ALL you need to know about China’s return in 2023 and the 35 ASX names most exposed to success

News

News

The world’s best foreign minister Penny Wong has said yes please to an invite from her Chinese counterpart Wang Yi this week.

And the Emperor was pleased.

So was Aussie businessman Jason Yat-Sen Li, who’s now Strathfield MP.

My statement on Australian Foreign Minister Penny Wong’s visit to China. This visit, the first by any Australian Government Minister since 2019, gives us hope that the worst days of the bilateral relationship are over. pic.twitter.com/lc6jWzGb0R

— Jason Yat-Sen Li MP (@jasonyatsenli) December 21, 2022

Down in Melbourne, IG’s regional specialst Hebe Chen told Stockhead that out of all the ASX sectors, those that suffered the worst pain from the bitter Australia-China bilateral breakdown (also utterly crucial for China’s own interests, ie: exports, mining), are the same which will be first to enjoy the light at the end of the tunnel.

“This potential light is stemming from the sour reality for President Xi that his nation is facing its biggest challenge in decades hence the timing is not ideal for him to deal with extra conflicts but rather fix the crack before it’s too late.

However, Chen warns it’s also too optimistic to expect the bilateral relationship between China and Australia to be smooth sailing moving forward.

“China’s ascending threat to the APAC region’s geopolitical stability has seen countries like Australia and Japan upsizing their military budget substantially in 2022.

For the years to come, the bilateral relationship between China and most of the Western countries including Australia will be dominated by its tensions with Taiwan, and that primarily depends on Xi’s ambition over the island in his third term,” Chen told Stockhead.

“This is the card that he holds close to his chest, meaning the concern and unpredictability in the region will only keep elevating.”

The two FM’s met on Wednesday Sydney time in the first formal meeting between the old buddies come frosty frenemies in 4 sad years.

Penny and Wang Yi got together in Beijing, following some probably nice messages between their bosses, as once loving trading partners seek to become kinder diplomatic neighbours.

The once steamy bilateral relationship – now as cold and silent as the forbidding depths of space – has been screaming for a show of warmth since 2018, when the 5th Australia-China Foreign and Strategic Dialogue in Beijing quickly descended into this scene.

Today I joined State Councilor Wang Yi for the 6th Australia-China Foreign and Strategic Dialogue.

The meeting is another step forward as we stabilise the relationship between our two countries. pic.twitter.com/8w8zXYNaNm

— Senator Penny Wong (@SenatorWong) December 21, 2022

That was when a new, abrasive and malevolent China emerged. One Australian officials were ill-equipped to deal with.

It wasn’t long until – sans warning – an increasingly offended China slapped some $20bn of targeted sanctions on sectors like wine (thanks for coming Treasury Wines Estate (ASX:TWE), perhaps a little of the coal and of course, lobsters.

However, after the initial shock (and to Beijing’s obvious outrage) the only lessons we learned was the danger of over-reliance on a single, unreliable economic partner and how to quickly diversify our export markets.

Even more infuriating for the Chinese Communist Party, the move helped upend global commodity markets. The iron ore and the coking coal most particularly desired by China, suffered what BHP et al would’ve marveled at as the poetry of economic justice.

Peak competitors like Brazil’s Vale just couldn’t get their ships together and the stunning, record commodity prices and friendly new global buyers more than offset the Chinese tariffs.

That was a lucky break which the gloating government of Scott Morrison and Treasurer Josh Frydenberg mistook for the poetry of just being too clever by half. Frydenberg in particular began to burn every cultural bridge in sight with a petulant triumphalism which made it impossible for Chinese authorities to give a single lobster of concession.

China likes synchronicity and it just so happens that the 6th Australia-China Foreign and Strategic Dialogue will welcome Penny on the 50th anniversary of the establishment of diplomatic relations between the two nations.

By April 2020 then Prime Minister for Everything was urging the World Health Organization (WHO) to send “weapons inspectors” into Wuhan and go find a COVID-19 smoking gun while at the same time hurling insults and clandestinely forming AUKUS, the secret security, techno-nuclear alliance with the poms and the Americans.

I could go on here.

We banned Chinese telco giant Huawei from our 5G networks, they arrested the celebrity Australian newsreader Cheng Lei and the lovely writer and academic Yang Hengjun.

Both are still, terrifyingly, locked up and far from any kind of independent judicial future.

Wong and Anthony Albanese, the punchy wee prime minister as of May, have taken an early crack at getting China ties back on track without yileding on the issues which have become the real stocks in the mud – like maintaining steady pressure on the trade fracture and stiffening resolve on asking for the no strings release of Aussie citizens Lei and Yang.

The new PM met with China’s president Xi Jinping a few months back. He didn’t cop any of the insults directed at Canada.

But even better was the quiet welcome Wang Yi gave Penny in New York not long after Albo’s ascension.

Economically, the star’s could be aligning just as the political equinox arrives. Which would be stellar for all involved

Meantime, ex-Goldman, now IG Markets’ man in Sydney, Tony Sycamore told Stockhead local officials are turning their attention to lifting domestic consumption, to supercharge growth after years of zero-Covid policies.

“After an initial burst of China reopening optimism, a more cautious tone is in place as evidence of a bumpy reopening emerges,” Tony told Stockhead.

