ASX Small Caps and IPO Weekly Wrap: Local markets fade despite a solid surge for gold

Despite many assurances from the leprechaun, Bobby's promised golden shower turned out to be quite a bitter disappointment. Pic via Getty Images.

- The ASX 200 ended the week -0.42% lower because of reasons

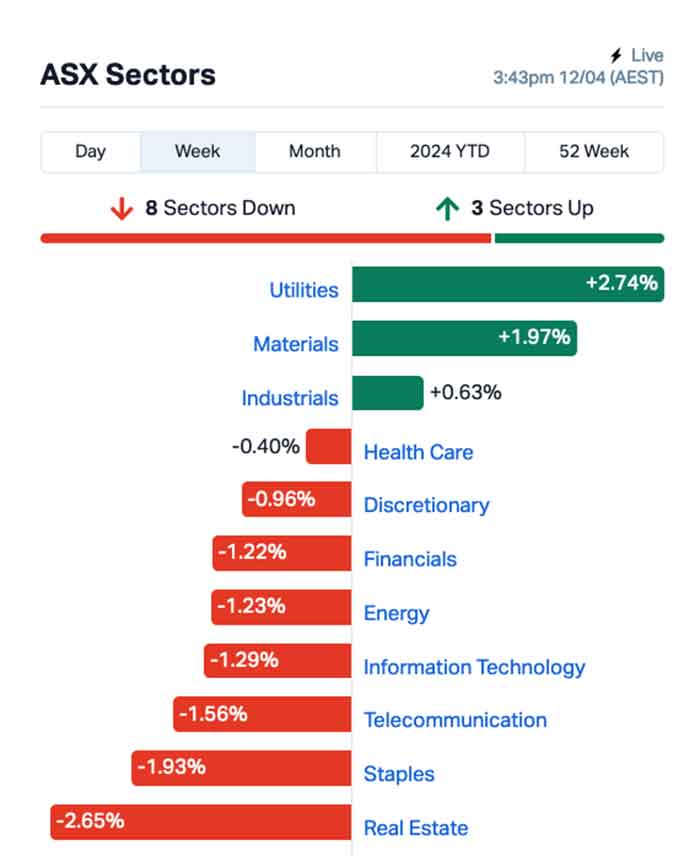

- Goldies won, but Utilities and Materials picked the eyes out of the rest

- A trio of triple digit gains put a shine on the Small Caps this week

Straight up – this one’s gonna be kept pretty brief, as Friday is drawing to a close, my energy levels are deep in the red and the small child I sent to fetch me fresh coffee an hour ago appears to have absconded with my fresh, crisp $10 note.

Why is it so hard to get good help these days?

Anyhow – it’s been a bumpy week in many respects for the ASX, with the net change for the benchmark within a whisker of being a fat, round zero, at just -0.4% (ish).

Most of the blame for that can be laid at the feet of Wall Street, because as scapegoats go, New York is both massive, and conveniently a long way away, so even if someone there does get mad at me, I’m unlikely to get my teeth kicked in about it.

The Wall Street hullabaloo was all about interest rates again, with the week marred by an unexpectedly hot tranche of CPI data that was like a cold, metal spoon to the tip of investors’ hopes of a rate cut in America before the election in November.

That knocked the wind out of Wall Street, and – as is tradition – investors on the ASX ingested that sentiment like the scent of crook hotdogs and taxi fumes, sending local markets scurrying for shelter in the only sensible place: Gold.

Spot prices for the precious metal touched new all-time highs during the week, driven by market sentiment, the need for a safe haven and – dare I say it – Costco feeding it’s conspiracy-awash customer base with lurid tales of bars of gold for sale, alongside 44-gallon tubs of black olives and pallettes of poo tickets to last even the poopiest of family’s well past the oncoming apocalypse.

There was also an eclipse that drove a lot of Americans mad, for a variety of reasons – the best of which was one sector of the US community firmly believing that the sun was going disappear as a sign that we’re all (well, they would be – I definitely wouldn’t) about to be Raptured.

The tale of one woman’s efforts to divest herself of her worldly riches pre-Rapture was pure poetry.

She reportedly tipped workers in one restaurant US$1,100 in two visits on the basis that she wouldn’t need the cash in heaven, only to turn up after the eclipse was over claiming she’d been defrauded and demanding the money back.

