ASX Small Caps and IPO Weekly Wrap: ASX biotechs make hay as bond markets boil

News

Local markets have made ground on Friday, but October so far has been gruelling work for all corners of the ASX.

But it’s hard times on turbulent seas for the average Aussie micro cap just trying to stay afloat. ‘Higher for longer’ hurts the most when you’re smaller and that bit more vulnerable.

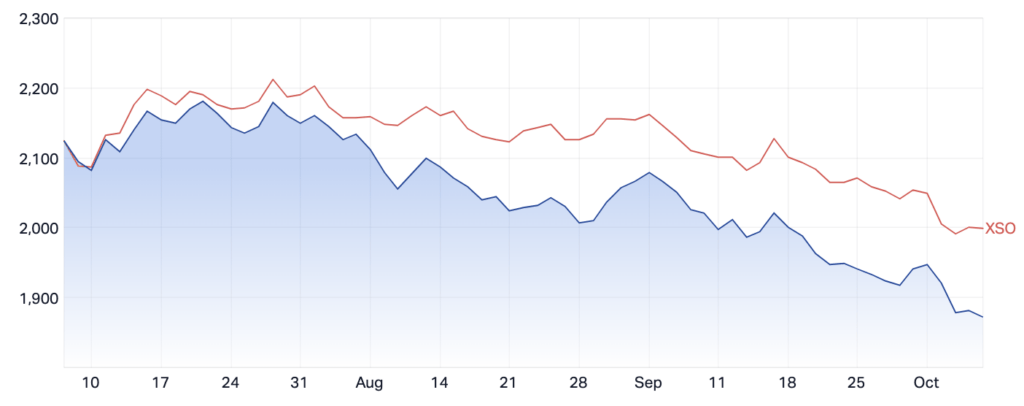

It’s been a tough run for the ASX Emerging Companies (XEC) index.

The XEC has lost about -2.5% this week, but almost -10% for the last month. The XSO is down -2% and -6.5% for the month.

The ASX200 has had a marginally better run, but October has not offered the turnaround traders looked for after an awful and typically temperamental September.

On the economic front, the newbie RBA Governor Michele Bullock left interest rates unchanged at the October Board meeting and the associated Statement on Monetary Policy was just about what it’d been in September, back when ex-Guv’nah P. Lowe ran the books.

The November Board meeting is a more opportune time for the RBA to consider whether to recalibrate its messaging, says Bill Evans at Westpac.

“That meeting will be informed by the upcoming September quarter Inflation Report and an updated set of RBA forecasts. We have lifted our near-term inflation forecast profile (on higher oil, a lower Australian dollar and sticky services inflation) but have retained our 2024 view.

“The RBA will similarly need to revise its inflation outlook profile, adjustments which are unlikely to be sufficient to warrant an interest rate hike. We continue to assess that rates will remain on hold ahead of an easing cycle commencing in the September quarter 2024.”

And it’s been a crazy week on interest rate markets.

“That has the US yield curve less inverted as risks of a US recession recede, reinforced by the impacts of rising US bond supply associated with large budget deficits.

“We have lifted our end 2024 US bond yield forecast from 4.0% to 4.4% and kept the end 2024 Australian/US 10 year spread at –20bps,” Evans said.

Both US and Australian 10-year bond yields have climbed oh-so sharply, sending shivers through global markets. But identifying the catalyst only highlights how much emotion is riding shotgun on equities right now.

“What’s intriguing of late is that the bond sell-off has not reflected anything notably new in the economic data,” says Betashares’ head economist David Bassanesse.

Rather, the jumpy yields – US 10-years cracking on toward 5% until easing off on Thursday in New York – seem more driven by the heart than the head.

“(The bond rout) appears more to reflect concerns with rising oil prices and Fed rhetoric discounting the possibility of rate cuts early next year,” Bassanese said this week.

“Moody’s warning of a potential US credit rating downgrade due to mayhem in Washington did not help the bond market mood, though equity markets at least seemed to shrug it off.”

