Our banks should be fine. But we can walk their battlements with Marcel Thieliant from Capital Economics if it helps you sleep

Australia's financial system at nite. Via getty

Australian banks are unlikely to experience the same valuation losses that resulted in the demise of Silicon Valley Bank, says Capital Economics senior Australia & New Zealand economist Marcel Thieliant.

The biggest risk Marcel believes, is that a freezing up of overseas bond markets shuts down funding avenues for the major banks, but the Reserve Bank of Australia could always step in by providing emergency lending.

“We therefore still expect the RBA to hike the cash rate by another 25bp in April.

“In short, there are good reasons to think that the crisis won’t call into question the solvency of the US or the wider global financial system in the way that Lehman did.”

What if… a tour of Fortress Financial Australia

But these are banks, so let’s follow Marcel through his tour of what a crisis could mean for Australia’s financial system.

BTW, You can find more on Capital Economics’ take on the SVB debacle here.

For a start, Marcel says, it’s very unlikely that the big losses on bond holdings which triggered the demise of SVB can be replicated in Australia.

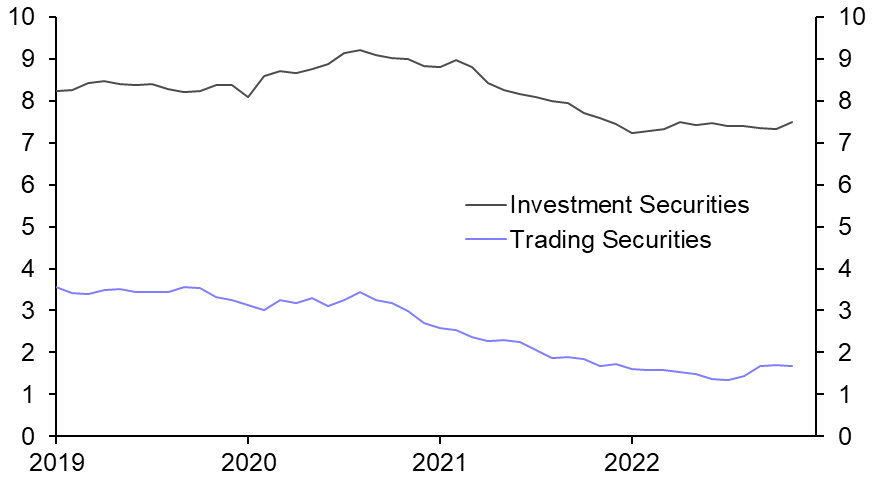

“Australia’s banks hold around 5% of their assets in government bonds and a larger 7% in bonds issued by securitisers, but a large share of the latter is issued by banks themselves and used as collateral for the RBA’s Term Funding Facility and other lending facilities.

“More importantly, only bonds held in banks’ trading books need to be marked to market and those account for just 2% of bank assets.”

Bond Holdings By Australian Banks

(Lat. = January % of Assets)

What’s more, a regulatory surcharge on interest rate risk has encouraged banks to hedge most of their bond portfolio against interest rate movements, which I did not know.

Indeed, the RBA estimated a year ago that a 200bp rise in interest rates would only lower major banks’ CET1 capital ratio by 28bp.

“That suggests that the ~300bp rise in 10-year AGS yields since late-2021 only contributed around one-third to the 1.2%-pt decline in banks’ Tier 1 capital ratio over this period.

