ASX Small Caps and IPO Weekly Wrap: Lotsa pushin’ and shovin’, not a whole lotta movin’

News

News

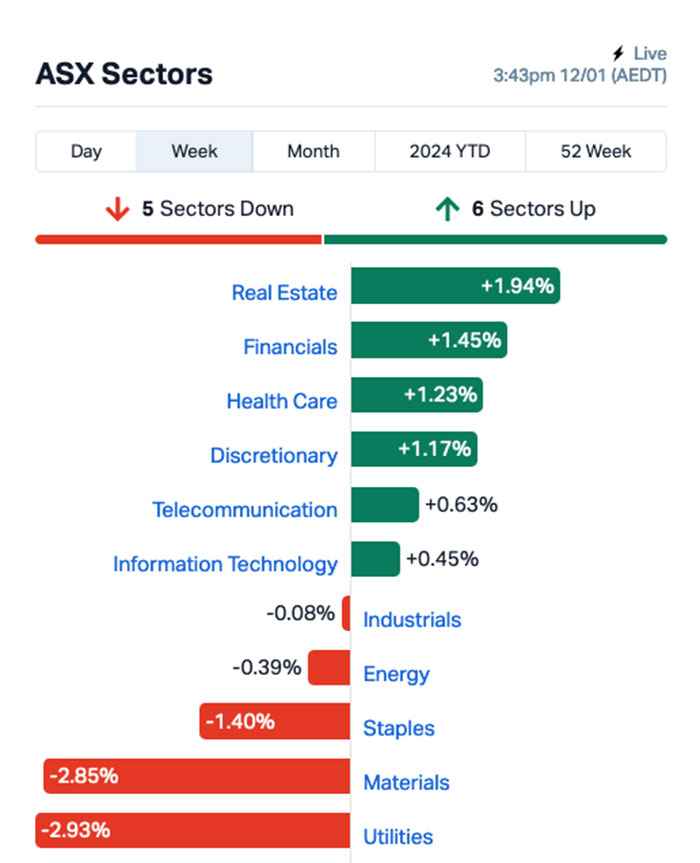

We’re two weeks into the trading year, and it was a solid week for Real Estate and Financials, the latter despite a very choppy performance since Monday that saw some fairly wild swings between gaining and losing ground, and the former probably because I got an email telling me that my rent has gone up by an utterly outrageous amount.

It’s like getting mugged every time I walk to the bathroom. Utter lunacy. Rant. Rage. Etc.

Anyway… the end result is that the ASX as a whole barely moved, climbing less than 0.1% during a week that saw a number of factors exerting influence on investor sentiment.

The first was the carryover from last week of US investors coming to the all-too-slow realisation that their pre-Xmas spending spree on guesses that interest rates are going to start being cut turned out to be highly premature.

So, sentiment on Wall Street has been less than stellar, and that – as per usual – has translated into a muted outlook for Aussie investors as well.

On top of that, commodities have been playing a major role in market sentiment, and they’ve been swinging wildly this week thanks to geopolitical pressures, ongoing wars and some major announcements in the energy market.

Oil prices in particular have been moving abruptly and massively intraday – last night was a classic example, as Brent crude jumped more than 2.0% because – *checks notes* – Iran decided that it was going to yoink a tanker destined for Turkey and full of Iraqi oil, on the basis that the very same boat was pinched from Iran by the United States a while back, because apparently it’s not outright piracy when America does it.

Anyway… it’s that sort of international hullabaloo that is giving the energy market all sorts of grief at the moment, especially as it seems this week that the US and the UK are both ramping up attacks on Houthi rebels in Yemen, on the basis that there is allegedly still a building somewhere in the country that hasn’t been flattened yet.

