Closing Bell: Another gloomy day for tech stocks as traders await US CPI data

ASX edges lower as profit-taking continues. Picture via Getty Images

- ASX drops as tech stocks continue to slide

- Gold rebounds ahead of US inflation data

- South32 falls as Mozambique unrest disrupts production

The ASX extended its losses on Wednesday following the weak sentiment from Wall Street overnight.

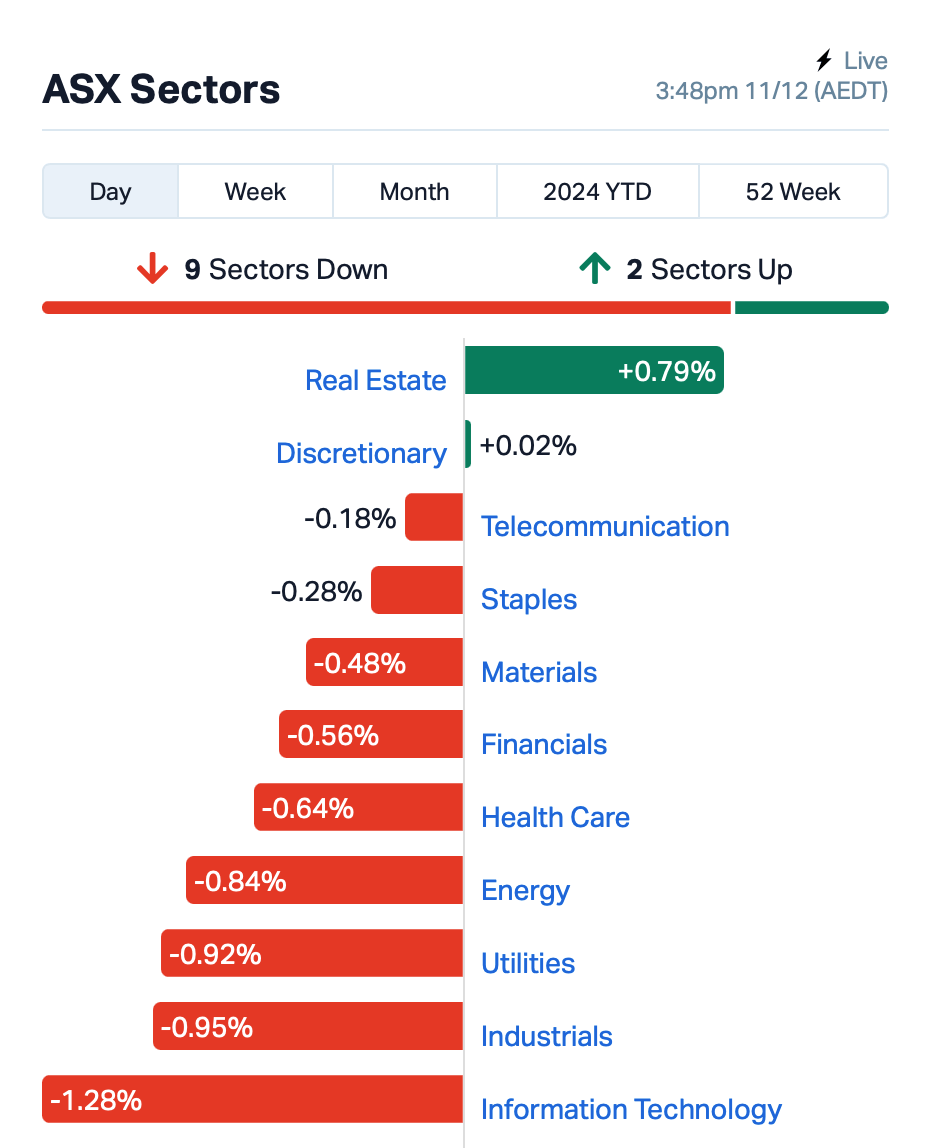

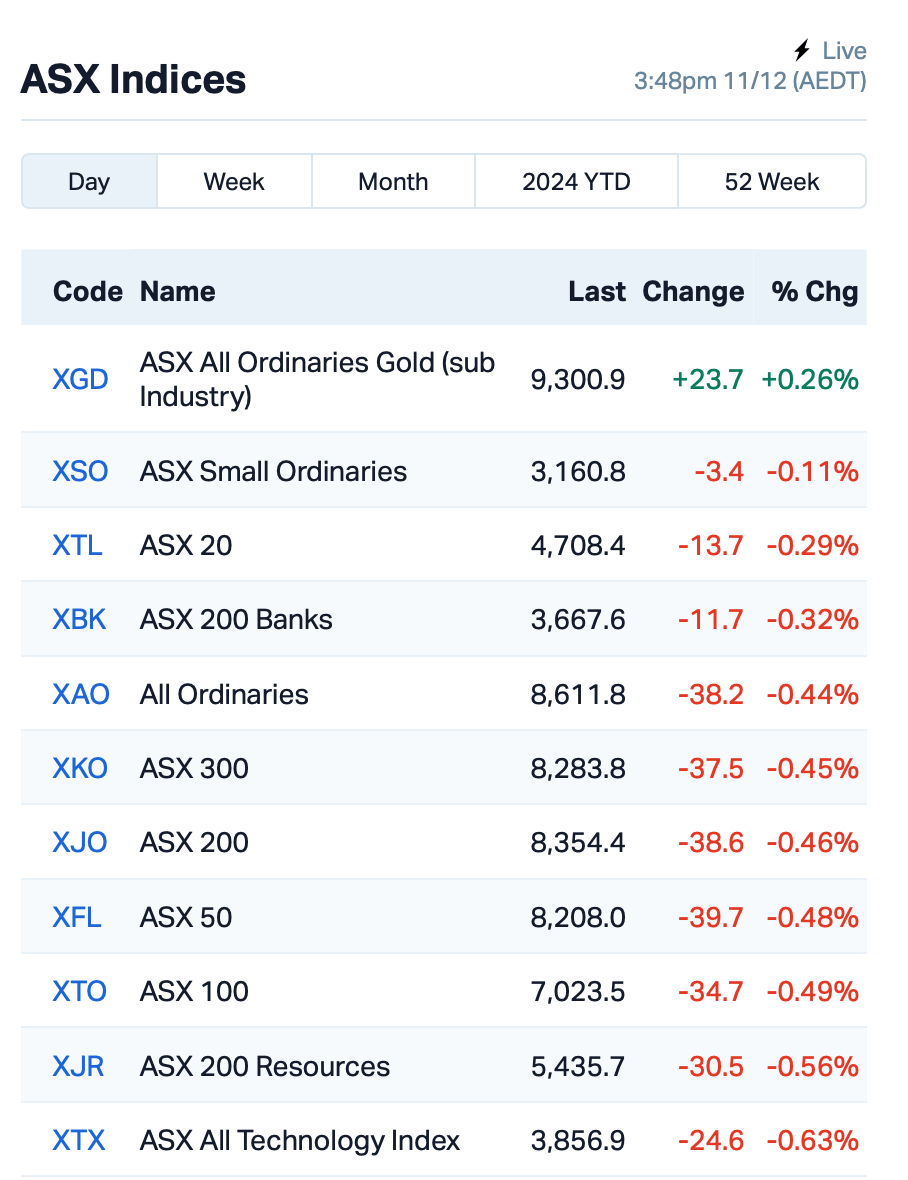

At the close, the benchmark S&P/ASX 200 was down by 0.47%, with tech once again the worst sector following its 4% retreat yesterday.

Traders are on edge ahead of Thursday’s US inflation data, which is a crucial piece of the puzzle in the Federal Reserve’s decision on whether to cut rates at its final meeting of 2024 on December 17.

In the commodities market, gold briefly rebounded above US$2,700 an ounce after hitting an all-time high of $2790 in October.

Across the region, Asian markets were mixed today as China stepped up its efforts to scrutinise foreign tech companies, following the announcement of a probe into Nvidia yesterday.

And back to the ASX – this is where things stood at around 15:45 AEDT:

In the larger end of town, tech heavyweight WiseTech Global (ASX:WTC) was down 2.5%, while Xero (ASX:XRO) slipped 1.5%.

Mining company South32 (ASX:S32) fell 5% after it withdrew its production forecast for its Mozal aluminium smelter in Mozambique.