Spoiler alert: she’s now US$1,100 poorer than she was before the perfectly normal and easily-explained-by-science celestial event took place.

What a bonehead.

WHAT THE SECTORS DID

Just like last week, Utilities caught the best of the week’s action, finishing the week +2.5% higher, thanks to some heavy lifting among the sector’s big names.

Materials was in the hunt as well, popping close to +2.0%, while Industrials climbed a shade over 0.6% – and that’s about where the good news stops.

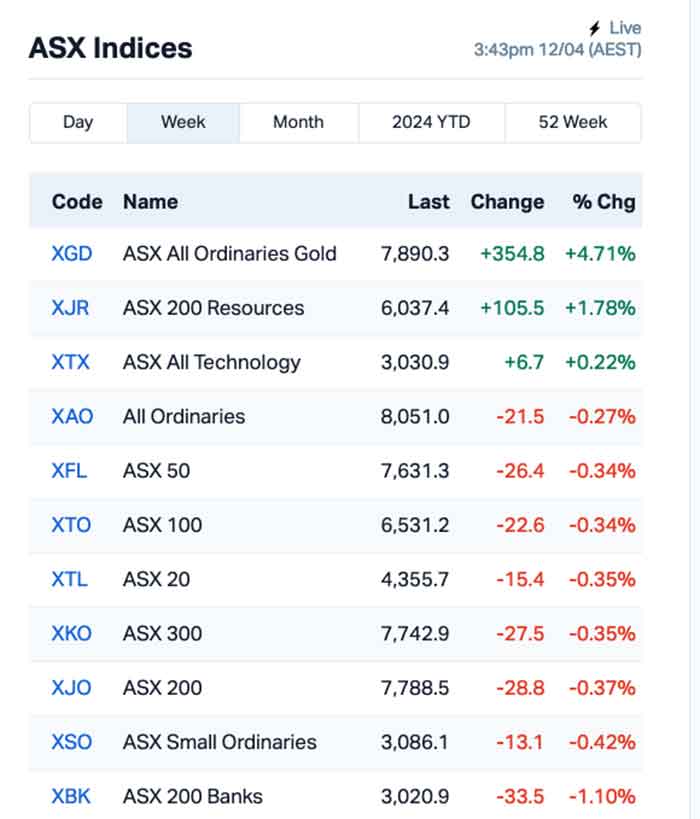

But the gilded crown for the week belongs to the Goldies – as mentioned earlier, a price boom and a desperate need for sanctuary saw renewed interest in the precious metal, and that saw the XGD All Ords gold index rise a smidge over +4.7% for the week.

The XJR Resources index was also lookin’ pretty sporty, up around +1.8% after a number of commodities enjoyed a surge in popularity, and price, through the week.

At the time of writing, some key metals are sitting a lot prettier than they were last week – iron ore is up +3.60%, silver has gained 5.2% this week, and platinum has bolted, selling 8.5% higher.

At either extreme, Tin is up +11.7%, but neobyniudms or however you say it is down by pretty much the same percentage.

So… which Small Cap officially won the week? Let’s find out together…

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| NPM | Newpeak Metals | 0.025 | 127% | $1,099,469 |

