ASX Small Caps Lunch Wrap: Sluggish day for the ASX as crude oil bleeds out 4.0pc

Pic: Getty Images

Local markets are fairly subdued today, after a wan effort from Wall Street on Friday didn’t exactly set the scene for Monday morning fireworks on the ASX.

The benchmark ASX 200 is up around 0.1% at lunchtime, with InfoTech and Consumer Discretionary gains offset by a sell-down in Energy – which is largely because crude oil prices have, once again, gone off a cliff.

I have neither the time nor the patience for much more preamble than that, so… here goes.

TO MARKETS

The ASX 200 benchmark was at 0.11% around lunchtime, after making a sluggish start to the day.

The feeling around the market is very much “hurry up and wait” – we’re deep into AGM season, and barring any massive surprises stemming from them, the rest of the brain space among investors is focused on inflation data, due out on Wednesday morning.

So the next couple of days are likely to be fairly slow going, as the market holds onto a wait-and-see stance until the ABS delivers whatever terrible CPI news it has up its sleeve to dash all hope of a rate cut in the foreseeable future.

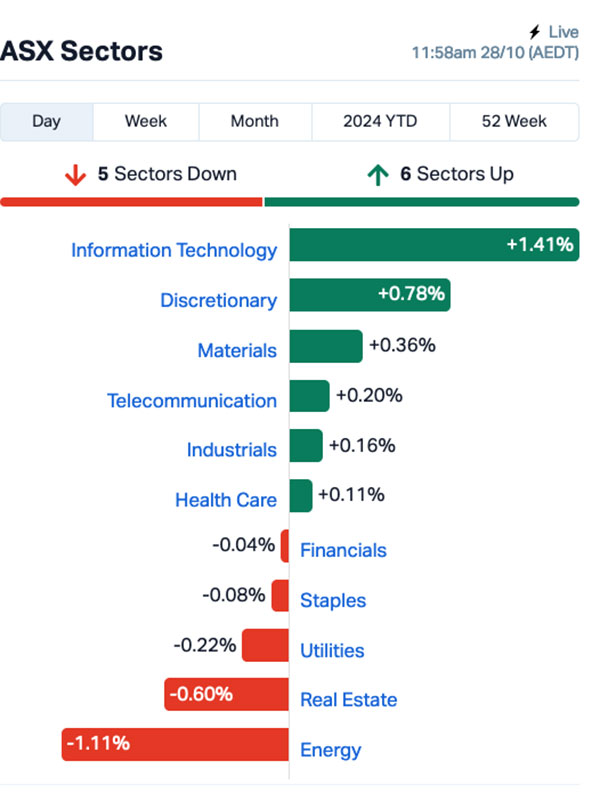

Here’s how the market sectors looked around lunchtime today:

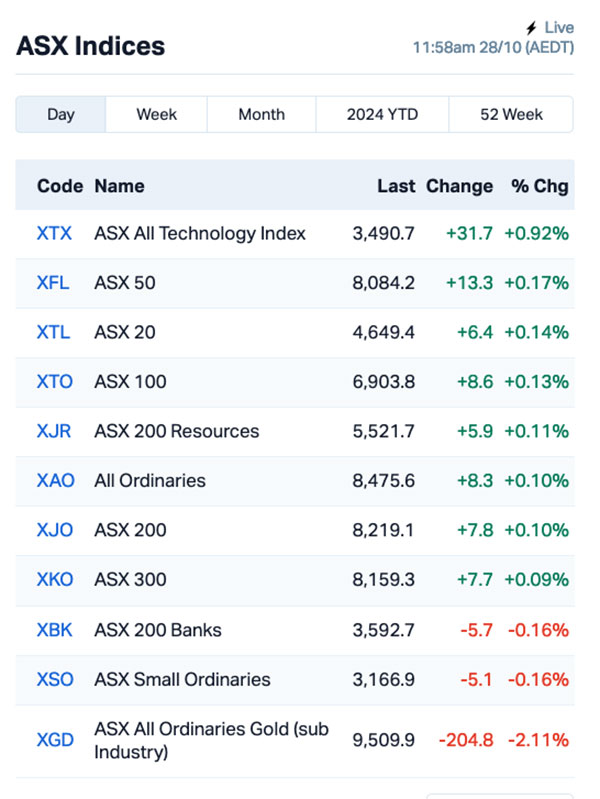

And here’s how the ASX sub-indices were looking at lunchtime.

