ASX Small Caps and IPO Weekly Wrap: Sharks circle but not in Azure waters

Via Getty

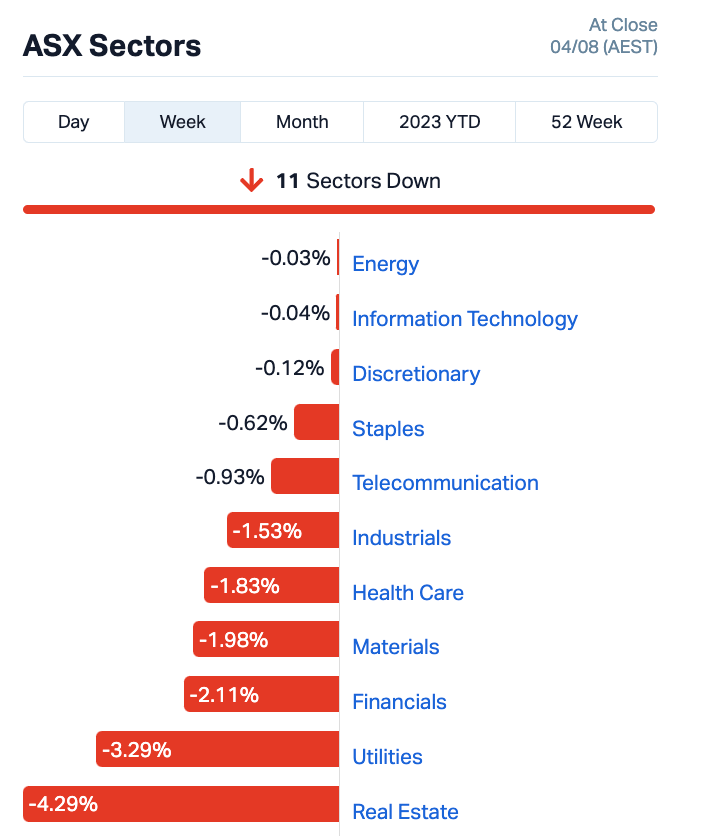

- ASX 200 benchmark rises Friday, bites for the rest

- All sectors bitten

- Except Small Caps bosses Pointerra and AW1

As far as weeks on the ASX go, the past five days will prove difficult to merely drink away.