That’s left us with a weekly sector scoreboard that looks like this:

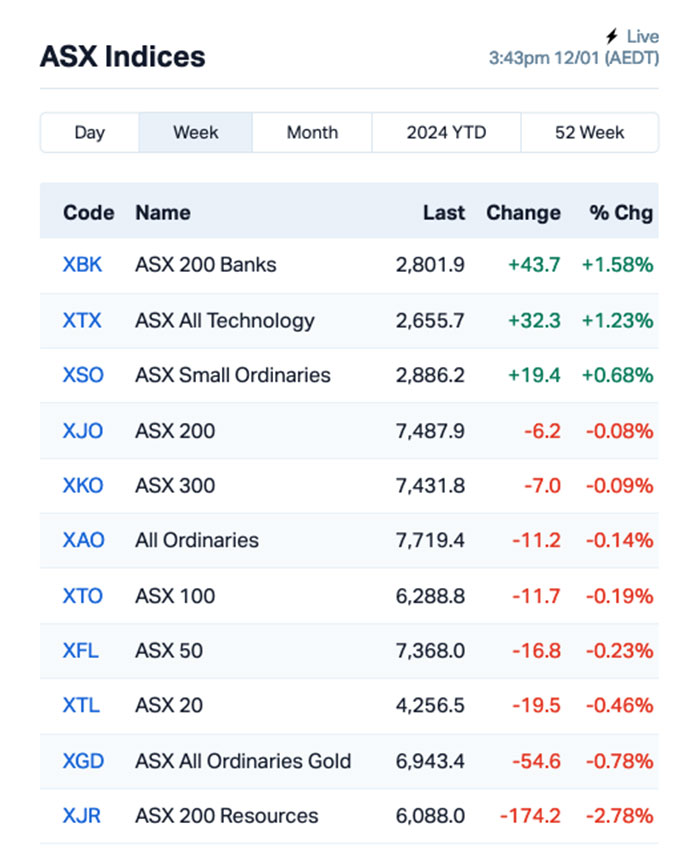

At a more granular level, the winner across the market this week was The Banks – which is about as surprising as watching that interminable Oppenheimer movie win loads of awards at the Golden Globes.

Once… just once… I’d like to see something that isn’t bloated and grossly self-indulgent do well and win a trophy or two – and the same goes for the Golden Globes.

It turned into a pretty good week for local tech stocks as well, despite that sector also experiencing some pretty wild swings day to day – and it’s also the sector that produced this week’s Top Earner.

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| SHG | Singular Health | 0.08 | 111% | $6,782,893 |

| FHS | Freehill Mining Ltd. | 0.012 | 100% | $31,348,179 |

| RGS | Regeneus Ltd | 0.006 | 100% | $1,838,621 |

| CPO | Culpeominerals | 0.1 | 85% | $11,423,111 |

| CE1 | Calima Energy | 0.11 | 69% | $65,700,681 |

| CZR | CZR Resources Ltd | 0.355 | 69% | $70,720,394 |

| GLA | Gladiator Resources | 0.032 | 68% | $17,611,608 |

| EEL | Enrg Elements Ltd | 0.01 | 67% | $7,069,755 |

| FFG | Fatfish Group | 0.036 | 57% | $50,048,629 |

| CMP | Compumedics Limited | 0.425 | 52% | $66,436,106 |

| YRL | Yandal Resources | 0.13 | 48% | $36,382,554 |

| JPR | Jupiter Energy | 0.025 | 47% | $31,758,256 |

| EPM | Eclipse Metals | 0.01 | 43% | $16,500,434 |

| XST | Xstate Resources | 0.017 | 42% | $4,822,787 |

| GUE | Global Uranium | 0.125 | 37% | $27,587,166 |

| CXU | Cauldron Energy Ltd | 0.036 | 33% | $38,516,528 |

| LV1 | Live Verdure Ltd | 0.48 | 33% | $56,618,364 |

| AVW | Avira Resources Ltd | 0.002 | 33% | $4,267,580 |

| BP8 | Bph Global Ltd | 0.002 | 33% | $3,671,126 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | $2,176,231 |