| M4M | Macro Metals Limited | 0.014 | 100% | $38,784,801 |

| CMB | Cambium Bio Limited | 0.010 | 100% | $9,959,200 |

| PSC | Prospect Res Ltd | 0.155 | 99% | $76,449,774 |

| SIX | Sprintex Ltd | 0.025 | 92% | $8,578,455 |

| KTA | Krakatoa Resources | 0.015 | 88% | $8,497,930 |

| FRS | Forrestaniaresources | 0.026 | 86% | $4,044,644 |

| EPM | Eclipse Metals | 0.010 | 67% | $17,677,244 |

| NWM | Norwest Minerals | 0.049 | 63% | $20,570,334 |

| PGM | Platina Resources | 0.031 | 63% | $18,072,230 |

| HHR | Hartshead Resources | 0.008 | 60% | $22,469,457 |

| FFF | Forbidden Foods | 0.019 | 58% | $3,431,629 |

| SBM | St Barbara Limited | 0.300 | 58% | $233,121,558 |

| RNX | Renegade Exploration | 0.011 | 57% | $10,036,697 |

| BDG | Black Dragon Gold | 0.028 | 56% | $5,644,192 |

| YRL | Yandal Resources | 0.170 | 55% | $40,171,142 |

| UBN | Urbanise.Com Ltd | 0.350 | 52% | $21,821,373 |

| AIS | Aeris Resources Ltd | 0.265 | 51% | $217,693,247 |

| HLX | Helix Resources | 0.006 | 50% | $13,938,875 |

| SIH | Sihayo Gold Limited | 0.002 | 50% | $18,306,384 |

| SLS | Solsticeminerals | 0.150 | 50% | $14,047,153 |

| AXP | AXP Energy Ltd | 0.002 | 50% | $11,649,361 |

| CDD | Cardno Limited | 0.320 | 48% | $12,499,412 |

| EXR | Elixir Energy Ltd | 0.105 | 48% | $105,336,477 |

| SRZ | Stellar Resources | 0.019 | 46% | $22,980,529 |

| RDN | Raiden Resources Ltd | 0.036 | 44% | $82,354,138 |

| WTM | Waratah Minerals Ltd | 0.115 | 44% | $16,430,095 |

| 14D | 1414 Degrees Limited | 0.093 | 43% | $21,911,504 |

| LEX | Lefroy Exploration | 0.150 | 43% | $28,064,187 |

| CMO | Cosmometalslimited | 0.054 | 42% | $5,434,961 |

| CYM | Cyprium Metals Ltd | 0.027 | 42% | $38,117,808 |

| WR1 | Winsome Resources | 1.405 | 41% | $280,454,025 |

| AQX | Alice Queen Ltd | 0.007 | 40% | $4,836,930 |

| NMR | Native Mineral Res | 0.028 | 40% | $5,875,814 |

| RTG | RTG Mining Inc. | 0.032 | 39% | $28,213,497 |

| ENX | Enegex Limited | 0.025 | 39% | $9,222,900 |

| CY5 | Cygnus Metals Ltd | 0.076 | 38% | $18,659,785 |

| TG1 | Techgen Metals Ltd | 0.040 | 38% | $4,703,905 |

| SPD | Southernpalladium | 0.455 | 38% | $19,600,639 |

| KNB | Koonenberrygold | 0.023 | 35% | $3,167,363 |

| DKM | Duketon Mining | 0.135 | 35% | $15,278,720 |

| ATP | Atlas Pearls Ltd | 0.175 | 35% | $71,547,693 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | $3,264,346 |

| POD | Podium Minerals | 0.052 | 33% | $22,282,592 |

| SKS | SKS Tech Group Ltd | 0.600 | 33% | $60,938,642 |

| HCD | Hydrocarbon Dynamic | 0.004 | 33% | $3,234,329 |

| LML | Lincoln Minerals | 0.008 | 33% | $13,632,362 |

| LNR | Lanthanein Resources | 0.004 | 33% | $5,864,727 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| LIN | Lindian Resources | 0.160 | 33% | $161,269,113 |