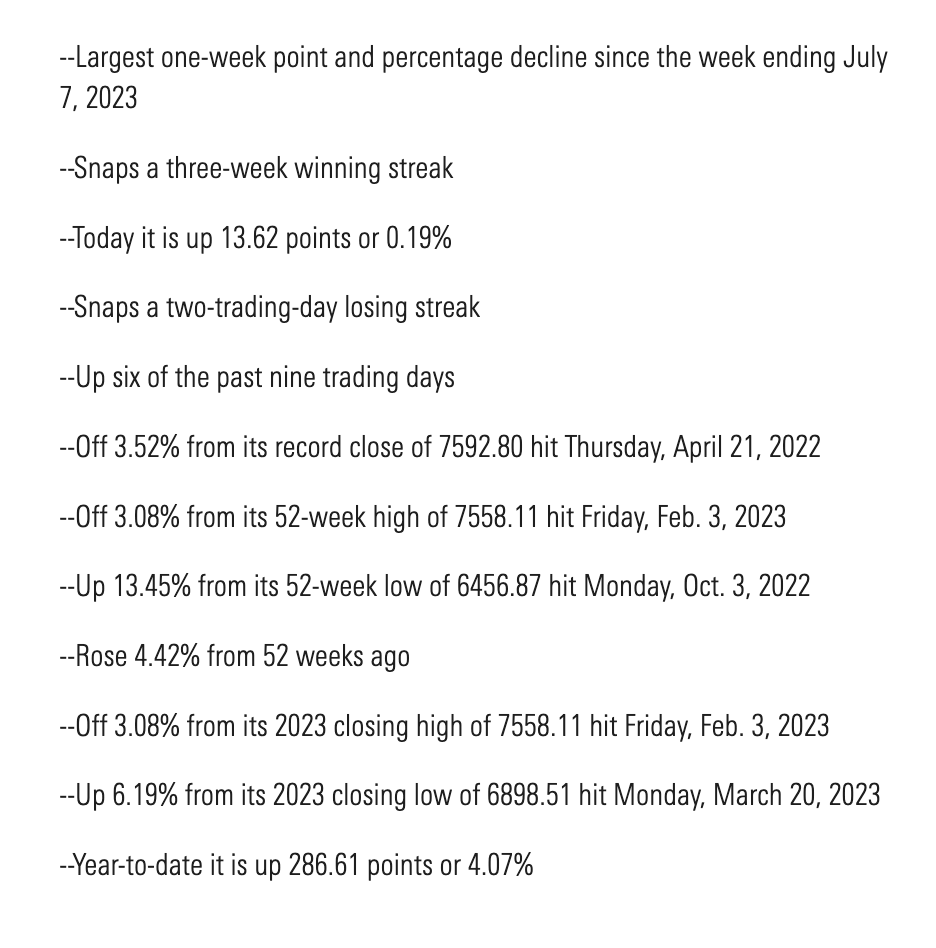

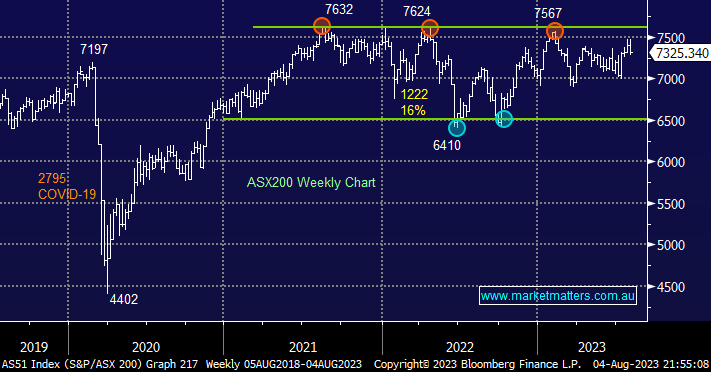

The S&P/ASX 200 rose 0.2% to close at 7,325 on Friday but still ended the week more than 1% lower, as a risk-off mood went from a trickle to a flood after US credit rating downgrade and a sharp rally in US Treasury yields.

At home punters trod water while watching the economic and monetary policy sharks circling after the Reserve Bank of Australia (RBA) unexpectedly held interest rates steady during Tuesday’s policy meeting.

The SPI Futures on Saturday morn reckon ASX200 will open on Monday morning shorn of -0.2% following a weak close in the US which saw the S&P500 reverse early gains – and call the government, BHP Group (ASX:BHP) slipped ~20c on Friday night.

However, Aussie firm Market Matters says business should be back about it on Monday.

“We believe the Fitch headlines will largely be forgotten by this time next week with markets refocusing on good old bond yields and of course the local reporting season, we feel investors are nervous towards earnings and misses will not be tolerated as we saw with our holding in ResMed (RMD) tumbling over 9% on Friday.”

The Benchmark in Brief

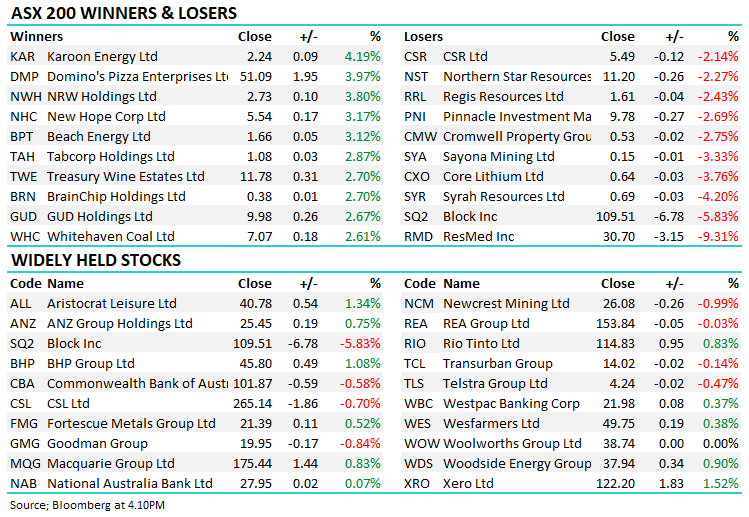

Mining and energy stocks mostly advanced on Friday, with gains from BHP Group (1%), Rio Tinto (0.9%), Fortescue Metals (0.8%), Pilbara Minerals (0.8%), Woodside Energy (1.1%) and Santos (0.6%).