| MHC | Manhattan Corp Ltd | 0.004 | 33% | $11,747,919 |

| NVQ | Noviqtech Limited | 0.004 | 33% | $5,237,781 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | $18,306,384 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| AUG | Augustus Minerals | 0.145 | 32% | $11,776,800 |

| VR1 | Vection Technologies | 0.029 | 32% | $30,417,902 |

| PCL | Pancontinental Energ | 0.0235 | 31% | $185,385,125 |

| BMG | BMG Resources Ltd | 0.013 | 30% | $6,971,769 |

| EMP | Emperor Energy Ltd | 0.013 | 30% | $4,429,587 |

| LBT | LBT Innovations | 0.013 | 30% | $15,116,124 |

| AW1 | Americanwestmetals | 0.175 | 30% | $80,749,837 |

| MOZ | Mosaic Brands Ltd | 0.175 | 30% | $27,668,498 |

| MXR | Maximus Resources | 0.044 | 29% | $14,427,260 |

| SRJ | SRJ Technologies | 0.097 | 29% | $14,664,626 |

| BSN | Basinenergylimited | 0.155 | 29% | $7,785,001 |

| NFL | Norfolkmetalslimited | 0.205 | 28% | $6,711,749 |

| HAR | Harangaresources | 0.215 | 26% | $16,445,738 |

| BGE | Bridgesaaslimited | 0.063 | 26% | $7,522,015 |

| MDR | Medadvisor Limited | 0.27 | 26% | $158,609,649 |

| OAU | Ora Gold Limited | 0.0075 | 25% | $39,826,416 |

| ADD | Adavale Resource Ltd | 0.01 | 25% | $6,719,297 |

| EME | Energy Metals Ltd | 0.15 | 25% | $27,258,831 |

| GSR | Greenstone Resources | 0.01 | 25% | $12,313,021 |

| HCD | Hydrocarbon Dynamic | 0.005 | 25% | $3,078,664 |

| LYN | Lycaonresources | 0.2 | 25% | $9,251,813 |

| NES | Nelson Resources. | 0.005 | 25% | $3,067,972 |

| SPQ | Superior Resources | 0.015 | 25% | $30,018,306 |

| ZEU | Zeus Resources Ltd | 0.01 | 25% | $4,592,810 |

Singular Health Group (ASX:SHG) was the bolter this week, coming outta nowhere with news about the receipt of a binding enterprise licence order for 5,000 annual licences of the company’s 3Dicom Patient software in the United States.

If I’m reading the ASX announcement correctly, though, it’s by no means a massive deal – Singular says that while the exact details of the deal are commercial in confidence, “revenue generated from this order exceeds the total direct to consumer sales of the 3Dicom software in the 2023 Calendar Year of ~AUD $50,000 by more than 40%“.

Which puts it just north of AUD$70,000 – which is not a huge deal by any stretch, but what it does do is open the door to the utterly massive US Veterans health market, which is far larger than you could possibly imagine.

Freehill Mining (ASX:FHS) ran in second this week, with the only news from the company a simple response to a speeding ticket from the ASX, asking why it’s gaining value at such an alarming rate.

The answer: “FHS is of the view that there has been a lag in the market with respect to understanding the information presented at the AGM and activities of the capital raising and use of funds.”

Make of that what you will…

And Culpeo Minerals (ASX:CPO) is in the winner’s circle at the end of the week as well, thanks to its cracking start to the week, which in turn came off the back of developments from this time last week, when the company said stuff about copper-gold porphyry rock-sampling and everybody went nuts.