So everyone should brace for some scary images, because not even China’s techno-control state can stifle the images of tens of millions of infections.

Sycamore says that even disregarding the official numbers (which show a super low case count and even smaller death toll), the simple math shows a lot of the world’s most populated country will get infected.

“Around 60% of the Chinese population is expected to contract Covid over the next three months.”

Chen notes – as Xi did at the CCP’s twice-a-decade congress in October – dark clouds could still threaten China’s economy.

“In light of this, the long-awaited returning demand on the ASX sectors like property, education, travel and those benefited largely from the rise of China in the past decade should be very limited thanks to the “new reality” of the Chinese economy — slower and much more complicated,” according to Chen.

“The slower the growth, the less resources will be available to spend and invest overseas.”

But be that as it may, since last week the usual suspects are making fast with their abaci, now that COVID-zero looks like being consigned to Chinese Communism’s already overflowing dustbin of dumb ideas.

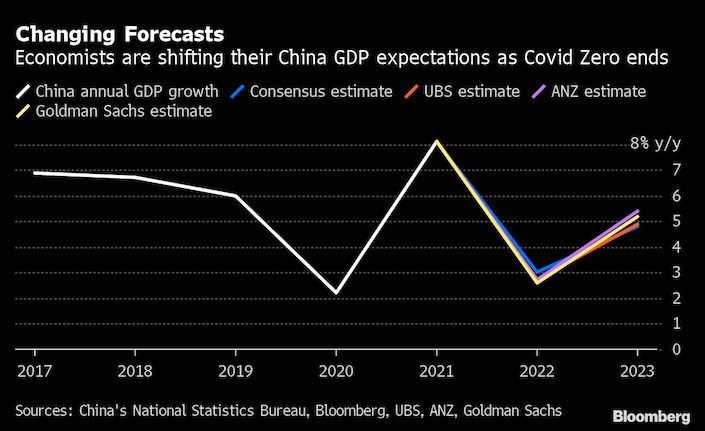

Both the ANZ and UBS have joined Goldman Sachs in upping growth projections for this year and next.

Goldman Sachs says there’s 4 reopening scenarios, with the #3 scenario the most likely:

An immediate, abrupt reopening in a somewhat disorderly manner. This might happen if Chinese officials felt that overall fatigue with controls was so severe that the ability to keep them in place was being undermined.

China launches reopening immediately but manages the pace to cope with the capacity of the health care system — similar to the way other countries reopened.

China reopens in April 2023 after steady preparations at the beginning of next year. This means zero-Covid policy would remain for the short term, so officials are able to prepare to better protect the most vulnerable in the population. This is the baseline GS Research forecast and is expected to be the most likely path forward. In this scenario, Shan forecasts that China’s real GDP growth will rise 1.5 percentage points to 4.5% in 2023, and then to 5.3% in 2024.

China continues to tighten Covid controls substantially in the months ahead, with significant restrictions for much of 2023.