| E79 | E79Goldmineslimited | 0.040 | 33% | $2,440,022 |

| NES | Nelson Resources. | 0.004 | 33% | $2,454,377 |

| BNL | Blue Star Helium Ltd | 0.008 | 33% | $15,538,122 |

| IMA | Image Resources NL | 0.093 | 33% | $96,327,400 |

| PLG | Pearlgullironlimited | 0.030 | 30% | $6,136,254 |

| ODY | Odyssey Gold Ltd | 0.026 | 30% | $20,674,036 |

| SLM | Solismineralsltd | 0.130 | 30% | $9,696,656 |

| SUM | Summitminerals | 0.079 | 30% | $4,098,513 |

| SKY | SKY Metals Ltd | 0.040 | 29% | $22,716,037 |

| CPO | Culpeominerals | 0.067 | 29% | $8,930,100 |

| HOR | Horseshoe Metals Ltd | 0.009 | 29% | $5,818,308 |

| VMS | Venture Minerals | 0.027 | 29% | $54,400,313 |

| EVG | Evion Group NL | 0.027 | 29% | $9,340,898 |

| CCO | The Calmer Co Int | 0.005 | 29% | $5,322,135 |

| FHS | Freehill Mining Ltd. | 0.009 | 29% | $20,970,911 |

| CHN | Chalice Mining Ltd | 1.503 | 28% | $540,658,993 |

| AQC | Auspaccoal Ltd | 0.086 | 28% | $43,602,245 |

| VMM | Viridismining | 1.385 | 28% | $69,469,006 |

| ORP | Orpheus Uranium Ltd | 0.110 | 28% | $17,275,023 |

| ARR | American Rare Earths | 0.300 | 28% | $152,961,223 |

Out in front by the close of play Friday was NewPeak Metals (ASX:NPM) on +124%, after it finalised the sale of its interest in the Finnish subsidiary companies, NewPeak Finland Oy and Kultatie Holding Oy, marking a significant milestone in the company’s strategic realignment efforts.

The Australian-based mining company has divested its Finnish assets to 1459992 BC, a Canadian unlisted private company associated with Emma Fairhurst, a prominent figure in the Canadian corporate landscape.

The transaction represents a crucial step in NewPeak’s rejuvenation strategy, aiming to bolster its financial position while focusing on core operations.

NPM is set to receive CAD$500,000 cash, CAD$1m in shares of the listed company, and a milestone payment of CAD$1.5m in cash or shares on reporting of a 500,000oz gold resource.

It was a tie for second place on +100% apiece for Cambium Bio (ASX:CMB) – formerly Regeneus – and Macro Metals (ASX:M4M), the former off the back of last week’s reveal of a $3.48 million two-tranche Placement at A$0.006 per share, and some shuffling of the top order in the board room this week – plus a name change, just to keep you on your toes.

Macro’s moves this week were also off the back of news from last week – but at $0.014 a share, it doesn’t take much to move the needle.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.001 | -50% | $15,569,766 |

| RMX | Red Mount Min Ltd | 0.001 | -43% | $2,673,576 |

| THB | Thunderbird Resource | 0.037 | -40% | $7,158,888 |

| ME1 | Melodiol Glb Health | 0.005 | -36% | $2,690,966 |

| SIT | Site Group Int Ltd | 0.002 | -33% | $7,807,471 |

| WEL | Winchester Energy | 0.002 | -33% | $2,040,844 |

| MHC | Manhattan Corp Ltd | 0.002 | -33% | $8,810,939 |

| ADS | Adslot Ltd. | 0.002 | -33% | $6,448,991 |

| AIV | Activex Limited | 0.008 | -33% | $1,724,021 |

| MTB | Mount Burgess Mining | 0.002 | -33% | $2,089,627 |

| ERL | Empire Resources | 0.002 | -33% | $2,225,870 |

| CBY | Canterbury Resources | 0.025 | -32% | $4,465,263 |

| ADO | Anteotech Ltd | 0.024 | -31% | $52,714,618 |

| ZMI | Zinc of Ireland NL | 0.014 | -30% | $2,984,020 |

| AVM | Advance Metals Ltd | 0.027 | -29% | $1,082,294 |

| BUR | Burleyminerals | 0.050 | -29% | $5,319,135 |

| AVH | Avita Medical | 3.360 | -28% | $239,574,986 |

| AEV | Avenira Limited | 0.007 | -28% | $14,094,204 |

| ICU | Investor Centre Ltd | 0.024 | -27% | $7,276,753 |

| WAK | Wakaolin | 0.045 | -26% | $20,341,638 |

| MMM | Marley Spoon Se | 0.052 | -26% | $6,592,567 |

| ASP | Aspermont Limited | 0.012 | -25% | $29,467,616 |

| CYQ | Cycliq Group Ltd | 0.005 | -25% | $1,608,825 |

| AYM | Australia United Min | 0.003 | -25% | $5,527,732 |

| DM1 | Desert Metals | 0.024 | -25% | $6,635,642 |

| CTN | Catalina Resources | 0.003 | -25% | $3,715,461 |

| GTI | Gratifii | 0.005 | -25% | $7,254,202 |

| MRQ | Mrg Metals Limited | 0.002 | -25% | $5,050,237 |

| MTL | Mantle Minerals Ltd | 0.002 | -25% | $12,394,892 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| SOM | SomnoMed Limited | 0.225 | -24% | $22,804,193 |