The headlines this morning are all about the price of oil, which is – in layman’s terms – a bit sh*te today.

Crude prices plunged about 4% when the markets opened this morning, with the outlook not great as we’re due for a seasonal slowdown that will reduce demand even further.

Adding to the woes on oil prices, OPEC is staring down the barrel of unwinding its members’ “voluntary” production cuts, put in place in an attempt to support oil prices.

The commodities squad at ANZ delivered a note this morning that paints a pretty grim picture, suggesting that “the prospect of additional oil supply hitting the market in December is likely to weigh on sentiment in the short term.”

“Even additional Fed rate cuts are unlikely to alleviate oil market concerns about weakening global economic growth and its impact on demand,” the note says.

Both WTI and Brent crude are down more than $3 a barrel this morning, and that’s had a flow-on effect across local Energy stocks.

That said, a lot of the downside in Energy today can be attributed to market heavyweight Paladin having a shocker, after it delivered a quarterly report this morning that appears to have made a lot of people very unhappy.

On the surface, the update looks okay – but Paladin’s been plagued by operational problems that have resulted in diminished results for the uranium player.

There are fixes for the issues, but they will mean a shut-down for operations in November, which has upset investors, and they’re storming the exits to the tune of nearly -21% at lunchtime today.

NOT THE ASX

Wall Street was mixed on Friday, with the S&P 500 down by 0.03%. The blue chips Dow Jones fell by 0.61%, while the tech-heavy Nasdaq rose by 0.59% to an all-time high.

ASX-listed iron stocks will be in focus today after iron ore futures closed 2% higher.

Gold enjoyed a 1% gain over the past week, and ongoing uncertainty around the US elections suggests more of the same could be in store this week.

The bond markets, meanwhile, are likely to see some action this week as everyone awaits the latest inflation data.

The Aussie CPI will be released on Wednesday, with expectations that annual inflation will ease to 2.9% for the three months ending September 30.

Traders have been pushing back their expectations for the first RBA rate cut, now looking at April 2025, and money markets suggest only a 30% chance we’ll see easing this year.

Over in the US, the Magnificent Seven stocks like Nvidia, Meta, Amazon, Microsoft, and Netflix all lifted on Friday, with Nvidia shares climbing around 2% to overtake Apple as the world’s most valuable company.

Waymo, Alphabet’s autonomous driving startup, announced a US$5.6 billion funding round on Friday to expand its driverless ride-hailing service. Alphabet’s shares were up 1.5%.

Tesla also had a solid day, with its shares rising by 3%. This followed a remarkable 22% jump in the previous session after the company announced its Q3 results and shared an optimistic sales forecast.

Intel rose more than 1% as its Core Ultra 9 285K chip, bundled with Z890 motherboards, quickly sold out in Japan and are now out of stock at major US retailers.

It’s going to be an interesting week in the US as big hitters including Alphabet, Microsoft, Meta, Apple, and Amazon are all set to report their earnings.

In Asian markets this morning, Japan’s Nikkei jumped to an early 1.87% gain, and Chinese markets are still closed at the time of writing, so you’ll need to check those yourself.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for October 28 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap AZ9 Asian Battery Metals 0.088 87.2 52,035,934 $14,204,104 LIS Li-S Energy 0.175 45.8 1,441,809 $76,824,028 DTR Dateline Resources 0.004 33.3 12,819,022 $7,548,781 PKO Peako 0.004 33.3 125,000 $2,635,425 RNE Renu Energy 0.002 33.3 627,451 $1,332,868 VR1 Vection Technologies 0.018 28.6 16,027,658 $18,572,246 AVE Avecho Biotech 0.0025 25.0 580,000 $6,338,594 PUA Peak Minerals 0.005 25.0 4,500,000 $9,988,441 RLG Roolife Group 0.005 25.0 10,579,234 $4,707,985 RMX Red Mount Minerals 0.01 25.0 51,963 $3,098,862 TTI Traffic Technologies 0.005 25.0 1,867,996 $4,475,272 UCM Uscom 0.022 22.2 85,659 $4,508,586 PPK PPK Group 0.47 22.1 199,709 $34,962,812 IBX Imagion Biosys 0.059 20.4 326,899 $2,008,662 CZN Corazon 0.006 20.0 4,605,552 $3,339,528 EPM Eclipse Metals 0.006 20.0 205,000 $11,254,278 POS Poseidon Nickel 0.006 20.0 3,845,058 $21,019,377 RFA Rare Foods Australia 0.024 20.0 300,000 $5,439,665 NXS Next Science 0.155 19.2 315,460 $37,980,830 OLL Openlearning 0.013 18.2 212,452 $4,653,756

Asian Battery Metals (ASX:AZ9) has annunnced the remaining assay data from the Phase 1 diamond drilling program at the 100% Oval Cu-Ni-PGE prospect, located in the Gobi-Altai region of Mongolia, including a highlight sulphide intercept in hole OVD021 of 8.8m @ 6.08% Cu, 3.19% Ni, 1.63g/t E31, 0.11% Co (CuEq2 12.57%) from 107.2m. The find is located within 800m of strike which remains open at depth and in the SE, NW, NE and SW directions.

Li-S Energy (ASX:LIS) was rising on news that it has substantially improved the performance of its lithium sulphur battery technology. The company says that it has been able to manufacture full size 10Ah semi-solid-state cells delivering an energy density of 498Wh/kg on first discharge, and an industry leading 456Wh/kg after formation cycling, with the cells continuing to cycle in ongoing testing.

RooLife Group (ASX:RLG) was up after announing that the global expansion of its RLG marketplace has delivered $270,000 in new sales achieved in October to date. The recent expansion included three new online stores launched this month in Australia, China and Hong Kong, with the new Indian RLG Marketplace on schedule for launch in November.

Imagion Biosystems (ASX:IBX) delivered a quarterly this morning that has investors pretty excited, mainly focussed on a licensing agreement with Aussie company Biosensis to produce and sell Imagion’s PrecisionMRX nanoparticles, specifically for the biomedical research markets.

The company also revealed that it has managed to attract significant investment, and expects to successfully complete a $3 million capital raise in early December, through a two-tranche share placement that it has previously announced received firm commitments.

Next Science (ASX:NXS) was up on news of the publication of a study which found the company’s XPERIENCE product to be efficacious in preventing periprosthetic joint infection (PJI) in patients undergoing primary total knee (TKA) and hip (THA) arthroplasties, aka joint replacements.

According to the study, the overall rate of Surgical Site Infection (SSI) of the 471-patient cohort was zero percent (0/471) compared to a 0.5% infection rate among the control group (4/824) who were treated with a povidone-iodine (Betadine) solution soak in a standardised protocol.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for October 28 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MHC Manhattan Corp 0.001 -50.0 650,000 $8,995,940 RIE Riedel Resources 0.001 -50.0 170,000 $4,447,671 VPR Volt Group 0.001 -50.0 348,794 $21,432,416 EEL Enrg Elements 0.002 -33.3 1,417,000 $3,135,048 FAU First Au 0.001 -33.3 266,667 $2,717,990 EQN Equinox Resources 0.15 -28.6 1,327,269 $26,008,501 LNR Lanthanein Resources 0.003 -25.0 284,071 $9,774,545 PAB Patrys 0.003 -25.0 450,000 $8,229,789 NNL Nordic Nickel 0.095 -24.0 3,225 $18,244,439 VAR Variscan Mines 0.013 -23.5 158,534 $7,531,006 OSL Oncosil Medical 0.01 -23.1 33,575,017 $49,193,042 PDN Paladin Energy 9.67 -20.9 5,445,892 $3,658,133,743 88E 88 Energy 0.002 -20.0 1,558,955 $72,334,530 AKN Auking Mining 0.004 -20.0 10,000 $1,956,751 BYH Bryah Resources 0.004 -20.0 878,969 $2,516,434 MOM Moab Minerals 0.004 -20.0 1,000,000 $4,044,071 ZLD Zelira Therapeutics 0.68 -18.1 22,286 $9,418,139 IMI Infinity Mining 0.025 -16.7 71,000 $4,072,324 PUR Pursuit Minerals 0.0025 -16.7 449,000 $10,906,200 QXR Qx Resources 0.005 -16.7 1,120,521 $6,660,467

ICYMI – AM EDITION

Golden Mile Resources (ASX:G88) has announced it has received commitments to raise $480,250 (before costs) from institutional and sophisticated investors, through the issue of 48,025,000 new, fully paid ordinary shares at an issue price of $0.010, subject to shareholder approval.