The Healthcare and IT stocks fell. Resmed just the pits at (-9.4%), Block Inc (-5.6%) and Megaport (-2.1%).

Elsewhere the favourites were just as mixed.

THE WEEK’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for the week:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ECG | Ecargo Hldg | 0.054 | 286% | $30,762,500 |

| VMM | Viridismining | 0.565 | 126% | $14,356,139 |

| 3DP | Pointerra Limited | 0.155 | 61% | $105,059,962 |

| LLI | Loyal Lithium Ltd | 0.51 | 59% | $37,119,501 |

| RDN | Raiden Resources Ltd | 0.0115 | 53% | $16,442,151 |

| AW1 | Americanwestmetals | 0.295 | 51% | $80,333,768 |

| BDX | Bcaldiagnostics | 0.105 | 50% | $27,487,692 |

| CT1 | Constellation Tech | 0.003 | 50% | $4,413,601 |

| EMU | EMU NL | 0.003 | 50% | $4,350,064 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | $4,942,733 |

| ERG | Eneco Refresh Ltd | 0.019 | 46% | $5,719,525 |

| E33 | East 33 Limited. | 0.036 | 44% | $18,687,193 |

| PET | Phoslock Env Tec Ltd | 0.023 | 44% | $14,985,372 |

| W2V | Way2Vatltd | 0.02 | 43% | $13,813,201 |

| AZS | Azure Minerals | 2.67 | 42% | $846,812,276 |

| DC2 | Dctwo | 0.027 | 42% | $3,529,334 |

| HYD | Hydrix Limited | 0.038 | 41% | $9,406,097 |

| BEX | Bikeexchange Ltd | 0.007 | 40% | $7,134,901 |

| CMX | Chemxmaterials | 0.115 | 39% | $4,559,501 |

| MXO | Motio Ltd | 0.047 | 38% | $12,287,429 |

| CG1 | Carbonxt Group | 0.08 | 38% | $19,270,921 |

| CUS | Coppersearchlimited | 0.3 | 36% | $16,366,417 |

| PPG | Pro-Pac Packaging | 0.285 | 36% | $47,238,805 |

| M2R | Miramar | 0.05 | 35% | $5,435,413 |

| AHN | Athena Resources | 0.008 | 33% | $8,563,740 |

| DXN | DXN Limited | 0.002 | 33% | $3,442,630 |

| EDE | Eden Inv Ltd | 0.004 | 33% | $8,990,833 |

| HIQ | Hitiq Limited | 0.028 | 33% | $7,736,599 |

| KNB | Koonenberrygold | 0.044 | 33% | $2,348,450 |

| MCT | Metalicity Limited | 0.002 | 33% | $7,472,172 |

| NAE | New Age Exploration | 0.006 | 33% | $7,179,495 |

| OKJ | Oakajee Corp Ltd | 0.02 | 33% | $1,828,921 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | $24,408,512 |

