Guy on Rocks: Storm’s Tier 1 potential could make AW1 bigger than Elvis

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions:

Gold was more or less flat last week, off a few dollars to close at US$1,959 despite a 60-basis point lift in the USD.

The rest of the precious metals were also a little softer with silver down 1.1% to US$24.27/ounce, platinum down 2.8% to US$935/ounce and palladium down 3.4% to US$1,217/ounce.

Macquarie commented (Macquarie Research, July 2023) that gold failed to make a new nominal high in 2Q23 due to a combination of a i) Subsidence of US banking solvency concerns ii), US debt ceiling raised without significant market stress, iii) Better than expected US growth, and iv) Consequent pricing out of 2H23 rate cuts and a firmer USD.

Copper closed up 8 cents to US$3.89/lb retracing last week’s losses, on back of Chinese stimulus as well as some short covering.

It appears China is taking some affirmative measures to boost their economy with more favourable policies to assist the property sector.

In addition to measures to boost the property sector, at the recent Politburo meeting last week there seemed to be a drive to boost big-ticket item consumption (autos, electronics, household goods) and service consumption (sports, leisure, tourism) as well as addressing local government debt risks (a figure that is often omitted in official debt reporting).

On economic news in China, PMI data on Monday showed the manufacturing index rising modestly to 49.3 above market expectations of 48.9 level and the non-manufacturing sector dropped to 51.5 from expectations around 53.0.