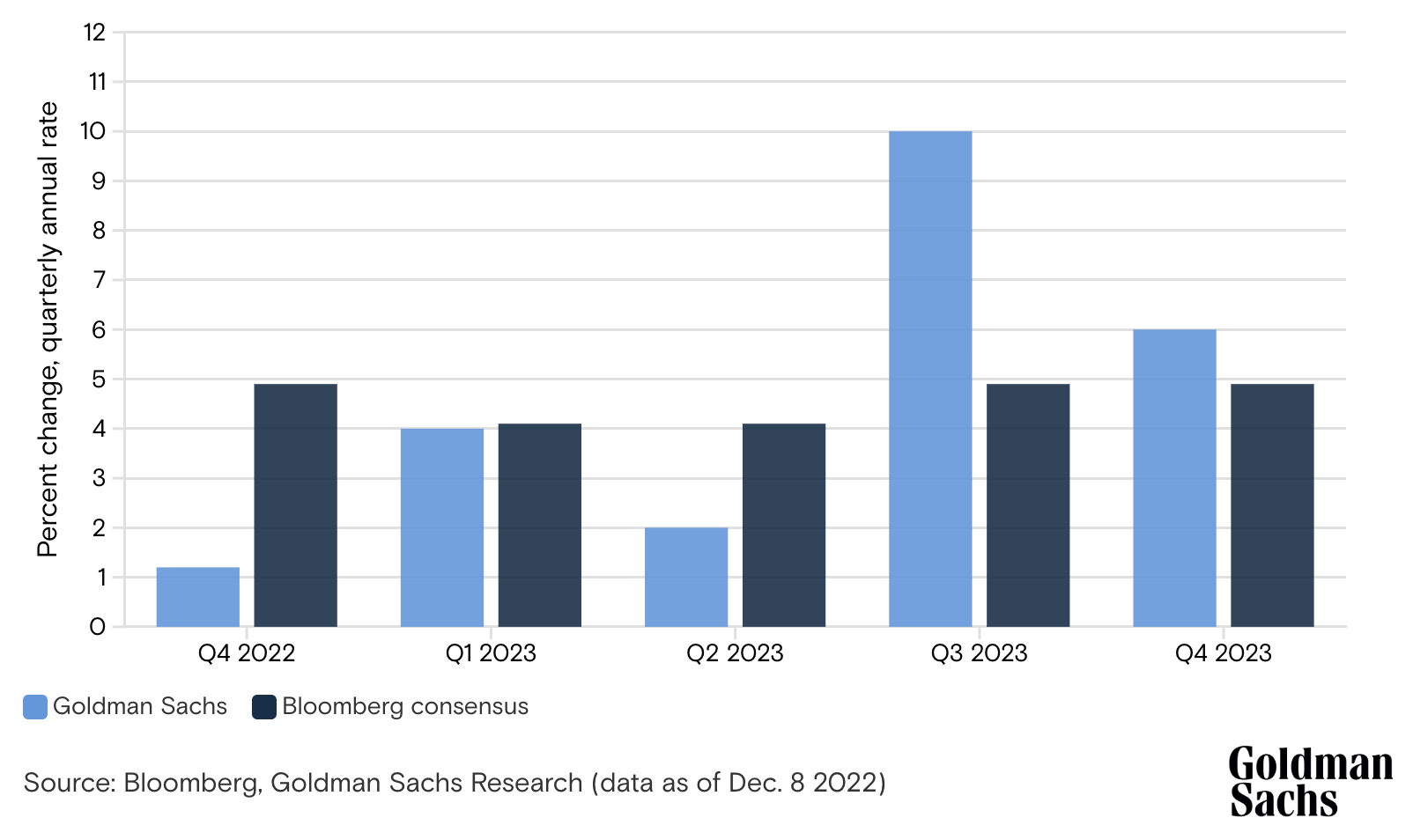

Goldman’s baseline forecast sees a strong rebound in the second half of 2023 after a Q2 reopening, but weakness in the near-term (real GDP)

After trimming forecasts for the near-term as COVID ran wild despite no policy reboot, both the banks’ economist teams have raised the outlook for Chinese GDP in 2023, expecting a sharp upward expansion of circa 5%, with hopes that domestic consumer spend will heighten and business activity will recover as infections subside.

The consensus estimate according to the latest Bloomberg survey is for China’s economy to grow 4.8% next year from an estimated 3% this year.

According to Caixin, China’s top numbers people led by President Xi and his discarded Premier Li Keqiang debated the merits of a 5% GDP growth target for next year at last week’s highly-anticipated but actually rather dull 2-day annual Central Economic Work Conference (CEWC).

Me old mates at Xinhua had this to report about the CEWC, and I guess it all bodes pretty good for Wong, Wang, 2023 and even the ASX.

“The meeting highlighted efforts to stabilize (sic) growth, employment and prices in next year’s policy agenda, pledging to better coordinate pandemic control and economic growth, further push forward reform and opening-up, restore market confidence and expand domestic consumption to promote an overall economic recovery…”

Take a tour of the ASX. There’s a hell of a lot of market cap out there with exposure to the Chinese economy and subject to the CCP’s hitherto increasingly emotional geopolitics.

But now that Xi appears to be forever embedded into all levels of decision-making, it looks like we’re back to Communism’s preferred strong man stability.

That could bode very well for the top of end of town names like Qantas, BHP and Rio.

Because considering some of the crazy own goals the CCP has been scoring against its own economy these last years, getting China-Australian bilateral ties back onside is starting to look like an easy win the party could use.

Earlier this month QAN showed its hand, launching direct services between Sydney and Seoul for the first time in nearly 15 years.

The flagship airline’s now launched new services to almost 30 international destinations, since the country opened its borders – including 8 countries previously not on its pre-COVID network.

For all its culled workforce, cap/hand approaches to government and generally playing possum, the fact is that while competitors fled Chinese skies, Qantas has been careful to keep one paw close to Peking.

Then of course, there’s China’s man in Perth and the direct intravenous supply he provides to the Chinese Steel Association (CSA).

In the wake of last week’s inititation of the China Mineral Resources Group (CMRG), a new state-owned agency set to be the world’s biggest iron ore buyer, as reported by Reuters and Bloomberg, Fortescue was apparently not on the lits of key iron ore providers involved in discussions. But that’s likely a reflection on just how tight FMG founder Andrew Forrest remains with Chinese buyers.

Bloomberg says the CMRG was set up this year to buy raw materials for the country’s giant domestic steel industry, but the new state agency appears to have a broader remit than that as Beijing steps up efforts to increase control over the natural resources needed to feed its economy.

CEWC: (We) must vigorously develop the digital economy and improve regulation. Must support platform enterprises’ role in economic development, job creation, and international competition. Again three pivots: ending zero-covid, property stimulus, and pull back Internet crackdown. pic.twitter.com/Mg7jJ5ncCW

— Shanghai Macro Strategist (@ShanghaiMacro) December 16, 2022

Meanwhile, Fortescue will be there when the next surge in property and infrastructure emerges from the current mire.

Easy money.

In fact, the All Ordinaries’ exposure to China’s – and let’s be frank – inevitable reopening is starting to turn heads.

We’ve done some record whingeing in 2022, but while the Aussie benchmark has lost about 3.45% in the last 12 months, the combined world indices have lost 18%.

The relativity of the ASX to China’s once undeniable economic orbit is now reaping global rewards with global funds finding their way into our two-and-a-half trillion dollar, resources-heavy Top 200 index.

