ASX small cap wrap: who’s hot and who’s not last week

News

News

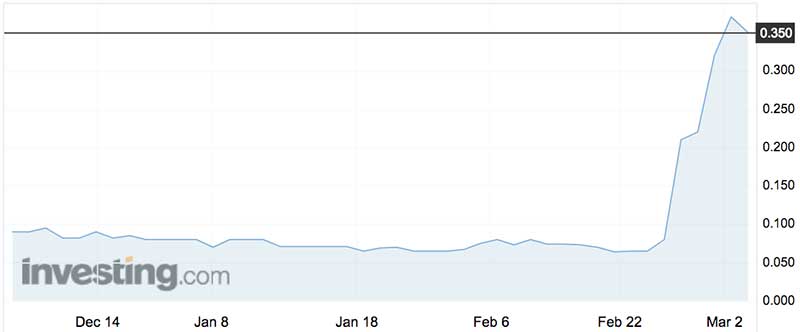

What’s going on at tungsten and gold play GWR Group (ASX:GWR)?

The stock rocketed six-fold in the space of a week — from 6.5c to a high of 41c.

It finished at 32c on Friday — a 392 per cent gain for the seven-day period.

Trades skyrocketed too — more than 4 million shares changed hands over a few days.

Queried by the ASX earlier in the week, company secretary Simon Borck said there was no news to share.

GWR is due to release a maiden mineral resource estimate for several prospects in its Hatches Creek tungsten, gold and copper project in the Northern Territory where “exceptional” drilling results were reported late last year.

Fellow tungsten play Tungsten Mining (ASX:TGN) put on 58 per cent to 47.5c, telling the ASX it continued to “make good progress” at its Mt Mulgine tungsten project in Western Australia.

Tungsten — used to harden steel in ballistic missiles and drill bits — has soared in price because of supply constraints. It’s predominantly produced in a single nation: China.

Taruga Gold (ASX:TAR) almost quadrupled to a high of 39c before closing the week at 24c — a 92 per cent gain for the seven days.

Taruga announced its acquisition of high-grade copper and cobalt projects in the Congo.

Taruga will acquire a 60 per cent interest in Mwilu and Kamilobe high-grade cobalt projects, with grades of up to 13 per cent cobalt already reported from channel sampling.

Taruga also has secured first right of refusal on other high-grade cobalt projects held by the government and a local consortium.

To fund it all, Taruga is raising $1.35 million at 10c a share.

US drug giant Perkin Elmer made a move on Aussie junior biotech RHS (ASX:RHS) this week — which pushed the Aussie junior biotech up 89 per cent to 26.5c

Perkin Elmer has offered to buy the company outright at 28c per share.

Directors of RHS have recommended shareholders accept the offer.

It followers a spate of merger activity in the local biotech space.

EHR Resources (ASX:EHX) went for a run, initially on no news, shooting up 54 per cent to 12.5c for the week.

The company — which has a stake in a Peruvian gold and silver project — told the ASX on Wednesday it had no unannounced news to share.

On Friday it announced the start of a new stage of exploration at the project.

Auris Minerals (ASX:AUR) announced a $1.2 million farm-in deal with Sandfire Resources (ASX:SFR) at its Morck’s Well East and Doolgunna copper projects in Western Australia.

The deal sent its share price up 47 per cent to 5c for the week.

Sandfire has to spend $2 million in two years on exploration of the two sites, while Auris explores the rest of its holding in other parts of the Bryah Basin in WA.

Cancer drug maker Patrys (ASX:PAB) jumped 50 per cent to 3.3c for the week after showing its brain tumour treatment could cross the blood-brain barrier and reduce the size of growths.

The last trial showed drug candidate PAT‐ DX1 killed cancer cells in the lab, and the latest one shows that is works on mice with human glioblastoma tumour implants as well.

“Glioblastoma is a particularly aggressive, highly malignant form of brain cancer characterised by very fast cellular reproduction,” Patrys told investors on Wednesday.

Patrys will now prepare for clinical trials in 2019.

Here are the best performing ASX small cap stocks for Feb 26-Mar 2:

This table may be best viewed on a laptop or desktop

| ASX Code | Name | Change (Feb 23-Mar 3) | Price Mar 2 | Price Feb 23 | 52wk High | 52wk Low | Market Cap |