Each month, Romano Sala Tenna’s team at Katana Asset Management’s Australian Equity Fund tracks noteworthy macro news items.

He says that during September, there were 16 such ‘significant’ items that came across the desk – 15 of them were negative.

“And that in a nutshell is the story of September: the narrative (finally) turned negative,” Romano says.

“Clearly the main driver was the breakout in US 10-year bond yields. Despite no action on the part of the US Fed (or RBA more locally), the market increased its expectations of further rate rises.

“And we would hasten to add that the cumulative effects of the inflation induced rate rises over the past 2 years look to be finally biting. Covid savings buffers have been eroded. Household spending is beginning to rebase. Corporate sales and earnings are coming under pressure…”

However, with the change in technical indicators, this pressure has abated for the time being.

“In fact, the market now looks to be oversold, and additionally October usually signals the beginning of the strongest period each year. So we would not be surprised to see a relief rally in the coming weeks.”

But when we step back from the short-term market machinations, Katana says there’s one large headwind facing markets:

“The yield on bank deposits now presents a genuine alternative to stocks. This is likely to reduce the marginal flow of funds into equities and accelerate outflows, should fear take hold.”

The S&P/ASX 200 Health Care [XHJ] index fell -5.5% in September, while in the US, the benchmark NASDAQ Biotechnology Index was also down -4.8% with the sector not immune to the “higher for longer” strategy by the US Fed Reserve.

According to Morningstar analyst, Amy Arnott, however, healthcare (and consumer staples) will always be one of ‘the most resilient performers’ during periods of economic weakness.

“Consumers can’t easily cut back on prescription drugs, medical devices, or household basics like canned goods and paper towels even if they’re feeling the effects of a weaker economy,” Amy says.

But does the prospect of a looming recession mean you should overhaul your portfolio?

“No. In fact, making wholesale shifts in portfolio holdings is usually a bad idea,” Arnott said, adding that being mentally prepared for a recession can actually help investors survive a tough period ahead.

“Studying how the market has historically performed can help you set expectations for how your holdings might react if and when the economy weakens,” she said.

Which brings us to a fascinating week for local small caps, in particular the three standouts – all in the biotech business.

Here are the best performing ASX small cap stocks from October 2 – October 6:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| DXB | Dimerix Ltd | 0.195 | 200% | $61,248,175 |

| NOX | Noxopharm Limited | 0.11 | 162% | $24,547,988 |

| PUA | Peak Minerals Ltd | 0.005 | 67% | $5,206,883 |

| BIT | Biotron Limited | 0.081 | 59% | $68,547,813 |

| TOY | Toys R Us | 0.014 | 56% | $11,075,017 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | $15,642,574 |

| EDE | Eden Inv Ltd | 0.003 | 50% | $10,090,911 |

| FGR | First Graphene Ltd | 0.08 | 48% | $41,314,369 |

| AL8 | Alderan Resource Ltd | 0.014 | 47% | $8,633,725 |

| ARE | Argonaut Resources | 0.087 | 45% | $6,657,756 |

| TZL | TZ Limited | 0.024 | 41% | $6,162,195 |

| NIM | Nimyresourceslimited | 0.26 | 41% | $20,141,590 |

| LML | Lincoln Minerals | 0.007 | 40% | $9,944,983 |

| TSL | Titanium Sands Ltd | 0.007 | 40% | $12,402,633 |

| BLG | Bluglass Limited | 0.052 | 37% | $80,986,420 |

| 3DA | Amaero International | 0.265 | 36% | $106,295,529 |

| ZNC | Zenith Minerals Ltd | 0.13 | 35% | $45,809,515 |

| ADA | Adacel Technologies | 0.75 | 34% | $57,168,742 |

| ADS | Adslot Ltd. | 0.004 | 33% | $12,897,982 |

| AXP | AXP Energy Ltd | 0.002 | 33% | $11,649,361 |

| CRB | Carbine Resources | 0.008 | 33% | $2,758,689 |

| M4M | Macro Metals Limited | 0.004 | 33% | $7,948,311 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | $24,408,512 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| HIO | Hawsons Iron Ltd | 0.053 | 33% | $44,115,411 |

