ASX Small Caps and IPO Weekly Wrap: Another decent week for the techies… shame about the rest

Emily was, in hindsight, strangely happy, considering she was moments away from being struck by a train. Pic via Getty Images

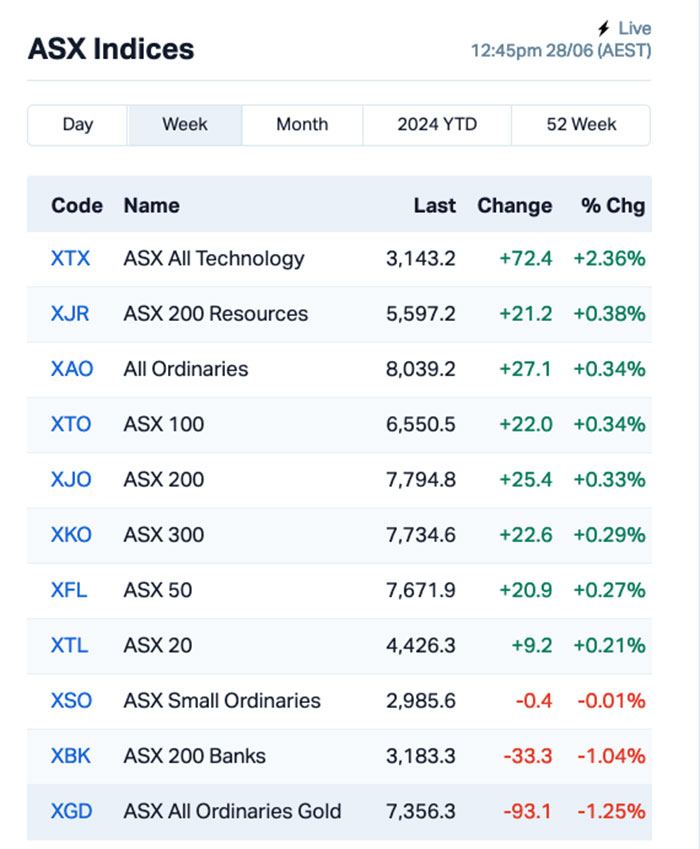

- The ASX 200 was on track for a somewhat surprising modest win for the week

- The Techies did better than everyone else in the face of monster inflation

- Who won the Small Caps race? Read on to find out…

Spoiler alert: I’m filing this a little early on Friday – but the general gist of it will have been the same either way… and that’s a surprising lift for the ASX 200 over the course of this week, because Wednesday’s shock inflation data frightened the stuffing out of quite a few investors.

It’s not a big gain – less than +0.5% is my prediction – but as most of that will have come from Friday’s mini-recovery after two days of blood-letting, it’s a pretty good indicator of how resilient Aussie markets are becoming to bad news.

According to the ABS, the Aussie CPI hit 4% in May, up from 3.6% in April – and a most unwelcome high water mark for a nation that is already feeling cost-of-living squeezes.

The shock jump has all but put the final nail in the coffin of all talk of a rate cut by the RBA before the end of this calendar year (barring, of course, some kind of deflationary Christmas miracle).

There has even been some nervous chatter about whether the RBA board is prepared to yank even harder on the rates lever in a bid to head off any further shocking results in the months to come.

But, uncharacteristically, I’m going to leave it to the experts to read the tea leaves and chicken guts on rates – because most of them are lining up broadly in the ballpark with Deutsche Bank chief economist Phil O’Donaghoe, who reckons that the cash rate will be firmly wedged in at 4.6% once Santa’s done breaking into everyone’s homes in December.

That has pretty much been the talk of the markets this week – everything else has been very much a sideshow, with the past couple of sessions running like thick molasses through a straw.