Widespread protests and violence over disputed elections in the country have disrupted transport to the plant. Though the company says its workforce is safe, the unrest has caused uncertainty over its production targets.

Meanwhile in the healthcare space, Chemist Warehouse could list on the ASX by as early as February 2025 after a $29 billion merger with Sigma Healthcare (ASX:SIG), pending shareholder voting on certain resolutions. SIG’s shares fell 0.2%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | 50% | 275,092 | $703,362 |

| GGE | Grand Gulf Energy | 0.003 | 50% | 100,000 | $4,900,774 |

| NES | Nelson Resources. | 0.003 | 50% | 2,082,900 | $4,343,855 |

| NXD | Nexted Group Limited | 0.170 | 48% | 1,532,101 | $25,474,429 |

| IBG | Ironbark Zinc Ltd | 0.004 | 40% | 1,255,175 | $4,584,120 |

| AXL | Axel Ree Limited | 0.095 | 36% | 21,928,470 | $6,363,131 |

| GCR | Golden Cross | 0.004 | 33% | 2,484 | $3,291,768 |

| JAV | Javelin Minerals Ltd | 0.004 | 33% | 5,480,224 | $16,559,796 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 506,000 | $9,863,776 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | 3,566 | $1,447,073 |

| EMH | European Metals Hldg | 0.170 | 31% | 81,848 | $26,967,812 |

| HOR | Horseshoe Metals Ltd | 0.013 | 30% | 534,163 | $6,632,817 |

| VR1 | Vection Technologies | 0.029 | 30% | 14,618,705 | $29,710,579 |

| APC | Aust Potash Ltd | 0.023 | 28% | 774,008 | $1,831,601 |

| AAU | Antilles Gold Ltd | 0.005 | 25% | 4,270,264 | $7,431,504 |

| PUA | Peak Minerals Ltd | 0.009 | 21% | 6,543,043 | $17,479,772 |

| TFL | Tasfoods Ltd | 0.017 | 21% | 104,746 | $6,119,337 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 189,296 | $6,267,791 |

| CZN | Corazon Ltd | 0.003 | 20% | 250,000 | $1,919,764 |

| HE8 | Helios Energy Ltd | 0.012 | 20% | 1,542,327 | $26,040,494 |

| TEM | Tempest Minerals | 0.006 | 20% | 100,000 | $3,136,349 |

Antilles Gold (ASX:AAU) has updated the scoping study for the Nueva Sabana gold-copper mine in Cuba. The revised plan excludes mining in the fifth year and shows a slight drop in net profit but a 2% increase in IRR. Initial production will focus on gold and copper-gold concentrates, with an offtake agreement being negotiated to fund construction.

Corazon Mining (ASX:CZN) has retracted its December 10 announcement about the strategic expansion of the MacBride Base & Precious Metal Project in Canada. The company found that the historical exploration data provided was incomplete and unreliable. However, it has expanded the MacBride project area from 26km² to 56km², covering a 14km strike length along the MacBride/Wellmet trend, with new mining claims awaiting approval.

Helios Energy (ASX:HE8) has secured $150,000 in short-term loan funding to complete an updated resource report for its Presidio oil and gas project in Texas. The loans, provided by the company’s directors, personnel, and Gleneagle Securities, are in addition to the undrawn $500,000 facility from Gleneagle. The report will highlight the potential of Helios’ large acreage in the region.

NextEd Group (ASX:NXD) has secured exclusive rights to re-enrol around 1800 students from International House (IH) after IH entered administration. This includes both English language and vocational students across Sydney, Melbourne, Adelaide and the Gold Coast.

NextEd will also acquire relevant course materials, but will not be acquiring IH’s business or employees. The move is expected to give NextEd an additional $6-7 million in revenue for the second half of FY25.

Axel REE (ASX:AXL) has announced record high assay results from its Caladão Project in Brazil, including grades of 28,321ppm TREO and 7606ppm MREO.

The results, from a 2600m drilling program, show strong, near-surface mineralisation with impressive lateral continuity across a 30km² area, which represents just 10% of the total target area. The company believes these high grades highlight the scalability of the deposit.

Dynamic Metals (ASX:DYM) has defined strong drill targets at the Cognac West gold prospect in WA, based on recent soil sampling and rock chip assays, including results of up to 2,040g/t gold.

