You might be interested in

Mining

Lithium boffin Michael Fotios sees carbonate prices reaching US$50,000t by Christmas

Tech

ASX Tech April Winners: Sector falls ~4% in month as rich-lister increases stake in Vinyl Group

Long Shortz

News

Local markets fell this morning, dragged down by a mixed result on Wall Street which saw the Dow hit a nine-day winning streak, while the tech-heavy Nasdaq fell more than 2.0% as the ongoing US love affair with anything (except seagulls) that’s got chips inside hit a fairly solid speedbump.

As we head towards lunch, the ASX has been doing its best to bounce from a morning low of -0.4% – but whatever it’s doing, it looks like it’s doing it slowly. I’m not sure whether it’s the market, or the fact that Australia’s Glorious NBN is, once again, non-functional in my area.

So here I am, trying to run an office setup with a laptop wirelessly tethered to a mobile phone which in turn is connected to an already pretty wonky mobile phone network getting a rock-solid, absolutely-not-the-5G-I-was-promised signal that is patchy at best.

Like a goddamned caveman.

But before I get into the market news of the day, I feel obligated to share with you some news that will no doubt strike fear into the hearts and Speedos of every Australian who’s ever set foot in the ocean.

New research™ from noted shark documentary maker expert underwater guy Tom “The Blowfish” Hird has uncovered some pretty disturbing facts™ about sharks off the coast of the US state of Florida, and their apparent love of cocaine.

According to a recent write-up in LiveScience, Hird decided to investigate whether the countless thousands of sharks that live off the coast of America’s dumbest state are being affected by the vast quantities of South America’s Finest being dumped into the ocean during failed importation attempts.

I’m not using the term “vast” lightly here, either – in June this year alone, the US Coastguard reportedly found more than 6,400kg of coke in the Caribbean Sea and Atlantic Ocean, valued at US$163 million, which is roughly $9 trillion worth at Sydney or Melbourne street value.

And – brace yourselves – Hird reckons that the sharks in that area are quite probably very, very into the whole undersea party scene, following a serious of (admittedly extremely dubious) experiments.

Hird and his team dropped a bunch of simulated bales of cocaine – large packages made up to be visually similar to the ones that often get ditched in the ocean – and tossed them into the water alongside some fake birds (I think… the literature’s not very clear…) to see which ones the local sharks would get into.

To his surprise, the sharks ignored the pretend wildlife and made straight for the bales of cocaine to much on them enthusiatically.

One shark was filmed swooping in, “grabbing an entire bale in its mouth and making off with it” – probably because there was a heaps better party with way sexier sharks on the next reef over.

There were a couple of other experiments that appear to have confirmed (and I’m using that word lightly, in this instance) that the sharks are pretty enthusiastic about consuming cocaine.

Those led to some tedious monologuing from The Blowfish himself about “delicate marine ecosystems” and “tragic abuse of the environment”, but – typically – not a word was said about the tragic waste of what are most likely some very, very good drugs.

That said, I’m not convinced that the experiments prove that the sharks off Florida are really getting hooked on blow at all.

But if you do happen to encounter a bloated, sweaty shark who wants to talk at you for nine solid hours about the hedge fund they own, perhaps now you’ll know the reason why.

Local markets have fallen this morning, because US tech stocks took an unexpected beating overnight throughout a weirdly mixed session on Wall Street.

US investors took a mallet to the knees of the tech sector there, which has translated into an all-out brutalisation of anything that even looks like it might emit an electronic beep on the ASX today.

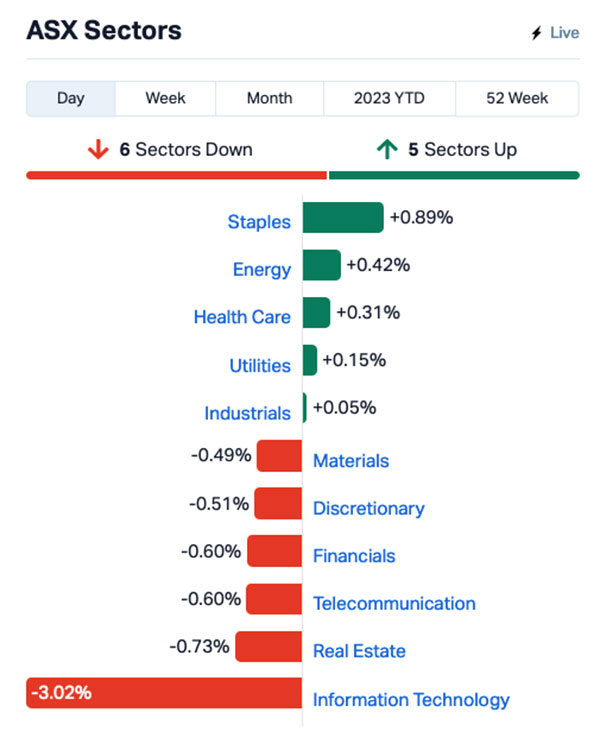

I could wax lyrical for a few inelegant paragraphs about numbers, and trends, and sentiment and all that other guff – but instead, here’s a chart to tell the story.