| CCX | City Chic Collective | 0.6 | 32% | $111,321,641 |

| MAP | Microbalifesciences | 0.41 | 30% | $111,039,435 |

| ASM | Ausstratmaterials | 1.81 | 29% | $285,065,938 |

| EQN | Equinoxresources | 0.155 | 29% | $6,750,000 |

| AUQ | Alara Resources Ltd | 0.04 | 29% | $28,723,502 |

| ATV | Activeportgroupltd | 0.135 | 29% | $24,718,040 |

| BFC | Beston Global Ltd | 0.009 | 29% | $17,973,422 |

| MRL | Mayur Resources Ltd | 0.25 | 28% | $70,559,329 |

| FG1 | Flynngold | 0.07 | 27% | $8,182,955 |

| KAI | Kairos Minerals Ltd | 0.024 | 26% | $62,901,893 |

| AHI | Advanced Health | 0.245 | 26% | $38,098,195 |

| WR1 | Winsome Resources | 2.07 | 25% | $306,273,890 |

| AZY | Antipa Minerals Ltd | 0.02 | 25% | $64,746,927 |

| DEL | Delorean Corporation | 0.04 | 25% | $8,197,395 |

| ERL | Empire Resources | 0.005 | 25% | $5,564,675 |

| FFT | Future First Tech | 0.01 | 25% | $6,790,947 |

| GTG | Genetic Technologies | 0.0025 | 25% | $28,854,145 |

Mining on Thursday was more of the Azure Minerals’ (ASX:AZS) story – a new monster hit from its emerging tier 1 lithium discovery in the Pilbara:

More good news for $AZS! Very broad zones of #lithium mineralisation intersected in the AP0011 pegmatite at #Andover:

⭐ 209.4m @ 1.42% Li2O in hole ANRD0017

⭐ 2nd hole intersected: 183.1m @ 1.25% Li2O in hole ANDD0228✅ #ASX ➡️ https://t.co/hABMLsc23v$AZS.ax #ASXNews pic.twitter.com/QBkoOlBjmi

— Azure Minerals (@AzureMinerals) August 3, 2023

Outrageous, says our man Badman who’s no easy man to poke an ‘oh’ from.

“The Creasy/SQM-backed explorer jumped 20% in morning trade, breezing through $1bn market cap in the process. It is up 1200% over the past 12 months,” he mumbled on the day.

Right next door Errawarra Resources (ASX:ERW), Greentech Metals (ASX:GRE) and Raiden Resources (ASX:RDN) are conducting early stage ground recon and pegmatite sampling programs. They also surged in early trade Friday.

“The continued success of Azure Minerals Ltd and the recent announcements of lithium bearing rock chip sample results by Greentech Metals provides the company with confidence that the area remains prospective for lithium bearing pegmatites,” ERW said yesterday.

“Together with the exploration success of Azure Minerals and Greentech Metals, Raiden Resources (ASX:RDN) recently announced rock chip assay results peaking at 2.22% less than 1km from the Andover West tenement.”

Gold explorer Koonenberry (ASX:KNB) has final approval to begin fun at the virgin Bellagio prospect, about 160km northeast of Broken Hill in NSW.

Aircore drilling starts this month is designed to test what’s under multiple high-grade gold samples from outcropping quartz veins, including 39.4g/t gold and 22.5g/t gold rock chips…

And a robust gold in soil anomaly with a maximum result of 33ppb Au.

MD, Dan Power, told Our Badman this week:

“The long-awaited final approvals for Bellagio open the door for the first ever drilling program to test outcropping quartz veins which have returned some spectacular gold results to date.”

KNB says it all begins in the coming weeks:

Over on the health and bio front, BCAL Diagnostics (ASX:BDX) shared some breakthrough results with the market for its breast cancer diagnostic test, achieving a high-qual sensitivity of 90% and a specificity of 85.5%.

This validation shows strong potential performance with a balance of sensitivity (ability to detect true positive samples), and specificity (ability to detect true negative samples).

The data is also consistent with the findings of earlier Aussie studies using a different mass spectrometry platform, and suggests a major steps towards commercialisation.

Our Emma Davies wrote earlier this week that the BCAL breast cancer test should readily be capable of being replicated not only in BCAL’s dedicated laboratory in Australia but:

“More importantly, will enable blood samples to be analysed (using the BCAL test) in commercial laboratories throughout the world,” Em says.

Up 50%, the company now expects first sales in the second half of 2024.

Pointerra (ASX:3DP) rose after announcing a 10-year energy utility program in the States.

Its existing customer Entergy, a Fortune 500 company, has selected Pointerra’s US EPC partners for its 10-year, US$15 billion grid resilience CAPEX program.

Guy Le Page was all over American West Metals earlier this week, and he brought home the bonbons.

The $92m-capped copper hunter has revealed a “major discovery” at the Storm project in Canada.