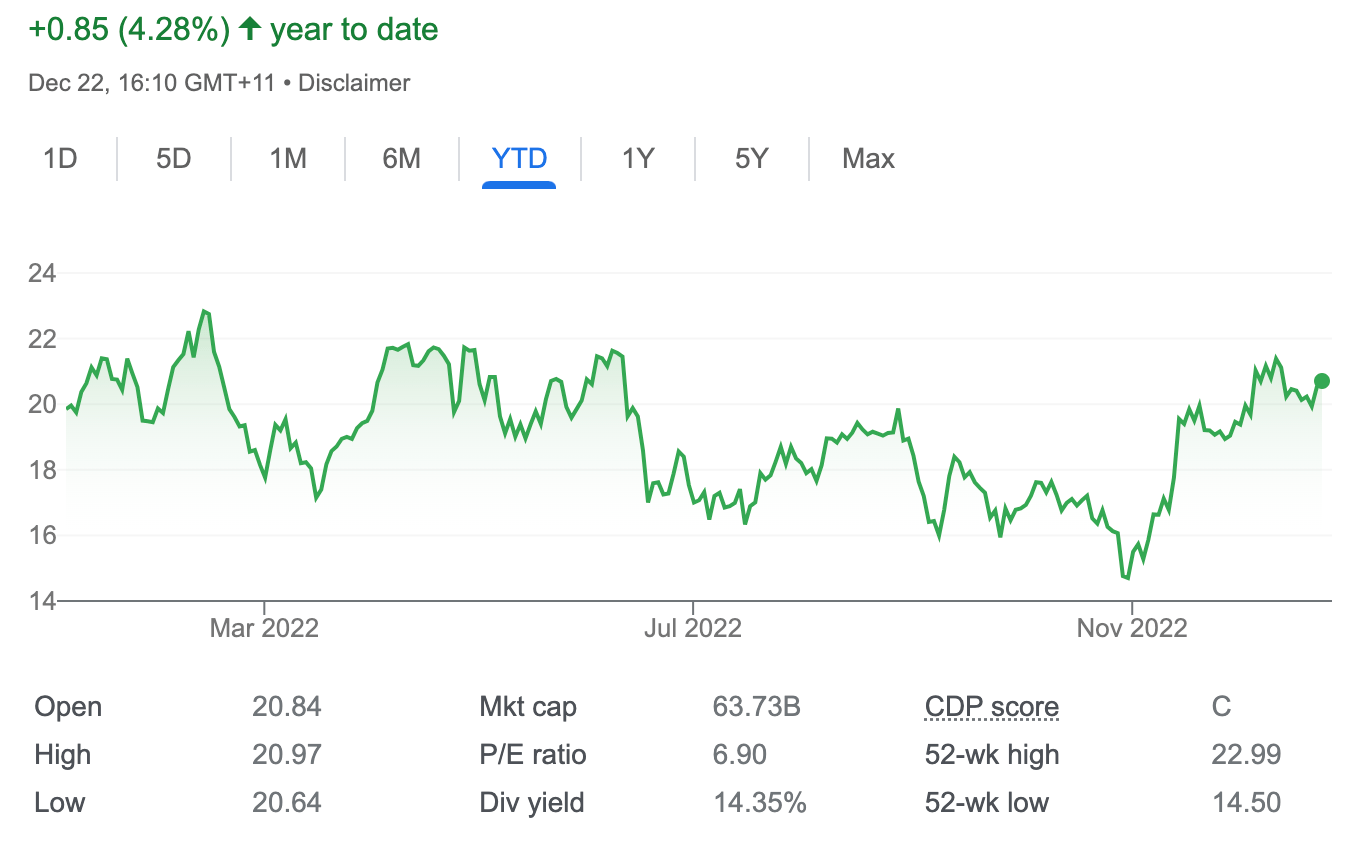

Across the ASX the ratio of dividends for FY22 relative to share prices was a fulsome 6.4%. Compare that to the 2.1% for Wall Street’s S&P 500.

In fact, in a very crappy year the Aussie benchmark payed out the best dividend to share price multiple when compared to the greater majority of global developed markets.

The big banks and the top miners make up about a full quarter of the Aussie benchmark, they’re solid defensives with cracking balance sheets and sterling China exposure. In 2023, there’s a lot there to like.

The fully-frankedness of our tax regulators, which has always looked kindly on the SMSF and pension-income crowd, leaves dividend payouts =largely to themselves, which is half the reason listed firms like to take the chance to share them.

And in a time of plenty, the usually mercenary big miners have chosen not to bulk up with M&A, rather taking the riches of historic high export prices and returning the love to loyal shareholders.

It’s not the name you’d want to call a bellwether, but take a peek at the ‘Quiet Achiever’ in 2022.

