Mooners and Shakers: XRP’s frothing and Gensler’s left fuming by landmark US court decision

Coinhead

Coinhead

Morning Coinheads…

It’s a bright, sunny Friday morning in the world of crypto today, as Australia woke to the news that a US judge has ruled, categorically, that XRP is not considered to be a security, almost but not quite bringing to a close a long, sporadically-interestig court battle that had been looming over the crypto industry as a whole.

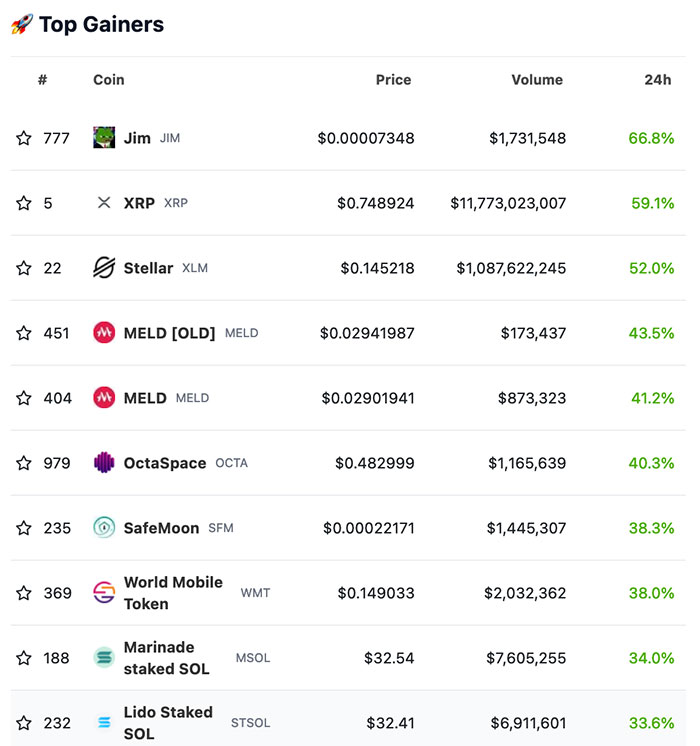

This is huge news – but before I do my earnest best to explain it to you, all the while quietly certain that we’re all gonna end up feeling like we know less than when we started – BTC is up 3.4%, ETH is up around 6.9%, Cardano is up 23.5%, and XRP is (at the time writing) up 72.4% for the past 24 hours.

The rest of it looks like this:

With the overall crypto market cap at US$1.3 trillion, up around 1.0% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The meat of this morning’s main story is simple: For quite some time now, there’s been a barney brewing between the broader crypto community (not all of it… but most of it, definitely) and the United States Securities and Exchange Commission Mega-Goblin, Gary Gensler.

Gensler has been on a mission for ages to have XRP – and, by extension, a bunch of other coins and tokens including ETH – classified as securities in the US, on the basis that he thinks they are.

Were they to be classified as securities, they would the fall under the purview of the SEC, thus allowing Gensler to prove to his schoolyard bullies that he meant it when he tearfully told them “you can only push me so far, you fiends!” back in the early 1800s or whenever it happened.

I don’t know. I wasn’t there.

However, in a humiliating defeat overnight, US judge Analisa Torres of the US District Court of the Southern District of New York – (before you ask, I did check it and yes, all of those words need to be in there as many times as they are) – has ruled that while Ripple’s XRP token is a security when offered for institutional sales, it is not a security “when sold to the broader public termed as programmatic sales”.

And there is, of course, being the US, an appeals process to go through.

BUT… to reach that landmark decision, the judge applied something called The Howey Test, which XRP has apparently failed with flying colours.

Well, Johnny, I’m glad you’ve asked – the Howey Test was devised by the US Supreme Court as a means of figuring out if a particular transaction constituted an investment contract or not, in an attempt to stop American HyperCapatalsts from sneaking up behind each other and punching their opponents in the back of the head.

If a transaction passes the Howey test, it’s considered to be a security, and therefore is subject to specific disclosure and regulatory requirements, of which there are many, about which I have neither the time nor the patience to go into right now.