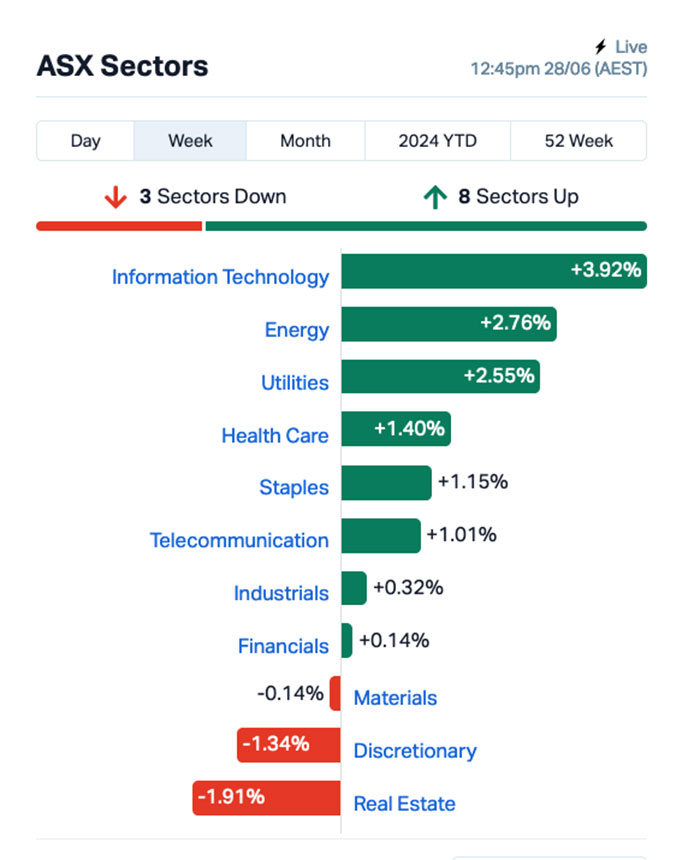

WHAT THE SECTORS DID

Here’s what the market sectors did:

As you can see, the Techies actually banked a decent week – largely thanks to some early excellence from US tech stocks.

Nvidia has been really volatile, though – the market darling of Wall Street suffered through two sessions of heavy selldowns, but rallied somewhat on Thursday amd looks poised to recover more before the weekend arrives.

Interestingly, though, was the goldies – normally something of a safe haven when inflation starts to bully the markets around, but this week that slice of the market is down – most likely while everyone tries to second-guess what China’s up to, as its appetite for bullion seems to have evaporated entirely over the past six weeks.

It’s worth noting, though, that this week might have only been a tiny taste of things to come, as market volatility is ratcheting up in a perilous fashion, thanks in no small part to Europe teetering on the brink of outright political lunacy.

Christian Edwards, who knows a lot about this sort of stuff, has covered it off very nicely in a yet-to-be published story he just showed me. I recommend you have a read of it when it lands on the weekend, because as cautionary tales go, this one’s a killer.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ENR | Encounter Resources | 0.73 | 103% | $286,275,814 |

| K2F | K2Fly Ltd | 0.18 | 80% | $33,646,894 |

| ACW | Actinogen Medical | 0.056 | 75% | $123,420,268 |

| VN8 | Vonex Limited | 0.035 | 75% | $12,664,002 |

| XPN | Xpon Technologies | 0.016 | 60% | $5,479,064 |

| ICR | Intelicare Holdings | 0.014 | 56% | $3,287,543 |

| SIT | Site Group Int Ltd | 0.003 | 50% | $7,807,471 |

| BUR | Burleyminerals | 0.16 | 45% | $21,803,787 |

| AL3 | AML3D | 0.095 | 44% | $32,430,517 |

| MRL | Mayur Resources Ltd | 0.26 | 41% | $98,455,805 |

| 3DP | Pointerra Limited | 0.042 | 40% | $28,982,765 |

| M2M | Mt Malcolm Mines NL | 0.025 | 39% | $4,052,964 |

| MLM | Metallica Minerals | 0.022 | 38% | $20,158,402 |

| KKO | Kinetiko Energy Ltd | 0.085 | 37% | $111,737,738 |

| JAT | Jatcorp Limited | 0.625 | 36% | $49,127,186 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| CLA | Celsius Resource Ltd | 0.0145 | 32% | $36,418,691 |