Ahuh.

It’s also not helping that the fat end of the Materials market is also being beaten with sticks this morning… MinRes (ASX:MIN) is down 6.7%, Newcrest (ASX:NCM) is down 5.0%, Pilbara (ASX:PLS) is down 4.2%, Perseus (ASX:PRU) is down 4.3%, and I’m gonna stop there before all of us are down deep, deep in the dumps.

As I may have mentioned once or twice already, Wall Street’s overnight session was pretty wonky, and a number of big tech stocks saw precipitous falls overnight.

The S&P 500 fell by -0.68%, Nasdaq by -2.05%, while blue chips index Dow Jones kept its nine-day winning streak alive and rose by +0.47%, Earlybird Eddy said this morning.

Eddy also notes this morning that the market’s “fear gauge”, the CBOE VIX index, is at lows not seen since the start of the pandemic.

This may suggest that the current rally may well prove to be a new bull market, but we’ve all heard that kind of old bull before.

Among the big names at the wrong end of the investor billy-clubs overnight was Tesla, which dropped 9.5% despite reporting record Q2 revenues after hours yesterday. Investors weren’t pleased when Elon Musk hinted that he would order more price cuts.

Arguably not helping things was market trepidation that the already very obviously distracted Tesla CEO has launched his new AI company, called xAI, aiming to “understand the true nature of the universe”.

It’s 100%, platinum-plated Peak Musk – and there’s no doubt that the company will end up doing something astonishing.

Whether it’s the kind of “astonishing” that the world needs, or wants to see, is open for debate – but when it accidentally figures out how to stop his EVs from driving into the side of little things like fire engines, I’m sure it’ll all be worth it.

Netflix also crashed 8% after a revenue miss was reported yesterday, while chip stock Taiwan Semiconductor (TSM) fell 5% after reporting first profit drop in four years on electronics demand slump.

In Japan, the Nikkei is down 0.3% on news that a former almost-professional sumo star has inked a deal that will see him depart Japan to go play college football in the US.

Former amateur yokozuna Hidetora Hanada – who looks exactly like a sleek, ultra-modern Japanese-style refrigerator with a glorious Lego-man haircut – has inked a deal to join the Colorado State Rams US Division I college football program, where he is expected to play Tight End until the novelty wears off.

It is expected that Hanada will then become an Offensive Linesman, like his hero Glen Campbell did back in 1968.

In a recent media interview, Hanada says he is “looking forward to the challenges ahead, and to participating in a sport where he is allowed to wear pants”. I might be mistranslating that last part, though – my Japanese is still a little rusty.

In China, Shanghai markets are 0.35% higher, while in Hong Kong the Hang Seng is 0.97% higher in early trade.

In Cryptoland, things are dull. Nothing’s happening. BTC’s not moving much, things that were popular a few days ago are not anymore, and not even the thought of SEC Toad Lord Gary Gensler looking apoplectic with rage – even while he’s asleep – over growing momentum behind BTC ETFs isn’t enough to warrant much more than a wan smile.

Rob “I’m the Clam Before the Storm” Badman has some interesting insights over at Mooners and Shakers, though, because he’s a diligent young bivalve mollusc who cares deeply about his work.