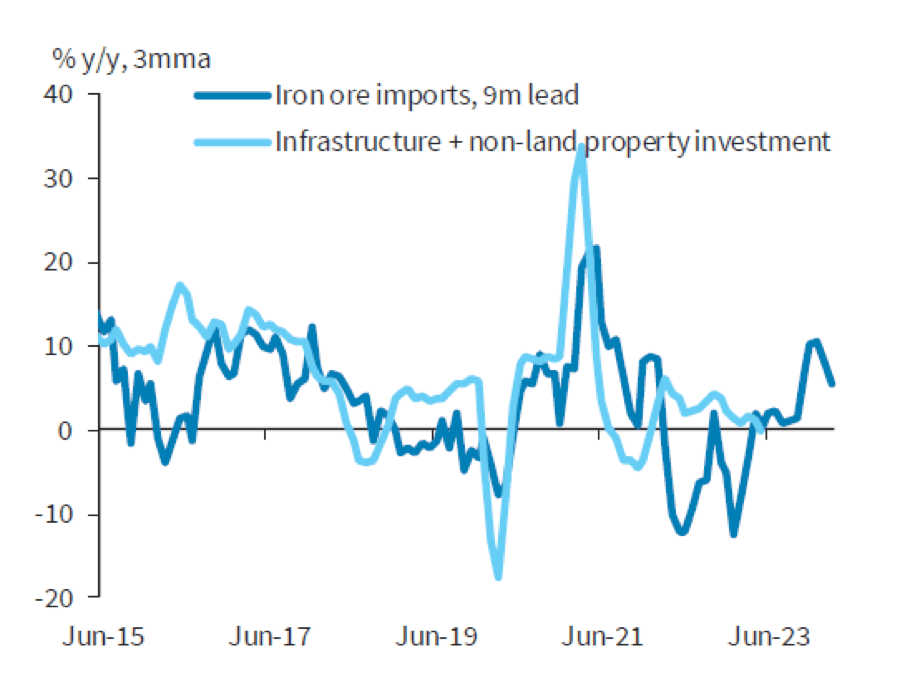

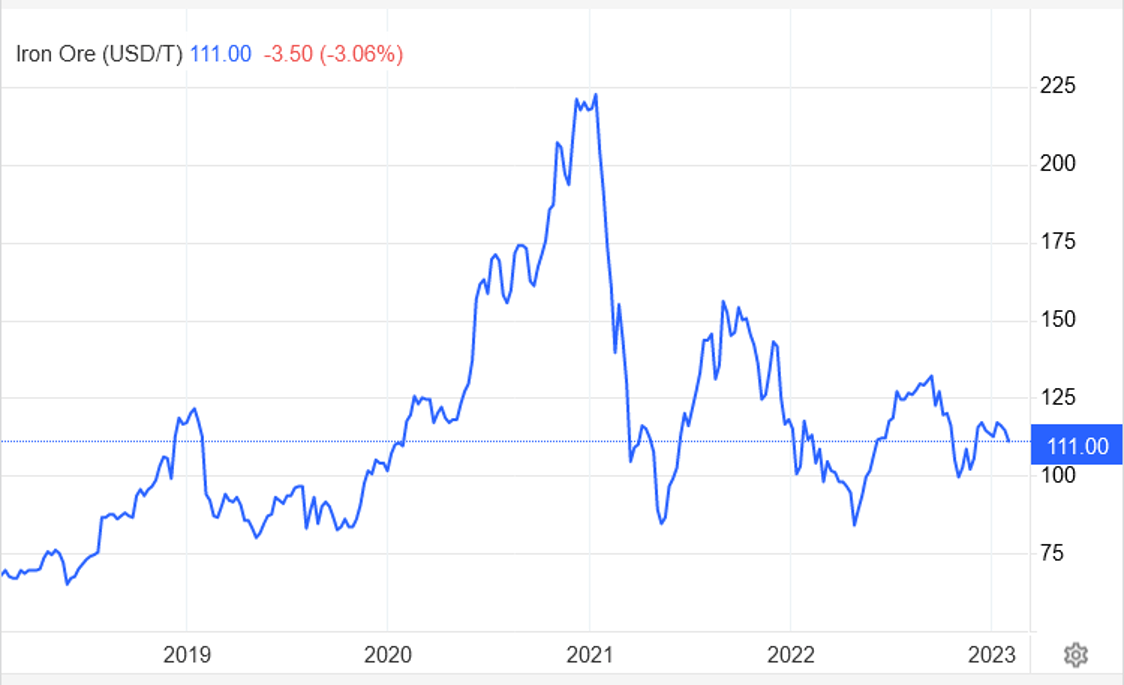

An overall improvement in Chinese industrial activity has also seen iron ore imports maintain solid levels (figure 1) with iron ore finishing the week around US$107/tonne (62% fines) (figure 2).

Some big moves happening in the mining space with the announcement last week of the intention of the Saudi Government that it would invest $US2.6 billion ($3.9b) in Vale and take a 10% interest in one of the world’s major nickel and copper suppliers.

There were also discussions with Barrick Gold about investing in a large Pakistan copper mine. In a surprising move Barrick recently announced it was diversifying into copper.

The US Government has recently responded to restrictions on gallium exports from China with the Pentagon planning to issue a first-time contract to a US or Canadian company to recover gallium from waste streams (such as semiconductor wafers) by the end of 2023.

The US holds reserves of germanium but not gallium.

