Monsters of Rock: ‘Seize De Grey’ – this tier 1 gold miner in the making has an easy 35% upside, says RBC

Pic: Zeferli, iStock / Getty Images Plus

- RBC Capital Markets initiates a $1.80/sh price target and an ‘Outperform’ rating on gold stock De Grey

- Plant expansion could see Mallina project produce 750-850kozpa, above the current ~550kozpa

- “If any hypothetical acquirer has a bullish outlook on gold, their peak valuation for the asset might approach our spot upside case of $3.14/sh”

RBC Capital Markets initiated a $1.80/sh price target and an ‘Outperform’ rating on De Grey (ASX:DEG), thanks to its “remarkable large-scale, low-cost project with high upside value potential”.

$1.80/sh would be an all-time high for the $2bn-capped stock, which was trading at just 5c when it uncovered the game changing Hemi deposit in the Pilbara early 2020.

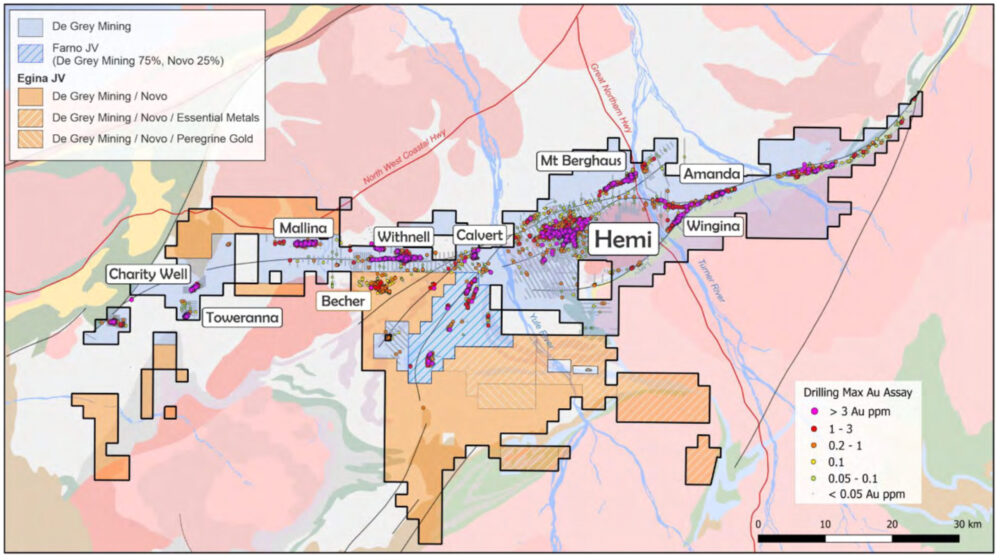

The 9.5Moz Hemi deposit underpins the 11.7Moz Mallina gold project, where first production is pencilled in for 2026.

“We forecast material gold production of ~550kozpa at a low AISC of ~A$1200/oz,” says RBC analysts Alexander Barkley and Paul Wiggers de Vries.

“Mallina would be a top 5 producing Australian gold mine. Mine life is already nearing two decades, with a capex payback of ~2.5 years.

“Our Mallina NPV of A$0.92/sh (spot A$1.96/sh) is a valuation starting point; with potential life extension and/or processing capacity increases to exploit the vast gold resource.”

De Grey share price chart

Big resource, throughput boost could push share price even higher

The current share price is not considering resource and plant capacity expansions, say Barkley and Wiggers de Vries.

“Will Mallina’s resource continue to grow? Emphatically yes, the only questions are by how much and when,” they say.

“The large 12Moz resource has been established in around five years.

“Multiple deposits remain open and regional discoveries continue to be made. The eventual underground potential at depth is considerable.”

A bigger resource and longer mine life could underpin higher plant capacity, which has a current base case of 10Mtpa.

“The benefit of higher capacity is advancing production and cash flow forward,” say Barkley and Wiggers de Vries.

“At 15Mtpa and with mine life extension, we calculate the site could operate at peak gold production of 750-850kozpa, above the current ~550kozpa.”

This realistic Mallina operating bull case could lift DEG value by ~60%, say Barkley and Wiggers de Vries.

‘High takeover appeal’

Mallina’s high production scale, low-cost, long-life, and location in a tier one mining jurisdiction could improve the portfolio of most gold miners, say Barkley and Wiggers de Vries.

“We find high corporate appeal for DEG. The progressive de-risking of the project could potentially fuel news flow around potential acquirers,” they say.

“… if any hypothetical acquirer has a bullish outlook on gold, their peak valuation for the asset might approach our spot upside case of $3.14/sh.”

That represents a big 135% increase on the current share price.

A project DFS – the most advanced of all economic studies – is due this quarter, but RBC expect few changes from the PFS.

“We expect reserve growth could be around the recent 20% increase in Measured and Indicated Resources, and costs should be comparable, but this is a risk,” say Barkley and Wiggers de Vries.

“We forecast a capital raise of A$1250m, and A$800m of debt, in line with DEG’s estimated capacity, leaving A$450m of equity to be raised this DecQ.

“While we forecast the equity raise at a 10% discount to the current share price, we expect strong investor appetite for what might be DEG’s final raise.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.