Here are the best performing ASX small cap stocks for July 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap PEC Perpetual Res Ltd 0.027 80% 86,891,086 8,182,259 AYM Australia United Mining 0.004 33% 125,000 5,527,732 ARN Aldoro Resources 0.185 32% 125,343 18,847,324 OAR OAR Resources Ltd 0.0045 29% 24,429,237 9,145,975 MOZ Mosaic Brands Ltd 0.205 28% 2,883,237 28,535,637 AMM Armada Metals 0.046 28% 114,609 2,468,450 CHW Chilwaminerals 0.19 27% 260,015 6,881,250 BP8 Bph Global Ltd 0.0025 25% 866,107 2,669,460 CTN Catalina Resources 0.005 25% 200,000 4,953,948 EMU EMU NL 0.0025 25% 333,333 2,900,043 GFN Gefen Interntional 0.005 25% 400,000 272,401 MRD Mount Ridley Mines 0.0025 25% 1,498,333 15,569,766 MRI My Rewards International 0.02 25% 2,316,476 5,863,886 IS3 I Synergy Group Ltd 0.011 22% 5,000 2,601,723 GNM Great Northern 0.033 22% 211,058 4,174,985 SKF Skyfii Ltd 0.075 21% 75,385 26,020,666 GTG Genetic Technologies 0.003 20% 2,461,265 28,854,145 ROO Roots Sustainable 0.006 20% 155,509 693,611 AML Aeon Metals 0.02 18% 735,782 18,638,811 EDE Eden Inv Ltd 0.0035 17% 7 8,990,833 MOH Moho Resources 0.014 17% 769,230 3,114,933 IXU Ixup Limited 0.064 16% 718,904 56,952,097 SVG Savannah Goldfields 0.105 15% 15,000 17,822,208 ELE Elmore Ltd 0.008 14% 63,750 9,795,687 BMR Ballymore Resources 0.16 14% 24,000 13,484,444

Leading the gains at the Small Cap end of the market today, Perpetual Resources (ASX:PEC) is back in the winner’s circle with a 73.3% boom because – and you’re not gonna believe this – the company’s making noises about buying a South American lithium tenement.

I know, right? I’m as astonished as you are. Etc etc.

Anyway – PEC’s entered into a binding option agreement to acquire a highly prospective exploration tenement package in the mining friendly state of Minas Gerais in Brazil, nestled within the highly prolific ‘Eastern Brazilian Pegmatite District’, which is renowned as one of the world’s largest regions for hard-rock lithium spodumene deposits.

The tenements are about 20km from the Tier 1 Grota do Cirilo spodumene mine owned and operated by NASDAQ and TSX-V-listed Sigma Lithium Corp, boasting a market capitalisation of approximately C$5 billion and has a world-class lithium resource.

In second place, clothing retailer Mosiac Brands (ASX:MOZ) expects a $17m profit for FY23 – a $33m turnaround to the prior financial year loss of $16m – after millions of Australians wised up to the fact that it was only the stubborn understains that have been holding their undies together for the past six or seven months.

“Whilst the Group remains cautious for FY24, it enters the new financial year with its cost base in the strongest position in over four years, as Covid related costs fall,” Mosaic said.

My Rewards International (ASX:MRI) has banked another 25% pop this morning (its second big jump this week), someone spent $55 to move the I Synergy Group (ASX:IS3) needle 22.2% and Pentanet (ASX:5GG) is up 17.3% on the back of yesterday’s quarterly showing the company’s consolidated revenue increased by 17% YoY to $19.7m.

Here are the most-worst performing ASX small cap stocks for July 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.001 -50% 2,041,604 $20,529,010 CCE Carnegie Cln Energy 0.001 -33% 1,285,955 $23,463,861 RGS Regeneus Ltd 0.007 -30% 2,008,353 $3,064,369 OCT Octava Minerals 0.083 -28% 1,088,003 $4,273,689 AXP AXP Energy Ltd 0.0015 -25% 690,000 $11,649,361 HMI Hiremii 0.042 -22% 213,537 $6,331,806 GLL Galilee Energy Ltd 0.1 -20% 80,035 $42,317,187 ERL Empire Resources 0.004 -20% 35,000 $5,564,675 VAL Valor Resources Ltd 0.004 -20% 2,505,212 $19,015,174 MXC MGC Pharmaceuticals 0.0025 -17% 749,999 $11,677,079 TOY Toys R Us 0.012 -14% 405,537 $12,083,213 TSL Titanium Sands Ltd 0.006 -14% 240,000 $9,844,785 XRG Xreality Group Ltd 0.05 -14% 158,190 $25,888,103 MX1 Micro-X Limited 0.1 -13% 523,582 $59,388,874 ADY Admiralty Resources 0.007 -13% 7,428 $10,428,633 INP Incentiapay Ltd 0.007 -13% 31,251 $10,120,509 TAS Tasman Resources Ltd 0.007 -13% 225,000 $5,701,354 PPG Pro-Pac Packaging 0.22 -12% 277 $45,421,928 OPL Opyl Limited 0.045 -12% 60 $4,453,068 AXI Axiom Properties 0.04 -11% 343,210 $19,472,115 BUR Burley Minerals 0.16 -11% 34,128 $18,233,416 KTA Krakatoa Resources 0.033 -11% 2,543,003 $13,444,934 KME Kip McGrath Education 0.53 -10% 30,961 $33,431,849 GBE Globe Metals & Mining 0.062 -10% 497,410 $34,967,040 BBC Bnk Bank Corp Ltd 0.36 -10% 170,141 $47,487,762