|---|---|---|---|---|---|---|---|

| GWR | GWR GROUP | 3.92307692308 | 0.32 | 0.065 | 0.41 | 0.033 | 80798208 |

| SSN | SAMSON OIL & GAS | 1 | 0.002 | 0.001 | 0.005 | 0.001 | 4924500.5 |

| TAR | TARUGA GOLD | 0.92 | 0.24 | 0.125 | 0.395 | 0.041 | 35851448 |

| RHS | RHS | 0.892857142857 | 0.265 | 0.14 | 0.295 | 0.062 | 23828928 |

| PPL | PUREPROFILE | 0.741573033708 | 0.155 | 0.089 | 0.45 | 0.087 | 16208168 |

| PMY | PACIFICO MINERALS | 0.625 | 0.013 | 0.008 | 0.012 | 0.004 | 7016510 |

| TGN | TUNGSTEN MINING NL | 0.583333333333 | 0.475 | 0.3 | 0.54 | 0.0229 | 280747744 |

| CTP | CENTRAL PETROLEUM | 0.56976744186 | 0.135 | 0.086 | 0.1986 | 0.077 | 74243608 |

| FEL | FE | 0.547619047619 | 0.065 | 0.042 | 0.076 | 0.019 | 22083928 |

| EHX | EHR RESOURCES | 0.543209876543 | 0.125 | 0.081 | 0.195 | 0.069 | 13722264 |

| PAB | PATRYS | 0.5 | 0.033 | 0.022 | 0.047 | 0.0039 | 34470044 |

| MXR | MAXIMUS RESOURCES | 0.5 | 0.0015 | 0.001 | 0.003 | 0.001 | 4540953 |

| AJJ | ASIAN AMERICAN MEDICAL GROUP | 0.5 | 0.105 | 0.07 | 0.125 | 0.07 | 29775276 |

| AUR | AURIS MINERALS | 0.470588235294 | 0.05 | 0.034 | 0.105 | 0.034 | 22016428 |

| MZM | MONTEZUMA MINING CO | 0.468085106383 | 0.345 | 0.235 | 0.345 | 0.125 | 25873948 |

| RXH | REWARDLE HOLDINGS | 0.466666666667 | 0.022 | 0.015 | 0.044 | 0.01 | 7208136 |

| IVT | INVENTIS | 0.444444444444 | 0.013 | 0.009 | 0.018 | 0.008 | 9134442 |

| FGR | FIRST GRAPHENE | 0.423076923077 | 0.185 | 0.13 | 0.215 | 0.06 | 74758496 |

| WCN | WHITE CLIFF MINERALS | 0.379310344828 | 0.004 | 0.0029 | 0.0077 | 0.0019 | 11596866 |

| PDN | PALADIN ENERGY | 0.344827586207 | 0.195 | 0.145 | 0.26 | 0.045 | 291183456 |

| COY | COPPERMOLY | 0.333333333333 | 0.012 | 0.009 | 0.027 | 0.009 | 15154276 |

| PKA | PLUKKA | 0.333333333333 | 0.012 | 0.009 | 0.033 | 0.004 | 2412134 |

| AWY | AUSTRALIAN WHISKY | 0.333333333333 | 0.04 | 0.03 | 0.04 | 0.026 | 17051786 |

| BDI | BLINA MINERALS | 0.333333333333 | 0.002 | 0.0015 | 0.003 | 0.001 | 7527765 |

| CUL | CULLEN RESOURCES | 0.333333333333 | 0.002 | 0.0015 | 0.003 | 0.001 | 3897840.25 |

| JVG | JV GLOBAL | 0.333333333333 | 0.002 | 0.0015 | 0.002 | 0.0009 | 5012890.5 |

| LKO | LAKES OIL | 0.333333333333 | 0.002 | 0.0015 | 0.003 | 0.001 | 55211136 |

| REL | RAVEN ENERGY | 0.333333333333 | 0.002 | 0.0015 | 0.002 | 0.001 | 9691197 |

| CYP | CYNATA THERAPEUTICS | 0.326315789474 | 1.26 | 0.95 | 1.35 | 0.37 | 106169768 |

| CAE | CANNINDAH RESOURCES | 0.325 | 0.053 | 0.04 | 0.15 | 0.013 | 6944244.5 |

Stream Group (ASX:SGO) was back trading after a suspension of more than 18 months — but its stock fell 55 per cent to 3.5c.

The company sold off its claims management business earlier this year, leaving just its BuildAssist claims management software as its sole revenue-maker.

Stream also told investors it had reached an agreement with the ASX on a proposed buyback of 2.2 million shares that “were issued to a company controlled by a director, Mr Lawrence Case … in breach of listing rule 10.11”.

To avoid calling a shareholder meeting for approval of the buyback, the ASX agreed the shares could be sold on-market with the profits donated to charity.

Sadly, the ASX’s only listed jetpack maker Martin Aircraft (ASX:MJP) looks set to de-list.

New Zealand-based Martin told investors it “continues to be in the development phase of its Jetpack product and needs to ensure that its limited cash resources are used to maximise the development of its product, rather than to pay for administrative costs, including ASX listing fees”.

The shares fell 50 per cent to 1.8c.

User-generated content app Crowdspark (ASX:CSK) — formerly known as NewZulu — fell after revealing a 9 per cent fall in revenue to $1 million and a narrower loss of $1.8 million.

The shares closed the week down 49 per cent to 7.1c.

Jayex Healthcare (ASX:JHL) continued a downward slide, trading down 40 per cent for the week at 1.5c.

Jayex, which makes software to help run hospitals and pharmacies, reported a 14 per cent decrease in revenue for the half-year.

