As Morgan Stanley moons over the Big 4’s buffers, UBS is eyeing the $400bn of fixed rate home loans which’ll mature by Xmas

Santa's waiting for the Big 4. Via Getty

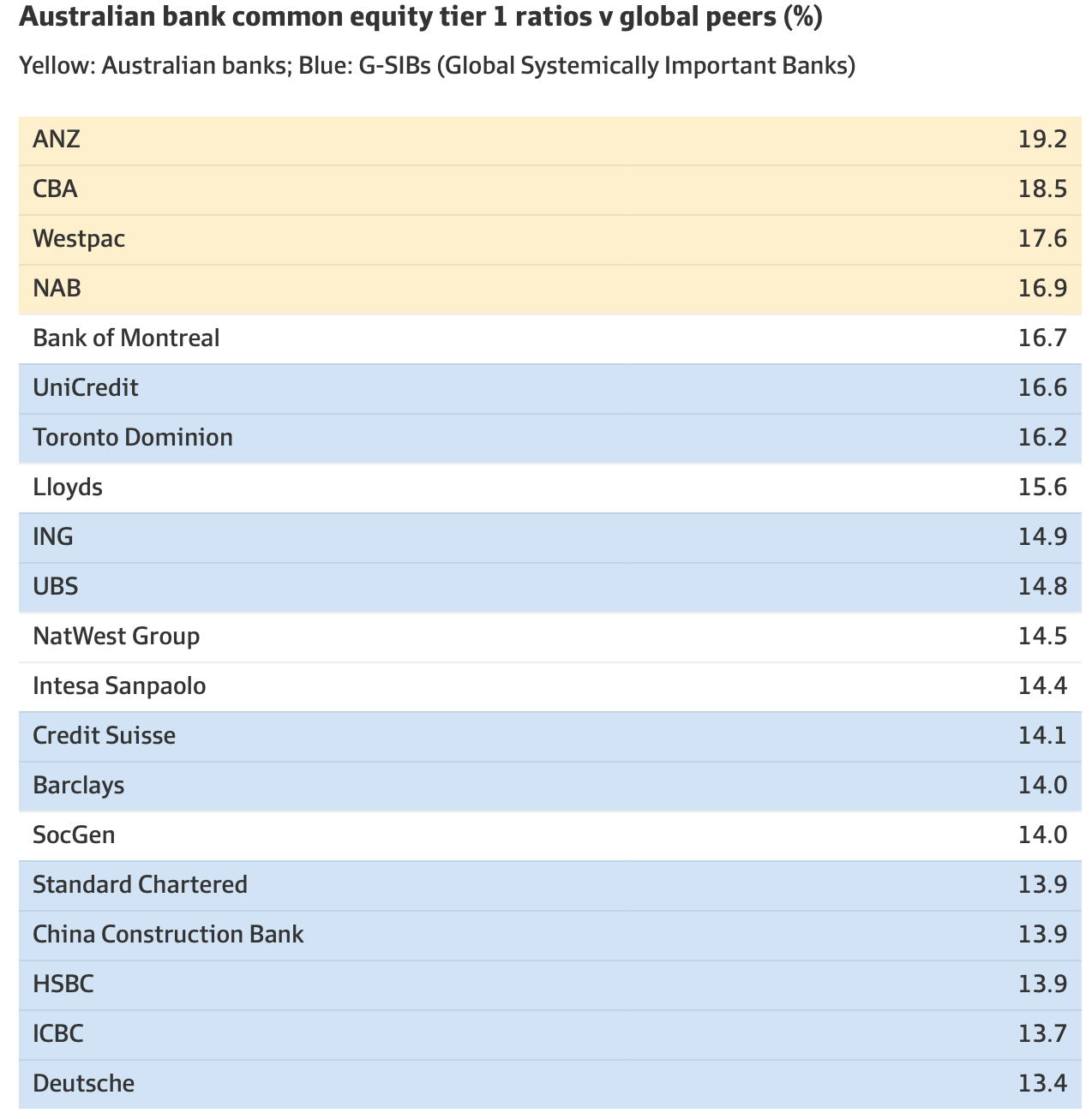

As Eddy mentioned this morning, the Aussie banks that matter are the best capitalised institutions in the world.

That’s according to new data rolled out by investment bank Morgan Stanley, itself conspicuously absent, I might add.

Anyone who’s tried to buy a house in Sydney, shopped around for a better loan, or just tried to telephone someone from one of the four big local lenders could’ve saved MS all the data-rolling anyway: these are surely the best capitalised institutions in the world. We’ve certainly done our little bit to help.

The Big 4 banks dominated the MS list of global banks on the capital buffer parade.

Although it’s good to see Credit Suisse doing so well too…

Source: Morgan Stanley via the AFR

Then there’s UBS, which is a few places above the bank it ate last week.

Unsurprisingly the wheels of justice didn’t pause in Bern when all that happened and UBS has this to say about the four Aussie majors: Well-positioned, but well-positioned in a bit of a gale force headwind.

Overall, UBS is of the view the Australian Banks and our overall post-Royal Commish system as ‘well positioned to deal with the unfolding pressures’ on the global bank sector.

However, with UBS there’s always a but and that but this time is a however – there’s multiple headwinds now confronting the Big 4 banks.

1. Funding costs are going up (here we’re talking: wholesale funding costs, the rate on deposits, subordinate debt interest rates post that Credit Suisse shock)

2. Increasingly intense competition for deposits

3. A bad debt cycle (of uncertain magnitude) is likely to emerge

4. Possible regulatory intervention (but less likely here since we’re still washing said Royal Commish out of hair)

On the deposit race, it’s been no secret CBA is widely seen as having the best deposit franchise in the country. But UBS says finally they’re having to sing aggressively for their supper. The other majors and even the Macquaries of this nation are looking for a piece with UBS highlighting Westpac for joining the Commbank in lifting their deposit pricing the most over the last 6 months.

A few lean years

UBS says because of the meteorological quirk of all these headwinds, they’ve gone and lowered their FY24 and FY25 earnings per share (EPS) projections for the quartet by as much as 8% and they’ve clipped their Price Targets by circa 18%.

Right now UBS likes the large banks over the small ones and the retail over the wholesale funded banks.

“Diversification is important both geographically and by line of business.”

What needs keeping in mind is that the key battleground for the Australian banks over the next few years remains the maturing of some $400 billion of fixed rate mortgages (~20% of total system residential mortgages) by Christmas (December 24).

UBS says the single biggest risk for Australian banks is policy error and too aggressive rate hike profile.

UBS: Key issues for the Big 4 at a stock level:

1) NAB – Downgraded to Sell.

NAB is a more wholesale-orientated bank, with a smaller retail deposit funding base. Competition for its prized business banking franchise looks set to intensify.

2) Westpac – Downgraded to Neutral.

UBS still like the Westpac investment case – self-help (cost-out) and a valuation well below historical averages. However, Westpac’s recent slowdown in mortgage lending growth results in UBS cutting loan growth forecasts.

3) ANZ – Maintained at Buy.

ANZ has been holding back on deposit pricing but was also a loser in the chase for mortgage market share post the pandemic, which may alleviate some credit quality concerns. The SUN acquisition should unlock value and at a 6% discount to book, and >7% dividend yield, the stock is not expensive.

4) CBA – Maintained at Neutral.

CBA benefits from a comparatively large (and stable) retail deposit base, however, at 2.1x Price to Book, it now screens as fair, at best (in line with its 10yr average).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.