| OLL | Openlearning | 0.016 | -24% | $4,285,905 |

| ZMM | Zimi Ltd | 0.026 | -24% | $3,572,454 |

| APM | APM Human Services | 1.248 | -23% | $1,128,133,794 |

| TNY | Tinybeans Group Ltd | 0.100 | -23% | $8,438,734 |

| TNY | Tinybeans Group Ltd | 0.100 | -23% | $8,438,734 |

| ZER | Zeta Resources Ltd | 0.200 | -23% | $106,080,139 |

| AHK | Ark Mines Limited | 0.120 | -23% | $6,930,802 |

| BNR | Bulletin Res Ltd | 0.051 | -22% | $14,387,053 |

| PEC | Perpetual Res Ltd | 0.011 | -21% | $7,040,324 |

| OAU | Ora Gold Limited | 0.006 | -21% | $34,836,005 |

| PIL | Peppermint Inv Ltd | 0.011 | -21% | $23,279,942 |

| PEN | Peninsula Energy Ltd | 0.103 | -21% | $232,968,525 |

| TBN | Tamboran | 0.150 | -21% | $309,043,080 |

| MQR | Marquee Resource Ltd | 0.015 | -21% | $5,994,074 |

| ICI | Icandy Interactive | 0.023 | -21% | $33,621,024 |

| FGR | First Graphene Ltd | 0.062 | -21% | $40,214,355 |

| WEC | White Energy Company | 0.039 | -20% | $4,416,178 |

| KOR | Korab Resources | 0.008 | -20% | $2,936,400 |

| AKN | Auking Mining Ltd | 0.020 | -20% | $4,707,074 |

| H2G | Greenhy2 Limited | 0.008 | -20% | $3,350,047 |

| HFY | Hubify Ltd | 0.012 | -20% | $5,953,636 |

| MSI | Multistack Internat. | 0.004 | -20% | $545,216 |

| OAR | OAR Resources Ltd | 0.002 | -20% | $5,306,622 |

| OPN | Oppenneg | 0.004 | -20% | $4,516,719 |

| JBY | James Bay Minerals | 0.190 | -19% | $6,531,000 |

| CTQ | Careteq Limited | 0.013 | -19% | $3,297,662 |

| 3PL | 3P Learning Ltd | 1.005 | -18% | $343,217,168 |

| TSL | Titanium Sands Ltd | 0.009 | -18% | $17,943,572 |

| MAG | Magmatic Resrce Ltd | 0.090 | -18% | $37,018,978 |

| TYX | Tyranna Res Ltd | 0.009 | -18% | $29,586,828 |

| DGR | DGR Global Ltd | 0.014 | -18% | $17,742,789 |

| KAM | K2 Asset Mgmt Hldgs | 0.042 | -18% | $10,125,578 |

HOW THE WEEK SHOOK OUT

Monday 08 April, 2024

Linius Technologies (ASX:LNU) was climbing on the back of last week’s news that the company had signed a new agreement to provide its sports solution, Whizzard, to the Lone Star Conference – one of the college-level football sporting associations in the United States.

Lepidico (ASX:LPD) rose sharply after announcing that eligible directors and key management confirmed they will participate in an Entitlement Offer.

Qoria (ASX:QOR) surged after knocking back a takeover proposal from K1 Investment Management that it received late last week, which had K1 offering $0.40 cash per Qoria share for 100% of the company. No prizes for guessing that Qoria has since climbed in value to just over that offer amount.

Mining minnow Alice Queen (ASX:AQX) was up +20% on news that its largest shareholder, Gage Resource Development, has agreed to invest a further $3.6 million to help advance its gold exploration activities. Gage currently holds an 18.67% stake in the company.

Far East Gold (ASX:FEG) announced that initial assays of drill core from the first ever drill hole at the Aloe Rek prospect area in the company’s Woyla Copper Gold Project have confirmed high-grade gold within the Victory vein system. Detailed field mapping across the Woyla tenement have confirmed an increase of 5,500m in the strike length of th project’s low sulphidation epithermal vein system from 13,000m to 18,500m.