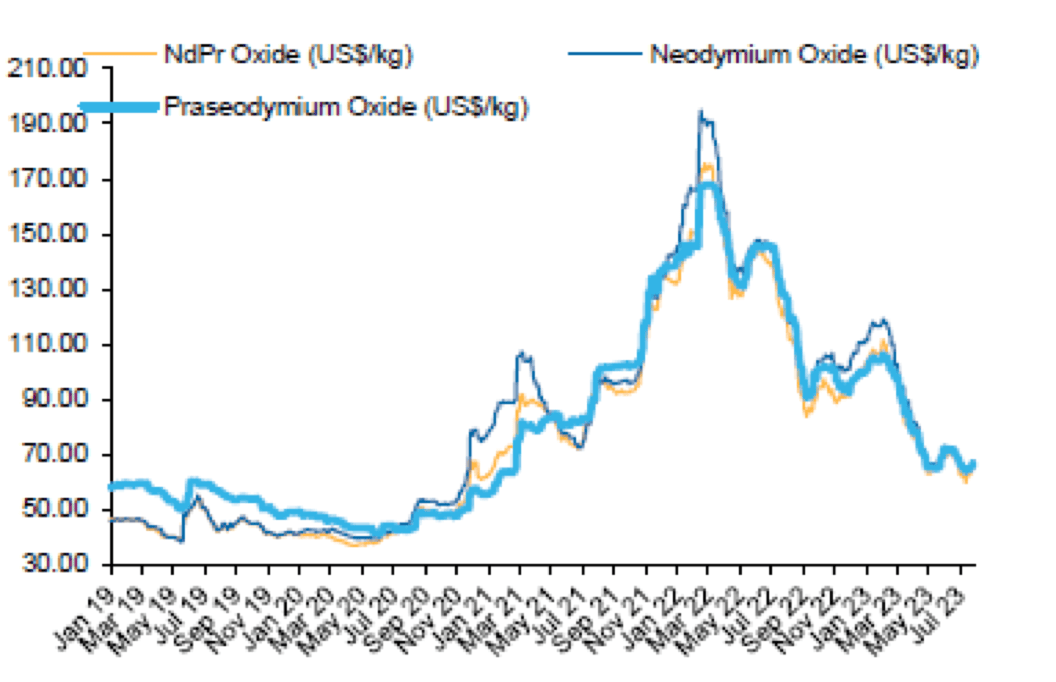

In other rare earths news Lynas is withholding some of its rare earths supply, critical in wind turbines, electronics and military applications, in response to weaker demand for permanent magnets.

The emerging rare earths sector in Australia will be looking forward to a recovery in neodymium and dysprosium prices (figure 3) which comprise most of the value in clay hosted rare earth deposits.

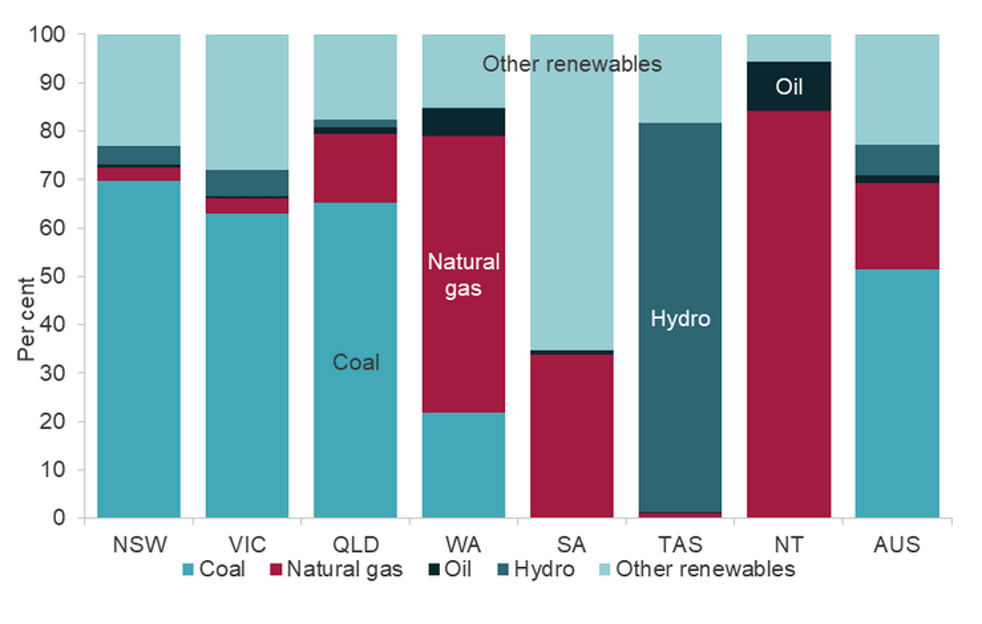

Just when you thought energy policies couldn’t get any worse, Victorian Premier Daniel Andrews (who according to the Cigar Social Climate Change Sceptic committee is doing the job of two people, “Laurel” and “Hardy”) has decided to put a stop on new gas connections.

Given that gas prices average just under 11 cents/kwh compared to electricity at around 22-25 cents/kwh (metro Melbourne), turning gas off makes a lot of sense?

I think the logic makes perfect sense for a state that remains heavily dependent on coal (figure 4).

Some important economic news out this week including US Manufacturing and Service PMIs, BoE expected to raise interest rates 25bps and non-farm payrolls on Friday.

Stock of the Week: American West Metals

There is nothing better than finding copper when you are facing a massive supply shortfall in a few years.

An even better result is to find a copper deposit that has a sniff of being a tier 1 copper resource in a tier 1 jurisdiction.

Full disclosure: RM Corporate Finance (of which I am a shareholder and director) holds shares and options in American West Metals (ASX:AW1) and earnt fees from placements, rights issues, and block trades in the last 12 months.