“The company faced on-going difficulties with the integration of the Appointuit product into the other group technologies, which resulted in the operational and financial results falling behind expectations in the Australian operations.”

Here are the worst performing ASX small cap stocks for Feb 26-Mar 2:

This table may be best viewed on a laptop or desktop

| ASX Code | Name | Change Feb 23- Mar 2 | Price Mar 2 | Price Feb 23 | 52wk High | 52wk Low | Market Cap |

|---|---|---|---|---|---|---|---|

| SGO | STREAM GROUP | -0.551282051282 | 0.035 | 0.078 | 0.078 | 0.035 | 7676541.5 |

| MJP | MARTIN AIRCRAFT | -0.5 | 0.018 | 0.036 | 0.165 | 0.016 | 11112206 |

| CSK | CROWDSPARK | -0.492857142857 | 0.071 | 0.14 | 0.4 | 0.065 | 2776596.75 |

| PRL | PETREL ENERGY | -0.428571428571 | 0.004 | 0.007 | 0.047 | 0.0035 | 6743739 |

| JHL | JAYEX HEALTHCARE | -0.4 | 0.015 | 0.025 | 0.045 | 0.012 | 2304343 |

| EGL | ENVIRONMENTAL GROUP | -0.368421052632 | 0.048 | 0.076 | 0.095 | 0.015 | 11228449 |

| NCL | NETCCENTRIC | -0.363636363636 | 0.014 | 0.022 | 0.052 | 0.014 | 3675000 |

| TPE | TPI ENTERPRISES | -0.344186046512 | 1.41 | 2.15 | 2.94 | 1.355 | 112303544 |

| AFT | AFT CORP | -0.333333333333 | 0.001 | 0.0015 | 0.002 | 0.001 | 9020528 |

| ATT | ANTE REAL ESTATE TRUST | -0.333333333333 | 0.002 | 0.003 | 0.044 | 0.002 | 46326.3203 |

| GGX | GAS2GRID | -0.333333333333 | 0.002 | 0.003 | 0.004 | 0.002 | 1864818.125 |

| MSI | MULTISTACK INTERNATIONAL | -0.333333333333 | 0.006 | 0.009 | 0.03 | 0.006 | 673823.5625 |

| RD1 | REGISTRY DIRECT | -0.315789473684 | 0.065 | 0.095 | 0.195 | 0.065 | 5386665.5 |

| MIL | MILLENNIUM SERVICES | -0.302816901408 | 0.99 | 1.42 | 1.81 | 0.93 | 45698616 |

| A3D | AURORA LABS | -0.292929292929 | 0.7 | 0.99 | 2.85 | 0.44 | 45721860 |

| DMC | DIGIMATIC GROUP | -0.287925696594 | 1.15 | 1.615 | 6 | 1.1 | 48370964 |

| KTE | K2 ENERGY | -0.285714285714 | 0.01 | 0.014 | 0.019 | 0.007 | 3389548 |

| BOA | BOADICEA RESOURCES | -0.277777777778 | 0.13 | 0.18 | 0.24 | 0.09 | 6366057.5 |

| SIV | SILVER CHEF | -0.274362818591 | 4.84 | 6.67 | 8.88 | 4.41 | 192412784 |

| GLA | GLADIATOR RESOURCES | -0.272727272727 | 0.008 | 0.011 | 0.017 | 0.002 | 4928443.5 |

| GRV | GREENVALE ENERGY | -0.272727272727 | 0.032 | 0.044 | 0.048 | 0.02 | 4107635.75 |

| MGU | MAGNUM MINING AND EXPLORATIO | -0.268292682927 | 0.06 | 0.082 | 0.082 | 0.036 | 16774729 |

| CNX | CARBON ENERGY | -0.258064516129 | 0.115 | 0.155 | 1.3 | 0.12 | 10064695 |

| POZ | POZ MINERALS | -0.256 | 0.093 | 0.125 | 0.145 | 0.02 | 15257818 |

| ADY | ADMIRALTY RESOURCES | -0.25 | 0.006 | 0.008 | 0.011 | 0.004 | 9225999 |

| UNL | UNITED NETWORKS | -0.245614035088 | 0.043 | 0.057 | 0.22 | 0.041 | 5284648 |

| HOR | HORSESHOE METALS | -0.24 | 0.019 | 0.025 | 0.032 | 0.016 | 3698391.5 |

| FOD | FOOD REVOLUTION | -0.225806451613 | 0.048 | 0.062 | 0.076 | 0.037 | 18664790 |

| EMU | EMU | -0.225 | 0.093 | 0.12 | 0.245 | 0.064 | 6873666 |

| DGO | DGO GOLD | -0.224358974359 | 0.605 | 0.78 | 2.45 | 0.21 | 7076120.5 |

| RIM | RIMFIRE PACIFIC | -0.222222222222 | 0.021 | 0.027 | 0.037 | 0.017 | 19813028 |

| VPC | VELPIC | -0.222222222222 | 0.007 | 0.009 | 0.029 | 0.007 | 9046769 |