Tuesday 09 April, 2024

Solstice Minerals (ASX:SLS) was leading the Small Caps at lunch time, on news that it has entered into a binding Sale and Purchase Agreement with Northern Star, to sell 100% of the Hobbes Exploration Licence for total consideration of $12.5 million. Solstice held 80% of the licence, while the remaining 20% was held by “an unrelated private company” – Solstice’s words, not mine – which has also agreed to the sale.

Explorer Miramar Resources (ASX:M2R) revealed that it is working toward a maiden drilling campaign at the Bangemall Ni-Cu-Co PGE project and has expanded its 480km2 Eastern Goldfields tenement portfolio. M2R was briefly up as much as 109% in very early trade, but that eased almost as quickly to be +55% by the closing bell.

Regeneus (ASX:RGS) was continuing its recent positive form after announcing a $3.48 million two-tranche placement, ahead of the company changing its name and ticker today to Cabrium Bio (ASX:CBM).

Patrys (ASX:PAB) jumped 12% after announcing that new data from preclinical studies using PAT-DX1 and PAT-DX3 (both called deoxymabs) in animal models were presented by Dr Kim O’Sullivan from Monash University during the plenary session at the 21st International Vasculitis Workshop in Barcelona. The presentation demonstrated positive preclinical data for deoxymabs in the autoimmune disease, anti-neutrophil cytoplasmic antibody (ANCA) vasculitis.

Next Science (ASX:NXS) announced the publication of a study which found BLASTX to be efficacious in the treatment of pressure ulcers, when used in conjunction with negative pressure wound therapy (NPWT). The study has been published in Diagnostics, an international peer-reviewed journal, by Dr Thomas E. Serena.

Wednesday 10 April, 2024

Out in front Wednesday was Forrestania Resources (ASX:FRS), which revealed that it’s been poring over old exploration and digging date, and had boots on the ground on-site, in its search for gold at the Ada Ann and Bonnie Vale North prospects, just north of Coolgardie, WA.

The highlight of the announcement was a rock chip grab sample that contained 49g/t Au, found in previously unrecorded, historic drill spoils at Ada Ann, to go with other grab samples of 15.7g/t and 13.5g/t.

Other gold finds pushing gains include Waratah Minerals (ASX:WTM), which reported maiden drilling at Spur, just 5km west from big gun Newmont Corporation’s (ASX:NEM) flashy Cadia Valley project (>50Moz Au, 9.5Mt Cu 1). And Waratah’s Spur is also hosted in “equivalent Late Ordovician-aged geology” within the Molong Belt of mineralisation.

Prospect Resources (ASX:PSC) has executed an agreement that will see Orpheus Minerals (ASX:ORP) exiting from its exploration projects in Zambia, and pay $1.0 million in fully paid PSC shares as partial reimbursement of prior exploration expenditure, along with three options to acquire ordinary PSC shares for every four shares issued, at 15 cents per share, expiring three years after issue.

Kula Gold’s (ASX:KGD) ultrafine soil sampling program has discovered the new Boomerang gold anomaly at its Marvel Loch project near Southern Cross. Drilling approvals are in place and a rig is ready to begin testing in the coming weeks.

And Wildcat Resources (ASX:WC8) said drilling beneath the Leia deposit has discovered a thick lithium mineralised repetition named the “Luke Pegmatite”, with best intercepts of: 41.0m @ 1.0% Li2O from 267m. Meanwhile diamond drilling at Leia continues to return impressive new results including: 68.0m @ 1.4% Li2O from 337m.

Thursday 11 April, 2024

Krakatoa Resources (ASX:KTA) updated the market on its ongoing reconnaissance work on new prospects at the Turon Project. New copper-gold prospect on Turon Project defined with rock-chip assays to 1.24g/t Au, 10.45% Cu, with anomalous Mo, and Sn. Four samples returned over 1% Cu, averaging 4.83% Cu to a maximum of 10.45%

Aura Energy’s (ASX:AEE) drilling defined two new areas of extensive shallow, high-grade uranium mineralisation at Tiris. Assays including 9m at 310ppm U3O8 have defined mineralisation over a strike length of +8km at Hippolyte South. Results are expected to deliver an upgrade to current contained resource of 58.9Mlb U3O8.

Prospect Resources (ASX:PSC) continued its upward trajectory, building on Tuesday’s announcement that the company has acquired an 85% interest in the large-scale Mumbezhi copper project, located in the Zambian Copperbelt, a prized geological jurisdiction.

