Winter is Coming: How to build a defensive fortress around your heart and your ASX portfolio

Cheer up. The world's about to end. Via Getty.

CASSIUS

Now, most noble Brutus,

The gods today stand friendly that we may,

Lovers in peace, lead on our days to age.

But since the affairs of men rests still incertain,

Let’s reason with the worst that may befall…

Welcome back to Stockhead. The only finance show you have to read and also get Shakespeare quotes flung at you.

Although the ASX200 is almost inside 5% of its all-time high (does double take at prompter), it’s been pretty much driven by what any smarty pants analyst worth their salt is going to call an “overwhelming defensive posture.”

Cyclical sectors falling over the past three months (Messrs Real Estate, Energy, Materials and Financials) and analysts at Macquarie Bank forecast cold, grinding and most possibly bitter macro headwinds are in the offing.

The winter season looks dark and calls for bonds before stocks – and if not – then at least defensives over cyclicals.

Macquarie’s dark heart has always been to plan for ‘the worst that may befall’ and they’ve been expecting a hard landing in the states, followed by a US recession in Q3 for some time.

To prepare for the depressing, if not inevitable, Macquarie’s been increasing its exposure to defensive healthcare names and equities which might do well from falling bond yields.

On the cyclical side of the bourse, they’re cutting exposure to energy names as well.

Last week’s remorseless Reserve Bank No. 11 rate hike since May last year has added to the weight of this argument.

And as any numerologist worth his or her salt would tell you the number 11 is known as a “master number.”

That’s because it has ‘unique and powerful vibrations.’

Those influenced by it tend to find inner strength in times of trial, coping well with crisis and chaos.

When the RBA dropped its own number 11 last week it led the All Ords on a 30 minutes dive into hell, projectile ejecting some 100 points before sanity returned.

“Whether a soft landing or a US recession, the slower growth that drives central banks to pause (and later ease) also tends to drive earnings downgrades and the outperformance of defensives over cyclicals,” Macquarie said in a note late last week.

So anxious times, and unlikely to just turn around overnight.

However, one can also say that on the whole the ASX benchmark is being stolid and stoic. More Boycott perhaps than Botham. (I’m sorry. 99% of our largely sane readership, often have to cope with unnecessarily obscure 70’s English sporting analogies.)

The best defence is not a good offence

Setting up your portfolio to look more like a Boycottian Castle than a Bothamesque Château is easy.

Just change up your masonry from the uber growth stocks, like perhaps Uber or some other spasming high-tech growth stock, to the much more hardy, reliable and proven companies.

The ASX has a lot of these stocks in the mix and your overpaid broker probably should too.

Easily identifiable by their long, crack track record of being Mature and Boring they never miss a dividend payout or a conservative forward guidance estimate. Yes, that might be because the profit margin is rarely mistaken for being sex on legs, but these stocks tends to stay resilient regardless of whatever economic stupidity (like a US banking crisis et al) is going on about the place.

Markets are being punchy, but underlying it all they’re still concerned whether central banks, in particular the US Federal Reserve, can somehow engineer a soft landing. QED: defensives should, as history suggests, outperform as this risk persists.

That’s because even if the wider world is on it’s fiscal knees counting every penny, ultimate demand for what these stocks make or offer usually remains as essential as ever.

Think sectors like Healthcare, Utilities, Consumer staples… I’d reckon a food and drinks stock with a pocket full of KFCs (yes, you Collins Foods (ASX:CKF) could fit the theme as well.

How to spot a defensive from 20 paces

To better ID them, hold a defensive stock up against a cyclical business (IE: one which goes gangbusters when the demand for their products like oil, gold or semiconductors is peaking) and ask yourself who’ll provide less myocardial infarctions over the long run.

The last few weeks has seen a broad selection of ASX companies deliver trading updates and quarterly results, resulting in net downgrades to (consensus) overall earnings estimates.

