CLOSING BELL: ASX caps off good week as emerging companies index rises 1.27pc

Pic: Getty Images

- ASX gains 0.78% while the emerging companies index rises 1.27%

- Ethereum and bitcoin head higher on back of US court ruling

- Amaero selects US over UAE for titanium manufacturing facility

Local markets continued to build on this week’s gains. The S&P ASX 200 benchmark was ~0.4% higher by lunch time, before closing 0.78% higher.

The S&P ASX Emerging Companies index (XEC) – a benchmark for Australia’s micro-cap companies – was also up today, closing 1.27.% higher.

Overnight, the Dow was up 0.1%, the S&P 500 rallied by 0.85%, while the tech-heavy Nasdaq surged 1.85% led by tech stocks.

US microchip stocks gained with Nvidia’s share price reaching record levels, while Amazon also hit a 10-month high after reporting record sales during its Prime Day event.

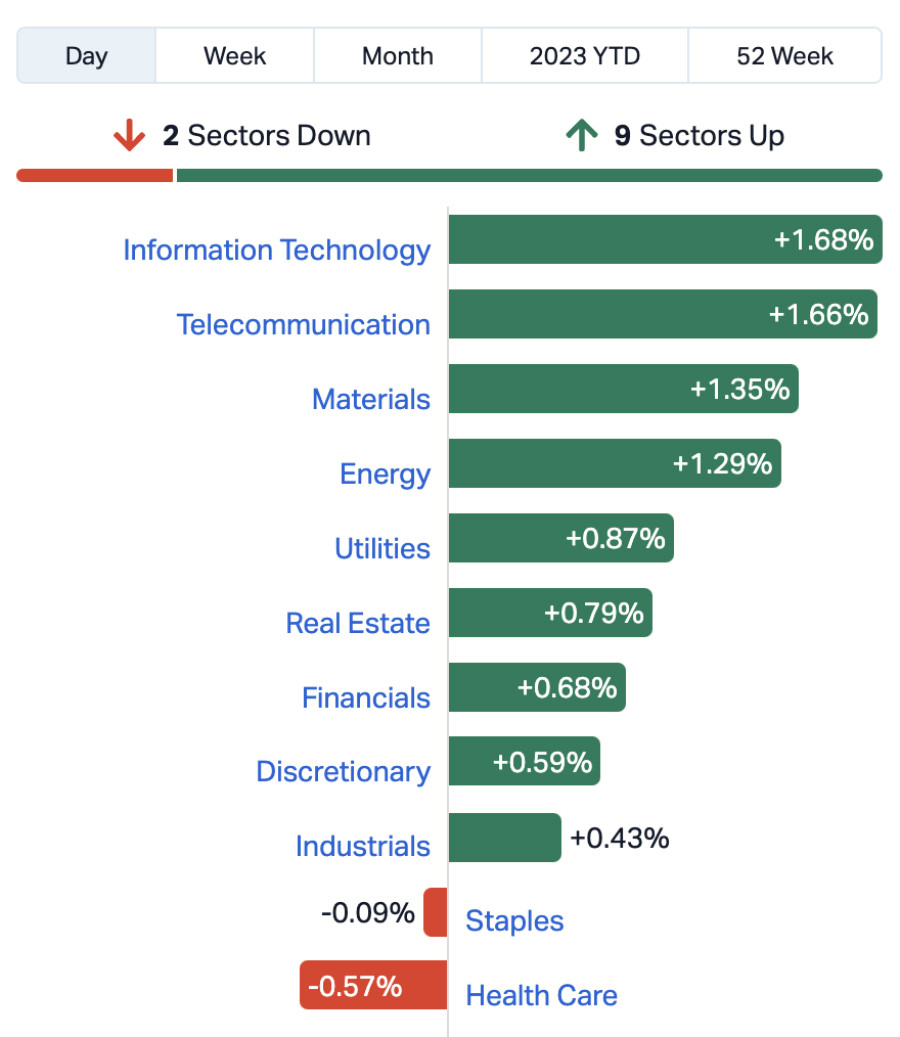

Info tech was the leading sector on the ASX today. At the end of the day, the ASX’s 11 sectors looked like this:

NOT THE ASX

Michelle Bullock will become the first Reserve Bank of Australia Governor with her appointment announced today following months of speculation about incumbent Philip Lowe’s future.

