Closing Bell: ASX cops body shot, down 0.92pc as Trump swings tariff bat

While we may have avoided higher import taxes today, the ASX still took a beating from the tariff bat. Pic: Getty Images.

- Trump rolls out tariffs to dozens of countries

- ASX retreats 0.92pc in response

- Utilities stays the course, lifting 0.7pc

You get a tariff… You get a tariff… You get a tariff!

Reminiscent of Oprah on a particularly bad hair day, Trump was handing out tariffs like they were Volkswagens today.

With the tariff pause deadline finally expiring, US President Trump gleefully began swinging the tariff club, smacking Canada with a 10% hike to bring their total tariff rate to 35%.

Dozens of countries were walloped with new import taxes, coming in at anywhere from 10% to 50%.

Brazil, India, Taiwan, Switzerland, South Africa, Laos, Vietnam… It might genuinely be easier to list who isn’t affected.

While Australia was spared anything beyond the current 10% tariff we’re operating under (so far), the ASX was a bit like a poorly treated dog spotting a rolled newspaper in hand.

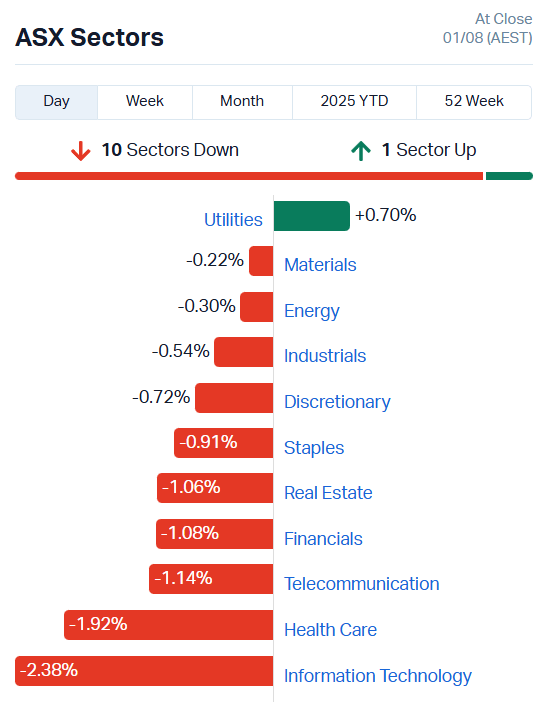

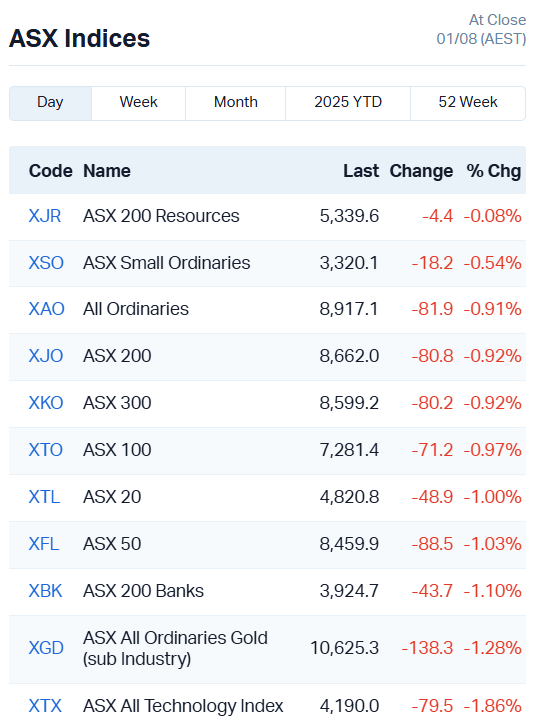

The bourse retreated 0.92% in a sea of red, with 10 of 11 sectors in the negative.

Utilities was the only sector to stand its ground, rising 0.70% as investors piled into the defensive industry.

Carbon credit and landfill gas management firm LGI (ASX:LGI) soared 14% in trade on no fresh news. They were joined by small caps Energy World (ASX:EWC), up 4%, and Frontier Energy (ASX:FHE), up 5%.