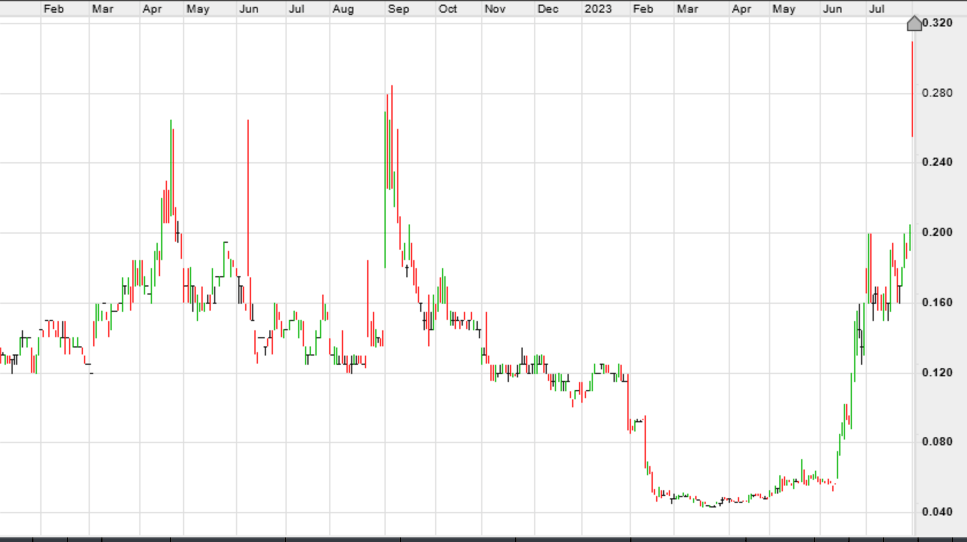

I most recently brought AW1 (figure 5) to the attention of the Stockhead faithful back in May 2023 as it was about to commence its 2023 field season on its Storm project in the Nunuvut region of northern Canada (figure 6).

The immediate interest was the potential for a 0.50 to 1Mt per annum direct shipping ore operation with the potential to produce in the order of 15-25 ktpa of copper.

So far the 2023 RC and diamond drilling of the near surface copper mineralisation has proved a winner with the majority of the drilling hitting potentially ore grade intersections.

My conclusion from the near surface work was that the Storm project area on its own has the potential to conservatively host +12Mt of potentially DSO material that could be beneficiated to a 30-50% copper concentrate.