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| REY | REY Resources Ltd | 0.105 | -42% | $22,230,342 |

| NME | Nex Metals Explorat | 0.018 | -38% | $6,345,585 |

| GL1 | Globallith | 0.72 | -38% | $208,212,239 |

| CLE | Cyclone Metals | 0.001 | -33% | $10,471,172 |

| ME1 | Melodiol Glb Health | 0.001 | -33% | $9,457,648 |

| TKL | Traka Resources | 0.002 | -33% | $1,750,659 |

| VPR | Volt Power Group | 0.001 | -33% | $10,716,208 |

| CAQ | CAQ Holdings Ltd | 0.007 | -30% | $5,024,504 |

| ERG | Eneco Refresh Ltd | 0.012 | -29% | $4,630,092 |

| DLI | Delta Lithium | 0.32 | -29% | $234,774,505 |

| AMM | Armada Metals | 0.025 | -29% | $5,200,000 |

| IVX | Invion Ltd | 0.004 | -27% | $32,108,161 |

| KTA | Krakatoa Resources | 0.028 | -26% | $13,691,109 |

| IND | Industrialminerals | 0.56 | -25% | $45,381,600 |

| MKT | The Market Limited | 0.21 | -25% | $67,404,242 |

| 1AG | Alterra Limited | 0.006 | -25% | $4,992,883 |

| AYM | Australia United Min | 0.003 | -25% | $5,527,732 |

| HLX | Helix Resources | 0.003 | -25% | $8,131,010 |

| MOM | Moab Minerals Ltd | 0.006 | -25% | $4,271,781 |

| NRX | Noronex Limited | 0.009 | -25% | $3,404,716 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| YOJ | Yojee Limited | 0.003 | -25% | $3,917,956 |

| EOF | Ecofibre Limited | 0.115 | -23% | $45,464,868 |

| PAM | Pan Asia Metals | 0.165 | -23% | $27,689,768 |

| ICG | Inca Minerals Ltd | 0.01 | -23% | $5,878,263 |

| RNU | Renascor Res Ltd | 0.097 | -22% | $246,322,527 |

| GCM | Green Critical Min | 0.007 | -22% | $9,092,680 |

| TX3 | Trinex Minerals Ltd | 0.007 | -22% | $10,409,173 |

| KNB | Koonenberrygold | 0.043 | -22% | $5,149,211 |

| E33 | East 33 Limited. | 0.018 | -22% | $9,667,597 |

| OCN | Oceanalithiumlimited | 0.09 | -22% | $4,975,038 |

| GT1 | Greentechnology | 0.22 | -21% | $72,967,982 |

| VML | Vital Metals Limited | 0.0055 | -21% | $29,475,335 |

| NWF | Newfield Resources | 0.13 | -21% | $117,418,915 |

| 1TT | Thrive Tribe Tech | 0.015 | -21% | $5,042,566 |

| WR1 | Winsome Resources | 0.79 | -21% | $141,234,639 |

| ARN | Aldoro Resources | 0.095 | -21% | $13,058,503 |

| BVR | Bellavistaresources | 0.099 | -21% | $4,911,486 |

| MLM | Metallica Minerals | 0.023 | -21% | $24,958,022 |

| SZL | Sezzle Inc. | 23.65 | -21% | $44,417,327 |

| WA1 | Wa1Resourcesltd | 11.78 | -20% | $509,020,659 |

| ATH | Alterity Therap Ltd | 0.004 | -20% | $15,245,305 |

| BMM | Balkanminingandmin | 0.1 | -20% | $7,104,051 |

| GGE | Grand Gulf Energy | 0.008 | -20% | $16,761,976 |

| RB6 | Rubixresources | 0.08 | -20% | $4,916,000 |

| RKT | Rocketdna Ltd. | 0.008 | -20% | $5,217,808 |

| SW1 | Swift Networks Group | 0.012 | -20% | $7,758,893 |

| WTM | Waratah Minerals Ltd | 0.088 | -20% | $14,040,263 |

| ENL | Enlitic Inc. | 0.785 | -20% | $56,017,454 |

| FL1 | First Lithium Ltd | 0.375 | -19% | $28,721,183 |

Monday 08 January, 2024

Culpeo Minerals (ASX:CPO) continued its climb on last week’s news of a decent-looking copper-gold porphyry rock-sampling report from its La Florida Prospect, in the Fortuna Project in Chile.

