ASX Small Caps Market Wrap: Which one of the seven signs of the weed apocalypse dropped this morning?

News

News

Local markets are hovering around break-even this morning, with winners and losers pretty evenly spaced among the sectors and only the goldies looking anything like proper winners before lunch.

The market-driving news overnight was a rapid fall in crude oil prices, which slid nearly 5% – leaving the market operating under a condition known as “contango” which is nowhere near as exotic and exciting as it sounds. I’ll explain it later, I promise.

But before I get into what’s happening on the ASX, there’s news from the US this morning that has sent shockwaves through the burgeoning global cannabis industry, after one of the demon weed’s most high-profile proponents announced that he’s calling time on lighting up and getting high.

I’m giving up smoke. pic.twitter.com/DDVl9Syixw

— Snoop Dogg (@SnoopDogg) November 16, 2023

In a message on X (I am refusing to include “formerly known as Twitter”, because if you don’t already know that by now, you’ve obviously been in a coma for 20 years and this news story will be of little interest to you anyway), rapper and perennial stoner Snoop Dogg has announced that he is “giving up smoke”.

Which is, in a way, roughly the same as you or I calmly announcing to the world that we are giving up sh..ting.

The rapper has not given a reason why, but I would be incredibly surprised if it’s not on doctors orders – for decades, Mr Dogg has smoked like a green log in a bushfire, which will undoubtedly have had some effect on his ability to do stuff. Like, breathe.

What effect this will have on the cannabis industry as a whole is yet to be determined, but I reached out to my own marijuana expert for his take on the situation.

Associate Professor Colin Bongfondler from the University of Inner Western Sydney says that there will almost definitely be a short-term impact on both the legitimate and illicit cannabis markets, but says it’s “a market correction that we had to have”.

“Prices have remained largely static for quite some time,” Prof. Bongfondler croaked from his beanbag in the corner of my living room, “so the sudden market glut left by this precipitous drop in demand will absolutely put downward pressure on any future pricing structure pieced together by the major players.”

“Whether industry players are nimble enough to be able to price that in short-term while they wait out the inevitable market volatility between now and Christmas remains to be seen,” he added, then: “You got any PopTarts in this place?”

But while the world waits to see what kind of bold new musical direction will emerge from a newly-smokeless Snoop Dogg, there is one person in particular for whom this is world-shattering news.

Her name is Renegade Piranha, and – until now – her full-time, US$50,000 a year job was to roll joints for Snoop.

In a recent interview, Ms Piranha told Australia’s largest FM Radio blob Kyle Sandilands: “I do about half a pound a day, which is 75 to 150 joints.”

Which sounds like a lot, because it is. It’s an astronomical quantity of weed, capable of rendering an entire squadron of art teachers and beat poets mute and immobile in less than 20 minutes, under the right conditions.

Local markets are experiencing a general malaise this morning, heading into lunchtime about 0.2% lower than when the session began, with a giant, oozy reason looming large over the market as a whole.

All the talk overnight was about the price of oil, which is falling at a concerning rate as investors and speculators absorb news of weak Asian economic data and revelations that US stockpiles are bursting at the seams, and reach the conclusion that demand for oil is about to fall off a cliff.

As a result, crude oil prices fell nearly 5% overnight. At the time of writing, the fancier premium Brent crude is still showing a -4.47% decline to $77.45 a barrel, but the budget WTI gear is up around 0.3% this morning to $72.12.

Reuters reported this morning that the price drop overnight was large enough and fast enough to leave both WTI crude and Brent crude’s front-month contracts trading below later-dated contracts, in a condition known as “contango” because it’s important to drop nerd words when weird sh-t’s going down.

