ASX Small Caps Lunch Wrap: Who’s trying really hard not to say ‘I told you so’ today? (hint: it’s me)

The two NASA astronauts would have had a better chance of making it home on time if they'd booked Bonza flights to the ISS. Pic via Getty Images.

Local markets hit the lunch break in far better shape than many of us were expecting, given the inflation-led drubbing the ASX has taken since Wednesday.

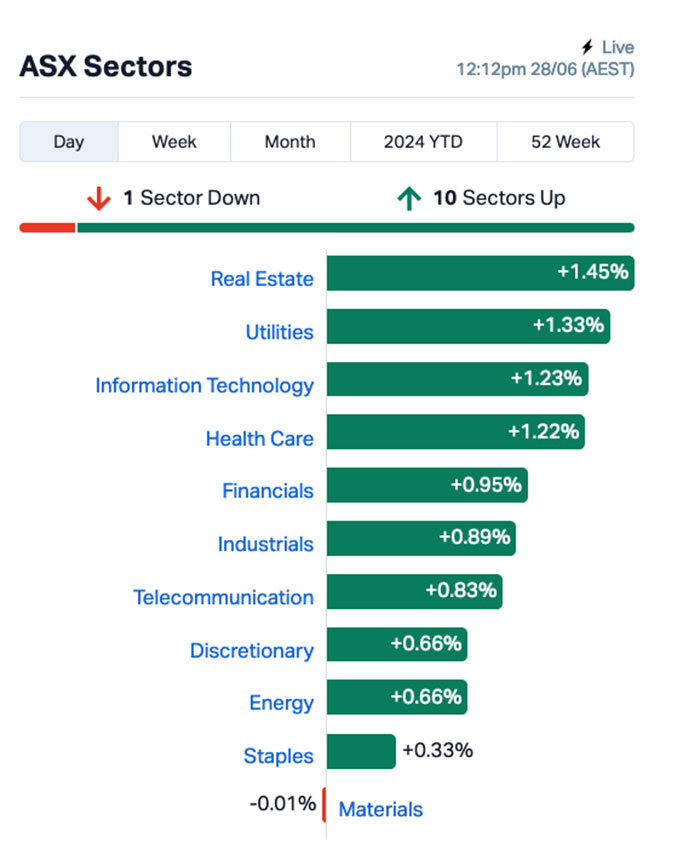

The benchmark ASX 200 was around +0.5% better off, with 10 of 11 market sectors making gains, leaving the Materials sector to scratch about in the dirt and wonder when it’s going to be their turn on the swings.

I’ll get into more detail on all that shortly, but first, I’m going to answer the question in today’s headline by saying that it’s me who’s trying (and, evidently, about to fail at the simple task of not saying I told you so).

On 28 May, I wrote about a couple of intrepid space travellers who were about to blast off from Cape Canaveral Space Force Station in Florida, aboard a rocket that had been put together by Boeing.

Yes, that Boeing. The one that’s been in the news because bits of their planes keep falling off, and – weirdly – the people coming forward to blow the whistle on the company are turning up dead with a shocking regularity.

Anyway, I told you so.

Astronauts Suni Williams and the still hugely improbably named Butch Wilmore were meant to be popping up to the International Space Station on 05 June for an eight-day stay, then come home.

But, much like Gilligan’s ill-fated “three hour tour” that turned out to be three complete seasons on CBS between 1964 and 1967, things have gone awry.

The astronauts are still on the ISS, because that Boeing Starliner we were worried wouldn’t get them to the ISS has managed to do the only thing that could be argued is actually worse.

The Boeing Starliner got them there, and stranded them there – the pair unable to come back to Earth on the Starliner because of some “technical faults” with the Boeing spacecraft.

Boeing had issued a statement in which it specifically said “the astronauts are not stranded”. And… let’s just say that’s at odds with how the situation is being widely reported.

The spacecraft manufacturer has acknowledged that there are some problems with the Starliner – not least of which are the five… five… helium leaks that were spotted during the flight to the ISS at the start of June.

And for what it’s worth, the Boeing spokesperson did point out that the Starliner is “performing well in orbit while docked to the space station” – and in case you need some translating here in order to appreciate just how breathtakingly idiotic that statement is, here you go:

The Boeing Starliner leaked helium the whole way up to the ISS, but now that it’s bolted to the side of the space station and not actively flying anywhere, it’s doing a bang-up job of being a spaceship.

The two NASA astronauts are now scheduled to do a spacewalk each in order to “gather more data” – ie, figure out just how badly the helium-driven propulsion system is damaged – before they’ll even think of trying to bring them home.

I wouldn’t be at all surprised to find out that Elon Musk and his SpaceX team were already prepared for just this scenario, and will have a solution in place shortly.