| HTG | Harvest Tech Group | 0.021 | 31% | $17,049,015 |

| M4M | Macro Metals Limited | 0.038 | 31% | $125,946,867 |

| OIL | Optiscan Imaging | 0.235 | 31% | $183,774,977 |

| TTM | Titan Minerals | 0.047 | 31% | $79,977,935 |

| MCA | Murray Cod Aust Ltd | 0.125 | 30% | $132,092,520 |

| PVE | Po Valley Energy Ltd | 0.039 | 30% | $44,040,542 |

| FCT | Firstwave Cloud Tech | 0.013 | 30% | $22,230,252 |

| KRR | King River Resources | 0.013 | 30% | $20,195,824 |

| HRE | Heavy Rare Earths | 0.035 | 30% | $2,117,078 |

| RC1 | Redcastle Resources | 0.022 | 29% | $7,222,251 |

| STX | Strike Energy Ltd | 0.2775 | 29% | $715,193,322 |

| AN1 | Anagenics Limited | 0.009 | 29% | $4,151,883 |

| APL | Associate Global | 0.135 | 29% | $7,626,478 |

| G50 | G50Corp Ltd | 0.18 | 29% | $18,032,850 |

| KLI | Killi Resources | 0.045 | 29% | $4,510,068 |

| SPX | Spenda Limited | 0.009 | 29% | $30,271,205 |

| LRV | Larvotto Resources | 0.12 | 28% | $25,081,165 |

| PPY | Papyrus Australia | 0.014 | 27% | $6,897,696 |

| CLU | Cluey Ltd | 0.038 | 27% | $6,451,634 |

| HVY | Heavy Minerals | 0.067 | 26% | $3,337,197 |

| AQI | Alicanto Minerals | 0.022 | 26% | $12,927,323 |

| EZZ | EZZ Life Science | 1.7 | 26% | $70,616,988 |

| MYR | Myer Holdings Ltd | 0.83 | 26% | $682,097,550 |

| HT8 | Harris Technology Gl | 0.01 | 25% | $2,991,355 |

| RCL | Readcloud | 0.085 | 25% | $11,842,565 |

| ROG | Red Sky Energy | 0.005 | 25% | $21,688,909 |

| VML | Vital Metals Limited | 0.0025 | 25% | $11,790,134 |

| WSR | Westar Resources | 0.01 | 25% | $2,340,578 |

| IRI | Integrated Research | 0.93 | 24% | $152,782,550 |

| CPV | Clearvue Technologie | 0.57 | 24% | $138,315,330 |

| BUS | Bubalus Resources | 0.16 | 23% | $4,826,051 |

| IMR | Imricor Medical Systems | 0.51 | 23% | $100,419,696 |

| FNR | Far Northern Resources | 0.19 | 23% | $6,791,707 |

Super quickly, here’s how the Small Cap winners ended up where they were on the ladder.

Encounter Resources (ASX:ENR) proved to be the best of a pretty ordinary bunch this week, but it was a worthy winner on the basis of its cracking niobium find at the company’s 100% owned Aileron project in the West Arunta region of WA.

The pick of the intercepts looked like this:

- 2m @ 3.0% Nb2O5 from 81m to EOH including 16m @ 6.0% Nb2O5

- 32m @ 2.5% Nb2O5 from 67m to EOH including 12m @ 3.3% Nb2O5

- 15m @ 1.5% Nb2O5 from 120m to EOH including 2m @ 3.3% Nb2O5

A takeover sporting a 90% premium to the recent closing price was enough to push K2Fly (ASX:K2F) into the winner’s circle for the week, after it was revealed that the company has stitched up a deal with Accel-KKR to buy the whole kit and kaboodle at 0.19 cash per share.

And Actinogen Medical’s (ASX:ACW) great news from its phase 2a biomarker trial for its Xanamem Alzheimer’s Disease candidate stole the health stocks show, after the results were published in the (100th edition!) of the peer-reviewed Journal of Alzheimer’s Disease.

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ME1 | Melodiol Global Health | 0.003 | -70% | $582,276 |