Bullock, who is the RBA’s deputy governor and was widely tipped to take over the top job, is set to assume leadership in what has been described as a once-in-a-generation overhaul of the central bank.

She faces the additional challenge of overseeing the RBA during a time of intense scrutiny due to 12 interest rate hikes since May 2022 as the bank responded to higher inflation, which have put pressure on households and markets.

Crypto is also making headlines today. Ethereum has experienced a notable surge, climbing 7% and surpassing the $2000 mark for the first time in a month.

The increase has coincided with a broader rally in risk assets and the USD’s decline to a 15-month low against major currencies.

Bitcoin is also benefiting from the positive sentiment, as the leading cryptocurrency saw a 3.8% gain, reaching $31,450.

The rally is largely attributed to a US court ruling involving the crypto company Ripple and the regulatory body, the Securities and Exchange Commission (SEC).

Stockhead’s Gregor Stronach dives into the case in Mooners and Shakers: XRP’s frothing and Gensler’s left fuming by landmark US court decision

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| 1CG | One Click Group Ltd | 0.016 | 78% | 77,974,547 | $5,526,638 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 2,254,486 | $15,642,574 |

| CCO | The Calmer Co Int | 0.003 | 50% | 1,661,847 | $1,128,155 |

| YPB | YPB Group Ltd | 0.004 | 33% | 1,000,000 | $2,230,384 |

| 3DA | Amaero International | 0.145 | 32% | 928,120 | $45,852,973 |

| CUF | Cufe Ltd | 0.018 | 29% | 2,265,656 | $13,525,573 |

| DMG | Dragon Mountain Gold | 0.009 | 29% | 386,210 | $2,762,702 |

| ELE | Elmore Ltd | 0.009 | 29% | 5,550,247 | $9,795,687 |

| EQS | Equity Story Group | 0.05 | 25% | 65,000 | $1,624,592 |

| NOU | Noumi Limited | 0.125 | 25% | 233,132 | $27,710,932 |

| RMX | Red Mount Min Ltd | 0.005 | 25% | 5,843,805 | $9,087,404 |

| DTC | Damstra Holdings | 0.135 | 23% | 1,056,399 | $28,346,603 |

| MVP | Medical Developments | 1.4875 | 22% | 416,885 | $104,860,788 |

| GRX | Greenx Metals Ltd | 1.07 | 22% | 121,315 | $235,553,506 |

| ICI | Icandy Interactive | 0.052 | 21% | 2,260,882 | $57,714,844 |

| PNM | Pacific Nickel Mines | 0.072 | 20% | 63,948 | $24,564,960 |

| PAB | Patrys Limited | 0.012 | 20% | 3,028,761 | $20,572,684 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 97,459 | $65,333,512 |

| VKA | Viking Mines Ltd | 0.012 | 20% | 1,663,998 | $10,252,584 |

| VRC | Volt Resources Ltd | 0.012 | 20% | 13,633,510 | $39,394,239 |

| TMB | Tambourah Metals | 0.215 | 19% | 355,314 | $7,608,457 |

| COB | Cobalt Blue Ltd | 0.465 | 19% | 2,754,452 | $144,322,437 |

| MDI | Middle Island Res | 0.025 | 19% | 3,617,579 | $2,570,783 |

| GWR | GWR Group Ltd | 0.096 | 19% | 272,816 | $26,018,549 |

| KED | Keypath Education | 0.505 | 17% | 13,411 | $92,007,585 |

| NEU | Neuren Pharmaceuticals | 13.64 | 17% | 1,749,959 | $1,473,224,469 |

Amaero International (ASX:3DA) says ‘financial, operational and strategic advantages’ led the company to select Tennessee in the US over the UAE for its titanium powder manufacturing facility.