It’s probably going to turn out to be a comically large trebuchet that SpaceX will use to hurl Cybertrucks at the ISS to knock it out of its orbit until it’s close enough to the ground that the astronauts can parachute down to safety… problem solved.

I’d pay good money to watch that.

TO MARKETS

Local markets are looking a lot healthier on Friday morning than they have since over the previous two sessions, with the benchmark up by about +0.5% at lunchtime – but it’s been a strangely quiet morning on the bourse.

There’s only a single, solitary market sector in the red – yes, it’s Materials. Don’t look so surprised.

At midday, the sectors looked like this:

And the more granular indices look like this:

In business news, there’s not a whole heap o super-interesting stuff going on today – but up the top end of town, ANZ Bank (ASX:ANZ) is no doubt breaking out the bubbly after Federal Treasurer Jim “Superninentdo” Chalmers told a strategically placed microphone that he’s okay with ANZ buying Suncorp.

But… and it’s a Big Jim Chalmers-sized but… there are conditions.

The deal-breakers that Chalmers plans to have in place inlude, but are not limited to, prohibiting local branch closures for three years.

Chalmers also said that ANZ must ensure no net employment losses across Australia for three years due to the transaction, and insist on proper engagement with employees and the Finance Sector Union.

Plus, ANZ has to get on board with the Bank@Post network, which is a great policy initiative that has slowly been turning suburban Australia Post offices into sub-sub-sub branches that function in a lot of ways, just like a bank… but with barely a fraction of the security.

But wait, there’s more: ANZ will be compelled to lend the Queensland state government $15 billion, ahead of the state hosting the Olympics in 2032 – which, given the propensity for the Olympic Games to turn into gigantic money-lined sinkholes, looks more like a hefty fee to do business than a loan.

NOT THE ASX

Om Wall Street overnight the S&P 500 and the blue chip Dow Jones index inched higher by +0.1%, and the tech-heavy Nasdaq lifted by +0.4%, with US markets unburdened by shockingly high inflation data like we are back home.

That said, the US market is cautiously anticipating the release of the US PCE (Personal Consumption Expenditures) index later tonight (US time).

If the PCE data falls short of expectations, experts warned of potential stagflation headlines. However, if estimates are met or exceed expectations, it could smooth the market’s transition into July.

“Still, an overbought market and relatively expensive market based on just a handful of mega names may need to recalibrate, and allow other sectors to co-exist with them or even begin to lead the market,” said Quincy Krosby at LPL Financial.

In US stock news, Levi Strauss & Co plunged by -15% after announcing tight quarterly sales too narrow for expectations.

Nike Inc also plunged by -12% post-market. Nike exceeded expectations for earnings in Q4, but its sales figures and Q1 guidance fell below expectations due to weaker consumer demand in North America and China.

Online comics company Webtoon Entertainment jumped +9.5% on its Nasdaq debut. Webtoon is a digital platform where comic book and manga artists can publish their creations, reaching global audiences.

Asian markets are doing their thing this morning, with Japan’s Nikkei up 1.0%, the Hang Seng down by -0.75% and Shanghai markets are basically flat in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 28 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap TD1 Tali Digital Limited 0.002 100% 505,061 $3,295,156 HVY Heavy Minerals 0.069 30% 268,972 $3,337,197 SPX Spenda Limited 0.009 29% 8,795,808 $30,271,205 BFC Beston Global Ltd 0.0025 25% 4,028,536 $3,994,094 LPD Lepidico Ltd 0.0025 25% 1,105,530 $17,178,239 ROG Red Sky Energy 0.005 25% 273,469 $21,688,909 SIH Sihayo Gold Limited 0.0025 25% 660,203 $24,408,512 AL3 Aml3D 0.105 22% 6,162,434 $32,430,517 E33 East 33 Limited 0.012 20% 399,121 $7,751,839 PRM Prominence Energy 0.006 20% 422,341 $1,556,882 DLI Delta Lithium 0.275 20% 2,335,292 $164,083,643 3DP Pointerra Limited 0.043 19% 3,910,505 $28,982,765 ALR Altair Minerals 0.0035 17% 1,130,038 $12,889,733 BNL Blue Star Helium Ltd 0.007 17% 2,509,868 $11,653,592 EXL Elixinol Wellness 0.0035 17% 53,241 $3,963,547 CLU Cluey Ltd 0.037 16% 111,692 $6,451,634 IMI Infinity Mining 0.015 15% 455,427 $1,543,794 RLF RLF AgTech 0.046 15% 141,052 $9,169,718 ENR Encounter Resources 0.73 15% 3,583,075 $286,275,814 CCO The Calmer Co International 0.008 14% 10,880,281 $9,669,200 MKL Mighty Kingdom Ltd 0.004 14% 250,000 $11,255,801 OLY Olympio Metals Ltd 0.032 14% 256,099 $2,393,341 FFG Fatfish Group 0.012 14% 3,652,880 $14,769,017 ACM Aus Critical Mineral 0.083 14% 17,902 $2,578,816 JPR Jupiter Energy 0.025 14% 27,883 $28,020,348

Pointerra (ASX:3DP) has moved into the top spot on Friday at lunchtime, rising after revealing a juicy US government contract. The US Department of Energy (DOE) has awarded the company a US$1.63 million contract for a program to model a range of electric grid resilience investment scenarios by electric utilities.