In fact, by the looks of things, almost the entire winners list yesterday was made up of companies being driven by external forces such as commodity prices, or their gains are simply carry-overs from newsworthy announcements that hit the market last week.

Nova Eye Medical (ASX:EYE) – which also had happy news out last week – was riding that momentum, with a helpful boost this morning from news that the company has managed to grow its US sales revenue up 65% to US$5.1 million for the six months ended 31 December 2023, compared to the same period last year.

And then, like magic at 12pm, Kali Metals (ASX:KM1) made its market debut, and finished its first session on the bourse with a 78% gain under its belt and, I’m guessing, no shortage of high-fives around the table in the boardroom.

By the time the Closing Bell rang, the rest of the afternoon’s success stories looked a lot like the morning’s – big moves on little news from the likes of Gladiator Resources (ASX:GLA), Yandal Resources (ASX:YRL), Matsa Resources (ASX:MAT) and BMG Resources (ASX:BMG), as investors went bananas piling into a swathe of junior goldies, despite the precious metal dipping 0.5% throughout the day.

Tuesday 09 January, 2024

The small caps results for Tuesday 09 January are brought to you by the word “confusing”, because it was all a little hard to get a handle on throughout the day.

There were lots of small caps moving briskly around the market without the usual niceties of telling us why – and there were genuinely far too many of them to list every single one… but a quick glance suggested that most of them are little goldies, making hay while spot prices remain above US$2,000/oz.

Up near the top of the list with a 17% spike was Rincon Resources (ASX:RCR), which last had news for the ASX on 03 January when the company announced that drilling had confirmed wide zones of mineralisation at its Westin Prospect in WA.

Later in the day, Monday’s debutante Kali Metals (ASX:KAL) fired back into life, adding another 23% to the 78% it stacked on during its first day on the bourse.

And Widgie Nickel (ASX:WIN) enjoyed a boost of its own, after investors took their sweet time digesting an early morning announcement of an updated JORC-compliant Mineral Resource Estimate for its Gillett nickel deposit.

Widgie says there is a lot more nickel at the site – we’re talking a 75% increase in total contained nickel versus the 2023 Mineral Resource Estimate – and that got investors up and out of their seats, pushing the company nearly 24% higher.

At the not-awesome end of the scale, however, was Talisman Mining (ASX:TLM) – it lost 14% before lunch after delivering news of further assay results from additional RC drillholes completed at the Durnings Prospect, part of the company’s 100%-owned Lachlan Project in NSW, which appear to have underwhelmed investors.

Wednesday 10 January, 2023

Market newbie Kali Metals (ASX:KM1) absolutely crushed it again in early trade, up 38% and bucking the overall sell-off trend that hit the ASX’s lithium players pretty hard the previous day.

Kali dropped a well-timed announcement about rock chip and soil sampling that was carried out prior to its IPO this week, with results confirming that spodumene had been identified at Spargoville, part of its Higginsville lithium district in WA. Kali’s price continued to improve, moving beyond +46% by mid-afternoon.

Culpeo Minerals (ASX:CPO) was also on the move again, after the company spent a couple of days becoming pen pals with the watchdogs at the ASX over who knew what and when in relation to the company finding a copper-gold porphyry system at La Florida.

The correspondence was all a little convoluted, but the gist of it was that Culpeo got a bunch of results from rock chip sampling on the morning of 26 December – but, Culpeo said, it then took a while to get those results confirmed and the information out to market, which explains why it didn’t go public with the results until 04 January.

So the ASX wanted to know why it looked like there was something similar to a betting plunge on Culpeo stocks over the period between those dates, when the information had not been disclosed.

Culpeo said “all above board”, and that any delays in getting the data out were simply down to the holiday season and staff availability other such Christmassy things.

While we’re on the topic of correspondence, Fatfish Group (ASX:FFG) got a speeding ticket, asking for an explanation for why it had become hot property, climbing from $0.013 to $0.039 since 21 December.

Fatfish pointed to its recently completed, oversubscribed cap raise from earlier in the month.