3DA has signed a lease to be the sole tenant in 12,100sqm manufacturing facility in Cleveland.

The company said the State of Tennessee acted decisively to coordinate and to commit economic incentives from multiple stakeholders to attract the re-location of its flagship facility, along with 3DA’s research & development and corporate headquarters.

Furthermore the lease payments will be ~75% less than the proposed build-to-suit facility at KEZAD in the UAE. 3AD said as a direct result, it expects to accelerate breakeven operations by 12 months and to reduce working capital needs by $22 million.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.0015 | -25% | 2468463 | $20,529,010 |

| DXN | DXN Limited | 0.0015 | -25% | 1500000 | $3,442,630 |

| TSL | Titanium Sands Ltd | 0.006 | -25% | 785913 | $11,251,183 |

| AWJ | Auric Mining | 0.043 | -23% | 506274 | $7,328,137 |

| FFT | Future First Tech | 0.007 | -22% | 8255660 | $6,433,529 |

| LSR | Lodestar Minerals | 0.004 | -20% | 1170498 | $9,216,987 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 44000 | $19,462,207 |

| SRY | Story-I Limited | 0.004 | -20% | 6546690 | $1,882,024 |

| WFL | Wellfully Limited | 0.004 | -20% | 1681044 | $2,464,721 |

| GMN | Gold Mountain Ltd | 0.0105 | -19% | 33192087 | $25,609,124 |

| HAL | Halo Technologies | 0.105 | -19% | 53789 | $16,834,378 |

| LYK | Lykosmetalslimited | 0.08 | -19% | 49883 | $6,177,600 |

| AN1 | Anagenics Limited | 0.015 | -17% | 336776 | $6,581,159 |

| 1ST | 1st Group Ltd | 0.005 | -17% | 6500 | $8,501,947 |

| IEC | Intra Energy Corp | 0.005 | -17% | 7105373 | $4,234,690 |

| NES | Nelson Resources. | 0.005 | -17% | 96914 | $3,681,566 |

| RML | Resolution Minerals | 0.005 | -17% | 78963 | $7,543,751 |

| 1AG | Alterra Limited | 0.011 | -15% | 6000 | $9,055,183 |

| LNU | Linius Tech Limited | 0.003 | -14% | 49252 | $13,260,767 |

| RIM | Rimfire Pacific | 0.006 | -14% | 900980 | $14,036,713 |

| BCA | Black Canyon Limited | 0.16 | -14% | 100000 | $9,567,424 |

| CWX | Carawine Resources | 0.13 | -13% | 16000 | $29,522,620 |

| 1AD | Adalta Limited | 0.026 | -13% | 5101920 | $13,245,789 |

| IBX | Imagion Biosys Ltd | 0.02 | -13% | 56312401 | $26,856,313 |

| KZA | Kazia Therapeutics | 0.135 | -13% | 242461 | $35,344,513 |

LAST ORDERS

NSW-focused tin, gold, and copper explorer Sky Metals (ASX:SKY) inked an option to sell its Galwadgere project to pre-IPO explorer Burrendong Minerals (BML).

SKY said divestment of the non-core asset will allow it to continue to focus on resource expansion drilling and mine scoping studies at the Tallebung project and further work at the new Narriah project.

Tietto Minerals (ASX:TIE) founder and former MD Dr Caigen Wang will join the Aldoro Resources (ASX:ARN) board as a non-executive director.

Wang led TIE from ASX listing as an explorer to Africa’s newest gold producer at the 200,000 oz per annum Abujar Gold Mine in Côte D’Ivoire.

“I have known Caigen professionally for many years and have followed his success in taking the Abujar gold project from discovery through to commercial production,” ARN chairman Troy Flannery said.

“Caigen’s professional network in West Africa and Australia is expected to assist Aldoro greatly with its production intentions at both Narndee and Kameelburg.”

TRADING HALTS

Ark Mines (ASX:AHK) – Share placement

Minbos Resources (ASX:MNB) – Offtake agreement

Antisense Therapeutics (ASX:ANP) – Capital raise

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.