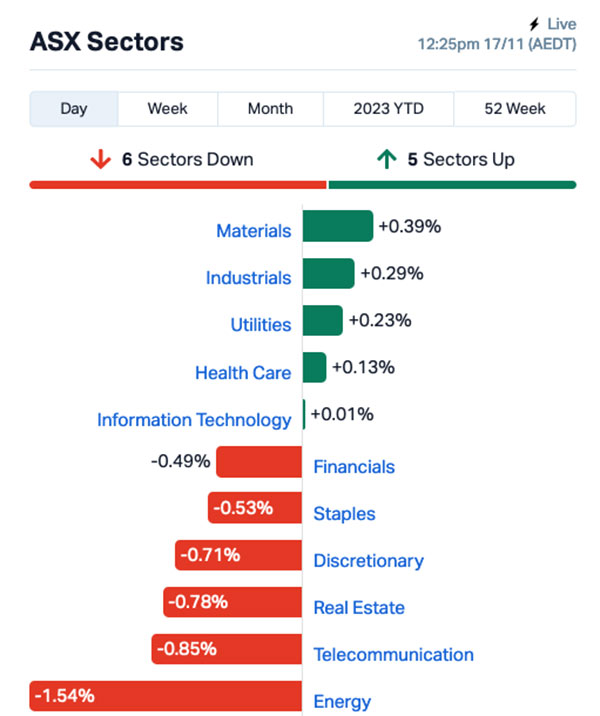

The crude crumble has had a predictable, but still terrible, effect on local Energy sector shares, leaving the sector down more than 1.5% this morning and leading the market’s losses.

Materials and Industrials are putting in a pretty wan effort to keep things afloat, but as the gong sounds to call us all to lunch, it’s not working – the ASX 200 benchmark is down 0.22% and floundering.

But with crude prices in the dumps, the goldies are having a field day this morning – the KGD All Ords Gold index is shining bright, up 2.6% so far today.

In the US overnight, investor sentiment was mixed resulting in a session that saw the S&P 500 rise by +0.12%, the blue chips Dow Jones index fall -0.13%, and the tech-heavy Nasdaq edge slightly higher, up +0.07%.

As it was locally, oil was the talk of the town in New York, with Earlybird Eddy Sunarto noting that current oil prices are now roughly 22% lower than September’s 2023 highs.

Meanwhile Wall Street’s VIX index, which measures the market’s fear factor, sat near a two-month low of 14.01.

In US stock news, Walmart tumbled -8% after its guidance outlook came in slightly less than expected. The retailer however reported quarterly earnings that topped estimates.

Another retailer, Macy’s, rose 6% after reporting an improvement in margins, however Alibaba crashed 9% after reports that Jack Ma’s family plans to sell down shares in the company. Alibaba’s Q2 revenue however came in line with analysts’ estimate.

Perhaps most alarmingly, though, almost all China-related stocks in the US fell in the wake of Chinese President Xi Jinping’s first visit to the United States in six years, which was going really, really well until President Joe Biden called him a “dictator”.

In Asian market news, Japan’s Nikkei is flat as the nation-wide shortage of weird things happening tightens its grip on Japanese investor sentiment, with experts suggesting that if something strange doesn’t happen in the next 24-48 hours, the entire country could catch fire.

In China, Shanghai markets are down 0.24% after investors were told by US President Joe Biden that their national leader is a dictator, while in Hong Kong the Hang Seng is down 1.39% because it has a note from its doctor saying it’s allowed to lie down for a nap whenever it wants to.

Here are the best performing ASX small cap stocks for 17 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap KNM Kneomedia Limited 0.003 50% 500,000 $3,009,571 TFL Tasfoods Ltd 0.039 50% 119,653 $11,364,483 ID8 Identitii Limited 0.028 47% 1,201,712 $8,117,522 MRR Minrex Resources Ltd 0.023 44% 39,943,939 $17,357,880 OMX Orange Minerals 0.048 33% 221,600 $1,822,506 CXU Cauldron Energy Ltd 0.015 25% 7,754,533 $13,585,961 AVE Avecho Biotech Ltd 0.005 25% 828,330 $10,793,168 GTG Genetic Technologies 0.0025 25% 2,030,236 $23,083,316 RWD Reward Minerals Ltd 0.095 22% 5,694,432 $17,772,545 AUH Austchina Holdings 0.003 20% 31,666 $5,194,709 CCO The Calmer Co Int 0.006 20% 650,058 $4,085,596 RLC Reedy Lagoon Corp. 0.006 20% 1,697,966 $3,083,418 G1A Galena Mining 0.091 20% 3,277,660 $57,195,220 RMI Resource Mining Corp 0.038 19% 168,815 $17,995,130 SHG Singular Health 0.046 18% 254,880 $5,511,100 ACP Audalia Res Ltd 0.014 17% 300,001 $8,305,634 EEL Enrg Elements Ltd 0.007 17% 785,714 $6,059,790 MOM Moab Minerals Ltd 0.007 17% 500,000 $4,271,781 MTL Mantle Minerals Ltd 0.0035 17% 325,011 $18,442,338 M2M Mt Malcolm Mines NL 0.022 16% 123,331 $1,944,527 UNT Unith Ltd 0.022 16% 4,837,809 $17,113,569 BTR Brightstar Resources 0.015 15% 3,442,013 $24,905,834 PHX Pharmx Technologies 0.053 15% 254,231 $27,531,312 BIR BIR Financial Ltd 0.063 15% 296,184 $16,675,892 HNR Hannans Ltd 0.008 14% 124,764 $19,115,984