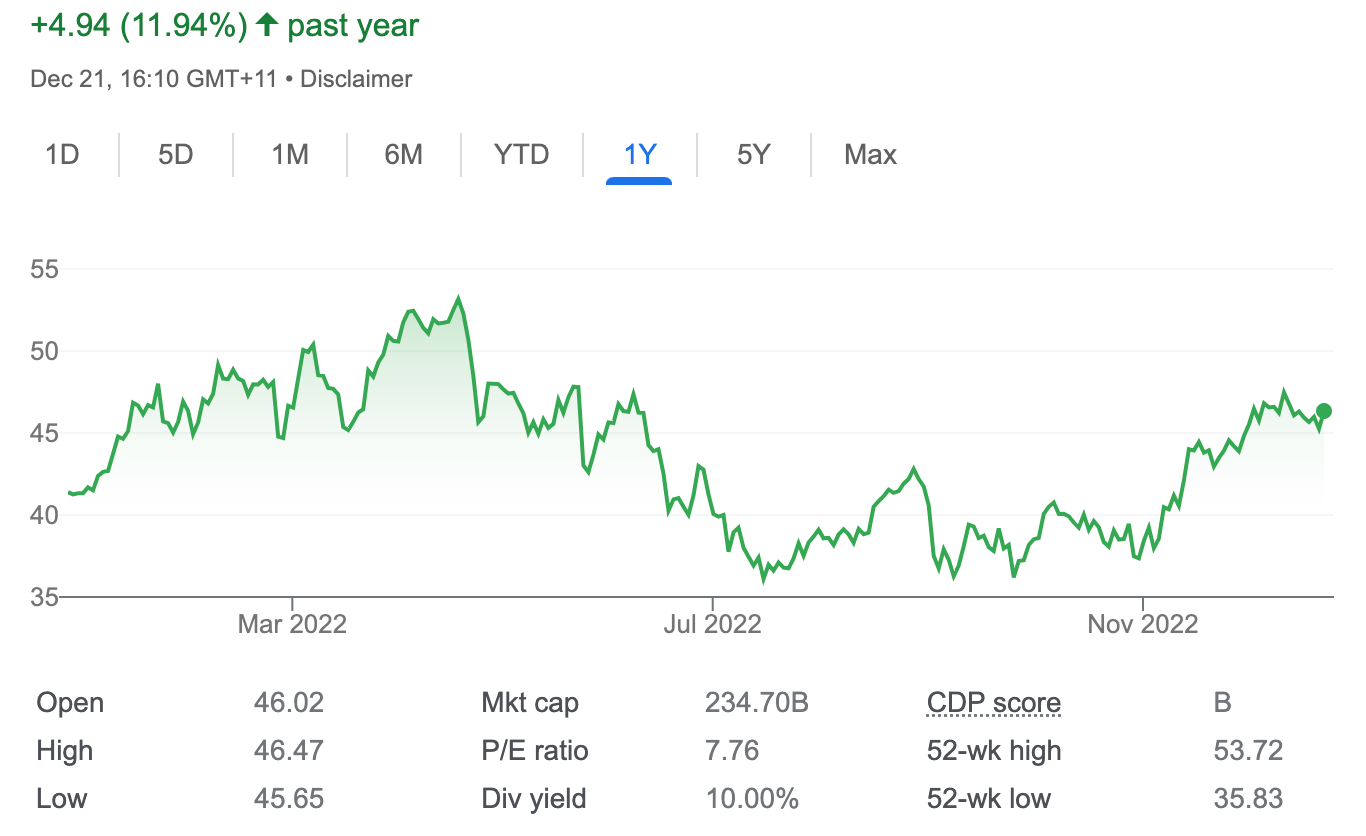

BHP (ASX:BHP) remains the country’s biggest company by a country mile. With a market cap of almost $235 billion, it’s still our best and beastliest regardless of the wars, plagues and penny pinching central banks of 2022.

The share price is up almost 19% for the nearly six months to Christmas (barring proof of Santa), while in a dreadful market the stock has come out 12% higher over the last year.

According to most analysts, BHP’s FY23 is set to be the strongest in almost a decade.

And now it seems the strategy has borne some juicy fruit.

Before China began showing its geopolitical teeth, and thanks in no small part to its COVID-19 policy debacle, the jet-stream of international cash has become “firmly entrenched” into the broad spectrum of China-exposed Aussie equities.

According to Morgan Stanley’s Chris Nicol the ASX200 can outperform next year to the tune of about 7%.

Nicol says the US investment bank is particularly partial to our Energy Sector, alongside Metals, Resources and the mixed bag of diversified miners. All of which Nicol prefers over the Banking Sector, both Consumer Sectors and the REITs and any associated names exposed to property.

“I’d say the interest in Australia is as strong as I’ve seen in the last 12 years, via offshore flows,” he told CNBC this week.

There’s little doubt that with China back on the table, local equities are much more likely to feature heavily in the diet of global investors, according to UBS.

The Swiss investment bank says China-linked revenues really rallied hard through November – and that’s just the impact on investor’s imaginations of what could be if this truly, madly deeply is the moment Xi’s government makes the call and drops zero-COVID in all its poorly executed, wilful and mean-spirited intention.

