ASX Small Caps Lunch Wrap: Who’s directing their misplaced rage at the Mona Lisa this time?

News

News

Local markets are doing something this morning. At 10.30am, it was a whole lotta nuthin, though – despite what some would call a “modest rise” when it first woke up at 10am, it didn’t last long or elicit much more of a response from investors than a “hmph – I guess it’s still working” before everyone lost interest and it wilted again.

Just like me when I wake up of a morning… being 50 sucks.

Anyway – I’ll get into the details of what’s happening once I’ve had a chance to dig through all the exciting announcements and data and charts… but before I do, there’s a news story that caught my eye this morning that I want to tug on your coat about, first.

The owner of the world’s most mysterious smile, The Mona Lisa, has been attacked in Paris.

Yes, again… this time, she’s been showered in tomato soup (cold, I’m assuming, so it’s safe to assume some kind of gazpacho maybe – it’s hard to tell without tasting it, though) by activists, who seem unhappy about food, or something.

That bit’s also kinda hard to tell – but according to people who speak French, the protesters are from a group called “Riposte Alimentaire” – Food Response – so they very cleverly attacked a painting with soup, to get us all thinking about protecting the environment and food security.

ALERTE – Des militantes pour le climat jettent de la soupe sur le tableau de La Joconde au musée du Louvre. @CLPRESSFR pic.twitter.com/Aa7gavRRc4

— CLPRESS / Agence de presse (@CLPRESSFR) January 28, 2024

It’s not the first time the Mona Lisa has been attacked in the name of activism, and it remains unclear precisely what it is that the Mona Lisa has done to upset so many people.

But she’s been targeted by protestors of different flavours for years, to the point where Da Vinci’s sly-smiling lady friend is now forced to live in virtual solitary confinement, hemmed in by shatter-proof glass like Hannibal Lecter in The Silence of the Lambs.

It was only a couple of years ago that the Mona Lisa was viciously attacked with a piece of cake, by a fella dressed as a lady in a wheelchair who managed to sneak a slab of moist gateau past security.

“There are people who are destroying the Earth,” the man said, after smearing dessert over the security glass. “All artists, think about the Earth. That’s why I did this. Think of the planet.”

The rest of you, please… think of the cake.

Prior to that, the Mona Lisa had a teacup thrown at it by a Russian woman who was miffed about being denied French citizenship, and was the target of a spraypaint attack while on loan to a museum in Japan in 1974, ruining a perfectly good holiday after being cooped up in the Louvre for hundreds of years.

It’s not clear what’s going to happen to the activists – they were scooped up quick-smart by the Mona Lisa Police and detained.

Staff, presumably armed with a bottle of Windex and a couple of damp rags, had the Mona Lisa back in action in no time at all.

Was the protest a successful one? In a way, yes.

It’s closing in on lunch time and I will happily admit that I now have a hankering for some soup, so… Mission Accomplished, ladies. Well played.

As the morning turns to lunch, and as thoughts turn from investments to the cup of soup that is now quietly steaming on my desk, the benchmark is doing its absolute best to break even and stay ahead for the morning.

At the time of writing, the ASX 200 benchmark is sitting on 7,564.1, putting it less than 70 points from the market’s all-time high of 7,632.89, which was set in August 2021.

So you could say that there’s a tingling of expectation in the air – we saw the US S&P 500 hit an all time high last week, and Japan’s Nikkei is hitting high notes that it hasn’t been able to reach since Craig McLachlan left Neighbours to inflict this utter s..tshow on an unsuspecting Australian public.

At some point, you just know that someone, somewhere was editing that video together and was told “It needs more shots of Craig’s arse… so don’t hold back. Really, really load it up – when the boss says more arse, he means more arse”.

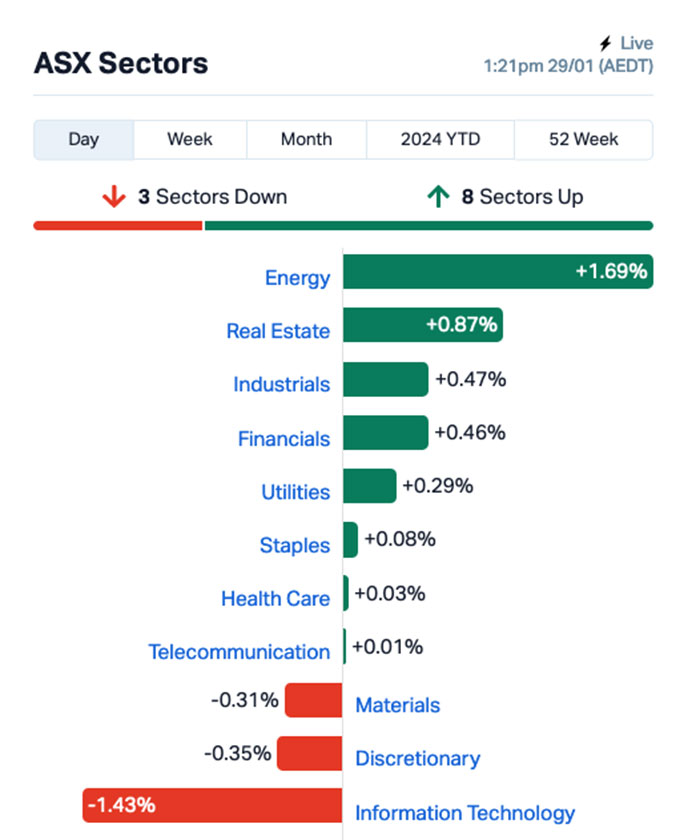

Out in front for the locals today is a booming Energy sector, which is way out in front of the market on about +1.6%, likely off the back of fast-moving crude prices which were up 1.0% overnight, and have continued to trickle slowly north throughout the morning.

Weighing heavily, though, are the local Tech sector (off by 1.36%) and Materials – the latter most likely influenced by some nervous pacing in the offices of BHP (ASX:BHP), as it awaits documentation from a major court case in Brazil.

The Aussie mining giant is on the hook for a collapsed tailings dam, which killed 19 people and levelled hundreds of homes in 2015 – and the unofficial word at the moment is that the Brazilian authorities have landed on a hefty compo package around 47.6 billion reals ($14.7 billion).

BHP has previously stated that it’s set aside some ‘rainy day’ money to cover it – but it looks like the company has severely underestimated how much they were expecting to pay, with that fund totalling just $5.6 billion.

At the moment, BHP hasn’t been officially served with any paperwork, so it’s all a bit up in the air – but it’s trading 1.3% lower this morning, so investors aren’t hoping for a very early Xmas Miracle there.

The other big local news for the day is about Australia’s much-vaunted Future Fund, set up to cover the ballooning costs of the Commonwealth’s super/pension liabilities after some Finance department wonk put together a spreadsheet and realised that the defined benefit pensions public servants were supposed to receive were about to bankrupt the nation in world record time.

The news is that it has a new boss, after the Labor government looked far and wide across the nation to find the best possible person for the incredibly important job of overseeing such a massive quantity of public money, and picked the best expert they could find.

Just kidding – they’ve given the job to former union boss Greg Combet, on the basis that he wears glasses, so he looks smart.

On Friday, while we were all neck-deep in burnt sausages and hot beer, Wall Street carried on like nothing was amiss, and delivered a mixed result that saw the Dow emerge as the session’s only winner, with +0.16% notched on the bedpost.

The S&P 500 lost ground for the first time in six sessions, edging down -0.1% and the tech-heavy Nasdaq took a knee, shedding -0.36%.

It seems like US investors might finally have gotten the message that the Federal Reserve has been screaming into their faces for the past couple of months, about how that market’s near-hysterical betting on interest rate cuts were outrageously premature.

Bond yields in the US have risen again, which is a sure sign that the bets on a rate cut in March are now well and truly consigned to the dustbin, with the rate cut canaries now piling in on a far more likely move by the Fed in May.

In US stock news, American Express surged 7% following a strong guidance that topped analyst forecasts, while Salesforce rose slightly after announcing that it would cut around 700 workers.

The US market is bracing for a rash of quarterlies this week from some of the so-called Magnificent Seven, including Apple, Alphabet, Amazon, Meta, and Microsoft.

If you’re hanging out for the latest from chipmaker and market-buster Nvidia, the bad news is that you’re going to have to be patient – we’re not expecting their quarterly to arrive until near the end of February.

In Asian markets, all eyes are on the embattled Evergrande, as it puts on a brave face and heads into a Hong Kong courtroom, where a decision is set to be made over whether the beleaguered construction company will be liquidated.

On its face, the whole thing is a colossal disaster – Evergrande defaulted on its debt in 2021 and cratered the construction sector in China, under the staggering weight of US$300 billion in liabilities.

This court case is, however, likely to be the first of many – it’s as complex a legal beast as it is large – and the fight over the scraps is going to be a tough one, given the number of jurisdictions involved across mainland China and other territories.

Hong Kong markets are up 1.24%, and Shanghai’s markets are inching lower, down 0.11% in early trade.

In Japan, the Nikkei is up 0.62%, and still several thousand points from hitting a post-1980s high water mark – but there’s plenty of momentum in Tokyo, and they could do with some happy news after the shocker of a start they’ve had in 2024.

Here are the best performing ASX small cap stocks for 29 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP AVW Avira Resources Ltd 0.002 100% 504,303 $2,133,790 MKG Mako Gold 0.013 44% 34,873,417 $5,961,685 SGC Sacgasco Ltd 0.013 30% 5,420,196 $7,796,871 JTL Jayex Technology Ltd 0.01 25% 175,582 $2,250,228 MCT Metalicity Limited 0.0025 25% 12,220,126 $8,970,108 NES Nelson Resources 0.005 25% 1,000,091 $2,454,377 ROG Red Sky Energy 0.005 25% 50,000 $21,208,909 VMS Venture Minerals 0.0085 21% 5,402,858 $15,470,091 FND Findi Limited 1.59 20% 459,980 $64,661,618 AQD Ausquest Limited 0.012 20% 1,272,468 $8,251,492 ESR Estrella Resources 0.006 20% 966,084 $8,796,859 HOR Horseshoe Metals Ltd 0.006 20% 350,000 $3,232,393 SIT Site Group Int Ltd 0.003 20% 1,800,000 $6,506,226 CBE Cobre 0.08 19% 21,752,957 $19,223,037 1AG Alterra Limited 0.007 17% 355,200 $4,992,883 OSL Oncosil Medical 0.007 17% 1,119,663 $11,847,247 PFE Pantera Minerals 0.057 16% 1,029,136 $6,498,505 KAI Kairos Minerals Ltd 0.015 15% 10,506,432 $34,071,858 TBN Tamboran 0.19 15% 187,930 $339,947,388 CG1 Carbonxt Group 0.115 15% 330,741 $31,588,831 GTG Genetic Technologies 0.115 15% 41,432 $11,541,725 BRK Brookside Energy Ltd 0.0115 15% 7,878,043 $47,645,456 SLB Stelar Metals 0.16 14% 43,274 $7,337,110 GHY Gold Hydrogen 0.77 14% 234,387 $51,747,541 GRX Greenx Metals Ltd 1.115 14% 38,721 $267,725,442

Avira Resources (ASX:AVW) is nominally on top of the winner’s list this morning, boasting a 100% jump to $0.002 per share, as local investors took a low-cost punt on the company’s recently-completed Phase 2 drill program at the Puolalaki Ni-Cu-Co-Au Project.

Copper prices are in the midst of a little boom at the moment, gold prices are holding above US$2,000 an ounce and it’s probably best we don’t talk about cobalt – but three outta four ain’t bad, and Avira’s got assay results due to market in the coming weeks.

Next best is Mako Gold (ASX:MKG), up 33% this morning in the wake of a due diligence update from the company about its flagship Napié Gold Project, where the company has been beavering away with a low-cost geological mapping and rock chip sampling at the Tchaga Nor target.

Mako boss Peter Ledwidge says the company is focussing its efforts on the western greenstone granite contact at Tchaga North and on new structural trends at the site, while progressing due diligence on a proposed “accretive transaction” with Goldridge, with negotiations there expected to recommence shortly.

The alarmingly-named Sacgasco (ASX:SGC) has pumped its way into third place this morning, up 30% on news that three directors have bought into the company a little deeper, snapping up half a million shares each for a smidge over $4,500.