Diamond drilling of a large gravity target has intersected thick intervals of copper sulphides, reports the company.

The two diamond drill holes were punched in 680m apart — the continuity of the mineralised horizon and the size of the gravity anomaly,>5km long and up to 1km wide, suggests that drilling has potentially identified a very large copper deposit, it says.

Assays are pending, and you can read more about it here, in this special report.

Guy’s conclusion from the near surface work was that “the Storm project area on its own has the potential to conservatively host +12Mt of potentially DSO material that could be beneficiated to a 30-50% copper concentrate.”

That sounds like a lot.

Chic-a-shock

Elsewhere, I like to watch City Chic (ASX:CCX). It’s got a cool name and this week looks to be leaving Europe, which this writer did too.

CCX on Thursday agreed to sell the Evans Brand, a stiff UK business it bought ‘pandemically’ for circa $40m. The sale is total – IP and customer lists and probs lots of inventory – and will raise about $12m.

CCX is also offering up the German fashion retail site, Navabi, which it bought in 2021 for a headline figure of $9.6m, although that purchase came with stock and cash. It is yet to find a buyer for Navabi, but coming home has seen the brand climb 30%.

THE WEEK’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks for the week:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| EEL | Enrg Elements Ltd | 0.004 | -64% | $5,046,171 |

| MSB | Mesoblast Limited | 0.485 | -58% | $887,483,259 |

| CCE | Carnegie Cln Energy | 0.001 | -50% | $31,285,147 |

| SPL | Starpharma Holdings | 0.1825 | -44% | $75,941,219 |

| SCT | Scout Security Ltd | 0.015 | -42% | $3,460,020 |

| AIS | Aeris Resources Ltd | 0.225 | -42% | $158,917,487 |

| AZL | Arizona Lithium Ltd | 0.019 | -41% | $58,022,723 |

| GBE | Globe Metals &Mining | 0.042 | -39% | $34,967,040 |

| VTM | Victory Metals Ltd | 0.24 | -37% | $19,152,791 |

| NNG | Nexion Group | 0.011 | -35% | $2,225,386 |

| SVR | Solvar Limited | 1.15 | -35% | $239,194,892 |

| BCB | Bowen Coal Limited | 0.087 | -33% | $187,966,757 |

| ZMM | Zimi Ltd | 0.025 | -32% | $2,787,372 |

| GEDDA | Golden Deeps | 0.069 | -31% | $8,086,587 |

| KCC | Kincora Copper | 0.047 | -30% | $5,658,155 |

| CMO | Cosmometalslimited | 0.075 | -29% | $2,481,488 |

| BET | Betmakers Tech Group | 0.1325 | -28% | $122,660,408 |

| JAL | Jameson Resources | 0.051 | -28% | $19,967,066 |

| ACS | Accent Resources NL | 0.008 | -27% | $3,785,018 |

| MTM | MTM Critical Metals | 0.067 | -27% | $6,599,177 |

| SKF | Skyfii Ltd | 0.05 | -26% | $20,984,408 |

| AAP | Australian Agri Ltd | 0.014 | -26% | $4,271,393 |

| 8VI | 8Vi Holdings Limited | 0.16 | -26% | $7,753,613 |

| CVV | Caravel Minerals Ltd | 0.195 | -25% | $100,628,718 |

| AYM | Australia United Min | 0.003 | -25% | $5,527,732 |

| GLE | GLG Corp Ltd | 0.165 | -25% | $12,226,500 |

| KEY | KEY Petroleum | 0.0015 | -25% | $2,951,892 |

| PIL | Peppermint Inv Ltd | 0.006 | -25% | $14,264,998 |

| SCL | Schrole Group Ltd | 0.225 | -25% | $8,025,207 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| YPB | YPB Group Ltd | 0.003 | -25% | $2,973,846 |