| MSG | MCS Services Limited | 0.002 | -50% | $594,299 |

| RIL | Redivium Limited | 0.002 | -50% | $5,461,710 |

| CCX | City Chic Collective | 0.1275 | -49% | $30,149,611 |

| CAQ | CAQ Holdings Ltd | 0.027 | -49% | $19,380,230 |

| CTT | Cettire | 1.205 | -46% | $421,268,233 |

| 1TT | Thrive Tribe Tech | 0.003 | -40% | $1,882,486 |

| AZ9 | Asian Battery Meltals PLC | 0.036 | -35% | $9,973,094 |

| AMD | Arrow Minerals | 0.002 | -33% | $21,078,730 |

| AUK | Aumake Limited | 0.002 | -33% | $3,828,814 |

| AVE | Avecho Biotech Ltd | 0.002 | -33% | $9,507,891 |

| DOU | Douugh Limited | 0.002 | -33% | $3,246,207 |

| GMN | Gold Mountain Ltd | 0.002 | -33% | $7,944,359 |

| LSR | Lodestar Minerals | 0.001 | -33% | $2,023,397 |

| MCL | Mighty Craft Ltd | 0.004 | -33% | $1,475,637 |

| MMM | Marley Spoon Se | 0.016 | -33% | $2,119,039 |

| RNE | Renu Energy Ltd | 0.004 | -33% | $3,630,670 |

| SIS | Simble Solutions | 0.002 | -33% | $1,506,901 |

| TD1 | Tali Digital Limited | 0.001 | -33% | $3,295,156 |

| PHO | Phosco Ltd | 0.023 | -32% | $7,553,201 |

| LRD | Lord Resources | 0.033 | -31% | $2,850,885 |

| KOR | Korab Resources | 0.007 | -30% | $3,303,450 |

| RDS | Redstone Resources | 0.0035 | -30% | $3,701,514 |

| ATV | Active Port Group | 0.046 | -29% | $17,168,842 |

| BYH | Bryah Resources Ltd | 0.005 | -29% | $2,177,268 |

| GES | Genesis Resources | 0.005 | -29% | $3,914,206 |

| AM7 | Arcadia Minerals | 0.036 | -28% | $4,330,854 |

| EOF | Ecofibre Limited | 0.03 | -27% | $12,123,965 |

| AAJ | Aruma Resources Ltd | 0.011 | -27% | $2,362,698 |

| HXG | Hexagon Energy | 0.011 | -27% | $5,642,075 |

| NSM | Northstaw | 0.011 | -27% | $1,678,509 |

| SRL | Sunrise | 0.335 | -26% | $28,872,799 |

| SUM | Summit Minerals | 0.37 | -26% | $23,028,808 |

| A3D | Aurora Labs Limited | 0.074 | -25% | $27,075,674 |

| ABE | Ausbond Exchange | 0.015 | -25% | $1,690,022 |

| AD1 | AD1 Holdings Limited | 0.006 | -25% | $6,290,539 |

| AL8 | Alderan Resource Ltd | 0.003 | -25% | $3,320,584 |

| BEL | Bentley Capital Ltd | 0.018 | -25% | $1,370,303 |

| BGE | Bridge SaaS | 0.015 | -25% | $2,029,750 |

| CLZ | Classic Minerals | 0.0015 | -25% | $1,511,096 |

| EDE | Eden Innovations | 0.0015 | -25% | $5,517,407 |

| ERL | Empire Resources | 0.003 | -25% | $4,451,740 |

| FHS | Freehill Mining Ltd | 0.006 | -25% | $17,999,067 |

| FTC | Fintech Chain Ltd | 0.006 | -25% | $3,904,618 |

| IEC | Intra Energy Corp | 0.0015 | -25% | $1,690,782 |

| IMI | Infinity Mining | 0.015 | -25% | $1,543,794 |

| JAV | Javelin Minerals Ltd | 0.0015 | -25% | $3,751,846 |

| MOM | Moab Minerals Ltd | 0.003 | -25% | $2,135,889 |

| MOZ | Mosaic Brands Ltd | 0.075 | -25% | $14,280,515 |

| MRQ | MRG Metals Limited | 0.003 | -25% | $10,100,475 |

HOW THE WEEK SHOOK OUT

Monday 24 June, 2024

Niobium has had a close encounter with Encounter Resources (ASX:ENR).

ENR says it has drilled itself right into some yummy thick, high-grade A1 niobium at the (not Simon) Crean carbonatite thingy which is a part of the Aileron project in the sexy West Arunta region of West Grunter (Australia).

Highlights include 52m at 3% Nb2O5 from 81m to end of hole, including 16m at 6% Nb2O5.

The iron ore and lithium explorer Burley Minerals (ASX:BUR) has jumped on news veteran cap markets exeuctive Dan Bahen is joining the BUR Board as non-executive chairman.

Dan has a bunch of experience – over 23 years of capital markets, commercial and finance – including 22 years with Paterson Securities and then Canaccord Genuity.