It’s a tie for Best Small Capper this morning, with both KNeoMedia (ASX:KNM) and Tasfoods (ASX:TFL) banking a 50% climb in the morning session.

Education SaaS firm KNeoMedia’s on the rise, thanks to news that it has received a second tranche of payment due from the New York Department of Education, in connection with the ongoing deployment of the ‘Connect All Kids’ education initiative.

The $700,000 payment from New York is the second of three instalments – the third of which has reportedly already been approved and processed for payment, meaning it’s likely to turn up in the very near future.

KNeoMedia says that it is in talks with the New York DOE around expanding its current offering, both through growing existing usage of the company’s tech and through the development of other complementary products, and as such it anticipates further payments from the US in due course.

Meanwhile, Tasfoods is flying this morning on reports that it has received ACCC approval to sell its Betta Milk and Meander Valley Dairy businesses to Bega Cheese (ASX:BGA), for a cool $11 million.

It’s a sweet deal for both sides – Tasfoods pockets the cash, Bega gets the businesses as well as a perpetual, royalty free licence to use the Pyengana Dairy brand for milk and cream products in Australia. Everybody wins!

With the ACCC greenlight behind it, Tasfoods says that the rest of the sale should proceed without incident, and expects that all the paperwork and handshakes should be complete by the end of the calendar year.

In third place today is regulatory tech firm Identitii (ASX:ID8), which has taken off with a 47% leap in the absence of any news to the ASX – as has nearby fourth place occupier Minrex Resources, which (at the time of writing) is surging very quickly through +56% despite having nothing to say to the ASX since the end of October.

Here are the most-worst performing ASX small cap stocks for 17 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CHK Cohiba Minerals 0.002 -33% 16,000 $6,639,733 GMR Golden Rim Resources 0.013 -28% 1,798,289 $10,648,591 ASR Asra Minerals Ltd 0.011 -21% 2,588,322 $20,386,879 SFG Seafarms Group Ltd 0.004 -20% 8,700 $24,182,996 MXC MGC Pharmaceuticals 0.945 -19% 55,209 $41,099,370 FHS Freehill Mining Ltd. 0.0025 -17% 230,000 $8,534,403 LVT Livetiles Limited 0.005 -17% 42,650 $7,062,664 ME1 Melodiol Global Health 0.0025 -17% 64,089,936 $11,547,311 RNX Renegade Exploration 0.005 -17% 80,008 $5,718,743 NAG Nagambie Resources 0.031 -16% 449,382 $21,523,874 TNC True North Copper 0.13 -16% 1,369,785 $40,275,425 OZM Ozaurum Resources 0.17 -15% 6,585,022 $31,750,000 KLI Killiresources 0.052 -15% 50,359 $3,634,079 1MC Morella Corporation 0.006 -14% 1,347,018 $43,145,149 AYT Austin Metals Ltd 0.006 -14% 145,000 $7,111,123 CTQ Careteq Limited 0.024 -14% 184,508 $6,219,440 AXN Alliance Nickel Ltd 0.052 -13% 32,000 $43,550,377 ATV Activeportgroupltd 0.1 -13% 132,517 $36,299,506 BEX Bikeexchange Ltd 0.007 -13% 572,680 $11,461,038 GBZ GBM Rsources Ltd 0.014 -13% 4,141,699 $9,925,149 GCM Green Critical Minerals 0.007 -13% 608,405 $9,092,680 LML Lincoln Minerals 0.007 -13% 3,182,546 $13,550,762 8VI 8Vi Holdings Limited 0.07 -13% 8,200 $3,352,914 LYN Lycaon Resources 0.175 -13% 26,225 $8,013,750 IAM Income Asset 0.08 -11% 29,000 $28,068,655