Can Frydo add a little Sachs appeal to Aussie investment banks suffering from high disinterest rates

Then Finance Minister Josh Frydenberg during Question Time in Parliament House on September 11, 2019. (Photo by Tracey Nearmy/Getty Images)

Slapped with a scorching $2.1mn fine for overcharging, starving for M&A deals and reeling from the thrill of an extra 400 basis points (bps) of interest rates (to an 11-year high of 4.1%) in the 13 months through June, who would not pity the frazzled Aussie banker sipping Dom Perignon with coke at the Ivy bar this past weekend?

But all is not lost, be it for the Big 4, the Reserve Bank or even those deal dry wrecking balls at the millionaire’s factory.

The announcement on Thursday that the former federal treasurer Josh Frydenberg is taking up the reins as Goldman Sachs’ new chairman for Australian and New Zealand business might be a blow to Liberal fans of the federal seat of Kooyong, but it could be music to the ears of 2023’s Aussie corporate wheelers and dealers almost at their wit’s end.

Because it’s been a dim and dormant 2023 across the Australian investment bank landscape, according to the latest Refinitiv data.

Corporate deals have been thin on the ground as uncertainty and interest rates clog up the capital. Across the country, the total inflow of fat M&A fees for local investment bank advisers came to just $US354m over the first nine months of the year, down well over 60%.

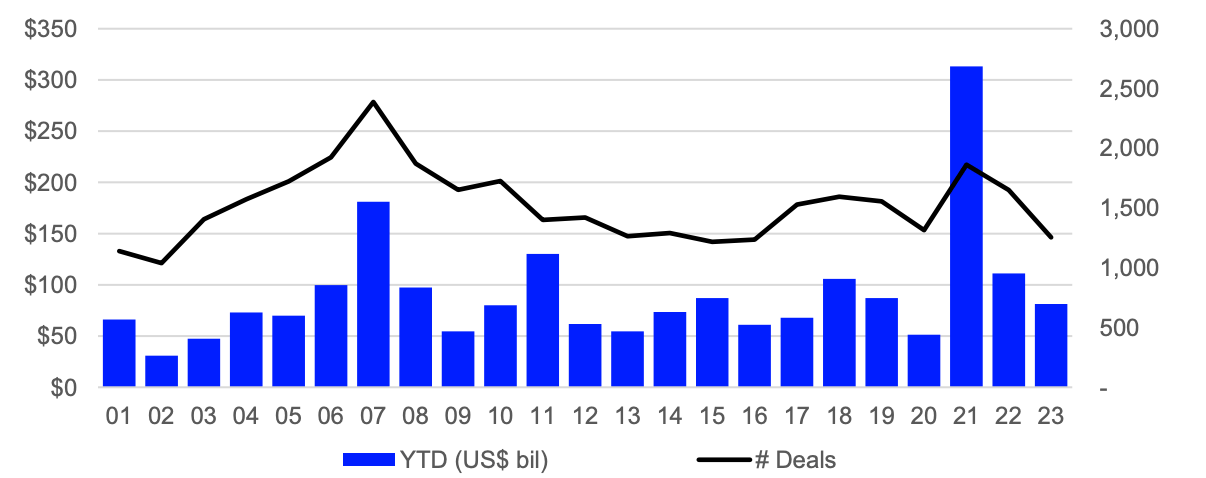

The dramatic capitulation has left local investment banking activities down circa 50% year-on-year, with Aussie M&A activity slumping to its lowest value since 2020, totalling $US81.bn for the first nine months of the year, a 27% drop compared to the same period 12 months ago.

That’s tuppence compared to the more than $US310bn of M&A over the first nine months of an admittedly fabulous pandemic-stimuli driven 2021.