| OLY | Olympio Metals Ltd | 0.19 | -24% | $7,450,016 |

| RGS | Regeneus Ltd | 0.01 | -23% | $3,064,369 |

| STA | Strandline Res Ltd | 0.17 | -23% | $225,519,960 |

| G50 | Gold50Limited | 0.17 | -23% | $9,965,025 |

| ICG | Inca Minerals Ltd | 0.031 | -23% | $15,035,309 |

| LDX | Lumos Diagnostics | 0.052 | -22% | $22,040,599 |

| NGY | Nuenergy Gas Ltd | 0.021 | -22% | $41,466,754 |

| 1TT | Thrive Tribe Tech | 0.028 | -22% | $9,788,510 |

| AQD | Ausquest Limited | 0.014 | -22% | $11,552,089 |

| BUY | Bounty Oil & Gas NL | 0.007 | -22% | $9,593,507 |

| PVS | Pivotal Systems | 0.007 | -22% | $5,378,655 |

| CST | Castile Resources | 0.05 | -22% | $12,820,829 |

| ID8 | Identitii Limited | 0.018 | -22% | $3,191,977 |

| PRM | Prominence Energy | 0.018 | -22% | $2,182,156 |

| M3M | M3Mininglimited | 0.145 | -22% | $7,674,695 |

| FLX | Felix Group | 0.098 | -22% | $15,358,532 |

| APS | Allup Silica Ltd | 0.055 | -21% | $2,116,241 |

| BNO | Bionomics Limited | 0.011 | -21% | $16,156,090 |

| HCT | Holista CollTech Ltd | 0.011 | -21% | $3,345,601 |

Smacked on Friday was regenerative medicine biotech Mesoblast (ASX:MSB), down over 50% on the morning after the US FDA (Food and Drug Administration) didn’t go for MSB’s resubmission for lead drug remestemcel-L, a potential treatment for children with steroid-refractory acute graft versus host disease (SR-aGVHD).

In its complete response, the FDA said it requires more data to support marketing approval.

To obtain this data, Mesoblast will have to conduct a targeted, controlled study in the highest-risk adults with the greatest mortality.

The company said the adult study is in line with its overall commercial strategy in the first place, since adults comprise 80 per cent of the SR-aGVHD market.

Meanwhile, the FDA’s inspection of Mesoblast’s manufacturing process resulted in no observed concerns.

The agency also raised no safety issues across more than 1300 patients who have received remestemcel-L to date, and acknowledged improvements to its potency assay.

“We remain steadfast in making remestemcel-L available to both children and adults suffering from this devastating disease, and have received substantial clarity in how to bring this much-needed product to these patients,” Mesoblast CEO, Silviu Itescu said.

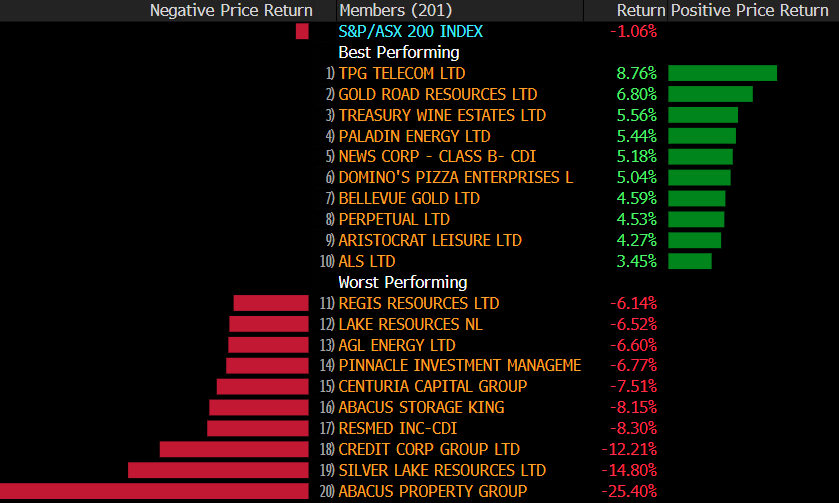

Market Matters noted other other big name losses came from Silver Lake Resources (ASX:SLR), -14.8% following their production update and Credit Corp (ASX:CCP), -12.2% on weak guidance, whereas no stocks got close to a double-digit advance suggesting on the stock level risks are skewed to the downside this month.