UBS points out that although the bulls can still point to the modest level of downgrades, just 0.1% off FY23 and FY24 earnings, a clear pattern is emerging.

While I’m not sure the terminology “defensive” isn’t simply the misguided yet preferred nomenclature of the aggressive investor (I would just go with sensible ), the fact is for markets, as Tim Boreham once put it – if conditions really deteriorate the market gods won’t be too discerning in terms of what stocks get whacked.

Certainly some are higher on the risk scale than others and they’re easy to spot.

The more emergent among the technology plays that still trade on extravagant multiples and are yet to run a profit.

Anything particularly speculative — whether in, consumer, resources or biotech. Just think the companies vulnerable as rates rise and the field for risk capital evaporates.

In case of recession break dance

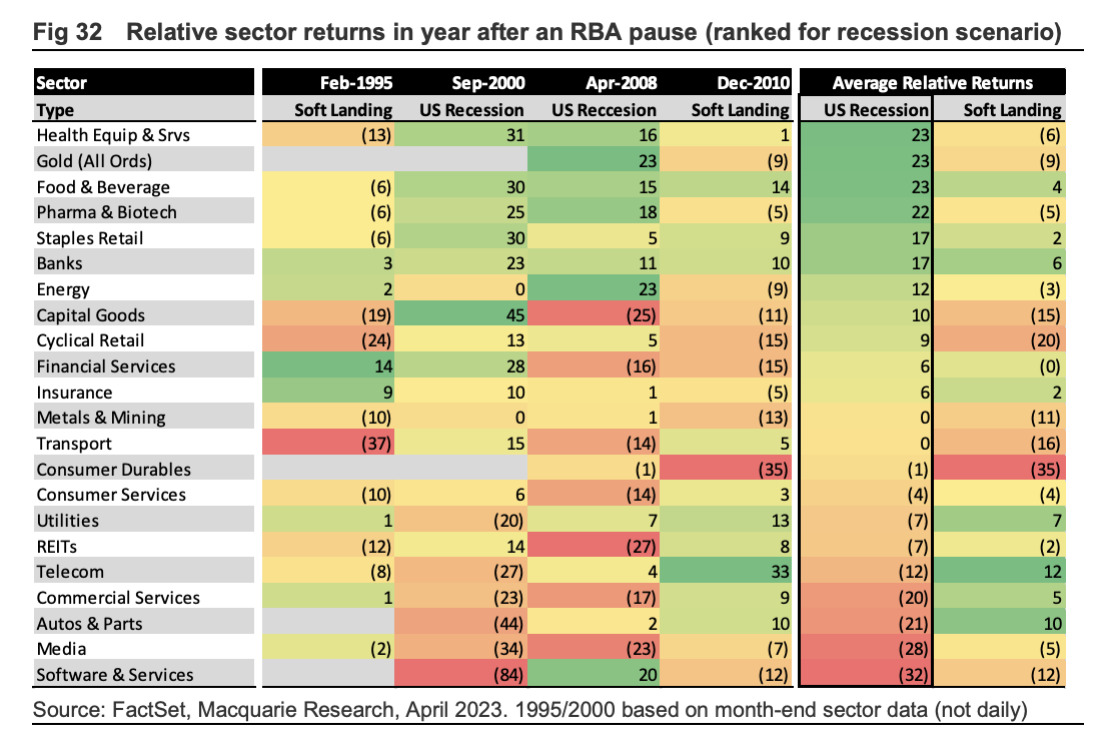

The last few times the Americans broke out in recession, and the RBA responded by hitting the brakes on rising rates – the ASX healthcare, consumer staples and gold sectors outperformed.

Among these the food, pharma and biotech businesses did particularly well.