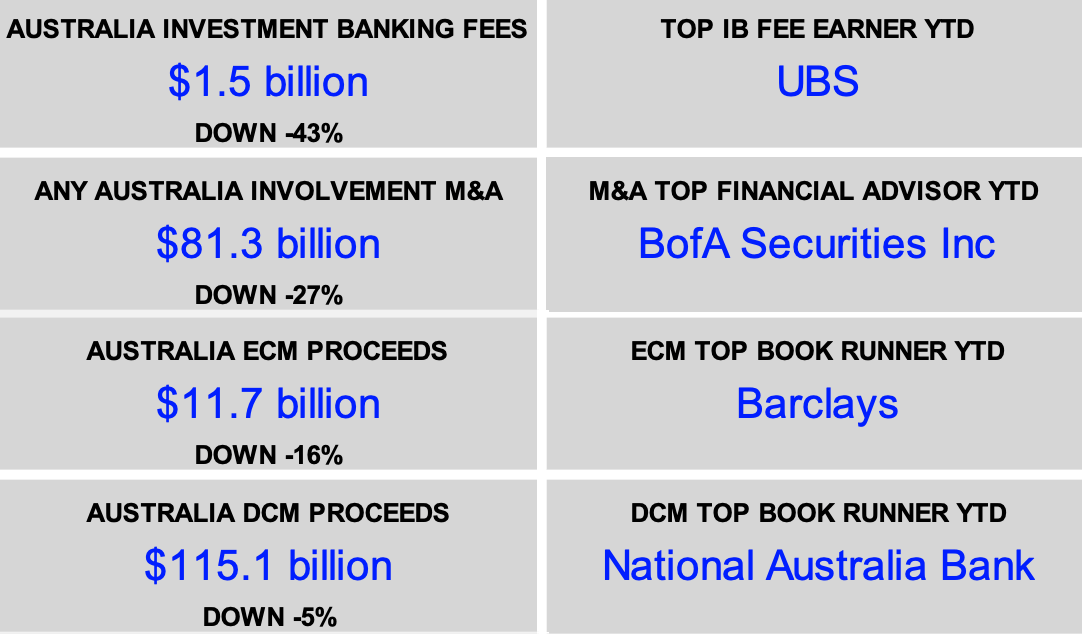

Australia Investment Banking Review YTD: Highlights in USD

Frydenberg dipped his toes in the Goldman Sachs pool last July, as a senior regional adviser for GS Asia-Pacific as a kind of runners-up bonus after losing the seat of Kooyong amid the terribly named Teal Wave of the 2022 federal election.

His appointment as chairman was confirmed in a Goldman Sachs internal memo:

“In this role, Josh will focus on further deepening and strengthening client coverage across the A/NZ region. He will continue to offer advice on economic and geopolitical issues as the firm’s senior regional advisor for Asia Pacific.”

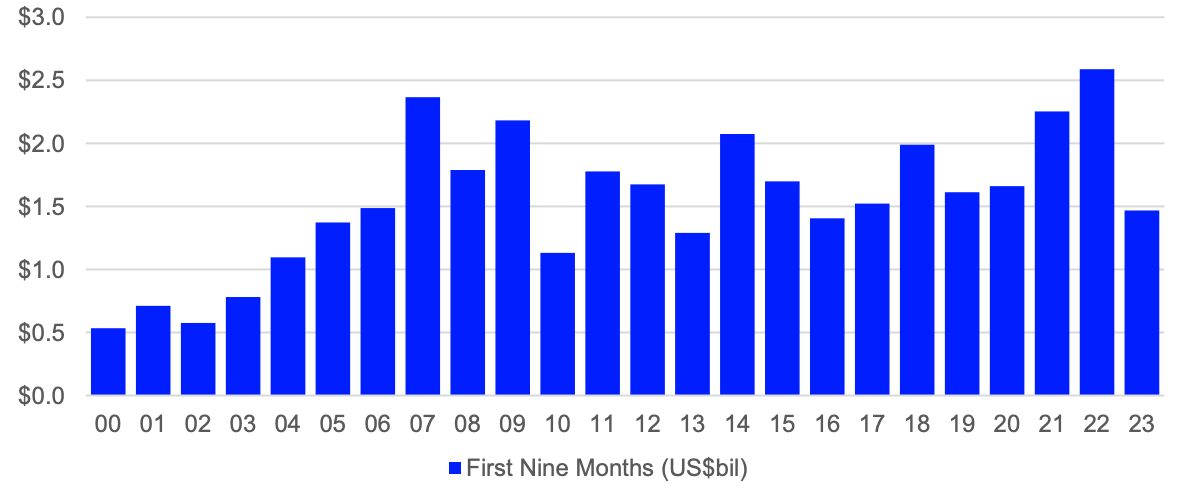

The only way is up really for the firm also suggested that Mr Frydenberg was widely recognised for his effective management and leadership of Australia’s economy during the pandemic. Australian investment banking activities generated US$1.5 billion so far during the first nine months of 2023, a 43% deficit against to the first nine months of last year, which wasn’t great either.

AUSTRALIA INVESTMENT BANKING FEES 2023 to date (USD)

Rising rates put a dampener on M&A activities:

ANY AUSTRALIAN INVOLVEMENT ANNOUNCED M&A VOLUMES

The appointment comes at a bit of a crunch moment for Goldman Sachs in particular.

The bank is in unfamiliar territory. Riven by internal strife and a merger and acquisitions landscape where activity has plummeted since the end of the era of ultra-cheap money.

Australian investment banking fees at Goldman Sachs are down 58% during the period to $US55m.

The firm ranks 8th for Australian M&A, behind Macquarie and NAB:

Australia Investment Banking Review: League Tables

In an effort to cut costs following the slowdown in activity and losses at its consumer banking business, Goldman culled over 6.5 per cent of its global workforce earlier this year, and is looking into a further round of lay-offs in October.

Refinitiv’s 2023 investment banking review, published on Thursday, found Australian investment banking activities generated $US1.5bn ($2.3bn) in the nine months since January, a sharp decline of 43 per cent compared to the same time last year.

- Australian M&A activity is at its lowest value since 2020, totalling $US81.3bn for the first nine months of the year, a 27% drop compared to the same period 12 months ago

- Australian investment banking activities generated US$1.5 billion so far during the first nine months of 2023, a 43% decline compared to the first nine months of last year

- ECM underwriting fees accounted for 22% of the Australian investment banking fee pool and totalled US$323.8 million, a 16% decline compared to first nine months of 2022

- DCM underwriting fees reached US$500.8 million, down 9% from the first nine months of last year. Completed M&A advisory fees amounted to US$354.1 million, down 62% from a year ago. Syndicated lending fees reached US$288.3 million, down 60% from the first nine months of 2022

- Based on preliminary data, UBS currently leads Australia’s investment banking fee league tables with US$114.1 million in related fees with a 7.8% wallet share during the first nine months of 2023

YTD TOP DEALS WITH ANY AUSTRALIA INVOLVEMENT

Who’s banking on Aussie banks?

They’re hard to love and now the Federal Court says the Big 4 are back to being unconscionable again.

In a Friday ruling, the court ordered NAB to pay a $2.1 million penalty for continuing to charge fees despite knowing it was wrongfully overcharging its customers.

The court found between January 2017 and July 2018, NAB ‘engaged in unconscionable conduct by continuing to charge fees when it knew it had no contractual entitlement to do so.’

The Big 4 bank naughtily continued to thwack us with periodic payment fees on 74,593 occasions totalling $139,845 to 2,888 of its personal banking customers and 513 business banking customers.

“NAB continued to charge fees when it knew it lacked any entitlement to do so and omitted to tell its customers of that wrongful charging. It took NAB over two years to stop charging these incorrect fees, which was clearly unacceptable,” ASIC’s deputy chair Sarah Court said. In court.

Morgan Stanley: Maintains CBA rating as Underweight

On Friday morning, before the brutal circa $2mn hit to NAB, Morgan Stanley ran the ruler over CBA’s share price, which has tracked the same direction as housing values over the past decade, Morgan Stanley highlights.

Housing values have risen by around 5% over the past six months and are now just -4.5% below the peak. Over the same period the CommBank share price has increased by 1.5%.

The broker considers this an important relationship as Australian housing loans account for more than 60% of the bank’s total loan balance, while housing values affect the loan size which in turn affects growth of the mortgage loan book.

The target is $85.50. Rating is Underweight. Current Price is $100.08.

Market Matters: Considering adding to MQG at~$162

Market Matters says MQG has ‘trod water through most of 2023’, although it’s still up +3.8% year-to-date, outperforming all of the Big 4 except ANZ Bank.

“MQG recently delivered a weaker-than-expected 1Q24 trading update, with three out of its four operating divisions disappointing the market. Still, we believe this provides a buying opportunity into this quality business where management is confident of a stronger 2H. In contrast, the market expects MQG to grow earnings ~15% over the next two years.

“We are considering increasing our MQG position in our Flagship Growth Portfolio if/when it tests its 2023 low, around 4-5% lower.”

The Big Four: Aussie fund managers are a large underweight

JPMorgan’s latest fund manager data highlighted some key positioning metrics for Australia’s largest sector:

1. The average sector underweight for financials ex-REITs increased in Jul-23 and is deep at ~550bps.

2. The latest bank registry data (reported for Jun-23) showed that domestic institutions accounted for 27% of major bank share registers on average, which JPMorgan think implies a ~900bps Underweight position in the major banks specifically.

3. NAB remains the bank stock most favoured by domestic Institutions. Local funds appear to have the most conviction in NAB, with almost all investors that list it in their monthly fact sheet as a Top 5/Top 10 holding having an Overweight position relative to benchmark.

4. The reverse is true of CBA (little conviction on holding).

5. WBC continues to be the most under-held bank stock.

6. Short interest decreased for the major banks over the last 3 months (to be back in line with the historical average of ~1% of market cap) but increased for the regionals.

Trimming Underweight positions by domestic fund managers would lead to strong relative sector performance.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.