In the bigger stocks, Origin Energy (AX:ORG) gained 0.7%, while APA Group (ASX:APA) added 0.7% and AGL Energy (ASX:AGL) lifted 0.4%.

Taking a peek at our indices, the ASX 200 Resources recovered a little of its pep to inch up 0.08%, mostly on gains in rare earth stocks, before reversing course and sliding by the same percentage.

Dateline Resources (ASX:DTR) jumped 17%, while Northern Minerals (ASX:NTU) added 3.2% and Lynas Rare Earths (ASX:LYC) 3.6%. Lithium and iron ore miner Mineral Resources (ASX:MIN) joined the party, climbing 4.6%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DMG | Dragon Mountain Gold | 0.013 | 117% | 1130675 | $2,368,030 |

| CYQ | Cycliq Group Ltd | 0.004 | 100% | 16315854 | $921,033 |

| 1AE | Aurora Energy Metals | 0.077 | 54% | 2184444 | $8,953,187 |

| ECT | Env Clean Tech Ltd. | 0.003 | 50% | 311236 | $8,030,871 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 250000 | $3,253,779 |

| MEL | Metgasco Ltd | 0.003 | 50% | 128627 | $3,674,173 |

| RDS | Redstone Resources | 0.004 | 33% | 2000000 | $3,102,802 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 70872 | $4,778,344 |

| LKY | Locksley Resources | 0.14 | 33% | 34589399 | $19,250,000 |

| PNN | Power Minerals Ltd | 0.078 | 32% | 2760510 | $8,517,795 |

| AON | Apollo Minerals Ltd | 0.009 | 29% | 150000 | $6,499,198 |

| MGU | Magnum Mining & Exp | 0.009 | 29% | 4108571 | $16,226,260 |

| PIL | Peppermint Inv Ltd | 0.0025 | 25% | 200090 | $4,602,180 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 4040000 | $18,739,398 |

| GBE | Globe Metals &Mining | 0.055 | 25% | 995968 | $30,564,732 |

| JLL | Jindalee Lithium Ltd | 0.485 | 23% | 80701 | $31,548,984 |

| RR1 | Reach Resources Ltd | 0.011 | 22% | 1316637 | $7,869,882 |

| IR1 | Irismetals | 0.11 | 22% | 980610 | $16,016,344 |

| CBL | Control Bionics | 0.045 | 22% | 148156 | $10,900,611 |

| SPG | Spc Global Holdings | 0.4 | 21% | 116060 | $63,684,021 |

| SRI | Sipa Resources Ltd | 0.018 | 20% | 787615 | $7,807,469 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 4221257 | $11,243,383 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 661184 | $13,474,426 |

| DTM | Dart Mining NL | 0.003 | 20% | 8039329 | $2,995,139 |

| PXX | Polarx Limited | 0.012 | 20% | 11153225 | $23,755,010 |

In the news…

Dragon Mountain Gold (ASX:DMG) has wiped out a convertible loan from October 2024 with a new loan provided by an unrelated major shareholder, ticking off the interest at the same time.

With its books in better shape, DMG has more flexibility to pursue fund raising efforts and look at new opportunities for acquisitions.

Aurora Energy Metals (ASX:1AE) is rubbing its hands together over a potential US$16 million payout of Eagle Energy Metals’ shares, as Eagle moves to list on the Nasdaq via a SPAC merger with Spring Valley Acquisition Corp.

Eagle holds an option over 1AE’s Aurora uranium project in Oregon – if the deal goes through, 1AE will be entitled to a 1% royalty on future uranium production with some milestone payments on the table to boot.

Locksley Resources (ASX:LKY) added $5.3m to the war chest after closing out a heavily oversubscribed share placement, featuring Tribeca Investment Partners as a cornerstone player.

