ASX Small Caps Lunch Wrap: Who’s figured out that getting your cats high is purrfectly fine today?

News

News

It’s been an interesting morning on the market thus far – the ASX 200 benchmark is down 0.3%, oil and gas prices are surging, and the Aussie dollar’s pulled up weaker than my excuse for why I was late to work this morning.

It’s almost like there’s a war in the Middle East, or something.

Plus Albemarle’s been pushed off the Liontown Resources table in the boardroom by Gina Rinehart, and a little Aussie goldie has gone quietly berserk on takeover news… it’s all happening.

Before I get to all that, though, there’s a quick news story from the World of Amazing Science, where it has been determined that it’s entirely okay for cat owners to let their kitties get completely munted on silver vine whenever they want, the lucky little buggers.

Known scientifically as Actinidia polygama, silver vine is a member of the kiwifruit family that only grows natively in Asia’s mountainous regions, between 500m and 1500m above sea level – and cats go proper mental for it.

So mental, in fact, that researchers became concerned that cats exposed to it might actually become addicted to it – or, at least, to the feelings of euphoria the plant appears to provoke, which are “like catnip, only heaps stronger, dude. It’s amazing. You should totally try it”, according to one of the cats involved in the study.

Compared to catnip, it’s like the difference between cocaine and crack – where the former produces a fairly mild buzz for our feline friends, silver vine prompts a rapid, euphoric high that wears off faster than catnip.

But, despite concerns from pet owners that they might be enabling their cats, the euphoria comes without any of the horrifying addictive qualities that would otherwise have seen cathouses (for want of a better word) springing up all over residential neighbourhoods where the drug was able to take hold in the community.

Researchers, including biochemistry professor Masao Miyazaki at Iwate University’s Faculty of Agriculture and graduate student Reiko Uenoyama, decided to investigate by keeping 17 cats in a laboratory and exposing a selection of them to the drug.

10 cats were guinea pigs on the experiment, which found that once they were exposed to the drug, several things happened.

First, their little cat brains were flooded with “happy chemicals”, and they rolled around in piles of silver vine leaves for “about 10 minutes” before moving away to lounge around being high.

The cats’ interest in the substance tended to wane over time, which led the scientists to believe that the animals were not developing a dependence on it – leading to the conclusion that it’s “highly safe, with positive effects on cats”.

Which is awesome for the cats, and great for humanity, as we can all sleep a little more soundly knowing that Ziggy or Mr Sparkle Paws aren’t likely to wait until you’re asleep before pawning your Xbox to pay for their habits.

It’s been a busy day for the ASX so far, with the benchmark slumping 0.3% by lunchtime thanks to a weaker-than-ideal performance on Wall Street Friday night, which in turn had the jitters because of the worsening war in Israel (among other things).

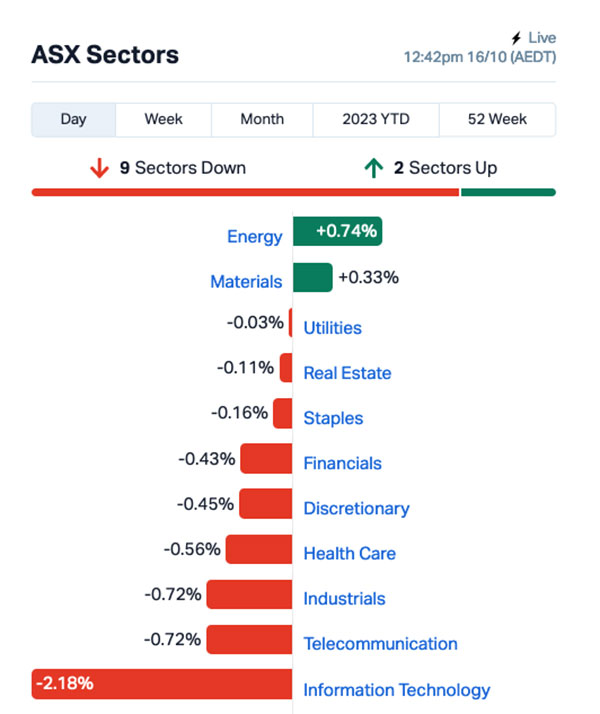

Sector-wise, local markets are broadly lower, with only Energy and Materials able to benefit from the global war worries – thanks to surging oil and gold prices.

They’re both easing a little as the morning wears on, but from the time local markets closed on Friday to this morning, Brent Crude climbed nearly 5.3% to be over US$90 a barrel, and gold stacked on more than 3.3% to be briefly over US$1,940 an ounce – which explains a lot of why the XGD All Ords Gold index is up more than 4.0% this morning.