IT stocks, media and real estate did badly, as per this handy one from Macquarie:

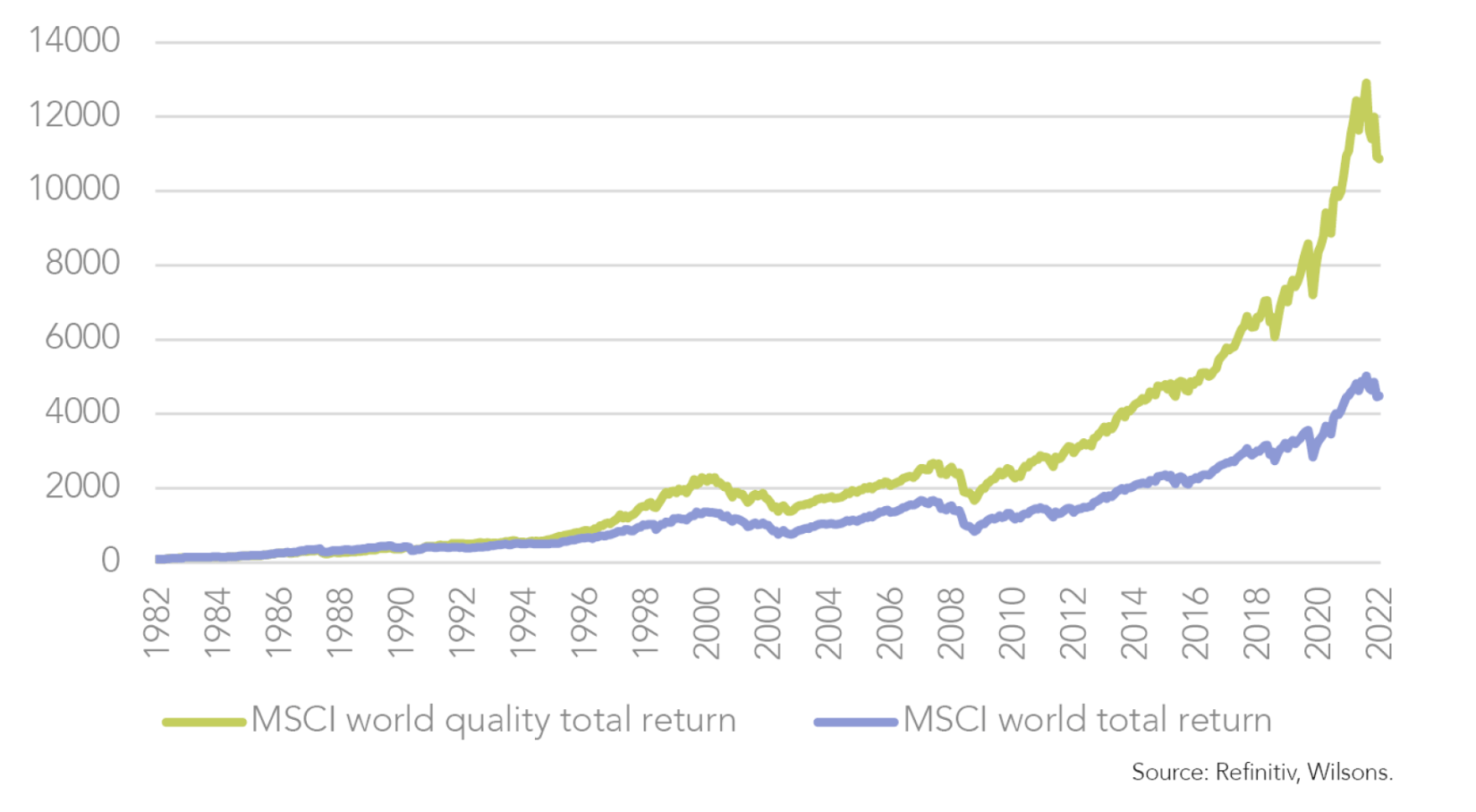

Last year as the market bottomed out for the first time, Wilsons head of investment strategy David Cassidy put the case for so called ‘quality defensives’ better than most, saying that these are the companies which “should be able to consistently provide stable earnings growth through a period of slower growth, while avoiding downgrades.”

Consequently, we get a bit of a virtuous circle going.