Funds raised will be used to fund additional exploration works including geochemistry, detailed geological mapping, geophysics and drilling at the company’s Pearl copper project, located in Arizona and for general working capital purposes

Asra Minerals (ASX:ASR) has revealed that it is a successful applicant for Round 30 of the Exploration Incentive Scheme (EIS) Co-Funded Drilling Program, and has been offered up to $150,000 to go towards exploration at its 100% owned Yttria Rare Earth Element (REE) project located in Leonora, Western Australia.

The EIS is a state government sponsored program designed to foster exploration throughout the state, for the long-term sustainability of the State’s resources sector and the demand for critical minerals on the transition to a net-zero energy system.

QX Resources (ASX:QXR) has received firm commitments to raise $1,000,000 (before costs) through a two-tranche share placement to new and existing sophisticated and professional investors, through the issue of 200 million shares at $0.005 per share, a 16% discount to to the company’s last closing price of $0.006 and a 16% discount to the 15-day VWAP.

Funds raised will be sed towards progressing the Company’s Queensland gold projects, Western Australian iron ore and hard rock lithium projects, for working capital purposes, and to identify and assess new complimentary project opportunities.

Riversgold (ASX:RGL) has completed a site visit at the Saint John high-grade copper, gold, antimony, and silver project, located in New Brunswick, Canada, immediately to the west of the city of Saint John and only 50km east of the US border.

Geologists took 64 rock chip samples to validate previous sampling sites with reported grades up to 17.6% copper, 70.4 g/t gold, 10.8% antimony, and 1,500 g/t silver, as well as expand sampling into new areas not previously sampled.

Norwest Minerals (ASX:NWM) has announced the completion of mapping and rock chip sampling at its Marymia East project, where it straddles the E52/2394 and E52/2395 tenement boundary.

The company says that a number of the multi-element assay results for the 115 rock chips collected return anomalous copper & zinc values, allowing Norwest to plan aircore drilling to test for base metal mineralisation (copper and zinc) at two sites in the southern portion of the BGB. The drill testing includes 21 holes totalling 1,050 metres across two drill lines at 50m hole spacing, and is due to begin in early 2025, following Heritage Study work.

Legacy Minerals (ASX:LGM) has delivered a drilling update from its Glenlogan Project, as completed by earn-in partner S2 Resources.

The company says that the main magnetic anomaly targeted is an alkaline gabbroic diorite, intruded by later quartz diorite porphyry (QDP) dykes that increase in abundance downhole, with the final 300 metres of the hole containing increasing QDP dykes, hydrothermal alteration and disseminated pyrite and increasingly anomalous levels of copper, gold and other chalcophile/pathfinder elements.

Per the earn-in agreement, S2 Resources can spend $6 million over 5 years to earn a 70% interest in EL9614 in two stages:

- Stage 1 – $2 million over 2 years to earn a 51% interest; and

- Stage 2 – $4 million over 3 years to earn a further 19% interest.

Raiden Resources (ASX:RDN) is getting ready to fire up the drills, after approvals were granted for exploration work on the Mt Sholl Cu-Ni-PGE project ]in the Pilbara, Western Australia.

The planned drilling, consisting of a minimum of 3,000 metres of Reverse Circulation drilling, is designed to test new targets defined by First Quantum Minerals, as well as direct extensions of the mineral resource previously defined by Raiden.

The program will be managed and financed by First Quantum Minerals under the MOU in place relating to the Mt Sholl project.

At Stockhead, we tell it like it is. While Golden Mile Resources, Asra Minerals, Riversgold, Norwest Minerals, Legacy Minerals and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.