To pass the test, the transaction needs to check four boxes:

XRP failed the test, sez the judge, because while there was expectation of profit for investors (…duh), it wasn’t expected to come “from the activities of others” – more specifically, retail buyers who purchase XRP from a digital asset exchange aren’t expecting to see gains directly from anything Ripple Labs is doing, or has done.

And that’s because XRP is Magic Internet Money, and when you buy some of it online, you have precisely zero idea who you’re buying it from – but it’s almost certainly not from Ripple, and try not to think too hard about it much more, in case you break it.

Surface-level, it means XRP (for now) is “back on the menu”, apparently – XRP’s value shot up around 75% to US$0.80 in the wake of the news, dragging the broader crypto market higher by a monstrous US$72 billion.

Looking longer term, it means that there’s now a test case against which other coins can be examined to see which side of the security fence they land – and that’s most likely going to hinge quite heavily on the manner in which each individual coin was brought to market.

Any questions around Bitcoin have already been answered – it’s not a security, because Gary Said So, That’s Why – but other majors including ETH are potentially going to be classed as securities because they were launched through ICOs, when the devs were selling coins directly to the public.

And now, having reached the limits of my understanding of this end of a market for which I hold thinly-veiled contempt, I suggest that if you would like to know more about this story, head on over to Twitter where everybody is still losing their god-damned minds.

Yes. I’ve got time to tell you one more thing, but it could be something Very Bloody Important for you to know.

Analysis from international crypto tax platform Koinly, and Australia’s second-largest crypto exchange Swyftx, has found that Aussie crypto users could be in for a very rude shock when they get around to dropping off their paperwork to the ATO this year.

The bean-counters at Koinly and Swyftx say locals are facing capital gains on up to $10 billion of realised and unrealised profits from the last tax season.

That’s $10 billion collectively, not each. Just so we’re clear.

Anyway – it’s not great news for the shockingly high number of Aussie crypto-dabblers who have next to no idea what the tax implications are, now that Bitcoin’s back from its time in the toilet the past couple of tax years.

But it could be very welcome news for the ATO in the form of around $1 billion in revenue it wasn’t expecting, which will almost certainly help the nation offset the skyrocketing costs associated with efforts to teach Prime Minister Anthony Albanese to say “Australian Government” without sounding like he’s swallowing his (or anyone else’s) tongue in the process.

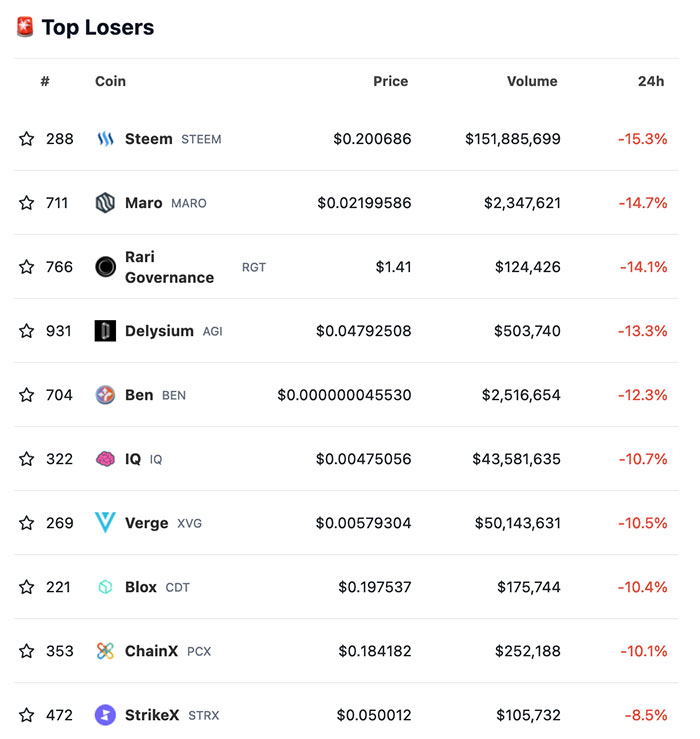

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

On a day with such momentous, market-jolting (in a good way) news, it’s hard to fathom how anything might be falling steeply… yet, here we are.

Last night’s winners and losers appear below.

PUMPERS

DUMPERS