| LV1 | Live Verdure Ltd | 0.39 | 32% | $43,742,032 |

| AJQ | Armour Energy Ltd | 0.145 | 32% | $13,921,215 |

| CZR | CZR Resources Ltd | 0.145 | 32% | $33,002,850 |

| HTG | Harvest Tech Grp Ltd | 0.034 | 31% | $22,606,827 |

| AX8 | Accelerate Resources | 0.03 | 30% | $8,753,840 |

| BNR | Bulletin Res Ltd | 0.097 | 29% | $30,827,066 |

| HVY | Heavymineralslimited | 0.1225 | 29% | $6,626,710 |

| PAB | Patrys Limited | 0.009 | 29% | $14,402,131 |

| MIL | Millennium Grp Ltd | 0.575 | 28% | $26,883,058 |

| PVE | Po Valley Energy Ltd | 0.051 | 28% | $52,153,273 |

| IMI | Infinitymining | 0.14 | 27% | $10,871,194 |

| LCY | Legacy Iron Ore | 0.019 | 27% | $115,322,872 |

| LEG | Legend Mining | 0.0265 | 26% | $72,611,930 |

| RVS | Revasum | 0.145 | 26% | $14,298,748 |

| BOT | Botanix Pharma Ltd | 0.15 | 25% | $220,285,506 |

| AJX | Alexium Int Group | 0.02 | 25% | $11,190,371 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | $6,605,136 |

| MCT | Metalicity Limited | 0.0025 | 25% | $9,340,215 |

| RMX | Red Mount Min Ltd | 0.005 | 25% | $13,367,880 |

| TMX | Terrain Minerals | 0.005 | 25% | $6,288,219 |

| B4P | Beforepay Group | 0.455 | 25% | $15,929,240 |

| LM1 | Leeuwin Metals Ltd | 0.31 | 24% | $14,331,200 |

| EYE | Nova EYE Medical Ltd | 0.235 | 24% | $45,750,934 |

| STK | Strickland Metals | 0.075 | 23% | $118,417,834 |

| TOE | Toro Energy Limited | 0.0135 | 23% | $62,156,869 |

Coming full tilt out of a Thursday morning trading halt, the shares in Aussie biotech Dimerix have been on an absolute tear ever since.

At the time of writing – near 2pm (Sydenham time) DXB is up 200%, or gaining about 15% – 20% for every hour they’ve been unlocked from the halt.

Why?

Well, settle in because we are going to wrap your head around the minutiae which makes biopharmaceuticals tick.

Firstly, DXB is set to receive $230mn in upfront and milestone payments following its exclusive licensing deal with a multi-national pharma giant (ADVANZ PHARMA)… a company so big we can only write its name in upper case.

ADVANZ is signing up to commercialise Dimerix’ DMX-200 a treatment for a rare kidney disease called Focal Segmental Glomerulosclerosis (FSGS), following regulatory approval.

The biotech is now undertaking its Phase 3 trial, (known as ACTION3), into its lead drug DMX-200, with the first analysis outcome forecast for mid-March, 2024.

The license agreement with ADVANZ covers the European Economic Area, UK, Switzerland, Canada, Australia, and New Zealand, while DXB retains all rights to commercialise the drug outside of these territories.

Last month the US Food and Drug Administration (FDA) granted DXB conditional approval in both the US and Europe because right now there’s no effective treatment for FSGS – Orphan Drug Designation (ODD) – for the brand name QYTOVRA.

Fortunately brand name marketing doesn’t weigh too heavily in the rare disease drug field.

And FSGS is a rare disease that needs a cracking treatment.

The illness attacks the kidney’s filtering units, where blood is cleaned, causing irreversible scarring which leads to permanent kidney damage and eventual end-stage failure.