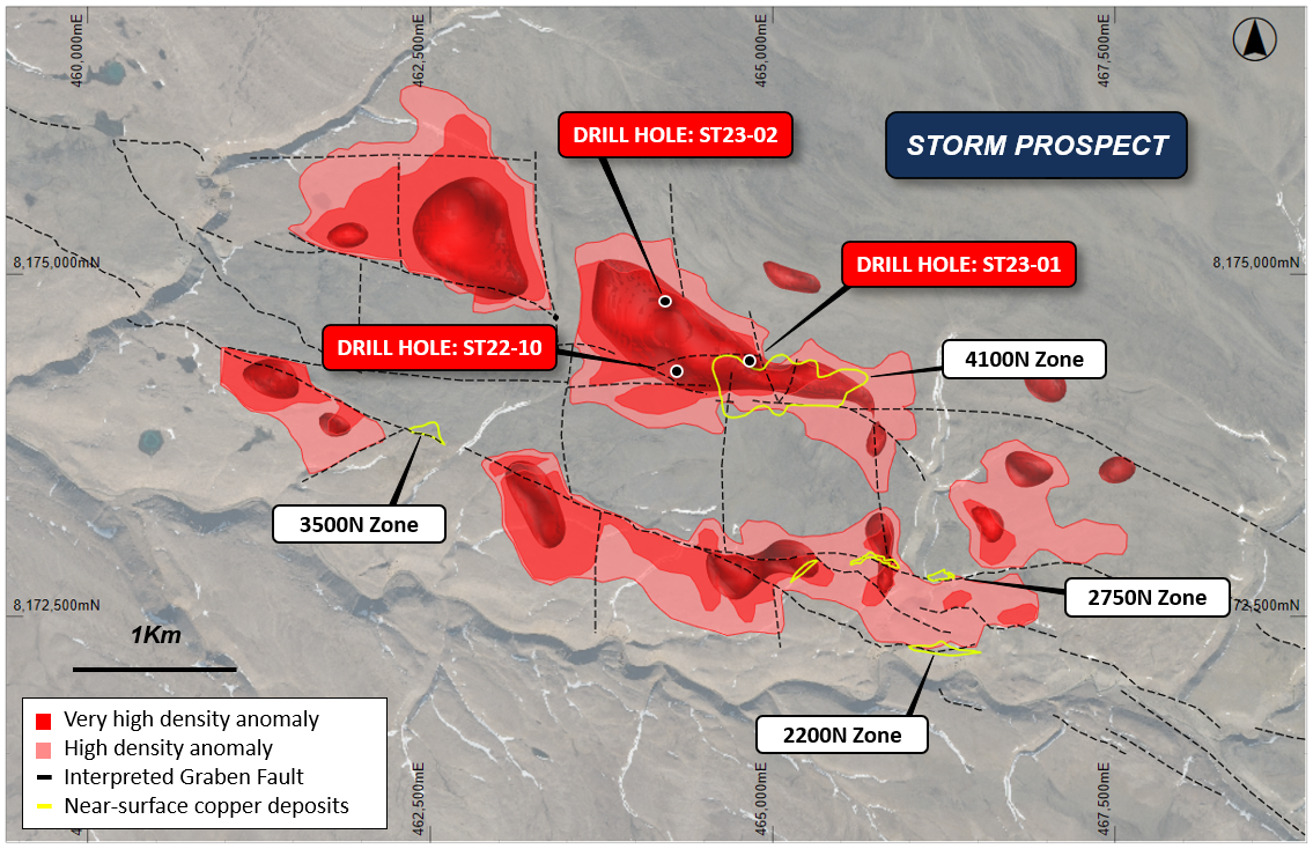

This estimate however is only based on a few zones of mineralisation that have been drilled with a number of key targets either open or untested (figure 7).

Using an ore sorter or DMS (dense media separation) plant should be a relatively low capital cost project (in comparison with building a flotation circuit, for example) with potentially very high margins if the resources hang together and metallurgy continues to deliver favourable results.

Anyway, we will find out as the company intends to publish a maiden JORC Resource and complete a Mining Study later this year.

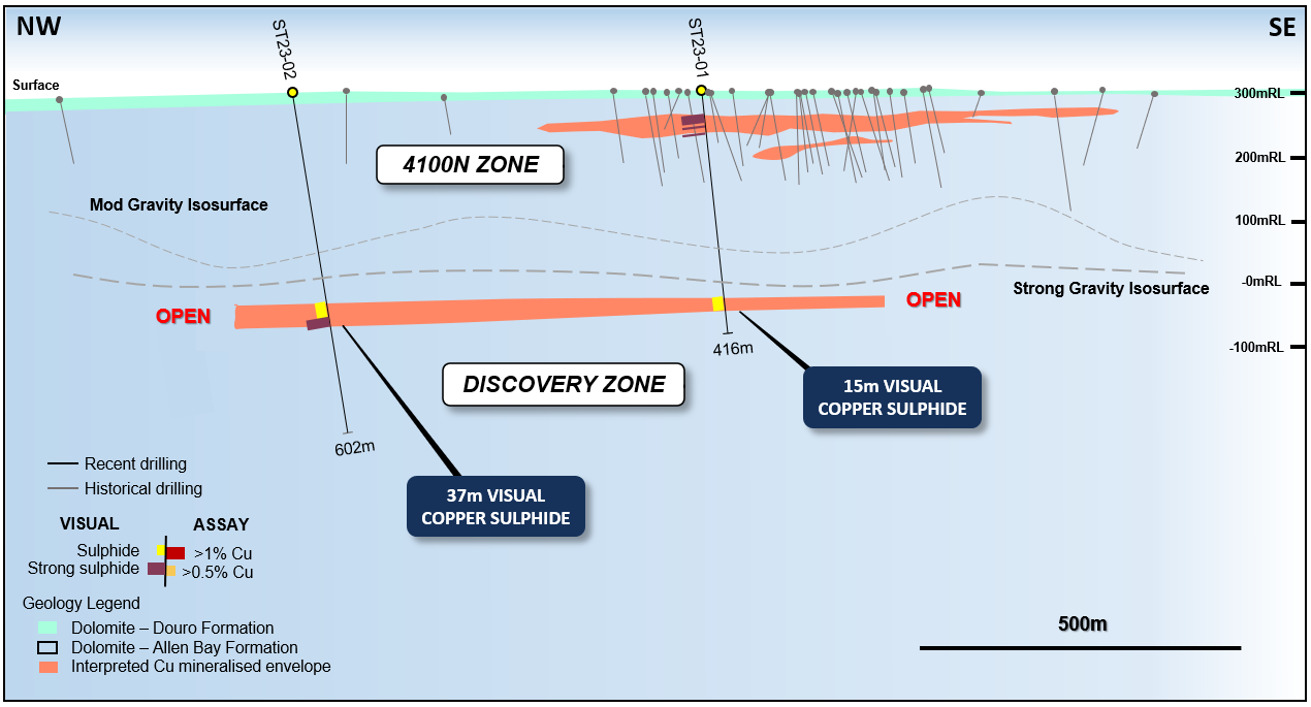

First prize would be to supplement this with some laterally extensive copper mineralisation at depth.