Cyclone Metals (ASX:CLE) jumped after announcing an upgraded Indicated and Inferred Mineral Resource of 16.6 billion tonnes containing 29.3% total Fe and 18.2% magnetic Fe, cut-off grade 12.5% magnetic Fe at Project Iron Bear. The Indicated portion of the Mineral Resource is 2.15 billion tonnes containing 28.68% total Fe and 19% magnetic Fe.

Renegade Exploration (ASX:RNX) announced that its found a very large magnetic anomaly just north of the Mongoose prospect at its flagship Cloncurry Project, which it now plans to drill in May, with the help of a $300,000 Collaborative Exploration Initiative (CEI) grant from the Queensland Government.

And Cosmos Exploration (ASX:C1X) says that high-grade rock chip assays up to 2.20% TREYO (33% NdPr) have been received from its Leatherback L1 mineralised trend, and the results significantly surpass previous high of 1.09% TREYO previously collected from the L2 trend.

Friday 12 April, 2024

Defence manufacturer HighCom (ASX:HCL) receives a new order of ballistic products from a military customer worth $4.7m. Good news for HCL, which suffered a $13.4m loss in the December half “mainly due to the company not securing several large international orders in the Middle East”.

NewPeak Metals (ASX:NPM) finalises the sale of its share in a Finland gold project to a soon-to-be-listed Canadian company. NPM receives CAD$500,000 cash, CAD$1m in shares of the listed company, and a milestone payment of CAD$1.5m in cash or shares on reporting of a 500,000oz gold resource.

Estrella Resources (ASX:ESR) was also on the move, after announcing it had uncovered a manganese host rock over 27km of strike at the Lautém project in Timor-Leste.

The company says that it has managed to secure a site in the city of Dili for its team to work with the samples that are being collected in the field, in a small office that has a sample preparation area established.

Meanwhile, larger gold stocks surged alongside a new record high spot price, led by RED 5 (ASX:RED), Regis (ASX:RRL), Resolute (ASX:RSG), and Bellevue (ASX:BGL).

Lunnon Metals (ASX:LM8) reported the results of a recent reverse circulation (RC) drilling program at the Baker nickel deposit, the company’s cornerstone asset at its Kambalda nickel project. Extensional drilling program has delivered growth potential up-dip. Results include 9.0m @ 5.29% Ni, 6.0m @ 4.99% Ni, 7.0m @ 3.99% Ni and 3.0m @ 8.14% Ni. Mineral Resource Estimate will be updated in due course.

FBR (ASX:FBR) says its ordinary shares have commenced trading on the OTCQB Venture Market under the ticker “FBRKF”. The OTCQB Venture Market is a US trading platform operated by OTC Markets Group in New York. FBR says the listing will increase exposure to, and generate increased interest from, US domiciled retail and institutional investors in its shares.

Oncosil Medical (ASX:OSL)’s clinical strategy continues to progress, with the first patient treatment using the OncoSil device occurring in the UK for the TRIPP-FXX clinical study. The TRIPP-FXX study will assess the safety and efficacy of the OncoSil device when given with standard FOLFIRINOX chemotherapy for treatment of locally advanced pancreatic cancer.

Sierra Rutile (ASX:SRX) announced the results of the Definitive Feasibility Study (DFS) for the Sembehun Project in Sierra Leone. Highlights include: Expected mine life of 14 years, no change to previous Sembehun Ore Reserve of 173.7 Mt @ 1.46% rutile, and an average of 175ktpa of rutile production projected from 2028 to 2038. Capex estimate is reduced by 11% to $301 million, or a $36 million reduction on the 2022 Preliminary Feasibility Study (PFS). Expected payback is within 55 months from project commencement.

IPOs that happened

Far Northern Resources (ASX:FNR)

Date of Listing: 12 April, 2024

IPO:$6 million at $0.20 per share

Far Northern Resources is an advanced Brisbane based gold exploration and base metals company, boasting three projects across North Queensland and the NT, including two tier one projects, Empire (QLD) and Bridge Creek (NT), both of which are drill-ready and already hold JORC compliant Resources.

FNR didn’t enjoy the best of debuts, however, closing out Day 1 on -15% slip to $0.17, down from opening at $0.195 mid-morning.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.