DXB says around 80,000 people suffer from FSGS in the US and around 220,000 worldwide, making it a potentially wonderful ending to a lot of suffering and – as investors have noted – a potential billion-dollar market opportunity for DXB.

The benefits of ODD include various development incentives including seven years (FDA) and 10 years (EMA) of market exclusivity if regulatory approval is received, exemption from certain application fees, and a fast-tracked regulatory pathway to approval.

DXB says it will continue to fund and execute the global ACTION3 trial and ADVANZ will be responsible for submission and maintenance of the regulatory dossier in the licensed territories, as well as all sales and marketing activities.

In exchange for the rights, DXB will receive an upfront payment of €6.5 million (~$10.8 million) within 30 days, plus potential development, and commercialisation milestones of up to €132 million ($219 million).

Furthermore, DXB is eligible to receive tiered, escalating, mid-teen to 20 percentage royalties on net sales of DMX-200 if successfully commercialised.

The two companies will now form a joint steering committee to align development and commercialisation of DMX-200 in FSGS in the territories, leaving DXB free to pursue and progress licensing opportunities with potential partners outside the ADVANZ territories.

Another Aussie biotech came gunning out of a trading halt this week after winning its own Orphan Drug Designation (ODD) status by the US FDA – this one for its CRO-67 preclinical drug candidate for the treatment of pancreatic cancer.

The ODD is just one of three (incl Dimerix) which Aussie companies have been awarded out of some 260 applications this year alone.

The benefits will bring NOX tax credits for qualified clinical trials; exemptions from application fees; and up to seven years of market exclusivity after approval.

Noxopharm chief executive officer Dr Gisela Mautner said NOV’s pancreatic cancer program is a high priority.

“We are committed to progressing its development as quickly as possible. Further studies are in the works, as are investigations into dosing and formulation.

“For CRO-67 to achieve an ODD is a significant milestone for us… in addition to financial benefits, it will strengthen our commercial position in a market which has seen very few new treatments over recent decades,” Dr Mautner added.

CRO-67 is a novel, dual-cell pre-clinical candidate designed to target pancreatic cancer. An absolute turd of a disease – it’s difficult to treat, rich in tumours which themselves are surrounded by a dense barrier of cells which protect the cancer from treatment, as well as from the body’s immune system.

It also has a broad diversity of genetic variation across patients, presenting biotech firms with the challenge of developing a drug which works across the range.

Mice treated with CRO-67 for 21 days showed significantly reduced tumour volume in vivo by an average of 56.7% versus the untreated controls.

Still basking in the potential hinted at last week, when Biotron shares spiked and the company was promptly issued a speeding ticket by the ASX, after a coy message to shareholders from CEO Michelle Miller, who talked about the near-term outlook for BIT as it nears the final stage of three Phase 2 clinical trials for HIV‐1 and COVID‐19.

The genetics cell-focused biotech is developing a batch of new anti-viral therapies which potentially have broad applications.

Miller released her letter to investors, the major gist being that BIT is on the cusp, but can everyone please stay calm in the meantime.

“This is a pivotal time for the company as it completes data collection and analyses of samples and information collected during the trials ahead of release of headline data in coming weeks.”

Up 60% this week, after gaining a lot more last week – it seems clear no-one remained calm. Which may’ve been the point.