Looks like we are in luck. The announcement this week now demonstrates that the gravity anomalies modelled at around 250-300m depth at Storm are in fact copper sulphides with very significant strike potential.

So far, two diamond holes (figure 8) 600m apart have confirmed the gravity anomaly is stratiform copper mineralisation at a depth of around 300m and is not dissimilar in its mineralogy and texture to that intersected near surface at the 4,100N zone.

So there may be a significant portion of the deeper mineralisation that could also be amenable to ore sorting/dense media separation.

We will have to wait for assays and further drilling for the remainder of this field season to see what we are dealing with here.

The company has mentioned today that the gravity anomaly measures 5km x 1km, so there is enough data for the Stockhead faithful to do their own numbers here on what the tonnage potential could be.

Whether any of this contains potentially ore grade mineralisation remains to be seen.

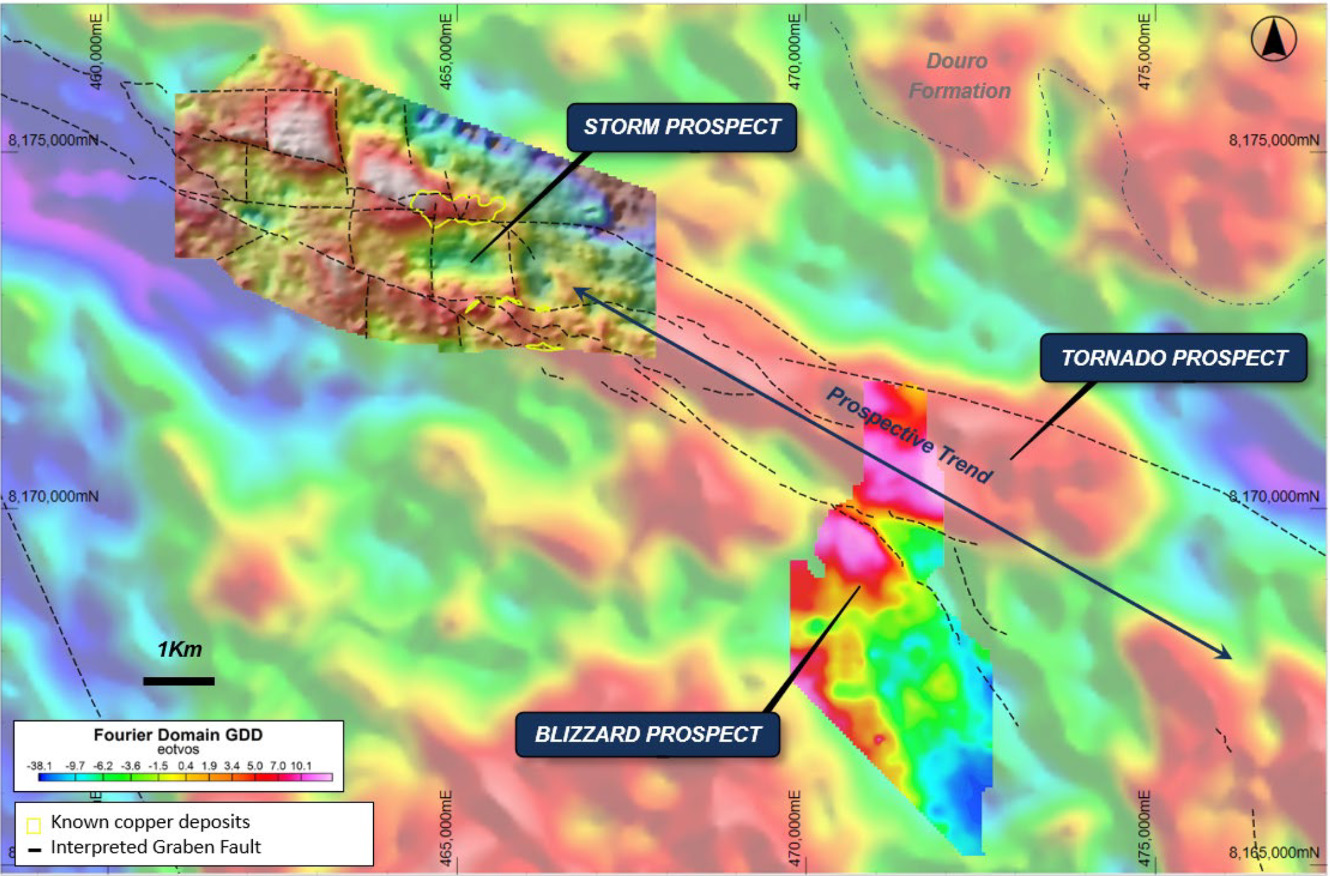

It is also worth having a look at figure 8 which appears to show the prospective trend southeast of the Storm Prospect with an apparent strike of a further 25-30km or so.

This leaves me in no doubt that we are looking at a potentially large-scale copper deposit.

It is likely that there are additional zones of copper mineralisation within this trend that will take some time to follow up.

Whether the continuity and grade at Storm and elsewhere on the project area, are going to be sufficient (as far as the deeper-seated mineralisation is concerned), to justify a mining study remain to be seen.

My personal view is that Storm and its surrounding prospects could be bigger than Elvis and Texas.