“This should drive investors to these stocks and generate above market returns for shareholders.”

Here’s a few sectors and stocks which are a good start to doing your own legwork.

Non-discretionary consumer

Think how the supermarket stocks like Woolworths (ASX:WOW) and Coles (ASX:COL) managed to make themselves direct beneficiaries of the COVID-crisis. Toilet paper stockpiling was not in any analyst breakdowns I read.

Gold stocks

China bought an extra 8.1 tonnes last month of the precious metal.

In the last few years we’ve seen the traditional safe harbour play respond well to both rising and falling interest rates.

When rates drop, according to Tim, they lessen the appeal of investing in bonds relative to zero-yielding bullion.

As Josh Chiat so fedtly points out, the price of gold might be soaring, but on the ASX those stocks have been bleeding over the last quarter to the tune of almost -10%. But the gold bugs maintain that if the crisis deepens, the lustrous stuff will shine.

Infrastructure stocks

The S&P/ASX Infrastructure Index is up over 11% in the 12 months to Thursday.

Sydney Airport (ASX:SYD) was smashed when the coronavirus crisis came to town, but the airport with the world’s most expensive parking remains Sydney’s main gateway to escape.

Toll-road operator Transurban (ASX:TCL) is up 7.5% over the last 12 months.

Boral (ASX:BLD) – Australia’s largest building and construction materials supplier – is ahead by almost 25%, admittedly from some deep post-COVID troughs. It’s almost 75% owned by Seven Group Holdings (ASX:SVW) itself up around 25%. Run by Kerry and Ryan Stokes and home to a beautiful basket of ASX reliables like Beach Energy (ASX:BPT) (29%) aforementioned Boral (74%) and Seven West Media (40%).

Quality outperforms in the long run

Healthcare Sector

Just as Coles and Woolworths are defensive favourites because everyone has to eat, health stocks are deemed to be “no-brainers” in a sickly market.

Considered a defensive sector since recessions don’t stop the human body from falling apart from misuse.

Yep, the need for medical care or medications is recession proof.

According to Wilsons, many of these companies also have a competitive advantage through R&D capabilities or patents for their products/services as well.

For them, blood plasma giant CSL (ASX:CSL) “is the definition of a quality defensive.”

Resilient earnings, high ROE and the ability to positively surprise the market.

Macquarie has healthcare as its top overweight sector.

Unsurprisingly they also like CSL, tghe biggest healthcare defensive of all time, largely based on the health giant’s record of “outperforming after RBA pauses”.

Sonic Healthcare (ASX: SHL) has been smashed over the last 12 months, but the stock and its peers like Ramsay Health Care (ASX: RHC) and APA Group (ASX: APA) have all typically outperformed over the last four RBA pauses as rekated (above) by MQG).

The brokers at Macquarie reckon CSL, Ramsay and APA are forecast to grow forward earnings per share above 10% over the next 12 months.

Industrials

Industrial like names like Amcor (ASX:AMC), Orora (ASX:ORA) and Brambles (ASX:BXB) typically have little downside earnings risk, and regularly find themselves on the relative safe haven lists with annuity-style earnings from packaging and logistics. revenues.

Falling bond yields

MQG’s has also renewed its focus on stocks that benefit from falling bond yields, cheaper defensives and quality companies. These include companies such as Goodman Group (ASX: GMG), Orora again and Aristocrat Leisure (ASX: ALL).

Travel

UBS says travel stocks on the ASX have been a bit of a highlight.

“Flight Centre (ASX:FLT) and SiteMinder both displayed strong top line growth and favourable seasonal trends which imply positive read through for Corporate Travel and Webjet.”

CTD is up about 40% year to date.

Webjet is up 17% this year and 35% over the last 12 months.

Big Banks

The Big 4 have revealed their results, set a few new profit records, but there’s a dampened outlook.