Emperor Energy (ASX:EMP) put on some late value in the wake of an announcement entitled “Judith Permeability Update”, which confirmed that Judith is, indeed, quite permeable and very gassy.

It also noted that Judith isn’t, as I assumed, a nursing home resident… it is, in fact, the name of a well first drilled by Shell in 1989, which Emperor has been busily probing as part of an updated petrophysical evaluation.

Meanwhile, another uranium explorer, Gladiator Resources (ASX:GLA), took off rapidly in early trade on the back of news that re-analysis of uranium samples from a trenching program at Southwest Corner – part of the Mkuju project in Tanzania – have come back above the detection limit (4245ppm U3O8) returned grades up to 7139ppm.

Thursday 11 January, 2024

Top of the pops for Thursday was Jupiter Energy (ASX:JPR), after the company brought in Sproule International to evaluate the Proved, Probable and Possible reserves for Jupiter’s three oilfields in Kazakhstan and to prepare a Competent Person’s Report as to its findings.

The report came back with an upgrade to the recoverable reserves associated with Jupiter’s field, with the total Proved, Probable and Possible total now standing at 46,796,000 bbls, which the company says carries an after-tax Net Present Value of ~$US180 million.

Also out of bed early on Thursday was Maximus Resources (ASX:MXR), which defined a number of ‘high-priority lithium targets’ at its $4.5m Lefroy Lithium Project JV with the South Korean state mining corp KOMIR.

Maximus’ managing director, Tim Wither, said assay results returned from a completed soil-sampling program were “very encouraging”.

“These initial results from the first phase of the project-wide soil sampling campaign have defined a significant anomalous lithium trend over 5km in length, allowing us to set high-priority drill targets at the Lefroy Lithium project.

“The presence of a large 3km x 1.5km lithium-in-soil anomaly, extending from the recent discovery of spodumene-bearing pegmatites, provides more encouraging signs that the lithium-in-soil anomalies may be associated with a very large mineralised system.”

Maximus owns 100% of the Lefroy Lithium Project, with KOMIR able to farm into a stake of up to 30% by spending up to US$3 million, with Maximus retaining management of the project.

CZR Resources (ASX:CZR) came out of voluntary suspension just after lunch, bearing news that it had entered into a binding Share Sale Agreement for the sale of its wholly-owned subsidiary Zanthus Resources, which controls an 85% interest in the Robe Mesa Iron Ore Project.

The buyer is Miracle Iron Resources, which operates under parent company, Shenzhen Naao Jianglan Investment Co, which in turn is a subsidiary of Xinjiang Jiangna Mining Corporation.

The news put CZR up more than 47% in a matter of minutes.

Elsewhere, Compumedics (ASX:CMP) climbed nicely throughout the day, after delivering a business update

telling the market it was likely to have increased its revenues by about a record $26 million in H1 FY24, up by roughly 35% on PCP.

Coal from Aspire Mining’s (ASX:AKM) Ovoot project in Mongolia was designated super high quality, or “fat”, making it ideal for producing coke, which is used in the smelting of iron ore.

“We are very excited by this confirmation which places our coal into the ‘fat coal’ market, which will attract a hard coking coal premium,” AKM’s Sam Bowles says. “In recognition of the distinctly unique qualities of this coal, the company will be branding the coal produced from the OCCP as Toson Coal.

“In Mongolian, ‘Toson’ is an adjective meaning ‘fat’ or ‘fatty’.”

Friday 12 January, 2024

A lot of the day’s early leaders were making headway thanks to market conditions and commodity price movement, leaving Lodestar Minerals (ASX:LSR) out in front on a no-news Friday for the company.

However, in amongst the winners list there were a handful of noteworthy mentions, including Duketon Mining (ASX:DKM) with a 16% lift off the back of an upbeat quarterly, showing that the company is still beavering away at its Tate Prospect, located north of the Duketon Greenstone Belt – and that there’s still money in the bank to keep the hunt going for a while yet.