Here are the best performing ASX small cap stocks from from October 2 – October 6:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| WBEDC | Whitebark Energy | 0.018 | -64% | $2,789,081 |

| C1X | Cosmosexploration | 0.14 | -61% | $7,116,000 |

| TKM | Trek Metals Ltd | 0.031 | -40% | $15,317,723 |

| ICN | Icon Energy Limited | 0.006 | -40% | $8,448,150 |

| CT1 | Constellation Tech | 0.002 | -33% | $3,678,001 |

| MEB | Medibio Limited | 0.001 | -33% | $6,100,744 |

| MOH | Moho Resources | 0.006 | -33% | $1,632,213 |

| AXN | Alliance Nickel Ltd | 0.045 | -33% | $43,550,377 |

| ZEU | Zeus Resources Ltd | 0.011 | -31% | $6,889,215 |

| NRX | Noronex Limited | 0.01 | -29% | $4,539,621 |

| RB6 | Rubixresources | 0.19 | -27% | $11,182,750 |

| R3D | R3D Resources Ltd | 0.037 | -26% | $5,389,108 |

| LYN | Lycaonresources | 0.215 | -26% | $8,414,438 |

| BML | Boab Metals Ltd | 0.105 | -25% | $18,318,591 |

| MHC | Manhattan Corp Ltd | 0.006 | -25% | $17,621,879 |

| PIL | Peppermint Inv Ltd | 0.009 | -25% | $18,340,712 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| S3N | Sensore Ltd | 0.17 | -24% | $6,186,851 |

| AGD | Austral Gold | 0.022 | -24% | $13,470,850 |

| GMR | Golden Rim Resources | 0.02 | -23% | $12,423,356 |

| NUH | Nuheara Limited | 0.12 | -23% | $26,448,564 |

| PR1 | Pureresourceslimited | 0.19 | -22% | $5,130,002 |

| FTZ | Fertoz Ltd | 0.07 | -22% | $19,337,612 |

| BTE | Botalaenergyltd | 0.078 | -22% | $4,669,583 |

| MEK | Meeka Metals Limited | 0.036 | -22% | $40,781,730 |

| AVH | Avita Medical | 3.54 | -22% | $211,128,273 |

| ARV | Artemis Resources | 0.022 | -21% | $34,648,204 |

| DY6 | Dy6Metalsltd | 0.11 | -21% | $4,241,874 |

| AHI | Advanced Health | 0.13 | -21% | $29,390,036 |

| ALV | Alvomin | 0.15 | -21% | $11,474,417 |

| TI1 | Tombador Iron | 0.015 | -21% | $32,377,236 |

| LLI | Loyal Lithium Ltd | 0.555 | -21% | $48,038,460 |

| 4DS | 4Ds Memory Limited | 0.115 | -21% | $218,280,407 |

| ENR | Encounter Resources | 0.24 | -20% | $98,881,445 |

| PEB | Pacific Edge | 0.1 | -20% | $81,071,711 |

| AAP | Australian Agri Ltd | 0.016 | -20% | $4,881,592 |

| CCO | The Calmer Co Int | 0.004 | -20% | $3,268,477 |

| CTN | Catalina Resources | 0.004 | -20% | $4,953,948 |

| CYQ | Cycliq Group Ltd | 0.004 | -20% | $1,430,067 |

| HPR | High Peak Royalties | 0.052 | -20% | $13,523,881 |

| JTL | Jayex Technology Ltd | 0.008 | -20% | $2,250,228 |

| MOM | Moab Minerals Ltd | 0.008 | -20% | $5,695,708 |

| MRQ | Mrg Metals Limited | 0.002 | -20% | $4,411,837 |

| OKR | Okapi Resources | 0.1325 | -20% | $28,361,612 |

| KGL | KGL Resources Ltd | 0.105 | -19% | $59,565,646 |

| OCN | Oceanalithiumlimited | 0.17 | -19% | $8,492,240 |

| SI6 | SI6 Metals Limited | 0.0065 | -19% | $13,957,016 |

| RLT | Renergen Limited | 1.125 | -18% | $37,907,470 |

| KNG | Kingsland Minerals | 0.205 | -18% | $9,875,841 |

| DMM | Dmcmininglimited | 0.055 | -18% | $1,647,250 |

Chariot Corporation (CC9) – Due to list on October 2, $15.5 million at $0.45.

CGN Resources (CGN) – Due to list on October 12, $10 million at $0.20.

Far Northern Resources (FNR) – Due to list on October 13, $6 million at $0.20.