Management says it’s a tick of approval for its US critical minerals strategy, with a dozen new institutional investors joining the ledger. The funding will go to drilling high-grade antimony and rare earths at its Mojave project in California, and advancing downstream permitting in the US.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.006 | -40% | 6494637 | $1,015,864 |

| EDEDA | Eden Inv Ltd | 0.022 | -27% | 158486 | $6,164,822 |

| PLG | Pearlgullironlimited | 0.011 | -27% | 5182 | $3,068,127 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 85632 | $9,673,198 |

| GMN | Gold Mountain Ltd | 0.057 | -25% | 735124 | $9,280,558 |

| NAG | Nagambie Resources | 0.013 | -24% | 708816 | $13,656,140 |

| AIV | Activex Limited | 0.01 | -23% | 509846 | $2,801,534 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 27966263 | $7,051,062 |

| MOH | Moho Resources | 0.004 | -20% | 200000 | $3,727,070 |

| OEL | Otto Energy Limited | 0.004 | -20% | 3181510 | $23,975,049 |

| TMK | TMK Energy Limited | 0.002 | -20% | 75548 | $25,555,958 |

| TMX | Terrain Minerals | 0.002 | -20% | 611996 | $6,329,536 |

| BDM | Burgundy D Mines Ltd | 0.027 | -18% | 2120163 | $46,903,965 |

| OKJ | Oakajee Corp Ltd | 0.048 | -17% | 359273 | $5,303,870 |

| ADY | Admiralty Resources. | 0.005 | -17% | 250000 | $15,776,876 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 2150809 | $11,104,423 |

| FAU | First Au Ltd | 0.005 | -17% | 2100000 | $12,457,748 |

| PRM | Prominence Energy | 0.0025 | -17% | 84000 | $1,459,411 |

| SLZ | Sultan Resources Ltd | 0.005 | -17% | 169954 | $1,566,501 |

| CHR | Charger Metals | 0.05 | -15% | 171504 | $4,567,795 |

| IRD | Iron Road Ltd | 0.028 | -15% | 47500 | $27,412,862 |

| DKM | Duketon Mining | 0.125 | -14% | 230177 | $17,749,679 |

| RPG | Raptis Group Limited | 0.165 | -13% | 543861 | $66,630,122 |

| AQX | Alice Queen Ltd | 0.0035 | -13% | 50000 | $5,538,785 |

| KRR | King River Resources | 0.007 | -13% | 167319 | $11,708,696 |

IN CASE YOU MISSED IT

Phase 1 drilling at Antipa Minerals’ (ASX:AZY) Minyari Project in WA’s Paterson Province has delivered new gold-copper zones and extended several existing deposits.

Asra Minerals (ASX:ASR) has completed a 23-hole reverse circulation drilling program at the Challenge prospect building on previous shallow gold hits.

Everest Metals Corporation (ASX:EMC) has validated the presence of further gold mineralisation beyond the established resource at its Mt Dimer Taipan project northeast of Kalgoorlie.

Aura Energy (ASX:AEE) has signed two key agreements for the future sale of uranium from its Tiris project in Mauritania.

Magmatic Resources (ASX:MAG) have locked in a $3.5 million exploration budget with joint venture partner Fortescue (ASX:FMG).

MoneyMe closed FY25 strong and heads into FY26 with strong operating cash flows, steady growth and AI firepower.

Redcastle Resources’ (ASX:RC1) scoping study has indicated a two-stage open pit at Queen Alexandra could generate early cash flow of up to $15m.

Zenith Minerals (ASX:ZNC) has started more drilling at its consolidated Dulcie project in Western Australia to grow gold resources.

DigitalX (ASX:DCC) has delivered a strong June quarter and made a decisive strategic pivot, doubling down on Bitcoin as a core treasury asset.

Trading halts

Akora Resources (ASX:AKO) – cap raise

Altair Minerals (ASX:ALR) – project acquisition and cap raise

Ballymore Resources (ASX:BMR) – cap raise

Infini Resources (ASX:I88) – cap raise

Macro Metals (ASX:M4M) – cap raise

Nutritional Growth Solutions (ASX:NGS) – cap raise

Perpetual Resources (ASX:PEC) – cap raise

Silver Mines (ASX:SVL) – cap raise

Variscan Mines (ASX:VAR) – cap raise

At Stockhead, we tell it like it is. While Locksley Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.