Delta Lithium (ASX:DLI) was up on Friday morning on news of a major upgrade to its gold resource at Mt Ida, which has grown the Baldock Deposit up 82% to 4.8Mt @ 4.4g/t gold for 674,000 ounces.

And Diatreme gave back some of its gains from earlier on Friday, after making headway while it has a takeover bid on the table for 100% ownership of Metallica Minerals (ASX:MLM) .

Diatreme – which already holds more than 63% of MLM – extended the deadline on its offer yesterday, but has made it very clear that the current offer of 1.3319 Diatreme shares for every Metallica share is as high as it’s willing to go.

And The Calmer Co (ASX:CCO) had more good news for the market today, with the company revealing that the renounceable rights issue announced on 3 June has closed heavily oversubscribed and raised approximately $2 million (before costs), with the company sorting out a follow-on placement to accommodate investors who missed the initial round.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 28 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AVE Avecho Biotech Ltd 0.002 -33% 255,894 $9,507,891.04 DOU Douugh Limited 0.002 -33% 241,671 $3,246,206.76 EEL Enrg Elements Ltd 0.002 -33% 908,365 $3,029,895.09 MSG MCS Services Limited 0.002 -33% 1,795,471 $594,298.96 1TT Thrive Tribe Tech 0.003 -25% 211,157 $1,882,486.08 CLZ Classic Min Ltd 0.0015 -25% 5,559,286 $1,511,096.09 MHC Manhattan Corp Ltd 0.0015 -25% 1 $5,873,959.55 CDT Castle Minerals 0.004 -20% 734,322 $6,639,131.59 FAU First Au Ltd 0.002 -20% 300,000 $4,154,983.19 IVX Invion Ltd 0.004 -20% 245,000 $32,122,661.03 LBT LBT Innovations 0.014 -18% 2,617,649 $26,417,767.88 1MC Morella Corporation 0.0025 -17% 4,257,518 $18,536,398.28 CCZ Castillo Copper Ltd 0.005 -17% 882,913 $7,797,032.13 EVR Ev Resources Ltd 0.005 -17% 695,962 $7,927,628.91 WML Woomera Mining Ltd 0.0025 -17% 103,012 $3,654,416.99 SFM Santa Fe Minerals 0.031 -16% 87,783 $2,694,295.19 CAZ Cazaly Resources 0.016 -16% 3,240,552 $8,764,756.83 TGH Terragen 0.011 -15% 279,219 $4,798,054.64 FML Focus Minerals Ltd 0.14 -15% 120,479 $47,282,176.43 ATV Activeport Group 0.046 -15% 166,739 $17,168,842.35 PHO Phosco Ltd 0.023 -15% 120 $7,553,200.78 ALY Alchemy Resource Ltd 0.006 -14% 316,001 $8,246,533.79 DTZ Dotz Nano Ltd 0.12 -14% 391,673 $73,326,695.12 LNR Lanthanein Resources 0.003 -14% 5,883,573 $8,552,726.45 SUM Summit Minerals 0.33 -13% 5,018,969 $23,028,808.26

IN CASE YOU MISSED IT – AM EDITION

Vertex Minerals (ASX:VTX) has wrapped up demobilisation of the Morning Star gravity gold plant in Victoria, which it plans to refurbish in combination with several items of the Hill End plant to form a logical process flow sheet.

Whilst this work has been occurring, the company has been considering the benefits of pre-concentrating the Reward gold mine ore using optical sorting technologies, including the inclusion of a Tomra ore sorter that utilises laser scanning.

This technology can essentially separate high-grade gold bearing quartz ore from the barren sedimentary country rock before it enters the processing stream – which significantly reduces the quantity of material that requires further processing to recover gold.

Vertex believes that up to a 50% reduction in the ore processing volume may be achieved with the inclusion of this technology in the process flow sheet.

Once changes to the process flow sheet have been incorporated, the company will update is prefeasibility study to reflect the staged ramp-up in production and the inclusion of pre-concentrating prior to ore processing at Reward.

At Stockhead, we tell it like it is. While Vertex Minerals is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.