As I recently reminded a Texan, however, the great State of Texas is only two-thirds the size of South Australia.

Happy to put a Plasencia Alma Fuerte cigar and bottle of Balvenie (25-year-old) on this one if any of the Stockhead faithful are open to a wager…

My gut feel is that Storm and the surrounding prospects have the potential to host a tier 1 copper deposit.

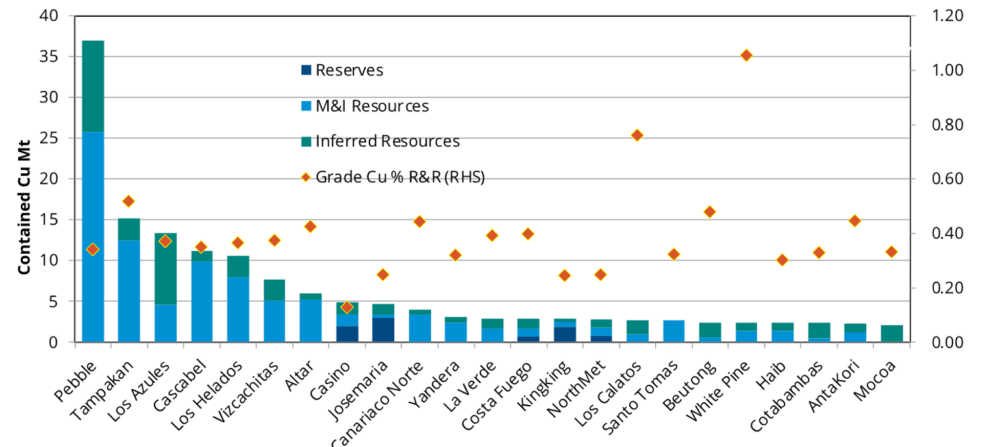

So what size copper deposit is going to move the needle from a resource point of view?

According to Ambrian, total resources (inclusive of reserves) of 2Mt of contained copper would see you in the top 20 copper deposits globally (figure 9).

Obviously that would be an excellent start but noting a number of these deposits are low grade and, in the current environment of cost inflation, margins are being squeezed or the metrics around feasibility studies are not meeting risk/return parameters.

So, in this part of the world given it is in a remote area (having said that, Polaris Zn-Pb mine happily operated 150km to the north for 20 years) something in the order of +100Mt @ 2% copper (inclusive of near surface and deeper-seated mineralisation) would get you on the playing field.

The ability to beneficiate 1-2% copper to a higher grade 30-50% concentrate is a potential game changer from a project economics perspective however, so a lower grade may suffice.

With a whopping 80 million+ shares ($23 million) through August 2, the day of the Storm discovery announcement, the stock closed up 4.5 cents to finish at 24.5 cents after touching 31 cents at one stage.

Stock from the recent 9.5 placement and 14 cent block trade no doubt contributed to much of this volume, however I suspect a new group of shareholders have expectations of a much higher share price…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.