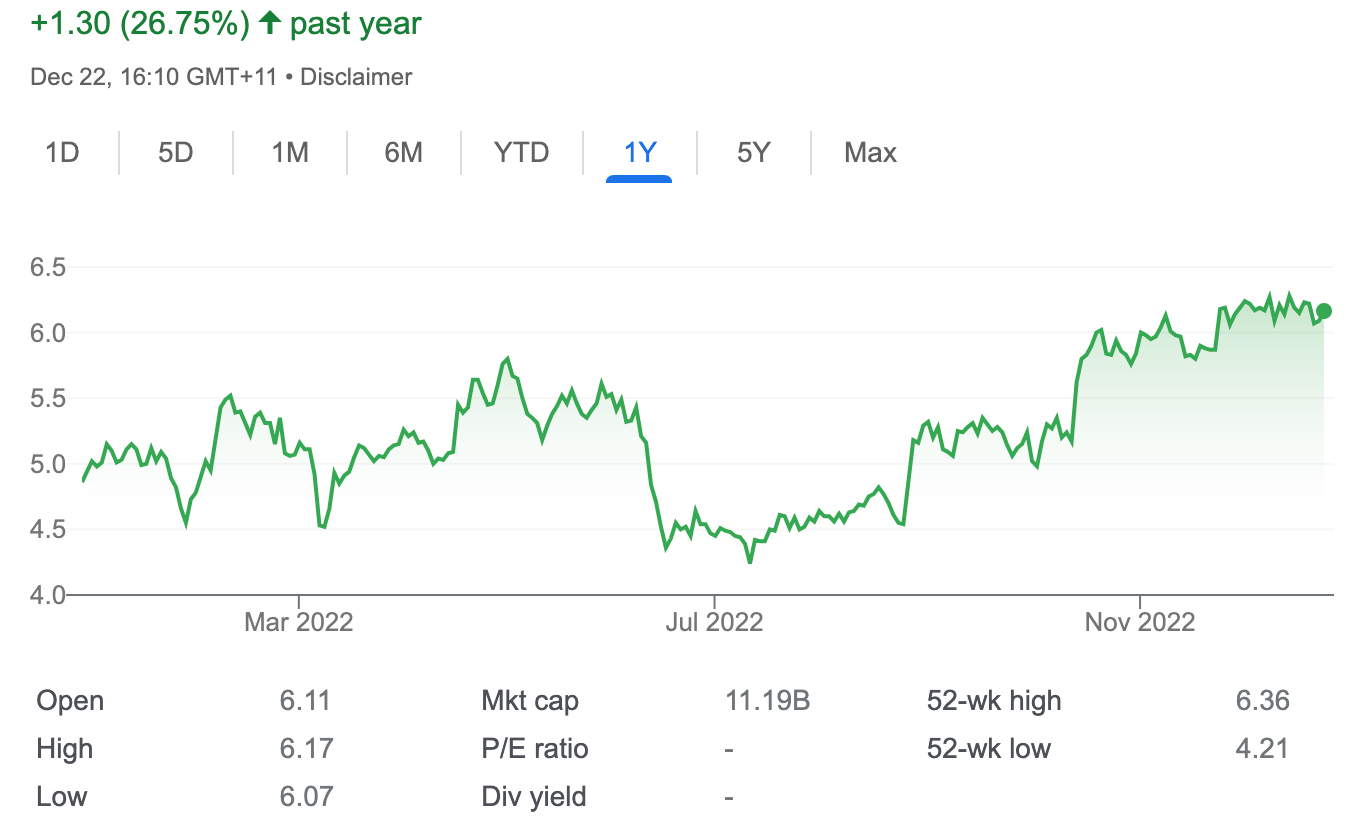

With meaningful property stimulus on the cards, UBS says there’s almost one-third of the ASX200 market weighting with potentially positive exposure to a free functioning Chinese market.

UBS has identified 35 companies with a strong China presence (~31% weighting within the ASX200).

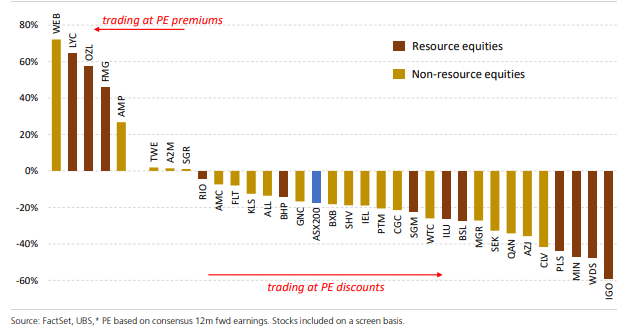

The bank says that all 35 of these Aussie-listed “China proxies” still trade at an 18% PE valuation discount to their pre-COVID valuations.

That’s vs the market as a whole which is trading at a 17% discount to its 17.3x P/E in November 2019

The median stock within UBS’ ‘China proxy’ list still trade at an 18% discount to its PE valuation from November 2019, which the bank said could imply that a China reopening is yet to be fully priced into these names.

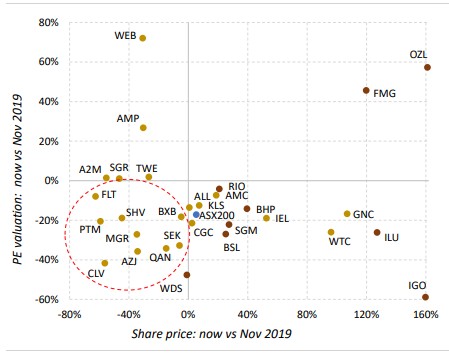

What you’re looking for here in these cool, but also slightly nonsensical dot plot, word cloud Hunt for Red October style charts is whatever remains inside the red circle of attraction.