Gold this week

Cameron Drummond. Who chose Stockhead over Forbes, and Liverpool over decency. Kept his remaining nonpartisan eye this week on the progress of the yellow.

Aside from looking good to lose more than 1%, which would be the safe haven metal’s worst weekly performance since late June, gold’s doing okay.

It steadied above US$1,932 an ounce late on Friday in Asia, but was still set to end the week lower, pressured by a US dollar with some bottle and rising US Treasury yield.

There’s been a whack of solid US economic data this week, enhanced by a US monthly jobs report which shows the US economy likely created 200K jobs in July of 2023 – the lowest reading since December of 2020, following a rise of 209K in June.

This’ll likely influence the path for US interest rates.

Together with other iffily okay economic indicators, it all has traders hoping the US Fed can snuffle inflation without causing a recession – the “soft landing” economists dream of and some even expect to happen by Xmas. In June, for example, the annual US rate of inflation touched a 2-year low at 3%, 3x lower than it was when we were here in 2022.

Cameron says China is back doing what it does best this week too.

“China’s imports of the shiny have risen 16% in the first six months of this year compared to the same reporting period in 2022. China chewed up 554.88 tonnes (t) of gold in the first half of 2023, according to the China Gold Association,” he writes.

Cameron’s top 3 ASX gold caps

Strickland Metals (ASX:STK) is cashed up on the back of its $61m sale of the Millrose gold project to Northern Star Resources, and is about to start exploration at its Yandal East and Earaheedy projects.

Over the coming months, the base metals and gold explorer will drill a number of highly-prospective gold and zinc targets — including Horse Well, Cowza and Great Western (gold), as well the Rabbit Well and Iroquois zinc prospects in the Earaheedy Basin.

Bray is very upbeat about Strickland’s exploration programs and says it’s going to be a very exciting run into the end of the year.

“We are looking forward to a very exciting finish to the year with potentially numerous additional gold and zinc discoveries in the offing,” he says.

“Importantly, the company remains extremely well funded as a result of the Millrose sale, meaning that major drilling campaigns at any future discoveries can be easily handled with the existing balance sheet.”

IP surveys are on their way this month and diamond drilling of Rabbit Well, Iroquois and several Horse Well targets are set to commence in ~5 weeks.

De Grey Mining’s (ASX:DEG) Hemi gold deposit at the 11.7Moz Mallina project just keeps growing.

RBC Capital has Australia’s newest gold heavyweight pegged to become Australia’s thirrd largest producer in its first five years and has an ‘outperform’ price target of $1.80/sh for the Pilbara beast.

“We forecast material gold production of ~550kozpa at a low AISC of ~A$1200/oz,” says RBC analysts Alexander Barkley and Paul Wiggers de Vries.

“Mallina would be a top five producing Australian gold mine. Mine life is already nearing two decades, with a capex payback of ~2.5 years.

“Our Mallina NPV of A$0.92/sh (spot A$1.96/sh) is a valuation starting point; with potential life extension and/or processing capacity increases to exploit the vast gold resource.”

Its DFS is due this quarter, with analysts and investors alike thinking there are potentially bigger sharks swimming around the project.

“We find high corporate appeal for DEG. The progressive de-risking of the project could potentially fuel news flow around potential acquirers,” they say.

“… if any hypothetical acquirer has a bullish outlook on gold, their peak valuation for the asset might approach our spot upside case of $3.14/sh.”

Gold hunter CHALLENGER GOLD (ASX:CEL) is eyeing lower costs and higher metal recoveries at the flagship Hualilan gold project in Argentina following breakthrough metallurgical testing results.

Hualilan’s monster endowment sits at 2.8Moz, updated in March this year, and the company is aiming to find the best processing techniques for returns on investment.

The project is nearby two huge operating gold mines, Barrick Gold’s Veladero which produces ~400,000ozpa and Fortuna Silver’s Lindero with an output of 110,000ozpa.

As part of a scoping study – the first proper looks at the economics of building a project — the company ran met test work through world-class lab SGS Lakefield which demonstrated “excellent recoveries of gold and silver using traditional sodium cyanide leaching”, Challenger says.

Interestingly, both Veladero and Lindero are heap leach operations.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.