Languishing today are the Tech Stocks, which fell hard when the market opened this morning, led lower by a weak performance on Wall Street on Friday.

Douugh (ASX:DOU) is seeing the worst of it, down nearly 17% this morning, and a sell off among the big names like has seen the likes of WiseTech Global (ASX:WTC), Xero (ASX:XRO) and NextDC (ASX:NXT) all fall more than 2.0% today.

The headline news, though, is US giant Albemarle walking away from it’s all-but-finalised deal to acquire Liontown Resources (ASX:LTR), after Gina Rinehart managed to buy up enough of the company from underneath the deal to turn it into an unworkable one.

It’s a bit complicated, but luckily we’ve got Josh Chiat on the case – and his pitch-perfect explainer does a way, waaaay better job than I could ever do, so go read that here and I’ll wait patiently for you to come back.

Friday was a mixed day on Wall Street, as the developing conflict in Israel gave investors a pretty serious case of the jitters, and the S&P 500 fell by -0.5%, the blue chips Dow Jones index was up by +0.12%, with the tech-heavy Nasdaq tumbling by -1.23%.

Earlbird Eddy reports that Middle East concerns, as well as some wonky US consumer sentiment data – it’s fallen sharply in October – have overshadowed a rally in US banks like JPMorgan and Chase, which beat estimates in their quarterly profits.

JPMorgan CEO Dimon said: “Currently, US consumers and businesses generally remain healthy, although, consumers are spending down their excess cash buffer.”

However, Dimon warned that “this may be the most dangerous time the world has seen in decades”.

Another stock to have surged includes budget retailer Dollar General, which jumped 9% after tapping former CEO Todd Vasos to take back the reins.

In Europe, airlines and travel stocks led the losses as worries about escalating violence in Gaza sent oil prices jumping, with Brent up 6% to US$90.89 a barrel.

In Japan today, the Nikkei has fallen 1.72% as investors in the nation’s silver vine farmers reailsed that the target market for the drug isn’t quite the captive one as first believed.

In China, Shanghai markets are down 0.47% and in Hong Kong, the Hang Seng is similarly down 0.51% in early trade.

Here are the best performing ASX small cap stocks for 16 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MRD Mount Ridley Mines 0.002 100% 1,107,056 $7,784,882.87 DCN Dacian Gold Ltd 0.215 72% 3,670,494 $152,100,117.25 BME Black Mountain Energy 0.028 33% 5,579,301 $3,847,707.91 KIN KIN Min NL 0.049 29% 3,517,387 $44,769,720.82 TMX Terrain Minerals 0.005 25% 250,000 $5,030,575.03 NWM Norwest Minerals 0.036 24% 66,484 $8,339,515.79 NOX Noxopharm Limited 0.105 21% 981,804 $25,424,701.65 ALY Alchemy Resource Ltd 0.012 20% 1,468,643 $11,780,762.56 LSR Lodestar Minerals 0.006 20% 2,920,193 $10,116,986.75 ME1 Melodiol Glb Health 0.006 20% 7,009,044 $14,736,601.86 SPQ Superior Resources 0.024 20% 3,421,771 $36,691,075.02 TRE Toubani Resources 0.14 17% 142,982 $14,103,461.76 AYT Austin Metals Ltd 0.007 17% 1,070,521 $6,095,247.93 KPO Kalina Power Limited 0.007 17% 290 $9,091,174.72 PUA Peak Minerals Ltd 0.0035 17% 3,000,000 $3,124,129.85 AGD Austral Gold 0.029 16% 20,600 $15,307,783.83 BMR Ballymore Resources 0.11 16% 102,219 $13,888,740.08 NMR Native Mineral Res 0.052 16% 1,329,765 $9,069,103.13 MHK Metalhawk. 0.097 15% 55,876 $6,616,764.92 ATH Alterity Therap Ltd 0.008 14% 177,859 $17,079,283.33 EMT Emetals Limited 0.008 14% 3,570,324 $5,950,000.00 FGH Foresta Group 0.016 14% 311,269 $28,916,489.50 LBT LBT Innovations 0.008 14% 2,758,002 $2,491,302.26 LCL LCL Resources Ltd 0.032 14% 7,239,504 $22,240,524.88 MXR Maximus Resources 0.032 14% 528,317 $8,976,961.50

There’s a clear standout performer mong the small caps this morning, and that’s Dacian Gold (ASX:DCN), which is soaring this morning after Dacian’s board told investors that they should definitely take up an offer from Genesis Minerals (ASX:GMD) for the latter to acquire all the bits of Dacian it doesn’t already own.