A defensive stalwart. A stalwart stalwart. These Big 4 banks of ours do well in times good and bad. Low rates invite the house buyers. Higher rates bring the profit rains thanks to the best gauge for an Aussie bank – your net interest margins (NIM)—the difference between what a bank banks from interest on money lent – and the interest it pays to bank depositors.

He’s lowered Morningstar’s NIM forecast to 1.9% from 2.0%, saying the big four’s results were overshadowed by margin headwinds, as intense mortgage and deposit competition means the trajectory is likely down heading into the second half.

UBS notes that the “Aussie consumer complex has also shown declining fortunes, with quarterly sales from JB Hi-Fi (ASX:JBH), Super Retail (ASX:SUL) and Seven West Media (ASX:SWM) all slowing.”

SWM is short about 40% on this time last year.

But what UBS days doesn’t mean a damn thing to Morgans when it comes to SUL.

SUL and A2m

Super Retail’s sales momentum in the 3Q has been more resilient than Morgans had assumed a few weeks back, though gross margins slightly missed the broker’s forecast.

After raising sales estimates and lowering gross margin expectations, Morgans has increased its earnings per share EPS forecasts for FY23 and FY24 by 3% and 4%, respectively. The price target also climbs to $15.50 from $15.00.

While the broker continues to expect tougher trading conditions in coming months, the Add rating is retained.

But that might be where an old fav comes in. The a2 Milk Company (ASX:A2M) for example is back on Morningstar’s global best ideas list.

It’s a tough stock to love because it has no concern at all for the psychological state of its shareholders.

Down 21% year to date, yet up 28% over the last 12 months.

A2M shares hit a 12 month high in February (ahead of its 1H fiscal 2023 results), but that decent report sparked another sell off, )shares plunged almost 15%) – with renewed and seemingly interminable fears around A2M’s future in its key Chinese market.

Shares then slipped again late last month after revenue growth looked like coming in at the lower end of forward guidance.

The news came soon after the company’s long-time manufacturing partner and fellow ASX-lister Synlait (ASX:SM1) downgraded its FY23 profit guidance due to an expected drop in demand.

The series of selloffs has pulled a2 Milk back into undervalued territory in recent months and, as of May 1, shares are trading at a 25% discount to where Morningstar sees fair value.

The infant formula maker which aims at both both China and anyone with a hankering for the A1 beta-casein protein.

The flip-flopping in and out of favour company is no stranger to Morningstar’s best ideas list, it’s been there and back more times than one of Peter Jackson’s hobbits.

Hewitt’s hobbit

Nevetheless, Morningstar analyst Angus Hewitt says there’s still a lot to like about the company’s prospects, notably in the ‘key battleground’ of China.

“A2’s share in Chinese-language-labelled infant formula continues to grow, supported by a2 Platinum’s solid brand health that underpins its narrow economic moat,” he says.

“We still expect solid future gains, with market share opportunities in Chinese infant formula, North American fresh milk, and other global dairy products supporting our outlook for double-digit annual EPS [earning-per-share] growth over the next five years.”

Hewitt points to declining births in China and shifting consumer habits as potential hurdles for the company, but adds that other factors should help offset these issues.

“Tailwinds of [Chinese] consumers preferring foreign brands are no longer blowing, as country of origin is no longer a point of differentiation.

“Offsetting the falling number of births in China, we anticipate premiumisation to continue and expect a2 Milk to capture market share.”

A final word

According to David Cassidy head of investment strategy at Wilsons the recurring revenues of defensive companies should be “even more valuable as a source of earnings stability” in this kind of environment where some sort of heinous recession feels like it’s just lurking around the next bank failure.

Cassidy says :history has persistently shown” that in times of said fear and volatility, defensive sectors have outperformed.

“Using a simple equal weighted portfolio of healthcare, communication services and consumer staples demonstrates that these sectors generally have smaller drawdowns than the market in periods of volatility.

“Investing in a quality company that has low volatility might not get your heart racing like a high growth stock. However, in the long run, protecting your downside while compounding your returns is likely to pay off.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.