Here are the most-worst performing ASX small cap stocks for 29 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume MARKET CAP SRX Sierra Rutile 0.061 -53% 7,627,159 $55,150,738 DXN DXN Limited 0.001 -33% 3,636 $3,230,010 DGR DGR Global Ltd 0.01 -29% 1,041,774 $14,611,709 HLX Helix Resources 0.003 -25% 7,505,359 $9,292,583 CXL Calix Limited 1.81 -23% 1,213,577 $424,490,524 TNY Tinybeans Group Ltd 0.13 -21% 84,378 $13,923,911 SRJ SRJ Technologies 0.08 -20% 12,496 $15,118,171 TAS Tasman Resources Ltd 0.004 -20% 13,958 $3,563,346 ALV Alvo Minerals 0.14 -18% 149,296 $15,832,153 TPC TPC Consolidated Ltd 6.56 -17% 2,925 $90,062,285 AXN Alliance Nickel Ltd 0.03 -17% 310,778 $26,130,226 ECT Env Clean Tech Ltd. 0.005 -17% 1,934,591 $17,185,862 KNM Kneomedia Limited 0.0025 -17% 150,000 $4,599,814 LPD Lepidico Ltd 0.005 -17% 2,871,193 $45,829,848 LSR Lodestar Minerals 0.0025 -17% 426,775 $6,070,192 M4M Macro Metals Limited 0.0025 -17% 541,670 $7,401,233 NRZ Neurizer Ltd 0.01 -17% 3,191,528 $16,535,348 NVQ Noviqtech Limited 0.0025 -17% 88,957 $3,928,336 RMX Red Mount Mining 0.0025 -17% 2,500,000 $8,020,728 RR1 Reach Resources Ltd 0.0025 -17% 955,206 $9,630,891 WML Woomera Mining Ltd 0.005 -17% 13,403,387 $7,308,834 LM1 Leeuwin Metals Ltd 0.105 -16% 21,344 $5,856,459 IPB IPB Petroleum Ltd 0.011 -15% 5,337,752 $7,346,592 GOR Gold Road Resources 1.45 -15% 6,575,648 $1,848,854,120 AUG Augustus Minerals 0.08 -15% 212,764 $7,907,280

RareX (ASX:REE) has delivered an Updated Mineral Resource Estimate for the Cummins Range Rare Earths & Phosphate Project, with the new totals standing at 524Mt @ 0.31% TREO and 4.6% P2O5 for 1.6 million tonnes of contained TREO and 24 million tonnes of contained P2O5.

Variscan Mines (ASX:VAR) has announced that it has negotiated the extension of the lease covering the San Jose mine site and facilities, near Novales, located in Cantabria, northern Spain. Under the new deal, San Jose has locked in a lease for the site and facilities for three years, extendable up to six years if required.

Ionic Rare Earths (ASX:IXR) has successfully completed a placement, according to an announcement this morning, which will see the company raise approximately $2 million to advance its Makuutu Rare Earth Project and Ionic Technologies’ activities – the bulk of which is coming from incoming executive chairman Brett Lynch, who has snapped up 83,333,333 Shares at $0.018 a pop, worth around $1.5 million, subject to shareholder approval.

Toubani Resources (ASX:TRE) has informed the market that it is set to kick off a targeted resource definition drill program at its Kobada Gold Project in southern Mali, which currently hosts 2.4 Moz in Mineral Resources which occurs over a 4.5km strike length.

South Harz Potash (ASX:SHP) has appointed a new non-executive chairman, elevating existing non-executive director Len Jubber to the position, effective 1 February, 2024, after current boss Ian Farmer announced plans to step down from the role, citing personal reasons.

And lastly for now, Pan Asia Metals (ASX:PAM) has news that it has received confirmation that an additional net total of ~100km2 or 10,000Ha of Exploration Concessions have been granted at the Dolores North and Dolores South Lithium Prospects, which are north of the Pink Lithium Prospect and part of PAM’s Tama Atacama Lithium Project.

At Stockhead we tell it like it is. While Pan Asia Metals, South Harz Potash, Toubani Resources, Ionic Rare Earths, Variscan Mines, RareX, and Mako Gold are Stockhead advertisers, they did not sponsor this article.

No animals were harmed during the production of this story, either – but I’m making no promises for later, because I’m about to have a big, meaty lunch. Meaty.