And Reward Minerals (ASX:RWD) says that the International Preliminary Examining Authority has provided a positive Preliminary Report on the “Patentability” of its processing technology for recovery of Potassium Sulphate (K2SO4 or SOP) directly from concentrated seawater and other high-sulphate brines.

Finally, hats off to Myer (ASX:MYR) which is up about 17% to end a fine Monday.

Myer shares surged on the news it was exploring a merger with Apparel Brands – which boasts retail brands like Portmans, Dotti, Just Jeans and Jay Jays.

Tuesday 25 June, 2024

Vonex (ASX:VN8) was the clear winner by the end of Tuesday’s session, up close to +100% on news that it has entered into a scheme implementation deed with MaxoTel to see the latter acquire Vonex for $0.0375 cents per share – a 108% premium on Vonex’s closing price on 24 June.

TMK Energy (ASX:TMK) says the Ministry of Environment and Tourism of Mongolia has endorsed the Gurvantes XXXV Project through approval of its Detailed Environmental Impact Assessment (DEIA) submission. The approval grants TMK permission to conduct significant drilling and appraisal activities into 2029.

Developer of radiopharmaceutical products for both diagnostic and therapeutic uses Radiopharm Theranostics (ASX:RAD) has received firm commitments to raise ~$70 million through a placement to international and Aussie institutional and industry investors, including Lantheus Holdings and specialist US healthcare investors.

Helix Resources (ASX:HLX) has announced further positive results in its search for new copper-gold deposits from the auger geochemical sampling program in the Eastern Group tenements, ~40km southeast of Nyngan, home of the Big Bogan, in central NSW.

Blackstone Minerals (ASX:BSX) has received $1m as an advance from an R&D lending fund backed by Asymmetric Innovation Finance and Fiftyone Capital on its future 2024 refundable tax offset for R&D expenditure. BSX says the advance reflects its ongoing investment to develop the Ta Khoa Refinery process and “unique strategy to convert nickel concentrate blends into battery products in the form of precursor cathode active material”.

Augustus Minerals (ASX:AUG) has contracted UTS Geophysics to conduct a VTEM Max survey on several copper-PGE-nickel-zinc-lead-silver and uranium targets within the 3,600km2 Ti Tree project. The survey, scheduled to start in August, will help to unearth the untapped potential of the Ti Tree project to host economic mineralisation.

QX Resources (ASX:QXR) says it will undertake a new program of trenching to extend known high grade gold mineralisation at its Big Red Project in Queensland where prior trenching returned results including mineralised widths of 9m @ 5.9g/t Au.

Wednesday 26 June, 2024

Diablo Resources (ASX:DBO) cancelled a bunch of securities on Wednesday afternoon. Enough to enlarge the survivors to $0.022 for a 37% gain. Easy money.

In complex, but ultimately happy news, Actinogen Medical (ASX:ACW) said it had a very positive phase 2a biomarker trial for its Xanamem Alzheimer’s Disease candidate, which was published in the (100th edition!) of the Journal of Alzheimer’s Disease. ACW says the trials demonstrate potential Xanamem efficacy in patients with elevated blood pTau.

And Metallica Minerals (ASX:MLM) was higher because of a takeover offer from Diatreme Resources, and nothing else matters right now. The offer – which Diatreme is adamant will not be improved upon – is gaining momentum, with the company now boasting a 63.79% interest in its target.

Elsewhere on Wednesday morning, Classic Minerals (ASX:CLZ) was up early, after announcing an extension to the closing date of its non-renounceable pro-rata rights issue at an issue price of $0.004 per new share, with 1 bonus option for every 2 shares subscribed for, exercisable at $ 0.02 on or before 30 June 2027.

Minbos Resources (ASX:MNB) has signed a non-binding collaboration agreement with Talus Renewables to develop the Capanda Green Ammonia Project through the deployment of Talus green ammonia technology, TalusAg, “a first-to-market green ammonia system which enables sustainable and cost-effective localised ammonia production”.

Mithril Resources (ASX:MTH) has received firm commitments for a capital raising of $3.7 million at $0.20 with cornerstone investment by Jupiter Gold and Silver Fundn at a 29 per cent premium to its last traded share price.

Eastern Resources (ASX:EFE) has engaged Nagom, an experienced lithium consultancy in Perth, to plan and manage metallurgical testwork for samples from the Lepidolite Hill Project.

