Banking on pot: Minus one global investment house, Switzerland moves to legalise cannabis

News

News

The Swiss government has moved quickly to shore up its uniqueness as a centre of commerce – albeit one where the banks eat each other – and hurriedly green-lit (no pun) plans to legalise the sale and consumption of cannabis in Zurich, Switzerland’s hitherto global centre for banking and finance.

Already short one global banking and finance centre this week, the Zurich city government and the Zurich University Hospital declared on Wednesday that the Swiss Federal Office of Public Health approved the conditions for the organic production of two separate strains of cannabis.

The test sales begin in August.

The exciting sounding trial will attempt to assess the various social and economic benefits of regulating pot, Mary-Jane, ganja or – as the Swiss are calling the project: Zuri Can – Cannabis with Responsibility (no pun).

Credit Suisse (former) Headquarters in Paradeplatz Square, Zurich:

Zuri Can ‘is intended to study the impact of regulated cannabis supply on the consumption and health of consumers,’ according to the joint (no pun) Wednesday press release.

The project was apparently on ice from last October, following strong objections by the health authorities. But it’s possible those officials were holders of Tier-1 Credit Suisse bonds, or perhaps they just have friends banking with Credit Suisse, because today Project Zuri Can is taking off (kind of a pun, but not).

Cannabis Suisse

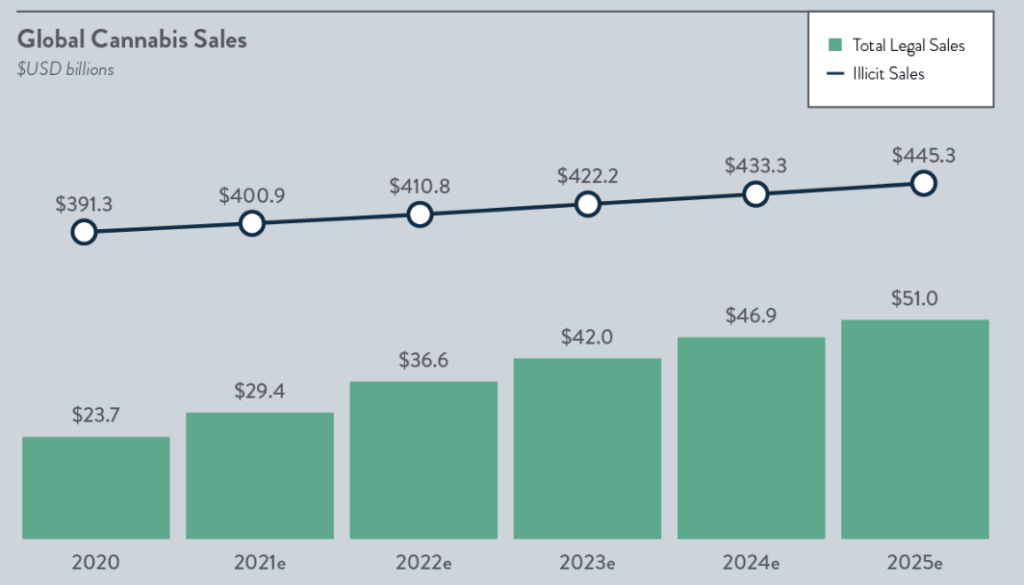

According to New Frontier Data, the global cannabis industry is poised for strong growth over the coming decade as expansion of legal access around the world accelerates. But since much of the world hasn’t yet legalised cannabis, nearly all the demand comes from illicit or unregulated markets.

In 2020, 94% of high-THC cannabis spend was in unregulated channels, FND says.

Cannabis consumers globally spent an estimated US$415 billion on high-THC cannabis in 2020, with annual spending projected to climb to US$496 billion by 2025.

“Control” groups

The sale of cannabis products from pharmacies and social clubs to control groups is now due to begin next August.

A maximum of 2,100 participants can take part in the large-scale pilot project in Switzerland’s biggest city. One suspects finding the subjects – who will be allowed to buy the drug for personal use from pharmacies, special dispensaries and social clubs across the city – will bot be too much a of a challenge.

All participants will be expected to do is answer a questionnaire every 6 months around their consumption habits – a good read, for sure – and what health effects they might experience as part of the study.

A first trial with about 400 participants was launched in the city of Basel last year, following a legal amendment by the Swiss parliament in 2020 allowing for trials to study the impact of the use of cannabis for recreational use.

What to do now?

Well. Personally, at the arrival of unexpected news, I like to panic first.

That done, I guess some preparation for either a Swiss vacay or watching what happens to local sector players.

In the case of the former, here is the Uni of Zurich sign up page for participating in Zuri Can. Good luck to you brave traveler.

In this last regard, it might be useful just to have an ASX pot stock list nearby, here’s a quick snippet from Emma Davies wonderful 2023 ASX Cannabis stock guide.

Keep it near in cases of emergency, or perhaps tedium: