ASX Small Cap Lunch Wrap: Oh what a CPI! Inflation elation as local markets jump on weak October prices

News

News

And just in – for fans of the monthly Consumer price Index (CPI) read – Aussie inflation data has cooled ahead of the Reserve Bank’s final meet for 2023.

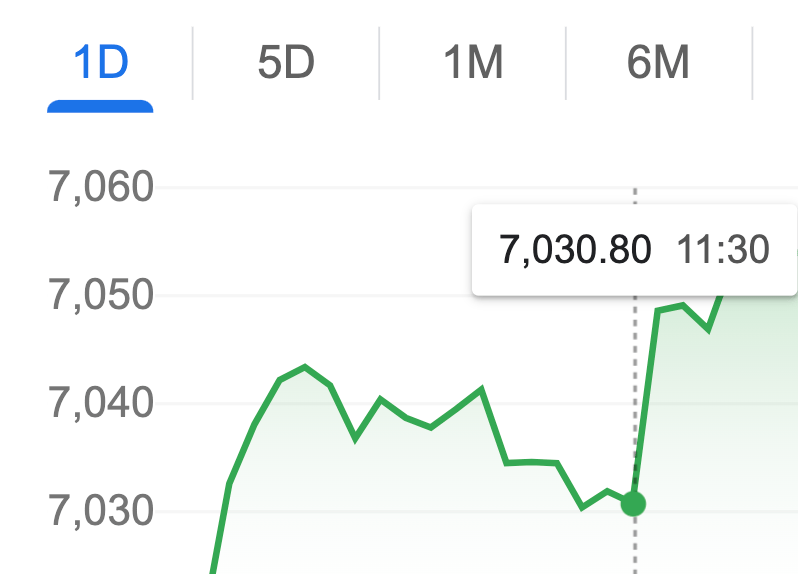

The ABS data dropped at 11.30am… right about here:

The latest monthly CPI indicator from the bureau of numbers shows inflation has eased sharply to 4.9% in the year to October, against the 5.6% in September and vs economist consensus of just 5.2%

That might just help allay fears of the RBA hiking again on Tuesday, according to street poet and IG analyst Tony Sycamore:

“The breath of relief from the RBA’s Martin Place HQ and mortgage holders nationwide was almost audible in the streets of Sydney, as today’s inflation number suggests that under the RBA’s current monetary policy settings, inflation is falling at a pace that should ensure a return to target within a reasonable time frame.”

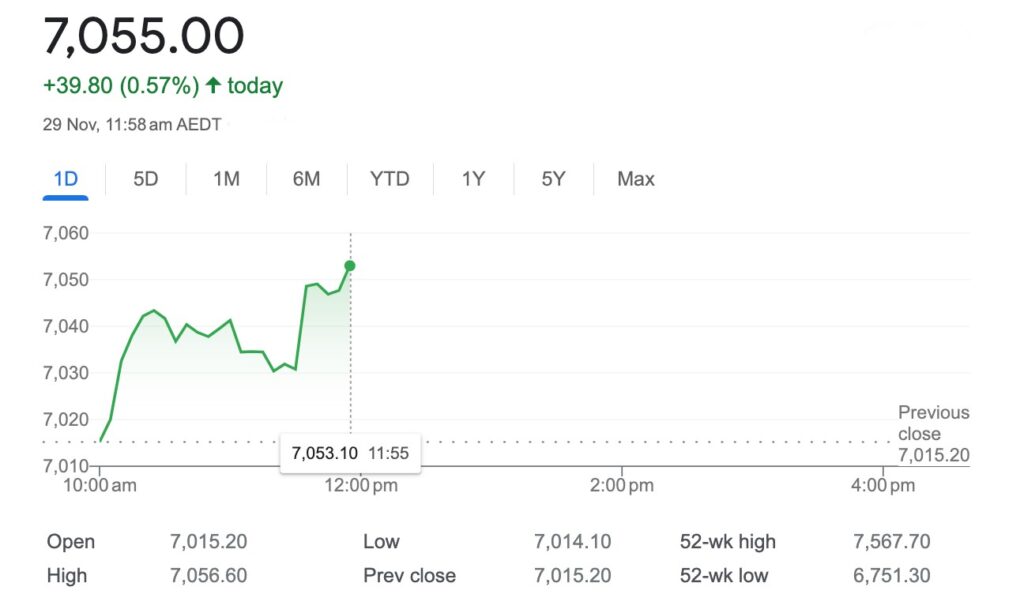

At midday on Wednesday Nov 29, the S&P/ASX 200 index was ahead by 40 points or +0.57% to 7055.

The RBA last hoisted rates – up to 4.35% – on Melbourne Cup Day. The governor M. Bullock has since driven hard-as-a-hawk publically on her growing concern that inflation here is ‘homegrown’ and much more stickier than previously thought.

Certainly energy and fuel costs have remained higher throughout the previous quarter.

While the October drop smashes consensus expectations in a good way, it is however, but a monthly read – and a volatile one at that – which includes a string of services-based sub-sectors, where price pressures have been stronger than in goods.

Meantime, Wall Street enjoyed a similar leg up on the same theme… all three majors rose following Fed Reserve governor Christopher Waller’s late tweak to the title of his speech that certainly seems to be implying the Fed is done with hiking rates.

Waller last spoke in October in a speech titled: Something’s Got to Give.

Overnight, he amended that to: Something appears to be giving.

“I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2 per cent.. There is no reason to say we will keep it really high.”

Some good news then as well for retailers as US consumers spent US$12.4 billion online on Cyber Monday, which was around 10% higher than last year.

Likewise, it hasn’t stopped Aussies from going hard during the recent Black Friday putsch – which itself has brought a spotlight back on the Aussie Retail Sector.

That and another timely drop on Tuesday from the bureau of stats, highlighting some surprising resilience in the sector.

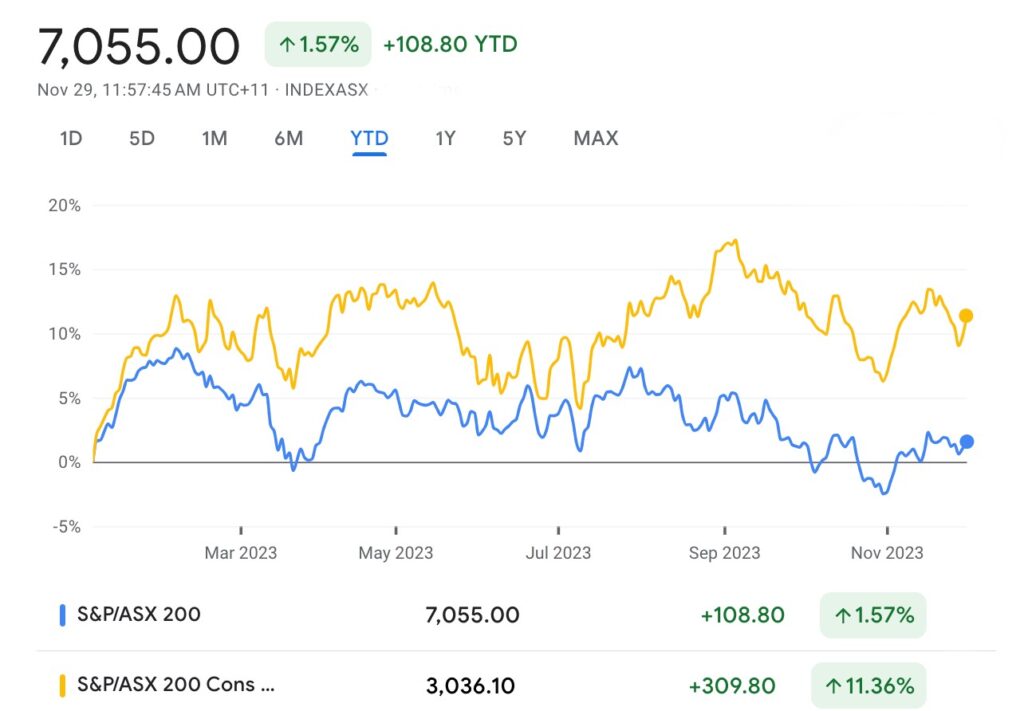

But first – the Consumer Discretionary Sector has been a surprise outperformer, year-to-date:

“Yesterday’s cooler than expected retail sales and CPI print today should give the ASX200 the shot higher it’s been looking for into year-end towards 7200” – that’s Tony Sycamore again.

Because Tuesday saw October retail sales down 0.2% month-on-month, slowing the year-on-year rate to 1.2%, the weakest month since June, although it did come on the back of stronger-than-expected September returns, which were up 3x consensus, at 0.9%.

UBS reckons a trend of moderating retail sales is clear, albeit volatile.

But there’s still a stock of resilience in our spending habits and the Aussie consumer ‘is not collapsing.’

We have tailwinds like the record population growth of +2.5% year-on-year, plus older households’ record superannuation benefits of +$145bn over the third quarter is equivalent to circa 10% of total Aussie household income.

So the sector has some handy buttresses.

According to JPMorgan channel checks, most local retailers were pleased with Black Friday trading, given limited supply chain disruption and healthy inventory levels in most categories.

But to what extent Black Friday has sucked the fun and the forward sales out of the traditional Christmas trading period remains to be seen.

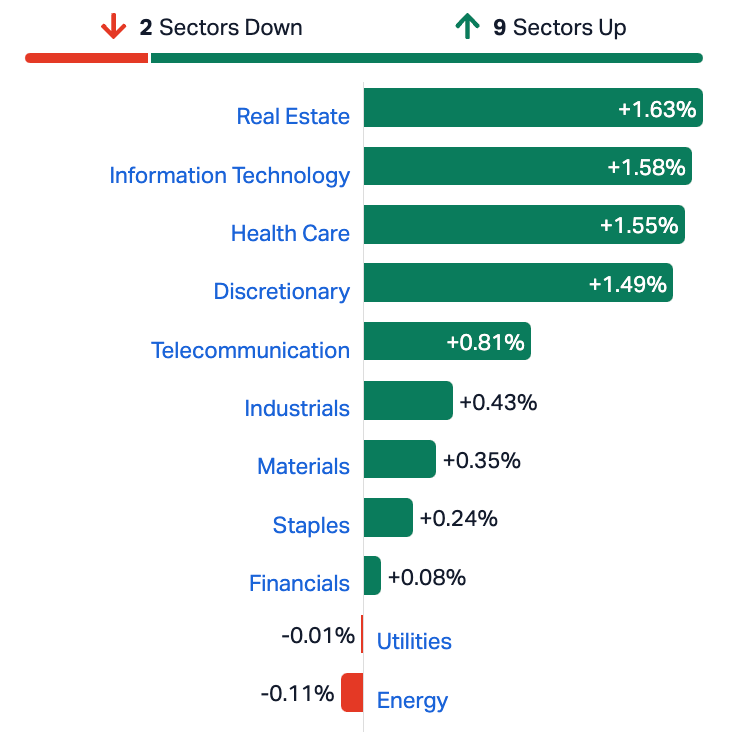

Healthcare stocks are ahead on Wednesday.

The Kiwi healthcare firm Fisher & Paykel Healthcare – FPH (ASX:) is up into double figures, with stonking 1H revenue and profit reveals, while heavyweight blood plasma giant CSL (ASX:CSL) is doing its bit for the benchmark too, after getting a green light for the ‘world’s first self-amplifying messenger RNA (sa-mRNA)’ COVID-vaccine.

CSL stock is up over +1.5%.

In New York, the S&P 500 rose by +0.1%, the blue chips Dow Jones index was up by +0.24%, and the tech-heavy Nasdaq climbed by +0.29%.

All three Futures tied to the major indices were higher ahead of the open in New York:

Here are the best performing ASX small cap stocks for 28 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WEL | Winchester Energy | 0.003 | 50% | 1,500,000 | $2,040,844 |

| EMN | Euro Manganese | 0.145 | 45% | 18,073,959 | $24,581,548 |

| ATH | Alterity Therapeutics | 0.004 | 33% | 4,612,500 | $7,319,693 |

| AUH | Austchina Holdings | 0.004 | 33% | 525,000 | $6,233,651 |

| MCT | Metalicity Limited | 0.002 | 100% | 23,997,269 | $6,376,629 |

| GTI | Gratifii | 0.009 | 29% | 100,000 | $9,266,300 |

| BMR | Ballymore Resources | 0.14 | 27% | 57,651 | $16,081,699 |

| GML | Gateway Mining | 0.02 | 25% | 250,000 | $5,303,721 |

| LBT | LBT Innovations | 0.01 | 25% | 1,364,930 | $9,247,203 |

| SWP | Swoop Holdings Ltd | 0.255 | 21% | 139,934 | $43,723,877 |

| RNO | Rhinomed Ltd | 0.041 | 21% | 134,725 | $9,714,470 |

| ADR | Adherium Ltd | 0.003 | 50% | 500,000 | $12,503,985 |

| NVQ | Noviqtech Limited | 0.003 | 20% | 4,962,572 | $3,273,613 |

| TMR | Tempus Resources Ltd | 0.006 | 20% | 1,285,567 | $1,714,614 |

| CLA | Celsius Resource Ltd | 0.013 | 18% | 111,952 | $24,706,568 |

| ZNO | Zoono Group Ltd | 0.059 | 18% | 459,670 | $9,496,384 |

| EGN | Engenco Limited | 0.295 | 18% | 1,004 | $78,948,353 |

| AKM | Aspire Mining Ltd | 0.092 | 18% | 179,255 | $39,595,685 |

| SHN | Sunshine Metals Ltd | 0.033 | 18% | 46,618,419 | $34,272,236 |

| EPX | EPT Global Limited | 0.02 | 18% | 100,000 | $7,580,533 |

| PHL | Propell Holdings Ltd | 0.02 | 18% | 4,328 | $2,046,044 |

| AEV | Avenira Limited | 0.014 | 17% | 1,878,515 | $20,847,087 |

| AGD | Austral Gold | 0.028 | 17% | 12,003 | $14,695,472 |

| HCD | Hydrocarbon Dynamic | 0.007 | 17% | 200,625 | $3,897,995 |

| TG1 | Techgen Metals Ltd | 0.087 | 16% | 2,857,303 | $5,787,621 |

Going the distance on Wednesday morning: Euro Manganese (ASX:EMN) which says it has locked in a US$100m funding package from global asset management firm Orion to help build the Chvaletice manganese project in the Czech Republic.

EMN is a battery materials company focused on becoming a leading producer of high-purity manganese for the electric vehicle industry and has been focused on developing Chvaletice as well as producing battery-grade manganese products out of Bécancour, in beautiful Québec.

Meanwhile, Ballymore Resources (ASX:BMR) has raised $1.8m via placement/ entitlement offer – plus another $1.5m from mining royalty firm Taurus – to advance the Dittmer gold mine to production.

Sunshine Metals (ASX:SHN) continued its golden run with investors this morning, on the back of last week’s incredible intersection of 17m @ 22.14g/t gold at its Ravenswood Consolidated project in North Queensland

The company believes it may have struck paydirt in a gold and copper rich feeder zone to the 2.3Mt zinc-gold-copper-lead-silver VMS resource at the Liontown deposit.

“The stunning intercepts at Liontown are a great reward for the solid geological work completed by the team,” Sunshine managing director Damien Keys told the market on Friday.

Here are the most-worst performing ASX small cap stocks for 28 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CHK | Cohiba Minerals | 0.002 | -33% | 2150000 | $6,639,733 |

| CLE | Cyclone Metals | 0.001 | 0% | 600000 | $15,396,757 |

| EML | EML Payments Ltd | 0.755 | -31% | 15464381 | $410,189,482 |

| SRJ | SRJ Technologies | 0.075 | -19% | 75000 | $14,059,899 |

| ZNC | Zenith Minerals Ltd | 0.125 | -17% | 208390 | $52,857,132 |

| LVT | Livetiles Limited | 0.005 | -17% | 703177 | $7,062,664 |

| R3D | R3D Resources Ltd | 0.038 | -16% | 192500 | $6,856,721 |

| ADVDB | Ardiden Ltd | 0.18 | -14% | 38225 | $13,128,676 |

| ADG | Adelong Gold Limited | 0.006 | -14% | 5160728 | $4,174,256 |

| BFC | Beston Global Ltd | 0.006 | -14% | 270253 | $13,979,328 |

| FFG | Fatfish Group | 0.012 | -14% | 13914144 | $16,663,356 |

| LRL | Labyrinth Resources | 0.006 | -14% | 608828 | $8,312,806 |

| STG | Straker Limited | 0.5 | -14% | 88654 | $39,346,793 |

| TOY | Toys R Us | 0.013 | -13% | 2502038 | $14,736,953 |

| BYE | Byron Energy Ltd | 0.1 | -13% | 925560 | $124,360,437 |

| FRX | Flexiroam Limited | 0.02 | -13% | 100004 | $15,193,965 |

| GCX | GCX Metals Limited | 0.047 | -13% | 1250 | $12,732,049 |

| AIS | Aeris Resources Ltd | 0.125 | -13% | 2231565 | $99,330,603 |

| NTM | Nt Minerals Limited | 0.007 | -13% | 125691 | $6,879,223 |

| RMX | Red Mount Min Ltd | 0.0035 | -13% | 1550000 | $10,694,304 |

| KTA | Krakatoa Resources | 0.043 | -12% | 5243475 | $21,309,998 |

| LGM | Legacy Minerals | 0.145 | -12% | 632473 | $13,730,008 |

| MPK | Many Peaks Minerals | 0.15 | -12% | 6673 | $6,183,662 |

| RGL | Riversgold | 0.015 | -12% | 6153243 | $16,171,445 |

| LM1 | Leeuwin Metals Ltd | 0.2 | -11% | 184859 | $10,076,625 |