And Cassius Mining (ASX:CMD) was up on news that its international arbitration against the Government of the Republic of Ghana – seeking damages in excess of US$275 million as a consequence of Ghana’s “breaches of contract and statute” – has taken a step in the right direction for the company, with the Tribunal finding that it has jurisdiction to hear the company’s contractual claims despite Ghana’s objections.

Thursday 27 June, 2024

Resources and exploration company Iris Metals (ASX:IR1) , with projects located in South Dakota and Western Australia has lifted on Thursday after dropping it’s FY24 annual report.

Since the start of the new financial year in April 2023, IRIS Metals Limited has progressed its exploration and related activities but says it has some irons in the fire for the year ahead.

Baby Bunting (ASX:BBN) jumped 24% this morning after delivering a trading update to investors, which included news that total sales from 1 May 2024 to 24 June 2024 were up a modest 1.0% on pcp, and that the company’s existing $70 million NAB facility has been renewed for a further 3 years at existing pricing.

Harvest Technology Group (ASX:HTG) says it has deployed n additional 30 NSI (Nodestrea Integrated device) units to its defence partner, Guerrilla Technologies.

“Continuing orders from Guerrilla highlight the growing collaboration and trust between our companies. The new units will further bolster Guerrilla Technologies’ network and semi-autonomous field assets, enhancing their capability to manage sensitive operations in remote and challenging environments with unparalleled secure communications,” HTG informed the ASX.

Bellavista Resources (ASX:BVR) was up early on news that the company has firm commitments for an unbrokered $1.2 million cap raise to new and existing shareholders and institutional investors, at $0.15 per share – a handy 12% discount to the company’s recent close at $0.17 a pop.

Bastion Minerals (ASX:BMO) released happy news that it has found more high-grade rare earths at its Gyttorp project in Sweden. Assays confirmed TREE+Y up to 8.3% from actinolite skarn, in line with previously announced xPRF results from the site.

And Sheffield Resources (ASX:SFX) announced results from a ramp up of production and shipments from the Kimberley Mineral Sands owned Thunderbird Mineral Sands Mine in Western Australia, which saw production of approximately 825,000 ore tonnes in June 2024, and concentrate production of approximately 55,000 tonnes ilmenite concentrate and 13,000 tonnes zircon concentrate over the same period.

Friday 28 June, 2024

Pointerra (ASX:3DP) has moved into the top spot on Friday at lunchtime, rising after revealing a juicy US government contract. The US Department of Energy (DOE) has awarded the company a US$1.63 million contract for a program to model a range of electric grid resilience investment scenarios by electric utilities.

Delta Lithium (ASX:DLI) was up on Friday morning on news of a major upgrade to its gold resource at Mt Ida, which has grown the Baldock Deposit up 82% to 4.8Mt @ 4.4g/t gold for 674,000 ounces.

And Diatreme gave back some of its gains from earlier on Friday, after making headway while it has a takeover bid on the table for 100% ownership of Metallica Minerals (ASX:MLM) .

Diatreme – which already holds more than 63% of MLM – extended the deadline on its offer yesterday, but has made it very clear that the current offer of 1.3319 Diatreme shares for every Metallica share is as high as it’s willing to go.

And The Calmer Co (ASX:CCO) had more good news for the market today, with the company revealing that the renounceable rights issue announced on 3 June has closed heavily oversubscribed and raised approximately $2 million (before costs), with the company sorting out a follow-on placement to accommodate investors who missed the initial round.

IPOs that didn’t happen yet

Piche Resources (ASX:PR2)

Proposed Listing: June-ish, 2024

IPO: $10 million at $0.10 per share

Blinklab describes itself as a mineral exploration company with multiple, drill ready uranium projects with the potential to host tier 1 mineral deposits.

The IPO, as listed, will be managed by Euroz Hartleys (Lead Manager).

Pengana Global Credit Private Trust (ASX:PCX)

Proposed Listing: June-ish, 2024

IPO: $250,000 at $2.00 per share

Pengana Global Credit Private Trust is a listed Investment Trust investing in global private debt.

The IPO, as listed, will be managed by Taylor Collison Limited, Morgans Financial Limited, Shaw and Partners Limited. (Joint Lead Managers).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.