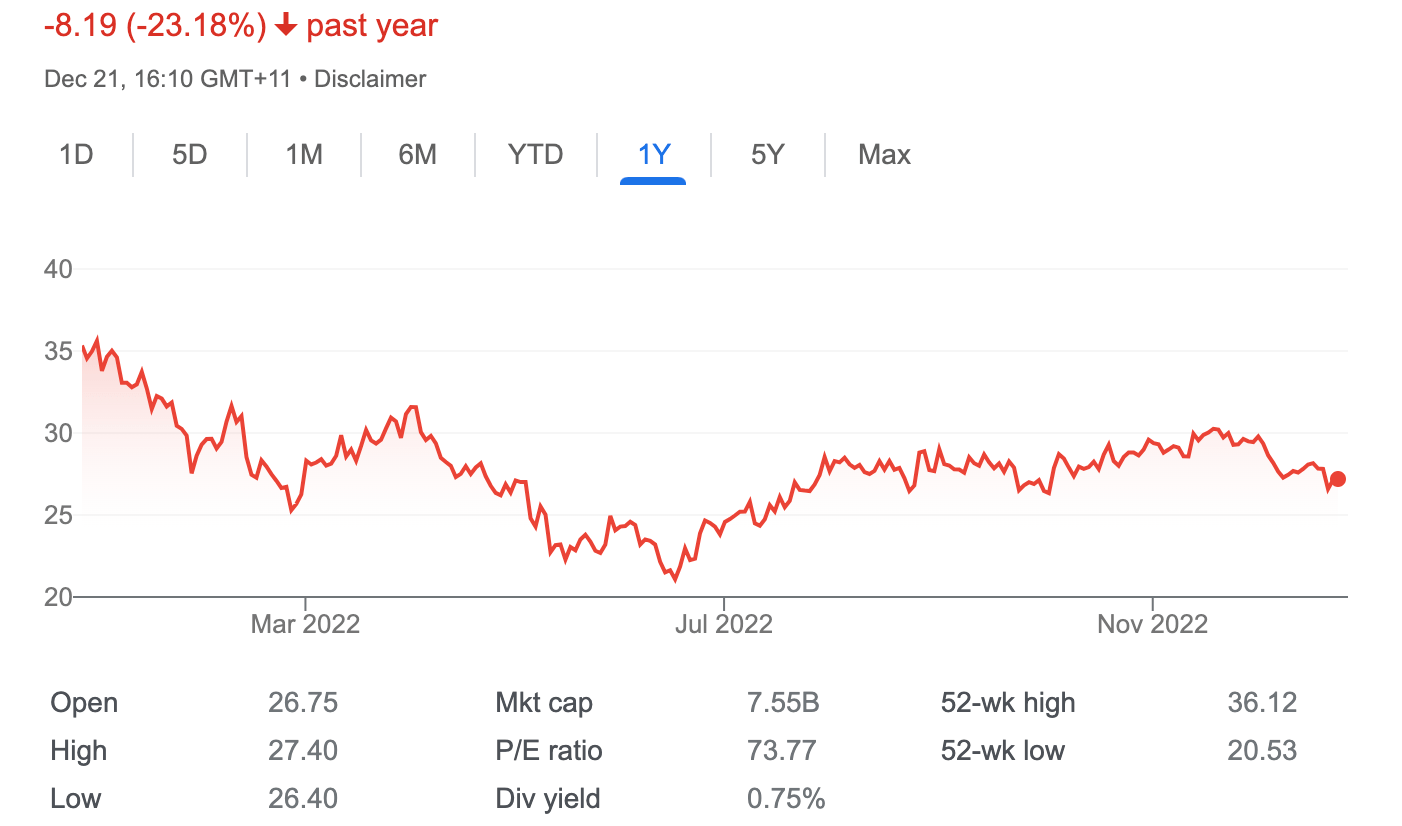

As one might note with some surprise, UBS sees something especially desirous in unlikely old flames, like that old bag Flight Centre (ASX:FLT) and the freight rail transporter Aurizon (ASX:AZJ).

UBS reckons Qantas (ASX:QAN) and Seek (ASX:SEK) as particularly attractive, although it is surprising that neither Mirvac (ASX:MGR), Cochlear (ASX:COH) or Altium (ASX:ALT) are mentioned, given China is 10-15% of group revenues, a significant growth driver. There’d be upside there, one would imagine because both stocks lead the names of Ausralian-listed businesses which have over recent years “specifically called out China-related headwinds” in their earnings downgrades.

Education is another sector that all kinds of analysts see getting some love from potentially closer ties – not to mention the broader economy – should there be a resumption of Chinese student enrolments across national universities.

Both MS and UBS have put a big recommend on IDP Education (ASX:IEL), in the optimistic event that Australian education exports can restart and student-visa issuances turn around. The key here will be for Chinese officials to stop, well, bad-mouthing local uni’s.