It’s a very generous offer, too, offering 0.1685 Genesis Shares for every one (1) Dacian share, improving to 0.1935 Genesis Shares for every one (1) Dacian share you hold if, during or at the end of the offer period, Genesis acquires a relevant interest in at least 95.1% of Dacian shares on issue.

That values Dacian at around $256 million, at an individual share price of $0.235 to start with, which – should the improved offer come into play – climbs to $328 million at $0.27 per share.

To save you doing the maths yourselves, that’s a premium of 116% to Dacian’s closing share price of $0.125 on 13 October, and 127% to Dacian’s 20-day VWAP of $0.119 per share.

At the time of writing, Dacian’s spiked 76% to $0.22 per share, and both Dacian and (obviously) Genesis are telling investors to get on board.

Elsewhere, BBlack Mountain Energy (ASX:BME) has jumped more than 42% this morning after informing the market that the previously announced sale of 100% of its acreage and its title and interest in the Half Moon prospect, a well in the Permian basin, currently held by subsidiary Seven Rivers, has been settled.

BME will pocket $10.4 million for the sale, which has executive chairman Rhett Bennett feeling pretty darn happy.

“This sale of the Half Moon acreage satisfies every element of our exciting short term gains strategy striking the right balance between an immediate cash boom and the future development opportunity that exists in Western Australia,” Bennett said.

“A return on investment of 100% in less than 8 months, at the time of agreement, is both a tremendously quick and strong outcome for the company.”

Kin Mining (ASX:KIN) went zooming on no news this morning, climbing around 29% and earning itself a “plz explain” postcard from the ASX, a response to which is due out any moment.

There’s a bunch of other small caps moving without fresh news, including Norwest Energy (ASX:NWE) and Noxopharm (ASX:NOX) – up 24% and 21% respectively.

And Superior Resources (ASX:SPQ) has jumped 20% on news of strong assays from the second hole of its Cockie Creek copper-gold-molybdenum prospect, west of Townsville in northern Queensland.

Hole CCDD002 has returned 117m @ 0.52% Cu, 0.11g/t Au and 109ppm Mo from 20m (CCDD002), including 71m @ 0.69% Cu, 0.13g/t Au and 158ppm Mo from 27m, 36m @ 0.77% Cu, 0.14g/t Au and 146ppm Mo from 56m and 10m @ 1.08% Cu, 0.20g/t Au and 44ppm Mo from 56m.

Noice.

Here are the most-worst performing ASX small cap stocks for 13 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CCE Carnegie Clean Energy 0.0015 -25% 9,472,463 $31,285,147 ENT Enterprise Metals 0.003 -25% 131,718 $3,197,884 MXC MGC Pharmaceuticals 0.0015 -25% 4,393,599 $8,855,936 EMP Emperor Energy Ltd 0.01 -23% 3,158,078 $3,495,212 FHS Freehill Mining Ltd. 0.003 -22% 7,768,436 $10,904,692 CNJ Conico Ltd 0.004 -20% 1,742,932 $7,850,475 IEC Intra Energy Corp 0.004 -20% 120,000 $8,303,908 NZS New Zealand Coastal 0.002 -20% 350,712 $4,167,525 JRL Jindalee Resources 1.385 -19% 40,829 $98,691,822 STN Saturn Metals 0.13 -19% 34,243 $25,846,177 DOU Douugh Limited 0.005 -17% 96,380 $6,341,852 FFG Fatfish Group 0.01 -17% 1,032,108 $14,282,876 HOR Horseshoe Metals Ltd 0.01 -17% 752,618 $7,721,744 ROG Red Sky Energy. 0.005 -17% 5,636,768 $31,813,363 TKL Traka Resources 0.005 -17% 1,600,000 $5,227,976 BMM Balkan Mining and Minerals 0.145 -15% 185,553 $11,697,220 RNT Rent.Com.Au Limited 0.018 -14% 1,055,000 $10,818,557 GW1 Greenwing Resources 0.125 -14% 220,411 $25,266,465 LYN Lycaonresources 0.22 -14% 33,027 $10,217,531 M4M Macro Metals Limited 0.0035 -13% 85,536 $7,948,311 MOH Moho Resources 0.007 -13% 1,210,714 $2,720,355 STM Sunstone Metals Ltd 0.014 -13% 669,577 $49,311,758 ALV Alvomin 0.14 -13% 64,861 $12,239,379 SB2 Salter Brothers 0.52 -12% 221,745 $54,552,607 AT1 Atomo Diagnostics 0.023 -12% 2,200 $16,619,260