and management of Golden Mile Resources. The explorer intends to accelerate its maiden drilling program at the Pearl copper project in the San Manuel mining district in Pinal County, Arizona, focusing on the Odyssey prospect.

G88 believes the asset is shaping up as a polymetallic play with recent rock chip assays returning up to 930g/t silver, 10.05% copper and 8.09% zinc during first pass sampling.

Lithium Energy (ASX:LEL) has extended the timetable for the sale of the company’s 90% interest in the Solaroz lithium brine project in Argentina to CNR Netherlands New Energy Technology (CNNET) B.V. CNNET is a subsidiary of Chinese listed CNGR Advanced Material Co, one of the world’s largest producers of precursors cathode active materials used by many leading companies in the battery materials supply chain.

Completion of the sale (totalling $97m) was to occur after the satisfaction of several conditions precedent under the Solaroz sale agreement on or before October 25. CNNET has now requested that the time for completion be extended by a further 60 days to December 24 as permitted under the Solaroz sale agreement.

Sovereign Metals (ASX:SVM) has wrapped up a 281-hole infill drilling program for over 5,607m at the Kasiya rutile-graphite project, northwest of Malawi’s capital of Lilongwe.

The program was designed to upgrade Kasiya’s 1.8bn resource at 1% rutile and 1.4% graphite, which is already the world’s largest rutile deposit and second-largest flake graphite deposit.

SVM said the results, expected in early 2025, will feed into the company’s future technical studies as part of ongoing pre-development activities at Kasiya.

TRADING HALTS

BPH Global (ASX:BP8) – pending an announcement in relation to a proposed acquisition.

Lotus Resources (ASX:LOT) – pending an announcement regarding a capital raise.

Pursuit Minerals (ASX:PUR) – pending the release of an announcement to the market regarding a capital raise.

Tolu Minerals (ASX:TOK) – pending an announcement in relation to an equity raising by way of a placement.

Reward Minerals (ASX:RWD) – pending the release of an announcement in relation to a capital raising.

Beam Communications (ASX:BCC) – pending an announcement in respect to the unsuccessful outcome of the arbitration relating to the ZOLEO Inc. joint venture between the company and its joint venture partner.

At Stockhead we tell it like it is. While Bailador Technology Investments, Chariot Corporation, Greenvale Energy, Javelin Minerals, Mt Malcolm Mines, Red Metal, Titanium Sands and Zeotech are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.