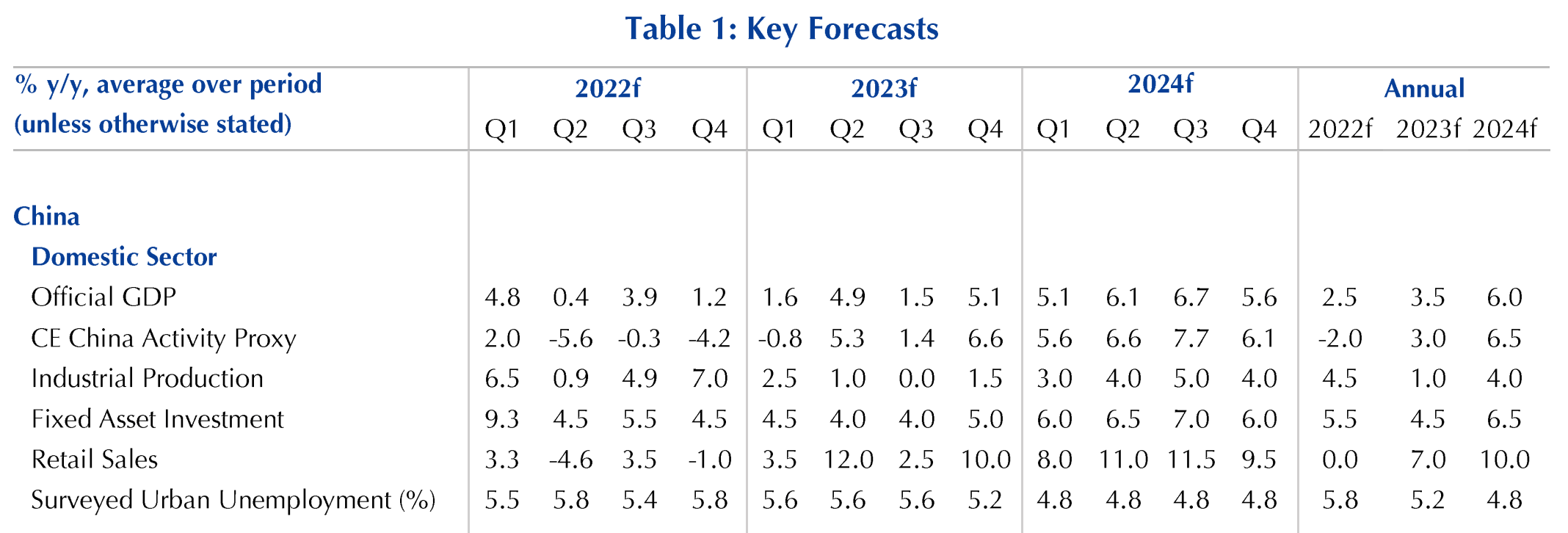

I’ve respect for anyone prepared to make mathematics out of the innumerable and opaque machinations within the brains trust of the Xi-dominated Politburo. Consider these permutations as capital Economics have done below, but under the influence all the currents and eddys of today’s geopolitics and even the promises of China’s top economic planner, the National Development and Reform Commission (NDRC), which last month said it will promote construction of wind and hydropower bases, ramp up renewable energy use and encourage direct foreign investment (DFI) in new tech.

This is their forecast for China’s key numbers as of December 15:

What we do know right now is that Chinese officials are taking immediate action on the two major headwinds buffeting the Chinese economy – namely – zilch-COVID and the delinquent property sector.

According to Capital Economics’ chief market strategist Mark Williams, authorities appear to have given up trying to manage the spread of COVID-19.

“If we’re right, the surge in infections underway in Beijing will spread rapidly across the country. As is happening now in the capital, many people will stay at home if they can and many firms that can’t operate remotely will be forced to reduce staffing. We now expect sharp falls in activity this quarter and next.

“The reopening wave of infections should have fallen back by the second quarter of 2023, paving the way for a strong rebound.”

It’s also worth noting that Xi Jinping’s priorities are now China’s.

And, as Williams notes, as Party Leader, Xi’s security and self-sufficiency will continue to drag on China’s productivity growth.

“And his determination to stay in power makes a course correction unlikely.”

It’s only a week now since China’s government probably truly abandoned the contradictions of its zero-COVID era.

The best and clearest signal for the people who really matter happened to well over a billion of them when, on Tuesday last, the government’s loathed COVID-tracking app – which has so absolutely thwarted the daily hopes and routines of people from Zhuhai to Zhejiang – went silent. Of course, what’s happening on the ‘back end’ remains anyone’s paranoid guess.

Last week, the always amazing Jeremy Goldkorn founder at the China Project (defo worth a look) wrote this personal and prescient note on what it’ll be like on the ground.

The virus is now spreading rapidly throughout the country, spurring panic buying of fever medicine like ibuprofen and paracetamol, as well as various folk remedies like canned peaches and lemons.

“Everyone I know in Beijing, Shanghai, Chengdu, Kunming, Lanzhou, rural Hebei Province — and no doubt everywhere else where I don’t have a recent contact — either has COVID, or has just had COVID, or knows more than a dozen people with COVID.

No one really knows what’s going to happen next.

I personally expect that China will have a similar experience to the rest of the world in 2020 and 2021, but on a more compressed timeline, thanks to vaccines, hard-won medical understanding of how to deal with the coronavirus, and the lack of anti-masking sentiment in China.