The company has refined high-grade zones with 755 infill soil samples, which will guide drilling in early 2025. Dynamic said it’s well-funded with $5.3 million in cash as of September 30.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VML | Vital Metals Limited | 0.002 | -33% | 1,074,000 | $17,685,201 |

| CT1 | Constellation Tech | 0.002 | -25% | 201,333 | $2,949,467 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 700,000 | $8,216,419 |

| INF | Infinity Lithium | 0.025 | -24% | 1,234,498 | $15,265,539 |

| EE1 | Earths Energy Ltd | 0.011 | -21% | 1,050,329 | $7,419,499 |

| OLH | Oldfields Holdings | 0.060 | -20% | 100,000 | $15,904,435 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 236,357 | $15,392,639 |

| T3D | 333D Limited | 0.008 | -20% | 33,333 | $1,761,835 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 356,043 | $11,058,736 |

| VEN | Vintage Energy | 0.004 | -20% | 11,846,544 | $8,347,656 |

| ACR | Acrux Limited | 0.033 | -18% | 4,180,503 | $11,628,674 |

| 8VI | 8Vi Holdings Limited | 0.043 | -17% | 1,202 | $2,179,394 |

| KEY | KEY Petroleum | 0.050 | -17% | 8,000 | $1,357,770 |

| AOK | Australian Oil. | 0.003 | -17% | 610,000 | $3,005,349 |

| AUK | Aumake Limited | 0.005 | -17% | 55,000 | $18,064,153 |

| NAG | Nagambie Resources | 0.020 | -17% | 2,400,747 | $19,119,256 |

| MTC | Metalstech Ltd | 0.110 | -15% | 112,326 | $25,680,133 |

| GIB | Gibb River Diamonds | 0.036 | -14% | 80,821 | $9,009,397 |

| CAV | Carnavale Resources | 0.003 | -14% | 1,002,465 | $14,315,764 |

| CCO | The Calmer Co Int | 0.006 | -14% | 13,699,546 | $15,465,705 |

| CVB | Curvebeam Ai Limited | 0.120 | -14% | 233,499 | $44,464,690 |

| PLC | Premier1 Lithium Ltd | 0.006 | -14% | 4,000,000 | $1,405,321 |

IN CASE YOU MISSED IT

Mithril Silver and Gold (ASX:MTH) is launching into the second stage of its 9000m drilling campaign, targeting a resource upgrade in the new year. The company is looking to drill more than 40,000m next year, driven by increasing demand for expansion as it works towards its goal of doubling the current 529,000oz gold equivalent resource.

Nerve-repair company ReNerve (ASX:RNV) is partnering with Bahrain-based Union MediScience B.S.C to drive its international expansion. The agreement includes sales and marketing of ReNerve’s flagship product, the NervAlign Nerve Cuff, under an exclusive distribution arrangement for the Middle East.

Wellnex (ASX:WNX) is aiming to list on the London Stock Exchange early in the new year, buoyed by the company achieving its strongest November on record, with sales of $3.16 million. The company is developing a range of brands spanning medical cannabis, pain relief and vitamins.

Sunshine Metals (ASX:SHN) has boosted its Ravenswood Consolidated resource by 28% to 904,000oz AuEq. The growth is thanks to successful drilling at Liontown, where resources jumped 53%. When drilling resumes in 2025, Sunshine will focus on targeting western extensions of the Liontown mineralisation.

Island Pharmaceuticals (ASX:ILA) has secured a key US patent for its lead drug candidate, ISLA-101, designed to reduce symptoms of dengue fever.

“Method of viral inhibition” was granted by the United States Patent and Trademark Office, and covers the use of ISLA-101 to limit the severity of symptoms through its administration.

It adds to a growing IP portfolio for Island, which includes Australia, Canada, Brazil and Singapore.

ADX Energy (ASX:ADX) is monitoring well pressure, sampling, and analysing fluid data at the Welchau-1 discovery in Upper Austria to determine the next steps. Results are expected early in the new year and will guide decisions on further stimulation and testing operations.

At Stockhead, we tell it like it is. While Mithril Silver and Gold, ReNerve, Wellnex, Sunshine Metals, Island Pharmaceuticals and ADX Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.