And 88 Energy (ASX:88E) dropped a flow-test update on the market news list, letting everyone know that things are full steam ahead for the Hickory-1 discovery well next month.

There’s still the small matter of building an ice road, well pad and getting the rig out to the site to deal with, but the company sounds pretty positive that things are all on track.

By the end of play, Singular Health (ASX:SHG) had risen to the top of the ladder, on yesterday’s news that it has received its first binding enterprise licence order for 5,000 annual licences of the 3Dicom Patient software in the US.

What it means in essence, is that a small number of US military veterans are now able to access their medical records digitally, rather than having to order (and wait for) a hard copy – which is a massive step forward for them.

Details of the enterprise sale are “commercial-in-confidence”, but SHG says revenue generated from this order “exceeds the total direct-to-consumer sales of the 3Dicom software in 2023 of ~A$50,000 by more than 40%”.

Which means, if I’m reading this correctly, this is an enormous jump for Singular – it’s up 110% for the week, adding close to $7 million in market cap off the back of a $70k contract.

Uranium player Basin Energy (ASX:BSN) saw a late rise as well, up a tidy 24% and climbing along with the rest of the uranium market as interest in yellowcake booms this week.

That’s off the back of a recent decision by the US Department of Energy (DOE) that it was exploring domestic supply of an enriched uranium fuel to reduce its reliance on Russian supplies, which has re-lit the fuse under local uranium players as well.

And CZR Resources (ASX:CR) is sailing again on the back of news yesterday of the $102m sale of its Robe Mesa iron ore project in the Pilbara to a Chinese buyer, which will see CZR bank double its pre-bid market cap in cash.

The buyer is Miracle Iron, which will pay a combined $122m to secure Strike Resources’ (ASX:SRK) Paulsens East project, which was briefly mined and shipped through the junior Utah Point Facility in Port Hedland a couple years ago, and CZR’s larger 33Mt Robe Mesa, an extension of Rio Tinto’s (ASX:RIO) Mesa F deposit at its Robe River JV.

Kali Metals (ASX:KM1)

Listing date: January 08, 2024

IPO: $15 million at 25 cents/share

Lithium explorer Kali Metals (ASX:KM1) banked a cracker of a debut this week, hitting the market running white hot on Monday at a start price of $0.435 – well above its $0.25 IPO and a solid indication that it was going to be hot property all week.

As the hours ticked by this week, Kali’s fortunes grew, with the newbie peaking at $0.76 on Wednesday, before easing gently now that the New Share smell has worn off and early profit takers have made their 30 pieces of silver.

Infini Resources (ASX:I88)

Expected listing: January 16, 2024

IPO: $5.5 million at 20 cents/share

I88 is looking to capitalise on lifting uranium prices with its planned ASX listing mid-month.

Focused on lithium and uranium exploration, I88 has eight projects including a mix of brownfield and greenfield assets in Canada and Western Australia.

Its WA lithium projects include Pegasus, Parna and Yeelirrie. In Canada it has the Des Herbiers Project and Valor projects in Quebec, the Tinco Project in Saskatchewan and Portland Creek Uranium Project (Newfoundland and Labrador) along with the Paterson Lake Project (Ontario).

Sixty Two Capital is lead manager of the float.

Golden Globe Resources (ASX:GGR)

Expected listing: January 18, 2024

IPO:$6 million at 20 cents/share

The gold explorer with projects in Queensland, WA and NSW was down to list on the local bourse in October 2023. In the last four years, the company says it has acquired four projects with high prospectivity including Dooloo Creek and Alma in Queensland, Crossways in Western Australia, and Neila Creek in NSW.

GGR says each of these projects offers substantial opportunities for gold resources, including high-grade copper. The explorer has conducted extensive drilling and sampling at Dooloo Creek, yielding impressive results over the past two years.

There are plans for further drilling across all GGR projects, with an immediate focus on Neila Creek and ongoing efforts at Dooloo Creek.

K S Capital is lead manager of the float.