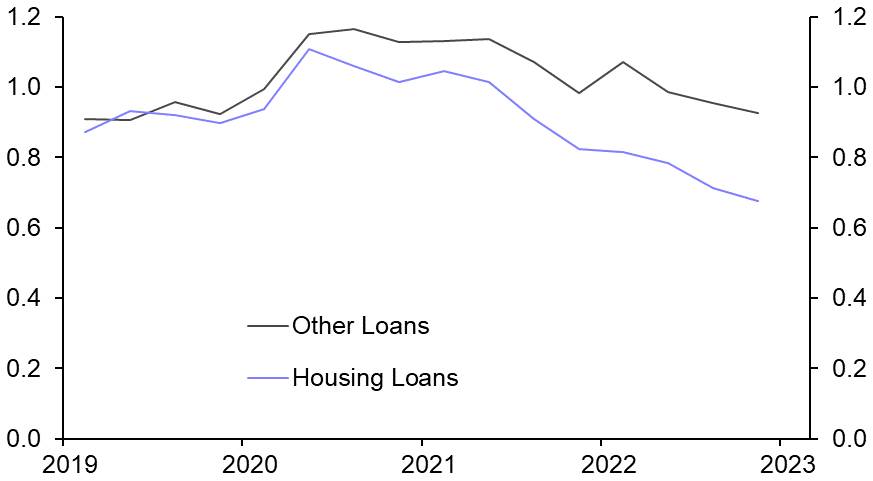

“Meanwhile, there are no signs yet that the surge in household interest payments since the start of the RBA’s hiking cycle has undermined the credit quality of banks’ loan books. In fact, data released by APRA this week showed that the share of non-performing loans continued to fall last quarter.”

Australia Non-Performing Housing Loans (% of Loans)

Non-performing loans will rise eventually as fixed-rate mortgages expire, interest payments continue to increase and the unemployment rate rises, but Capital Economics believes Aussie banks have plenty of time to prepare and their capital ratios are nearly twice as high as they were before the global financial crisis.

“The upshot is that banks’ solvency is unlikely to come under threat,” Marcel Thieliant adds.

He says the biggest threat for the Australian banking sector is that a clogging up of overseas bond and short-term wholesale funding markets threatens their liquidity.

“According to RBA estimates, short-term term debt accounts for around 20% of bank funding, while long-term debt accounts for another 10%. Bond issuance by banks was very strong last year because banks have to replace the $188bn they borrowed from the RBA’s Term Funding Facility over the coming year. The big five banks account for around 75% of bonds issued and the bulk of their issuance takes place offshore, with around two-thirds borrowed in USD.

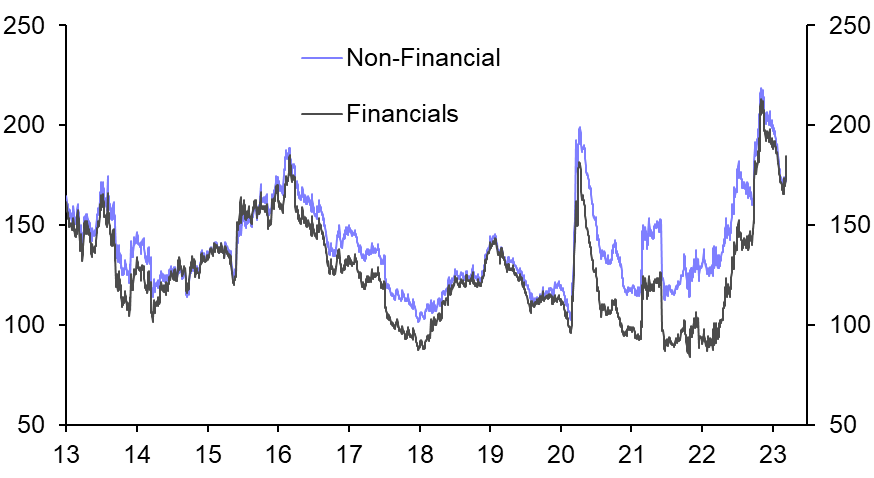

“So far though, there are no clear signs of trouble in funding markets. While short-term money market spreads have surged in the US, they remain very low in Australia.”

3-Month Interbank Rate Minus 3-Month OIS (bp)

“And while corporate bond spreads jumped at the start of this week, they remain below the peak reached at the end of last year.

“Only a small share of bank bonds will mature over the coming year and even if funding markets did freeze up, the RBA could always step in and provide emergency funding and/or ease collateral requirement just as the Federal Reserve did over the weekend.”

Australia Corporate Bond Spreads (bp)

Unless more pronounced signs of stress emerge, the outlook for the RBA’s cash rate will mostly hinge on the economic data.

Marcel: “If employment rebounded in February as we anticipate, we still expect the Bank to press ahead with another 25bp rate hike in April.”

That said, he adds, there are mounting risks that the central bank won’t hike again in May.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.